PIXEL

Pixels价格

$0.038730

+$0.00075000

(+1.97%)

从 (UTC+8) 0 点 到现在的价格变化

免责声明

本页面的社交内容 (包括由 LunarCrush 提供支持的推文和社交统计数据) 均来自第三方,并按“原样”提供,仅供参考。本文内容不代表对任何数字货币或投资的认可或推荐,也未获得欧易授权或撰写,也不代表我们的观点。我们不保证所显示的用户生成内容的准确性或可靠性。本文不应被解释为财务或投资建议。在做出投资决策之前,评估您的投资经验、财务状况、投资目标和风险承受能力并咨询独立财务顾问至关重要。过去的表现并不代表未来的结果。您的投资价值可能会波动,您可能无法收回您投资的金额。您对自己的投资选择自行承担全部责任,我们对因使用本信息而造成的任何损失或损害不承担任何责任。提供外部网站链接是为了用户方便,并不意味着对其内容的认可或控制。

请参阅我们的 使用条款 和 风险警告,了解更多详情。通过使用第三方网站(“第三方网站”),您同意对第三方网站的任何使用均受第三方网站条款的约束和管辖。除非书面明确说明,否则欧易及其关联方(“OKX”)与第三方网站的所有者或运营商没有任何关联。您同意欧易对您使用第三方网站而产生的任何损失、损害和任何其他后果不承担任何责任。请注意,使用第三方网站可能会导致您的资产损失或贬值。本产品可能无法在所有司法管辖区提供或适用。

请参阅我们的 使用条款 和 风险警告,了解更多详情。通过使用第三方网站(“第三方网站”),您同意对第三方网站的任何使用均受第三方网站条款的约束和管辖。除非书面明确说明,否则欧易及其关联方(“OKX”)与第三方网站的所有者或运营商没有任何关联。您同意欧易对您使用第三方网站而产生的任何损失、损害和任何其他后果不承担任何责任。请注意,使用第三方网站可能会导致您的资产损失或贬值。本产品可能无法在所有司法管辖区提供或适用。

Pixels 市场信息

市值

市值是通过流通总应量与最新价格相乘进行计算。市值 = 当前流通量 × 最新价

流通总量

目前该代币在市场流通的数量

市值排行

该资产的市值排名

历史最高价

该代币在交易历史中的最高价格

历史最低价

该代币在交易历史中的最低价格

市值

$2,983.93万

流通总量

771,041,667 PIXEL

占

5,000,000,000 PIXEL

的 15.42%市值排行

--

审计方

最后审计日期:2022年9月26日 (UTC+8)

24 小时最高

$0.038990

24 小时最低

$0.036560

历史最高价

$0.30900

-87.47% (-$0.27027)

最后更新日期:2024年12月6日 (UTC+8)

历史最低价

$0.018530

+109.01% (+$0.020200)

最后更新日期:2025年4月7日 (UTC+8)

您认为 PIXEL 今天会涨还是会跌?

您可以点赞或点踩来表达对该币种今日涨跌的预测

投票并查看结果

Pixels 动态资讯

以下内容源自 。

Sleepagotchi 💤🦖

😴 GM,睡觉的朋友们!

我们很高兴与 @pixels_online 一起推出我们的首个玩赚活动——🟩 GO GREEN 事件!

📅 开始时间:6月17日,UTC时间上午11点

📅 结束时间:6月24日,UTC时间23:59

🎯 在 Sleepagotchi LITE 中收集绿色球体,登上排行榜,争取:

🪙 500,000 $PIXEL(约20,000美元)

🏆 在前1000名玩家中分配!

🚨 重要提示:仅在活动期间收集的球体有效。英雄重置后的球体不算。

而这仅仅是个开始……通过我们与 PIXELS 的合作,还会有更多令人兴奋的掉落!

