Payment Party: Will Visa and Mastercard be absent?

Words: Prathik Desai

Compilation: Block unicorn

It took nearly a thousand years from the first banknotes of the Tang Dynasty in ancient China to the functional check system. This was followed by wire transfers, which accelerated cross-border trade in the 19th century. But what really changed the way payments were made was a forgotten wallet.

In 1949, Frank McNamara forgot to bring his wallet while having dinner with clients at the Major's Cabin Grill in Manhattan, New York. The incident embarrassed him, but it also led to a pioneering effort to ensure that similar incidents did not happen again. A year later, he returned with the world's first credit card, the Diners Club Card, which eventually evolved into a credit card network that processes billions of transactions every day.

It wasn't long before Mastercard and Visa emerged from the chaos of banking alliances and rebranding, largely driven by the need to survive.

As Bank of America's BankAmericard (later renamed Visa) gained market traction in the 1960s, other regional banks were concerned about missing out on credit card opportunities. To meet this challenge, a group of banks formed Interbank in 1966, later renamed Master Charge, and eventually Mastercard, which allowed them to consolidate resources, share infrastructure, and build a scalable competitive network.

This race to stay competitive has evolved into one of the most successful collaborations in the history of the banking industry. Payments have become simpler, but more importantly, they have become "invisible". Swiping or tapping is more than just convenience, it lays the foundation for modern commerce.

People can now take their purchasing power with them wherever they go. Merchants get faster payouts. Banks have gained a new source of income. And the middle layer – the credit card network – has become one of the most valuable businesses in the world.

In 2024, Mastercard and Visa will generate $17 billion and $16 billion, respectively, from payment services alone. The volume of digital transactions continues to grow every year.

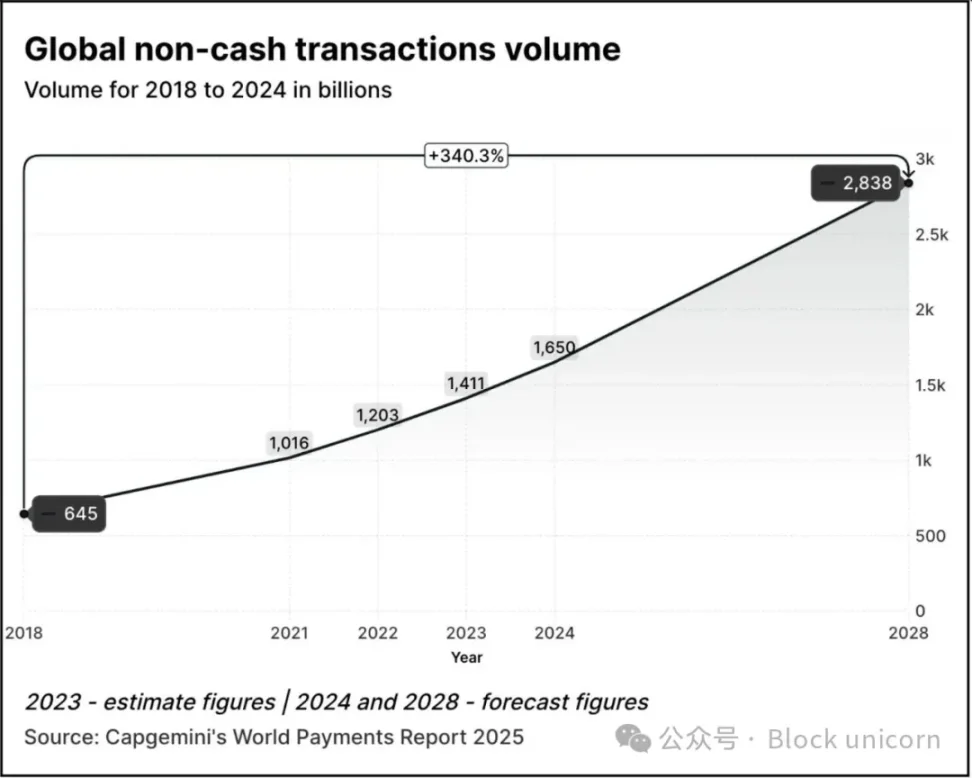

Transaction volume grew 2.5 times from 645 billion in 2018 to 1.65 trillion in 2024. According to Capgemini's World Payments Report 2025, transaction volume is expected to grow 70% from 2024 levels to 2.84 trillion by 2028.

