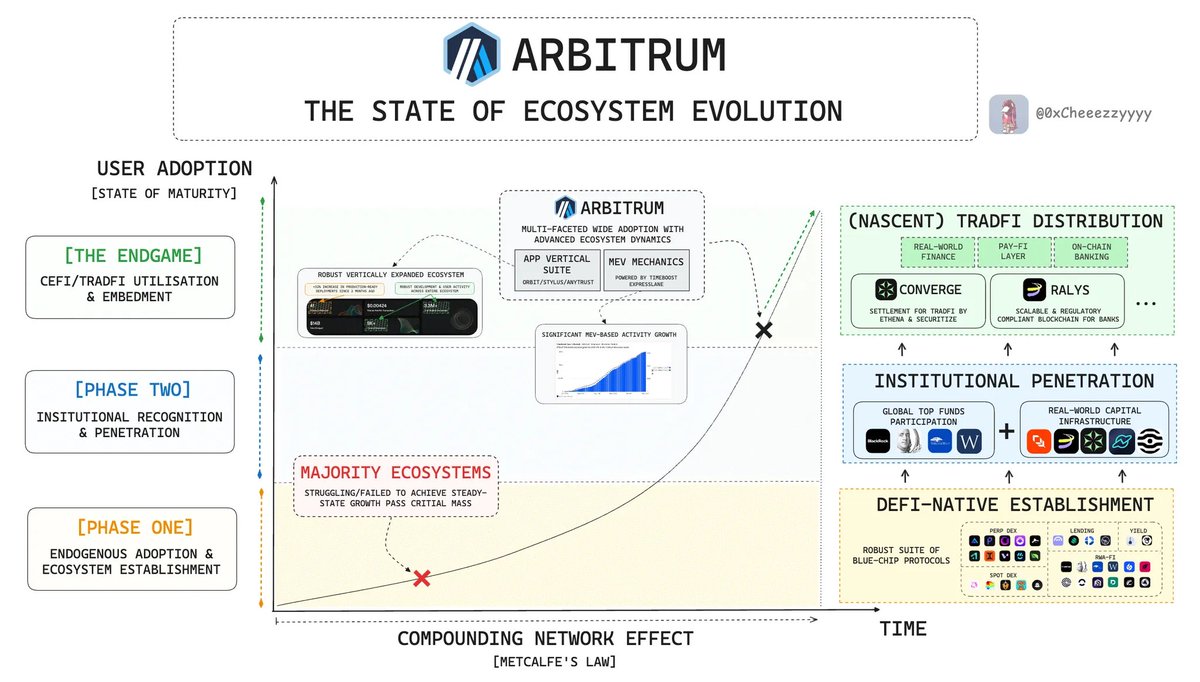

1/ @arbitrum didn't just scaled over the years.

It’s entering a unique phase of ecosystem discovery, playing a game few can.

This evolution redefines the boundaries of adoption:

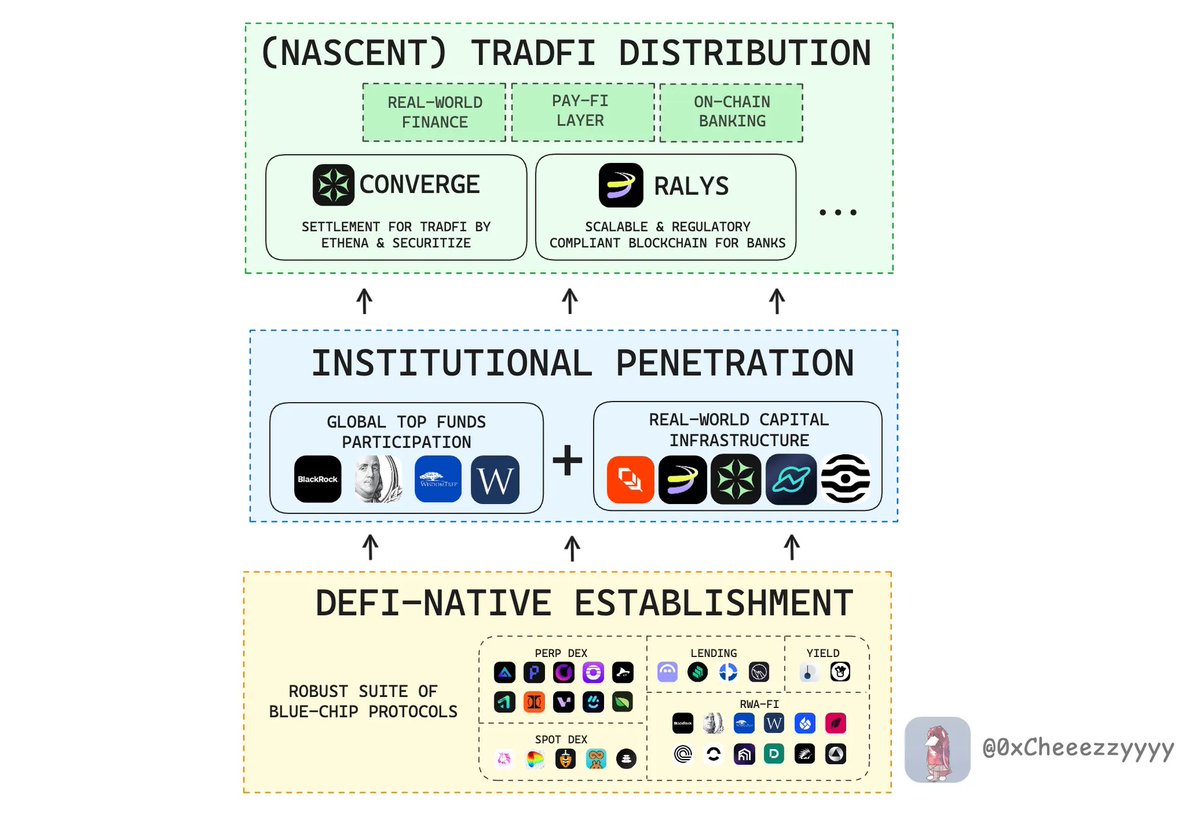

DeFi-native → Institutional Penetration → (Nascent Signs) TradFi Distribution

Insights🧵

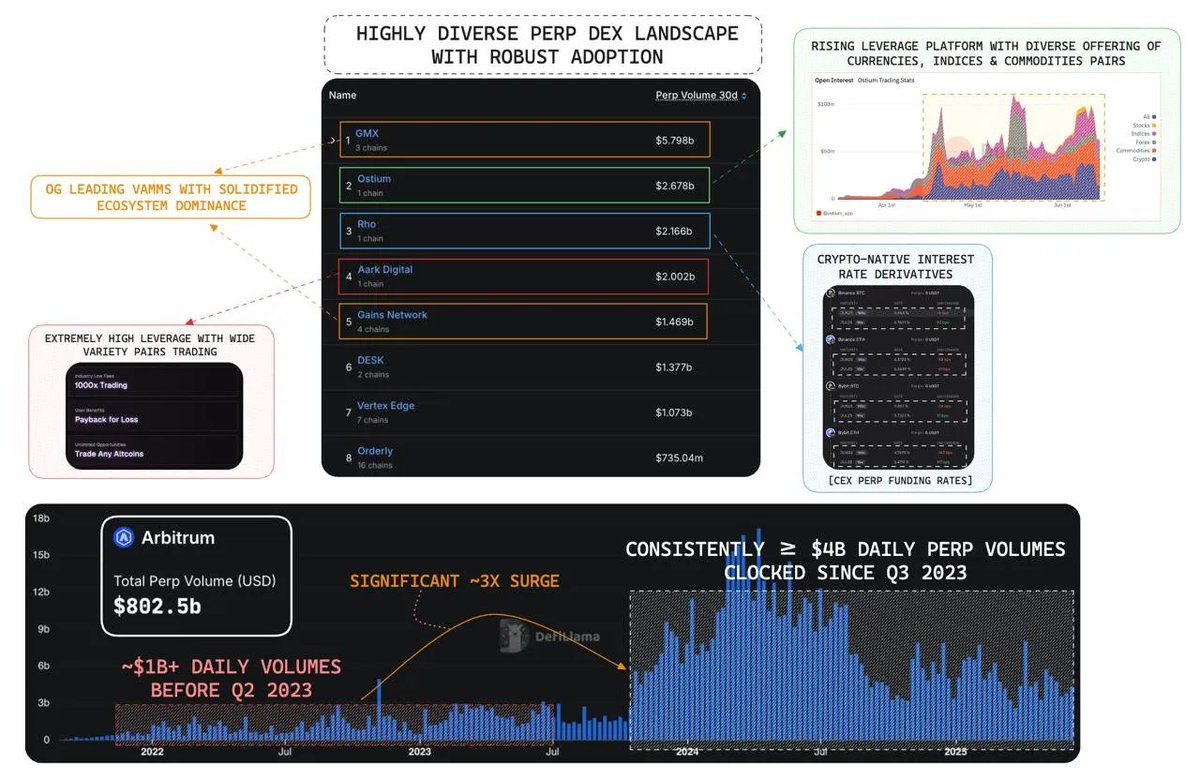

3/ @arbitrum has played a foundational role in shaping the perp DEX landscape, dating back to the early vAMM days led by @GMX_IO @GainsNetwork_io since Q3 2021.

Fast forward today, user adoption has reached steady-state maturity w/ strong retention reflected in daily volume trends:

🔸 ~3x increase in daily volume ($1B → $4B) since Q3 2023

🔸 $802.5B in cumulative volume

The perp DEX ecosystem has since diversified with new, specialised players:

🔹 @Rho_xyz: crypto-native IR derivatives (CEX funding rates)

🔹 @Aark_Digital: ultra high-leverage trading (up to 1000x)

🔹 @OstiumLabs: multi-asset exposure (currencies, indices, commodities)

