BTCFi Alpha File #02: July 11

BTCFi has crossed $6.35B in TVL, up +500% YoY.

That’s the headline. But the real alpha is in the rotation.

Because total TVL tells you size.

Inflow delta tells you conviction.

Some protocols are just passengers, lifted by the broader wave. Others are magnets, pulling in liquidity, users, and ecosystem mindshare through better architecture and stronger design.

To find out where the real traction is, I analyzed TVL shifts across the BTCFi ecosystem over the past 7 days and 1 month.

I wasn’t just looking for TVL spikes. I was looking for:

> Early product-market fit

> Sticky inflows over time

> Signs of protocols moving from speculative to foundational

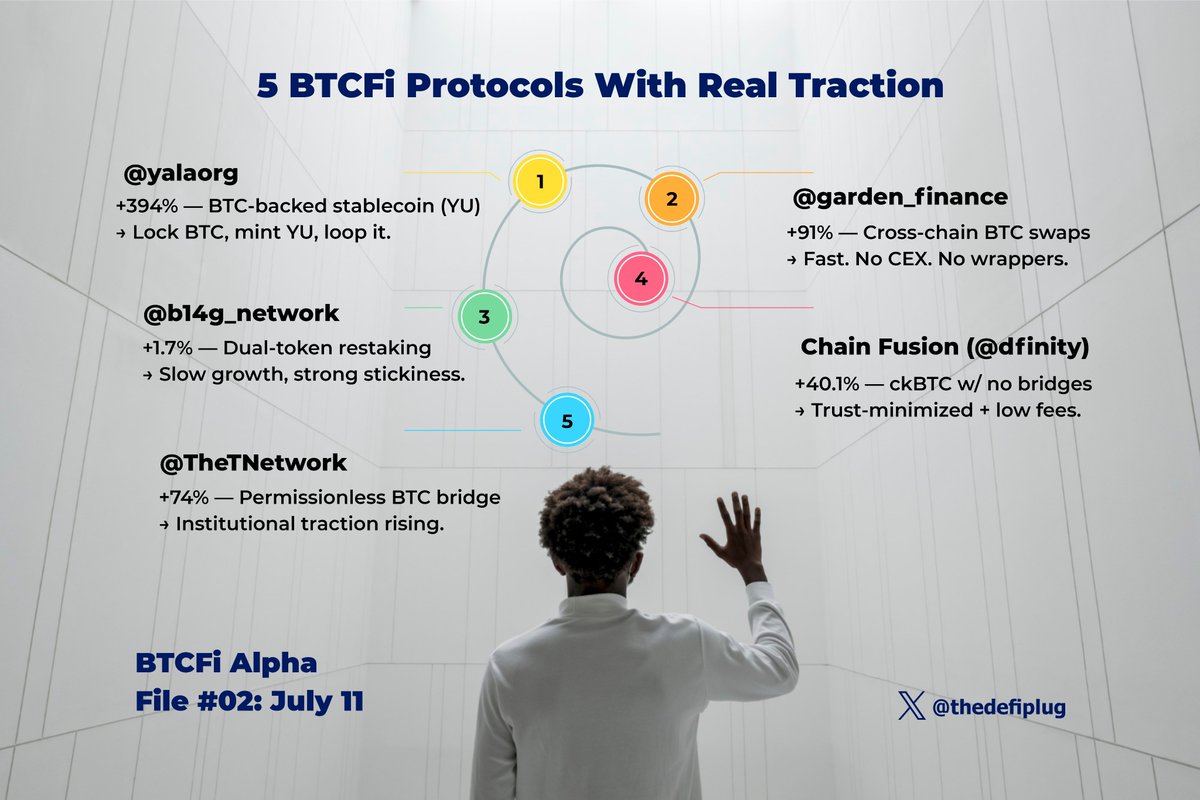

Here are five of the strongest signals over the past 1M:

1️⃣ @yalaorg

• TVL: $211.7M

• 7D: +53.5%

• 1M: +394%

Yala is building the MakerDAO of BTCFi.

Users lock Bitcoin, mint a stablecoin (YU), and loop it back into DeFi. It's capital-efficient. It's straightforward. And it works.

A 4x increase in 30 days doesn’t happen by accident. That points to real demand for capital-efficient Bitcoin-backed liquidity.