不要错过!👇

查看原文

1.45万

88

Investergram

8小时后,我们从60万飙升到超过320万。

这不是巧合,我告诉过你它被低估了,即使在300万时仍然非常低估。在这个领域中,开发和承诺需要如此之多,不仅要在应用商店和谷歌商店上架,还要整合加密货币和每个人最喜欢的角色?这太庞大了。

我从团队那里听说,他们很快将整合更多来自大社区的角色,这将增加曝光率,更多的合作伙伴,更多的持有者。

我敢你去@CoinMarketCap的Play to Earn #P2E部分,浏览前10个币种并比较提供的游戏。Degen Arena将远远脱颖而出。前10名中最低的市值是1.25亿,而$DEGEN仍然是个婴儿,将成长为一头野兽。

更高!@DegenArenaGame

$AXS $MANA $SAND $GALA $BEAM $PIXEL $SKL

Investergram

遇到了一种新推出的币,叫做 $DEGEN。

该项目在桌面、苹果商店和谷歌商店上都有其游戏上线。这显示了团队的奉献精神,显然他们在开发一个完整的玩赚游戏上投入了大量的工作,而没有通过私募、预售或种子阶段获得外部资金。

这告诉你,团队资金雄厚,并且不怕花钱来实现他们的梦想。

现在想象一下,这个代币的市值为60万美元,而P2E市场是一个超过50亿美元的行业。这将会飙升到数百万,你可以保存这条推文。

CA: 0x420658A1d8B8F5C36DdAf1Bb828f347Ba9011969

@DegenArenaGame

7.83万

93

USD 兑换 PIXEL

Pixels 价格表现 (美元)

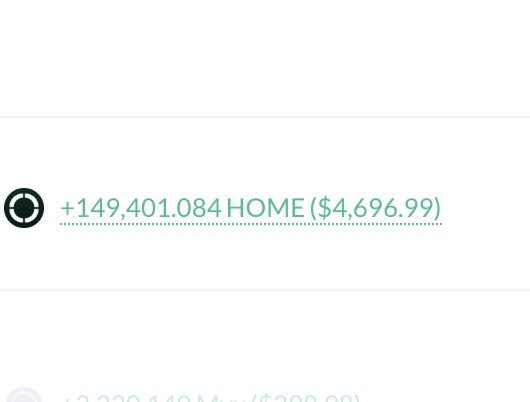

Pixels 当前价格为 $0.038730。Pixels 的价格从 00:00 (UTC+8) 上涨了 +1.97%。目前,Pixels 市值排名为第 0 名,实时市值为 $2,983.93万,流通供应量为 771,041,667 PIXEL,最大供应量为 5,000,000,000 PIXEL。我们会实时更新 Pixels/USD 的价格。

今日

+$0.00075000

+1.97%

7 天

-$0.00422

-9.83%

30 天

-$0.01843

-32.25%

3 个月

+$0.0010900

+2.89%

Pixels 常见问题

Pixels 今天值多少钱?

目前,一个 Pixels 价值是 $0.038730。如果您想要了解 Pixels 价格走势与行情洞察,那么这里就是您的最佳选择。在欧易探索最新的 Pixels 图表,进行专业交易。

数字货币是什么?

数字货币,例如 Pixels 是在称为区块链的公共分类账上运行的数字资产。了解有关欧易上提供的数字货币和代币及其不同属性的更多信息,其中包括实时价格和实时图表。

数字货币是什么时候开始的?

由于 2008 年金融危机,人们对去中心化金融的兴趣激增。比特币作为去中心化网络上的安全数字资产提供了一种新颖的解决方案。从那时起,许多其他代币 (例如 Pixels) 也诞生了。

Pixels 的价格今天会涨吗?

查看 Pixels 价格预测页面,预测未来价格,帮助您设定价格目标。

ESG 披露

ESG (环境、社会和治理) 法规针对数字资产,旨在应对其环境影响 (如高能耗挖矿)、提升透明度,并确保合规的治理实践。使数字代币行业与更广泛的可持续发展和社会目标保持一致。这些法规鼓励遵循相关标准,以降低风险并提高数字资产的可信度。

资产详情

名称

OKcoin Europe LTD

相关法人机构识别编码

54930069NLWEIGLHXU42

代币名称

Pixels

共识机制

Pixels is present on the following networks: Ethereum, Ronin.