The non-stop innovative evolution & sticky usage points to a self-sustaining relevant ecosystem.

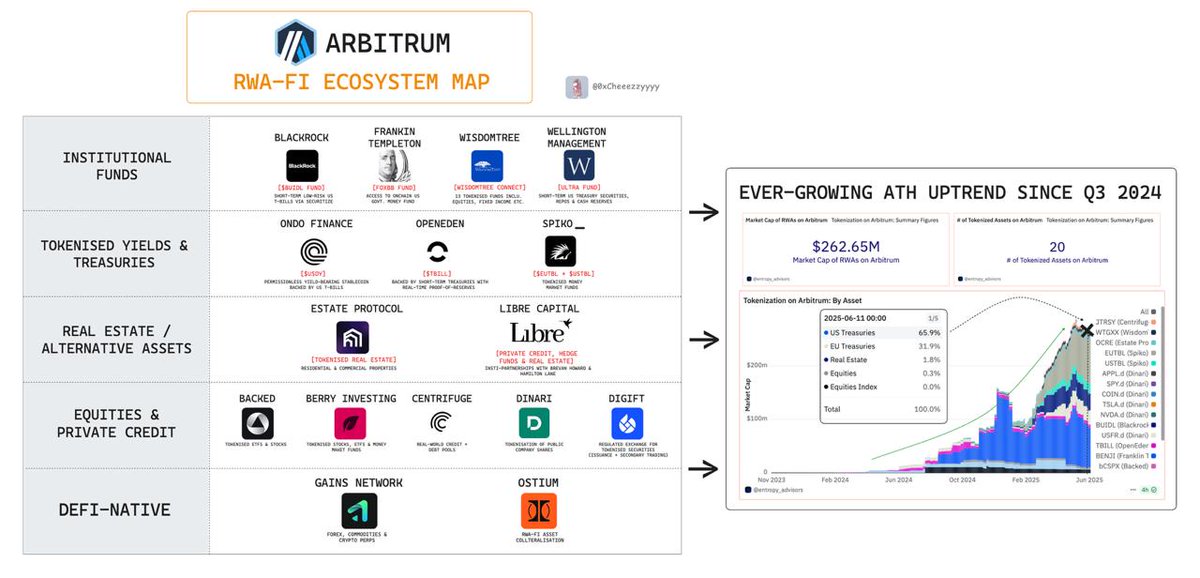

4/ @arbitrum’s RWA-Fi sector growth continues to accelerate to ATHs TVL of $262.7M since Q3 2024.

This momentum, backed by a diverse & growing list of global fund participants reinforces Arbitrum’s status as an enterprise-grade ecosystem for tokenised onchain finance.

Notably, @Spiko_finance’s $EUTBL now leads w/ EU Treasuries segment, commanding ~32% market share surpassing:

🔹 @FTI_Global’s $BENJI (27.5%)

🔹 @BlackRock’s $BUIDL (11.9%)

This clearly signals that insti-grade adoption is no longer theoretical.

5/ As insti-giants lead the charge, what's equally notable is the growing diversity across Arbitrum’s sub-ecosystem.

This spans both RWA integration & DeFi-native innovation.