In 2023, about 57% of non-cash transactions worldwide are done via debit or credit cards, and these transactions typically take 1 to 3 days to settle. Each transaction often needs to go through multiple institutions before the merchant can finally receive the payment. Still, the system works well. You can pay with the same card in Tokyo, Toronto or Thiruvananthapuram. Payments become intangible.

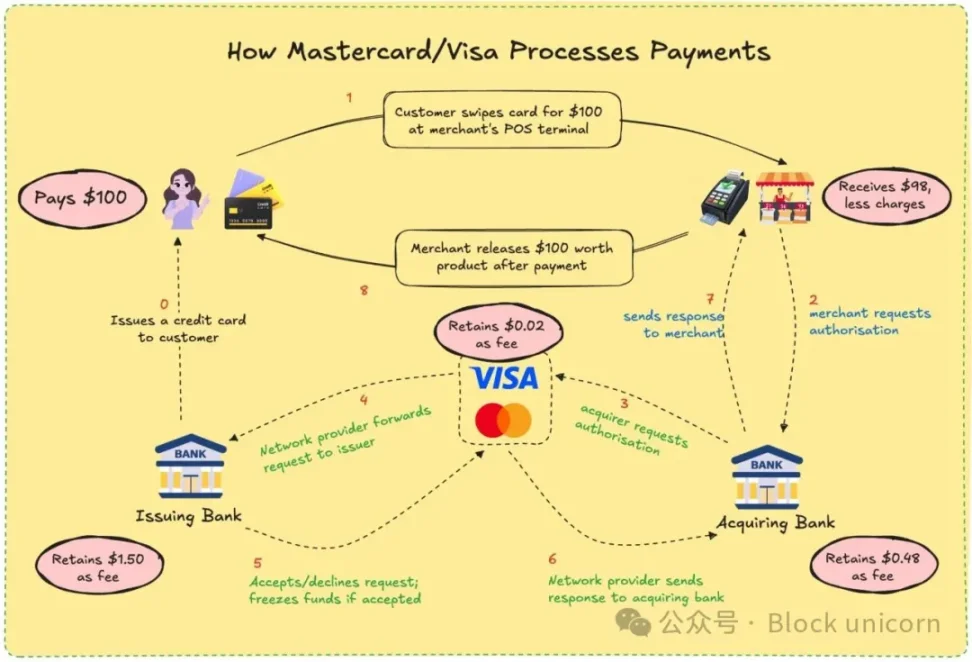

Visa and Mastercard never actually issue or hold your funds. What they have is a channel based on trust between financial institutions that do not know each other. When you pay by card, their network decides whether to allow transactions, matches the correct account, settles bills, and ensures that funds are eventually transferred.

To do this, the merchant needs to pay about 2-3% of the transaction value, and the fee is split between the issuing bank, the receiving bank, the processing agency, and the card network. In return, everyone gets a largely reliable system. You don't need to know who settled the payment, as long as it's done.

As a user, you probably don't hesitate about the process. Do you remember the last time you asked your favorite café how it gets its money after you swipe your card? You pay, they smile and respond, and life goes on. But for merchants, these percentage points add up to a small amount, especially for small businesses with small profits.

Have you ever been frustrated that you were charged a few dollars more when you paid with a card than cash or other digital payment methods? Now you know why.

Imagine if they could get paid immediately and with minimal processing fees, without delays. That's the promise of blockchain. Visa and Mastercard are trying to emulate or be outdone by this model.

With the addition of stablecoins, the dynamics of payment settlement have changed further. Over the past 12 months, the monthly trading volume of stablecoins has surpassed Visa's.

With stablecoins, transactions can be settled directly from one wallet to another in a matter of seconds. No banks, no processors, no delays, just codes. On networks like Solana or Base, fees are only a few cents, and transactions are done almost instantly.

It's not just theoretical. Freelancers in Argentina are already accepting USDC. Remittance platforms are integrating stablecoins to bypass the traditional banking system. Crypto-native wallets let users pay merchants directly without the need for a card.

The threat to Visa and Mastercard is a matter of life and death. If the globe starts trading on-chain, their role may disappear. As a result, they are adapting.

Mastercard's moves over the past year cannot be overlooked.

Its recent partnership with Chainlink aims to connect more than 3.5 billion cardholders directly to on-chain assets, representing more than 40% of the global population. The system leverages Chainlink's secure interoperable infrastructure, combined with the power of payment processors like Uniswap and Shift4, to create a fiat-to-crypto conversion bridge.

