There is a major misunderstanding about what the actual product is when it comes to stablecoins - particularly amongst DeFi stablecoin teams and investors.

They fundamentally misunderstand the business of Tether and Circle, which is why they can’t compete with either

To understand why, think if you bank account. The product isn’t Swift + ACH. The product is letting you move and spend your money when you want, where you want, and safekeeping it in the meantime. Maybe some yield, too.

It’s the same product as it was in 1800, before Swift/ACH

So you see why it’s silly to think the crypto part is important. Crypto is back office software. It works for Tether bc it allows USDT to simultaneously compete on the movement AND safekeeping of money vs local alternatives.

That’s the product: money moves & is safe.

Now look at Circle. We’ve learned a lot about their business since the S1. Very different (& less profitable) product than USDT. USDC adoption increasingly looks like an alternative to uninsured bank deposits.

There seem to be two main markets for this & one is low quality

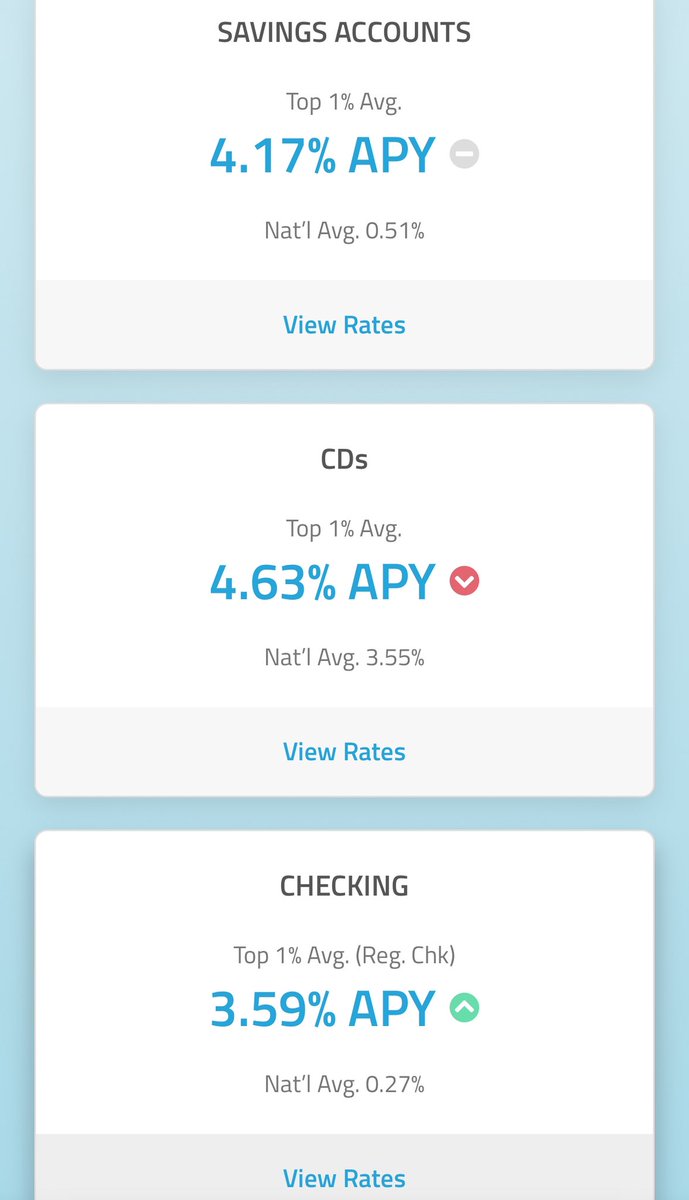

The first is simply an organization that will keep beyond the insurance limits in a bank. Circle offers better yield than the top 1% of bank accounts. If you’re uninsured on your own bank deposits anyway, USDC has some value proposition for you.

The other line of business is getting platforms to put their USERS into USDC. Coinbase, for example, has a strong incentive to have its own users hold USDC in lieu of just dollars in their CB account. This shifts some creditor claims while CB get 100% of the yield.

This is, of course, not great for a user whose alternative is to hold cash in an insured bank account or even just a a balance on CB. They’re already exposed to CB (uninsured) and now Circle as well, while CB makes money off that shift.

USDG (Paxos) has the same model

This also means it’s a commoditized business - USDC, USDG, et al compete primarily upon yield. Someone w a better mouse trap or margins will someday steal this business, just as USDC has stolen it from banks.

This is also the exact same problem DeFi stables have

If no one wants to hold or use your stablecoin unless you’re paying them a ton of money, you’ve misunderstood what the product is.

Tether, banks, money transmitters, and some fintechs understand what you don’t!

Ironically, DeFi stables are (were?) well-positioned to offer a strong value proposition in the form of safekeeping. No, self-custodial, unseizable money will never be as big as Tether. But it can still be a very profitable business.

In a cruel twist of fate, we’ve seen Maker/Sky actively destroying their previous success w DAI on safekeeping value proposition. It is now centralized and the risk profile of the backing has shifted sharply away from emphasis on safety. Significant there’s more DAI than USDS

So we end up with a stablecoin landscape that looks like this:

* USDT competes w foreign banks

* USDC/USDG/etc competes w US banks for uninsured deposits

* DeFi stables compete w investment products

2/3 of those are very “live by the sword, die by the sword” w minimal moat

32.47K

62

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.