This blend creates a rich landscape catering to:

🔹 Institutional allocators seeking compliance-ready, yield-bearing assets (e.g., treasuries, credit markets)

🔹 Crypto-native users chasing permissionless leverage, structured products or long-tail yield strategies

By covering both ends of the spectrum, Arbitrum positions itself as an all-encompassing ecosystem:

Capable of capturing capital across every vertical, from DeFi to TradFi.

RWA-Fi on @arbitrum is quietly scaling with maturity.

Since Q3 2024, the sector has grown steadily reaching new ATH TVL of ~$263M across 20 tokenised real-world assets.

Current breakdown shows institutional traction & asset diversity:

🔸 US Treasuries: 65% ($173.3M) driven by institutional-grade funds

🔸 EU Treasuries: 31.9% ($84M) led by @Spiko_finance’s $EUTBL

🔸 Real Estate: 2.8% ($4.8M)

🔸 Equities/Indices: <0.5% (~$1M)

Notably, the ecosystem’s depth has matured w/ new verticals taking shape beyond basic RWA exposure:

1. (Leading) Institutional Funds:

🔹 @BlackRock: $BUIDL fund exposed to ST low-risk T-bills

🔹@FTI_Global: $BENJI fund offering onchain access to onchain US Govt. Money Fund (FOXBB)

🔹@WisdomTreeFunds: Access to 13 tokenised funds incl. equities, fixed income etc.

🔹Wellington Management: ULTRA Fund → US Treasury securities, (reverse) repos & cash reserves

2. Tokenised Yield & Treasuries:

🔹@OndoFinance: $USDY stablecoin backed by US T-bills

🔹@OpenEden_X: $TBILL backed by US T-bills w/ real-time Proof-of-Reserves

🔹@Spiko_finance: $USTBL & $EUTBL tokenised money market fund

3. Real Estate / Alternative Assets:

🔹@EstateProtocol: Tokenised residential & commercial properties

🔹Libre Capital: Private credit, hedge fund & real estate w/ insti-partnerships (Brevan Howard & Hamilton Lane)

4. Equities & Private Credit:

🔹@BackedFi: Tokenised ETFs & stocks

🔹@BerryInvesting: Tokenised stocks, ETFs & MMFs

🔹@centrifuge: Real-world credit & debt pools

🔹@DinariGlobal: Tokenisation of public company shares

🔹@DigiFTTech: Regulated exchange for tokenised securities (issuance + secondary trading)

5. DeFi-Native:

🔹 @GainsNetwork_io: Forex, commodities & crypto perps

🔹 @OstiumLabs: Perps trading + RWA asset collateralisation

-----

These are early signals pointing toward Arbitrum becoming the de facto L2 for RWA liquidity where traditional capital meets DeFi-native programmability.

Still early & uponly from here imo.

