Perp DEX: The breakout DeFi vertical of 2025.

Highlight

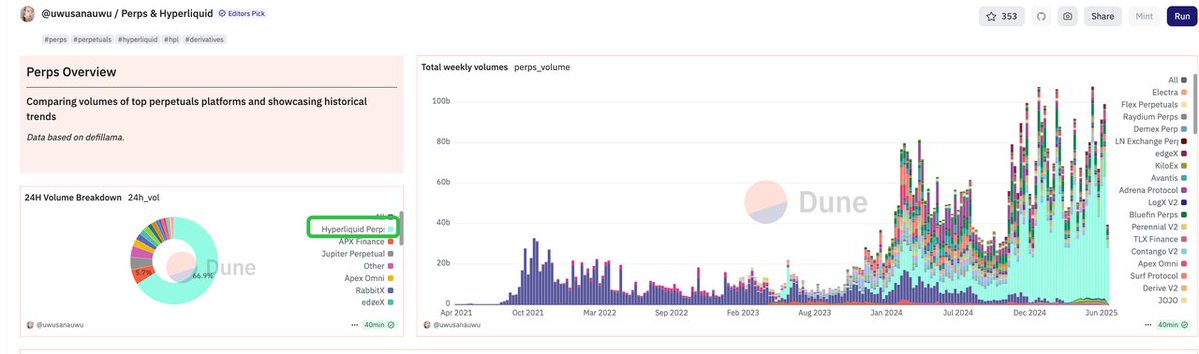

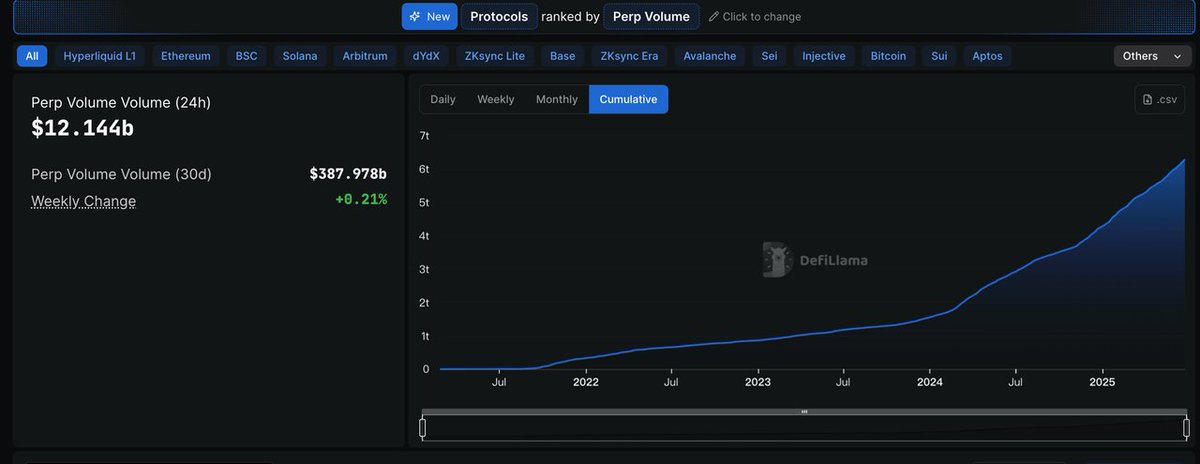

📊 Cumulative trading volume: $6.29T — up 121% YoY

🗓️ Monthly trading volume reached $382B in 2025, setting a new ATH — more than the other protocols combined volume

🔧 Perp DEXs edges:

Non-custodial = better asset security

High transparency and liquidity

High leverage, low trading costs

Intuitive wallet-native UX

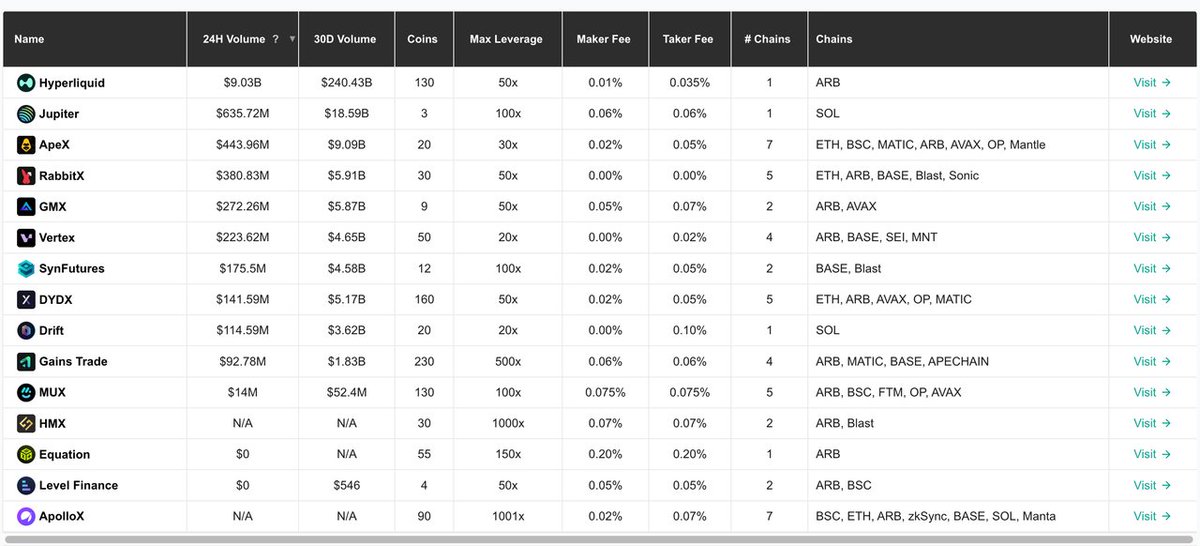

🧵 Landscape

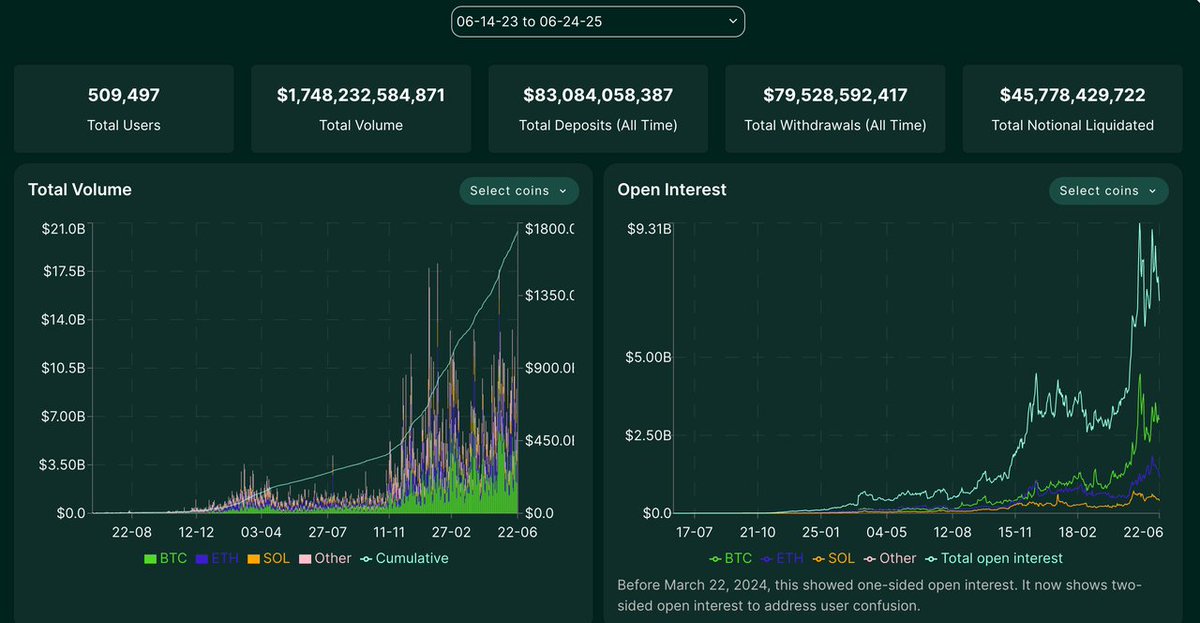

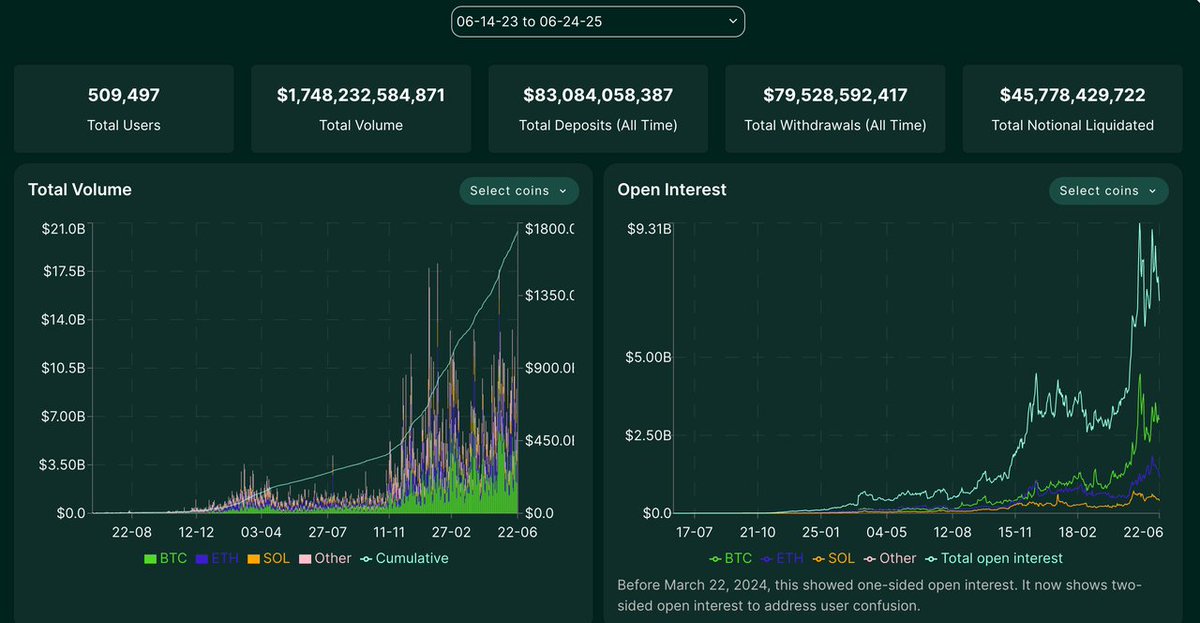

1️⃣ #Hyperliquid: the L1-native on-chain leader

🌐 Market share: 70%+, with $9.3B in daily trading volume, accounting for 64.7% of all on-chain perpetuals

📈 Cumulative volume: $1T+, new record

⚙️ Infra: custom-built L1 using #HyperBFT consensus + HyperEVM, supporting fully on-chain #CLOBs<5ms matching latency, 200K TPS — with target scalability to 1M orders/sec

🔍 Product:

Up to 50x leverage (#BTC, ETH, mid-caps)

Vaults (copy-trading) + #HLPs (passive LP yield)

🌱 Token & Community:

No VC — fully self-funded

70% $HYPE allocated to the community

Genesis airdrop to 94K users (~$45K avg. per user)

$3M/day buyback from fees → sustainable deflation model

2️⃣ dYdX: transitioning incumbent

⚠️ Market share dropped from 13.2% to 2.7%

📉 Switched to #dYdX Chain → UX disruptions

🔧 Up to 20x leverage, low fees (0.02%–0.05%)

🏛️ Cumulative volume: $1T+, in a slowly growth

3️⃣ Jupiter Perps @JupiterExchange (#Solana ecosystem)

🥈 Once held 8.8% market share

💥 Supports up to 100x leverage

💸 High-yield LP vaults: 50–70% APY

⛓ Built on #Solana’s native liquidity for smoother UX

Trends:

Modular and On-chain Architecture Innovations e.g., Hyperliquid’s “CLOBs on Blobs” is about fundamental decoupling, settlement & #DA

AI-enhanced uses in trading bots to uncover arbitrage & HF alphas

Infra upgrades: #L2s and fast L1s (Solana, #Sui, etc.) improve throughput & latency

#Perp DEXs evolve from Decentralized Access → Performance → UX → Institutional Trust

They're rapidly closing the gap with #CEXs on liquidity, speed, and UX — paving the road for the next wave of #DeFi killers

In 2025 and beyond, the core value of Perp #DEXs lies in:

Innovative product design

Liquidity incentive loops

Deep user loyalty & on-chain governance

6.16K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.