Let's update on the recent issue of Ethereum staking queues that many people are paying attention to, as well as my subsequent thoughts.

The starting point of all this was when @justinsuntron made a large withdrawal of his $ETH deposit on @aave, which directly led to a sharp increase in the platform's lending rates.

This change in rates was a fatal blow to the big players engaging in "circular lending." Let me explain their strategy: they deposit stETH, then borrow ETH, and immediately stake the borrowed ETH to get new stETH... and they keep repeating this, pushing the leverage to the extreme.

So, when borrowing costs skyrocketed, their only option was to "unwind the leverage," which means they had to liquidate urgently. This meant they had to sell a large amount of stETH on the secondary market to repay their loans.

This wave of concentrated selling pressure naturally led to a temporary "decoupling" of the stETH and ETH exchange rates. At this point, arbitrageurs bought stETH at a discount and then queued up at the official platform to unstake and exchange it back for $ETH at a 1:1 ratio.

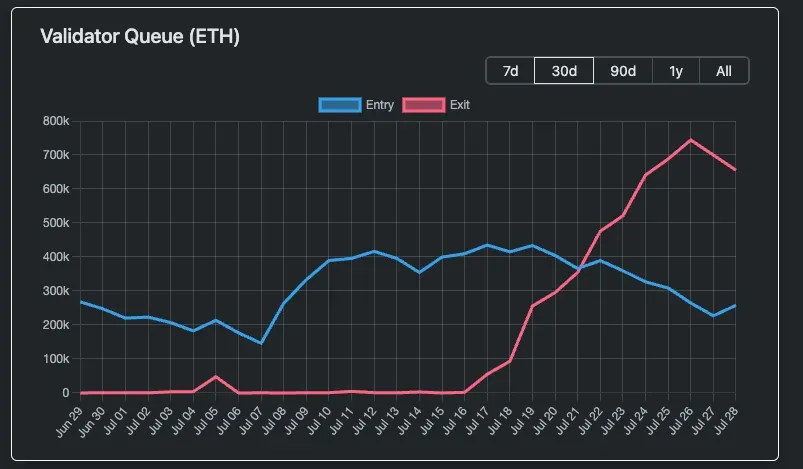

This is the direct reason we saw a surge in the number of people queuing to exit.

However, there is a crucial time lag here. According to the current queue numbers, the official unstaking takes an average of 11-12 days. If the event started to unfold on July 16, then the $ETH that these arbitrageurs applied to redeem won't actually unlock until at least July 27. This also means that from the 16th to the 27th, the number of people in line will only increase, not decrease, so the red line on the data chart will appear to keep rising.

Therefore, I believe the real indicator will be the trend after July 27. And indeed, we have seen that since that day, the trend of people queuing to exit has started to slow down and gradually decline.

From this perspective, I personally tend to believe that this wave of unlocking pressure is indeed coming from market behavior to deleverage, rather than big players lacking confidence in the future and wanting to dump before $ETH hits $4,000. If it were the latter, then logically, the number of people queuing to exit should remain high.

Thus, in the coming days, everyone can continue to observe this chart to see whether the red line continues to drop or flattens out (which would require extra caution) 📈.

Show original

22.78K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.