h/t @EntropyAdvisors for the @Dune insights

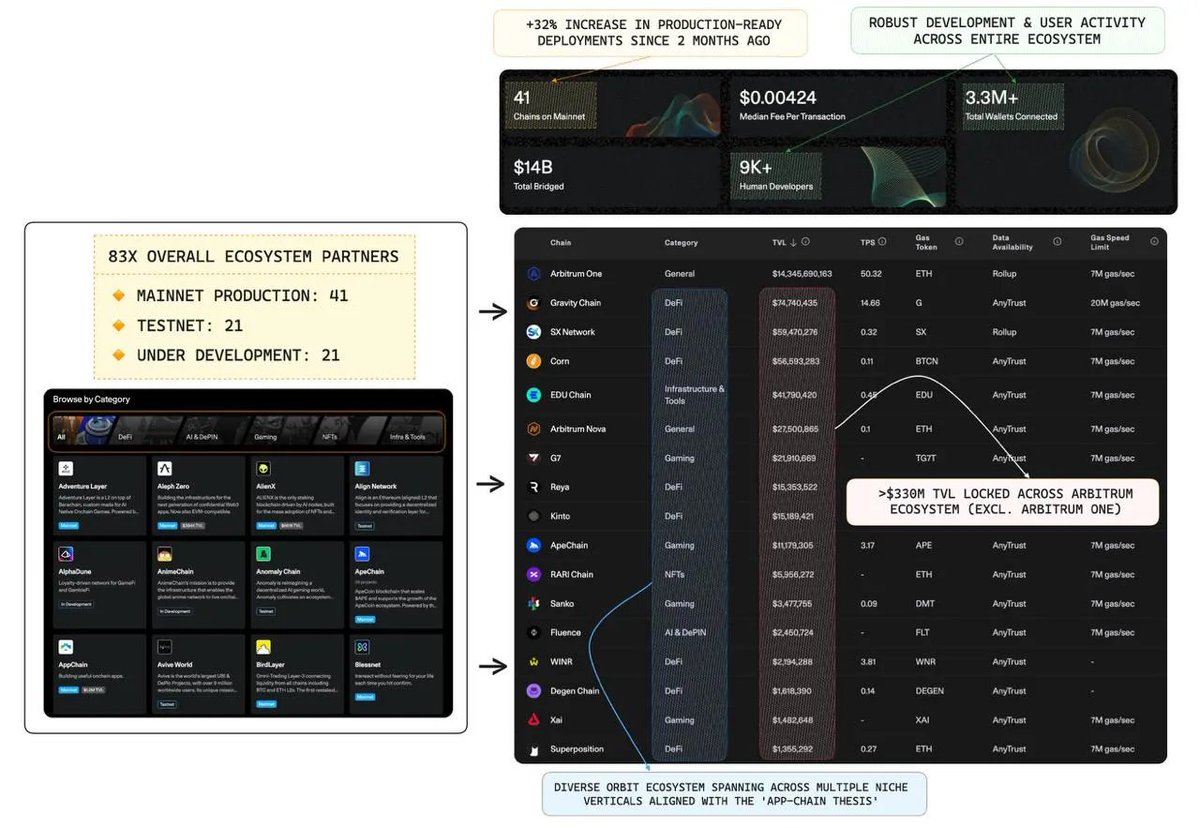

6/ @arbitrum Orbit & Stylus are becoming key drivers of multi-vertical growth, powering niche builds across a range of domains.

This aligns with the 'appchain thesis', where customisation + flexibility are essential for optimising infra.

Adoption is ramping up fast:

🔸 83 official ecosystem partners

🔸 41 mainnets live (+32% since April 2024)

🔸 21 in testnet + 21 in active development

🔸>$320M TVL across Arbitrum's ecosystem excl. ArbitrumOne

At this pace, it’s clear the framework is gaining industry-wide recognition as enterprise-grade infrastructure for next-gen blockchain applications.

7/ @arbitrum is seeing growing traction from institutional giants backed by real adoption & infra-level validation.

🔸Global Funds: @BlackRock, @FTI_Global, @WisdomTreeFunds, Wellington Management building RWA-Fi liquidity

🔸Infra Rails: @plumenetwork @Novastro_xyz @real_rwa bridging real-world capital onchain

And now, early signs of the TradFi distribution endgame are surfacing:

1. @convergeonchain building an institutional settlement layer (e.g. @ethena_labs, @Securitize)

2. @RaylsLabs rolling out a compliant chain for banks

The takeaway is clear:

Arbitrum is becoming the infrastructure of choice for real-world institutional deployment.