In addition, it has partnered with Fiserv and launched a stablecoin called FIUSD, which Mastercard plans to integrate into more than 150 million merchant touchpoints. What are their goals? Enables merchants to seamlessly convert between stablecoins and fiat currencies anytime, anywhere, just like email.

Through its Multi-Token Network (MTN), Mastercard also lays the foundation for stablecoin-linked cards, digital asset merchant settlement, and tokenized loyalty programs. Why forgo card-linked loyalty rewards just because you chose an on-chain payment option?

What's in it for Mastercard? Actually, a lot. Enabling on-chain settlement can reduce in-house processing costs by reducing middlemen.

Mastercard's $300 million investment in Corpay's cross-border payments division in April 2025 shows that they are betting on high-traffic, low-margin businesses, where cost-effectiveness is critical. Think of cross-border payments, which is one of Mastercard's key differentiators from its competitor, Visa. In 2024, Mastercard's cross-border transaction volume increased by 18% year-over-year.

They're also creating new fee structures: while traditional per-billing fees may be tapering down, now they can charge for API access, compliance modules, or integration with MTN.

At the same time, Visa has partnered with Yellow Card in Africa to experiment with cross-border stablecoin payments – something that Africa desperately needs. It has partnered with Ledger to launch cards that allow users to spend with cryptocurrencies and earn cashback in USDC or BTC. In addition, Visa continues to develop its Visa tokenized asset platform, which aims to enable banks to issue digital fiat instruments on-chain.

With stablecoin settlement, Visa doesn't have to trade through multiple banks or incur as much FX slippage. The motivation for this is to reduce costs and increase profit margins.

The philosophies of both companies are shifting. They are programming themselves as the infrastructure layer of programmable money. They realized that the future might no longer be dominated by card swiping, but by smart contract calls.

There is also a deep personal factor behind all this.

I had to wait three days for a refund due to a cancellation. I've witnessed international freelancers struggling with wire transfer delays and costs. I wondered why my cashback didn't arrive until a few weeks after the trade. For users like us, these inefficiencies are inconvenient, but they've become the norm. Web3 now offers an alternative.

For payment giants, the biggest hurdle will be cost. For merchants, traditional card transactions can cost 2% or more. With on-chain stablecoins, fees can be reduced to less than 0.1%. For users, this means faster cashback, real-time settlement, and lower prices. For developers and fintech companies, this means building applications that can connect directly to global payment networks without the need for traditional banking procedures.

Web3 will still have its own trade-offs. Credit card networks offer fraud protection, refunds, and dispute resolution services. This is not the case with stablecoins. If you send funds to the wrong wallet, those funds are likely to be gone forever. Despite the efficiency of on-chain capital flows, it still lacks the consumer protections that we value. The recent passage of the GENIUS Act in the Senate is likely to address some of the consumer protection concerns.

Visa and Mastercard aren't waiting for their time. Instead, they see the gap as an opportunity. By overlaying traditional compliance, risk scoring, and security features on top of stablecoin transactions, they aim to make Web3 safe for the average user. The strategy is to have other people build protocols and then sell them the hardware that enables those protocols to be used at scale.

They are also betting on trading volume. Not speculative transactions, but real-world uses: remittances, wages, e-commerce. If this traffic is moved on-chain, the companies that help manage it will benefit, even if they are no longer the toll collectors they used to be.

Visa and Mastercard want to be the enablers of building such an ecosystem from the ground up. So, when your chosen crypto wallet requires a trusted KYC layer, or your bank needs cross-border compliance, there's a branded API ready to go.

What does this mean for users? It could be a future where your wallet functions like a bank. You receive payments with stablecoins, spend through Visa or Mastercard interfaces, earn tokenized point rewards, and settle instantly. You may not even notice which chain it goes through.

For someone like me, who has been through everything from banking apps to UPI to buying coffee with cryptocurrency, the appeal is clear: I want the payment to be simple and effective. I don't care if it's a token or a rupee. What I care about is that it's fast, cheap, and error-free. If these old giants can guarantee this, perhaps they are worth continuing to exist.

Ultimately, it's a race to stay indispensable. If Web3 wallets become the new payment norm, the beneficiaries could also be those who are building tracks underneath. The card giants are betting that even if the currency is made, the infrastructure may still belong to them.

They want to be hidden behind the scenes again. Only this time, the pipeline will be made up of code.