The crypto-asset's Proof-of-Stake (PoS) consensus mechanism, introduced with The Merge in 2022, replaces mining with validator staking. Validators must stake at least 32 ETH every block a validator is randomly chosen to propose the next block. Once proposed the other validators verify the blocks integrity. The network operates on a slot and epoch system, where a new block is proposed every 12 seconds, and finalization occurs after two epochs (~12.8 minutes) using Casper-FFG. The Beacon Chain coordinates validators, while the fork-choice rule (LMD-GHOST) ensures the chain follows the heaviest accumulated validator votes. Validators earn rewards for proposing and verifying blocks, but face slashing for malicious behavior or inactivity. PoS aims to improve energy efficiency, security, and scalability, with future upgrades like Proto-Danksharding enhancing transaction efficiency.

Ronin utilizes a Delegated Proof of Stake (DPoS) consensus mechanism, where community-elected validators are responsible for securing the network and validating transactions. Core Components of Ronin’s Consensus: 1. Delegated Proof of Stake (DPoS): Community Voting for Validator Selection: RON token holders delegate their tokens to vote for validators, who are then selected to produce blocks, validate transactions, and maintain network security. Validators with the most votes are chosen to participate in consensus. Periodic Validator Rotation: Validators are regularly rotated based on community votes, enhancing decentralization and preventing long-term control by any single validator group. This rotation supports both security and fairness. 2. Incentive-Driven Voting System: Alignment with Community Interests: The voting system ensures that validators remain aligned with community goals. Validators that fail to perform adequately or act against network interests may lose votes and be replaced by more trusted participants.

奖励机制与相应费用

Pixels is present on the following networks: Ethereum, Ronin.

The crypto-asset's PoS system secures transactions through validator incentives and economic penalties. Validators stake at least 32 ETH and earn rewards for proposing blocks, attesting to valid ones, and participating in sync committees. Rewards are paid in newly issued ETH and transaction fees. Under EIP-1559, transaction fees consist of a base fee, which is burned to reduce supply, and an optional priority fee (tip) paid to validators. Validators face slashing if they act maliciously and incur penalties for inactivity. This system aims to increase security by aligning incentives while making the crypto-asset's fee structure more predictable and deflationary during high network activity.

Ronin’s incentive model combines rewards, slashing mechanisms, and governance features to support network security and encourage active community participation. Incentive Mechanisms: 1. Rewards for Validators and Delegators: Staking Rewards for Validators: Validators earn RON tokens as rewards for successfully producing blocks and validating transactions. These rewards incentivize validators to fulfill their duties diligently, maintaining network stability. Delegator Rewards: Delegators who stake their tokens with selected validators also earn a portion of the staking rewards. This sharing of rewards promotes broad participation from token holders in network security and governance. 2. Slashing Mechanism for Accountability: Penalty for Malicious Behavior: A slashing mechanism penalizes validators who act dishonestly or fail to meet performance standards by cutting a portion of their staked RON tokens. This deters misbehavior and encourages responsible participation. Delegator Risk: Delegators who stake with misbehaving validators are also subject to slashing, which encourages them to choose trustworthy validators and monitor performance carefully. 3. Governance Participation: RON Token for Governance: Beyond staking and transaction fees, the RON token enables token holders to participate in governance. This includes voting on network upgrades, validator selection, and other protocol decisions, giving token holders a voice in network direction and policy. Applicable Fees: • Transaction Fees: Fees are paid in RON tokens, contributing to validator rewards and helping to maintain network operations. These fees are designed to be affordable, ensuring accessibility for users while supporting validators’ roles.

信息披露时间段的开始日期

2024-06-12

信息披露时间段的结束日期

2025-06-12

能源报告

能源消耗

471.80083 (kWh/a)

能源消耗来源与评估体系

The energy consumption of this asset is aggregated across multiple components:

To determine the energy consumption of a token, the energy consumption of the network(s) ethereum, ronin is calculated first. For the energy consumption of the token, a fraction of the energy consumption of the network is attributed to the token, which is determined based on the activity of the crypto-asset within the network. When calculating the energy consumption, the Functionally Fungible Group Digital Token Identifier (FFG DTI) is used - if available - to determine all implementations of the asset in scope. The mappings are updated regularly, based on data of the Digital Token Identifier Foundation.

USD 兑换 PIXEL

社媒平台热度