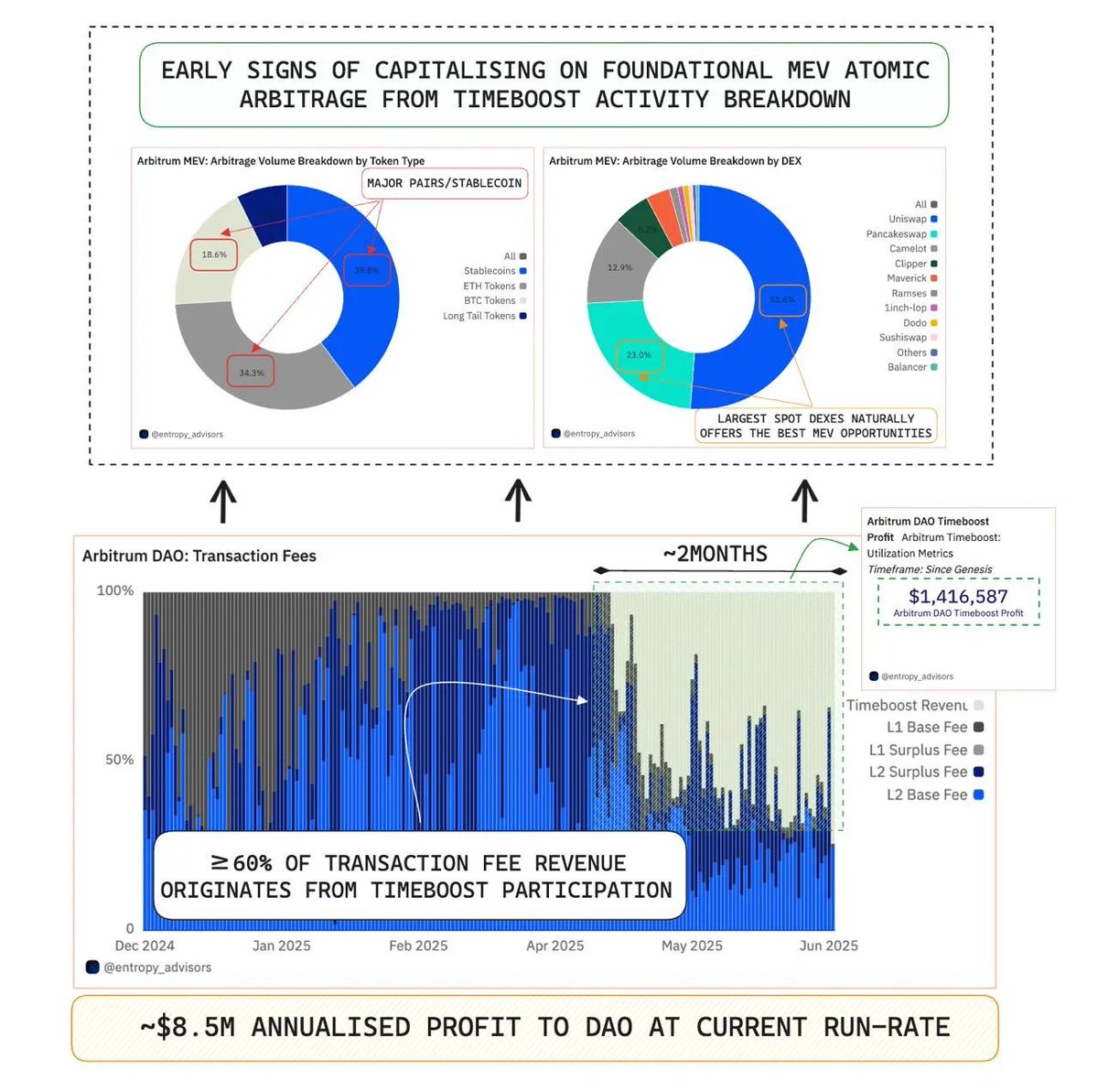

8/ The proliferation of MEV dynamics signals an ecosystem reaching next-stage maturity.

@arbitrum's Timeboost auction introduces efficient, fair competition mirroring mainnet’s PBS model.

Since launching <2 months ago, utilisation is considerably significant:

🔸 ~$1.42M in DAO revenue (annualised ~$8.5M)

🔸 ≥60% of tx fee revenue now comes from Timeboost

We're seeing early signs of MEV atomic arbitrage monetisation w/ most activity concentrated around high-volume pairs (BTC, ETH & stablecoins).

The next stage of maturity will be marked when long-tail assets begin capturing a larger share of MEV flow imo.