2️⃣ @garden_finance

• TVL: $4.48M

• 7D: +71.6%

• 1M: +91%

Garden is infrastructure that routes $BTC between chains. Fast swaps (30s). It does it without CEX friction, without shady wrappers, and with almost zero noise.

This kind of growth doesn't come from hype. It comes from real usage. BTCFi capital is starting to rotate across ecosystems, and Garden is already carrying the traffic.

This is the kind of protocol that just works. You don’t see it in the headlines. You see it in the flows.

3️⃣ @b14g_network

• TVL: $200.8M

• 7D: +7.6%

• 1M: +1.7%

b14g is a restaking protocol that uses dual-token staking. You stake both BTC and b14g to participate.

That alignment is key. It reduces emissions, slows down sell pressure, and builds stronger validator economics. It also opens up restaking to future appchains.

The TVL growth here isn’t explosive. But it’s sticky. In restaking, that matters more. You want infrastructure that holds value through market noise.

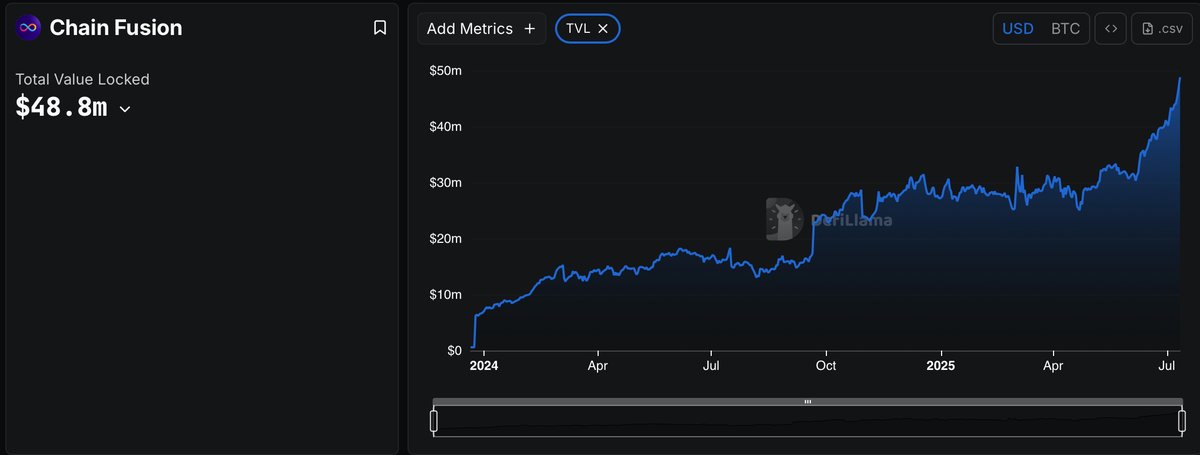

4️⃣ Chain Fusion (@dfinity)

• TVL: $48.8M

• 7D: +2.1%

• 1M: +40.1%

Chain Fusion solves a core BTCFi problem: trust-minimized, cross-chain BTC.

Built by Dfinity, it mints ckBTC: a 1:1 backed BTC derivative with smart contract custody, no bridges, and near-zero fees.

5️⃣ @TheTNetwork

• TVL: $594.3M

• 7D: +1.3%

• 1M: +74%

Threshold is the team behind tBTC, a fully permissionless Bitcoin bridge. It was early. Maybe too early.

But now the timing looks right.

TVL is rising again. Institutions want secure, non-custodial $BTC access. BTCFi protocols want integrations with credible bridges. And the market is shifting toward self-custody again.

tBTC is quietly picking up momentum from all sides, including latest integration with @SuiNetwork.

● What the Flows Are Signaling?

BTCFi isn’t just one thing anymore. The ecosystem is fragmenting. Routing. Vaults. CDPs. Restaking. Different layers. Different users. Real usage.

The protocols that are winning aren’t offering the highest APRs. They’re offering the best architecture. That’s what sticks.

Momentum doesn’t have to be loud. It has to be consistent.

✍️ Final Take

TVL tells you who made it last cycle.

Inflows tell you who is building for the next one.

In a $6.35B BTCFi ecosystem, the most interesting data point is not who has the most capital. It’s who is earning the next wave of it.

These five protocols are doing exactly that.

26.69K

261

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.