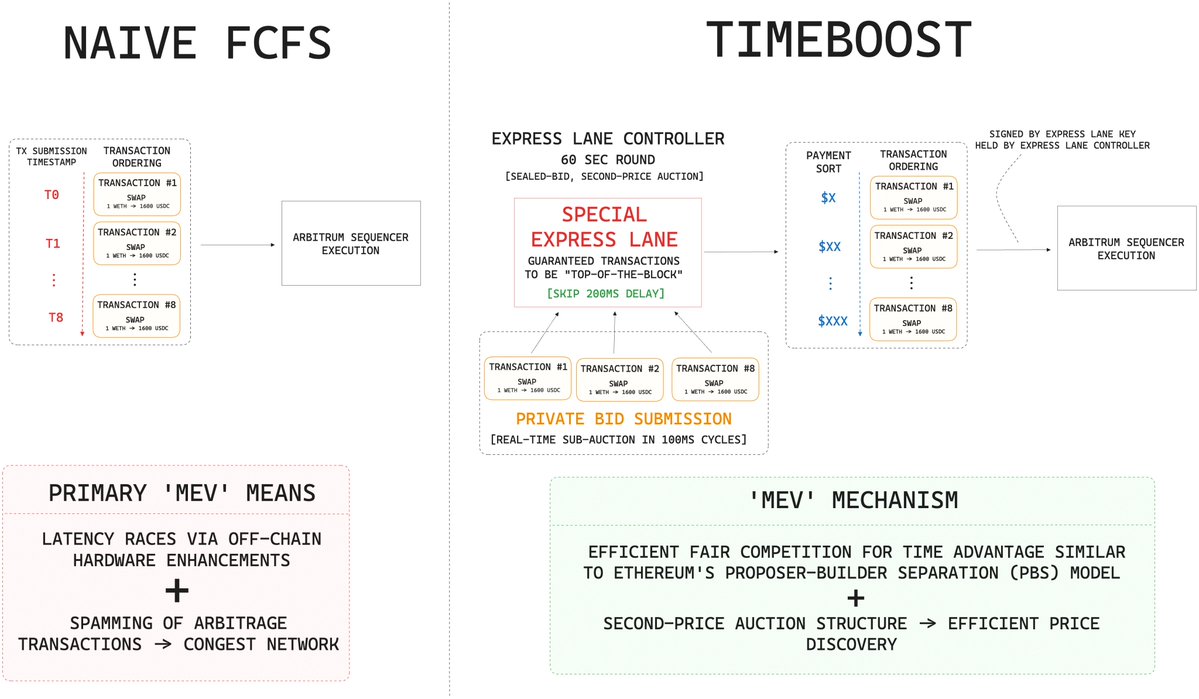

On Timeboost: @arbitrum's MEV

Since Arbitrum One & Nova launch, it has been operating via a FCFS sequencing model.

This resulted in:

🔸Latency races dependent on off-chain hardware effectiveness

🔸Network congestion from (arbitrage) tx spamming

Timeboost aims to overcome the limitations of FCFS while still retain its benefits.

How So?

This introduces an 'express lane' concept w/ 60s round managed by the winning auctioneer (mostly Kairos by @titanbuilderxyz & @SeliniCapital rn)

Users submit bids & txs are ranked by payment instead of submission timestamp.

This introduces the following benefits:

🔹 MEV fairness via Similar Ethereum’s PBS (Proposer-Builder Separation)

🔹 Better price discovery mechanism via second-price auction design for valuable txs (arbitrage etc.)

🔹 Less redundant txs → Less network congestion

🔹 Democratises access → users don’t need the fastest infra, just good modelling

9/ Interestingly, Timeboost expresslane alr accounts for ~5% of @arbitrum’s total tx count.

This sits on a steady uptrend since launch.

But what’s more telling is the volume footprint:

🔸 ~$175M in daily trade volume now stems from MEV arbitrage

🔸 ~21.8% of Arbitrum’s ~$900M avg. daily volume (past 1M)

This is highly significant imo, it suggests MEV is no longer a marginal layer but a core liquidity engine powering meaningful volume.

As MEV matures into a native yield stream, it signals both user sophistication + protocol-level monetisation reaching new depth.

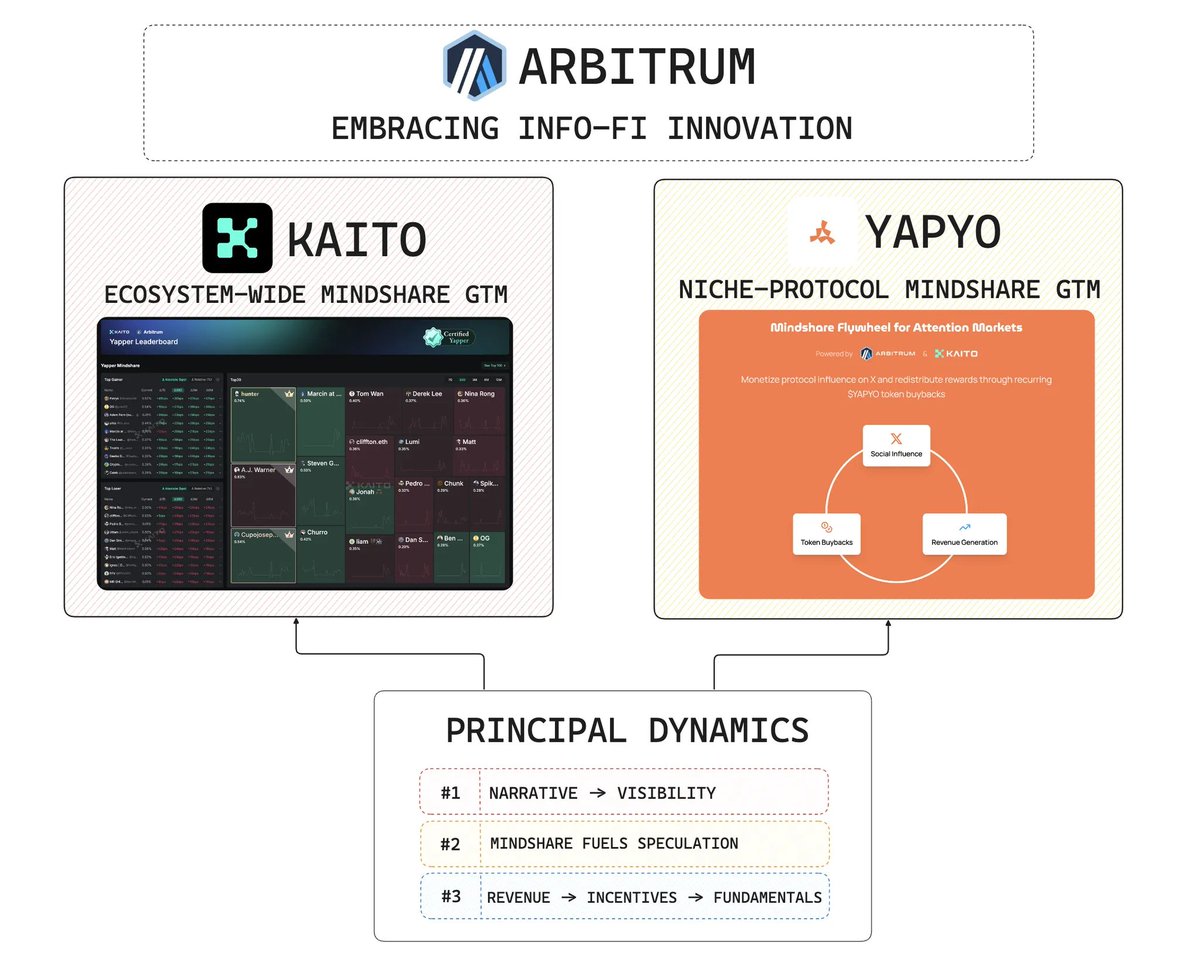

10/ Lastly, on InfoFi adoption:

@arbitrum stands out as a key ecosystem embracing this narrative, highlighted by its recent @KaitoAI integration via the yapper leaderboard.

This comes with 400k $ARB (~$124k) incentives over 3 months.

Now, second-layer InfoFi innovation is taking shape w/ @yapyo_arb that positions as a decentralised mindshare hub merging social coordination with incentive design.

Details are scarce, but early signs point to a niche protocol-focused GTM strategy powered by $YAPYO imo.

11/ It’s clear from the data, @arbitrum isn’t just another ecosystem.

It has reached escape velocity, entering the next phase of adoption beyond DeFi & into broader on-chain utility.

The maturity, depth & evolving dynamics speak for themselves.

Not all chains are playing the same game.

Arbitrum is playing its own.

12/ That's all, thanks for reading!

h/t @DefiLlama @Dune & massive s/o to @EntropyAdvisors for building a comprehensive suite of dashboards🫡

For more @arbitrum updates:

If you found this insightful feel free to share👇

lastly, tagging frens, Arbitrum enjoyoors & researchoors who might be interested in this research piece:

@EdFelten

@hkalodner

@ajwarner90

@sgoldfed

@0xRecruiter

@BFreshHB

@daddysether

@Churro808

@samfriedman6_

@lumbergdoteth

@MattyTom01

@peterhaymond

@MarcinPress

@allred_chase

@SpikeCollects

@RealJonahBlake

@yellowpantherx

@CocoraEth

@thelearningpill

@0xAndrewMoh

@Mars_DeFi

@PenguinWeb3

@kenodnb

@YashasEdu

@eli5_defi

@arndxt_xo

@cryptorinweb3

@St1t3h

@crypto_linn

@ahboyash

@ethereumintern_

@Shoalresearch

@Flip_Research

@2077Research

@PinkBrains_io

29.11K

237

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.