Identifying trends and chart patterns with trend line tools

You may have heard the popular saying in the trading world: "the trend is your friend". In trading circles, the phrase refers to the practice of being on the right side of the market. Markets often reward traders that agree with them by following the greater market trend.

That's easier said than done, and raises two key questions: how do you know which side of the market to be on? And, how do you detect a trend?

In simple terms, a visual glance at the price chart on the time frame of your trading choice can allow you to identify a trend. Professional traders always remind themselves that the "eyes don't lie". That is, if it looks like the chart is in an uptrend, it often is. It's the stories we tell ourselves (as traders) that try to influence what our eyes clearly see.

But there's good news, because a trend can be defined objectively.Technically speaking, an uptrend is defined as higher highs followed by higher lows. The opposite is true for a downtrend: lower highs followed by lower lows.

Trend lines help identify trends

Drawing trend lines on a price chart helps tell the story of a trend at a glance. Trend lines help reduce a trader's cognitive load by giving a visual representation of trend guidelines and thresholds. It's why mastering trend lines is an essential skill for traders aiming to analyze market movements efficiently. Trend lines visually represent price direction and can highlight potential support and resistance levels.

What is a trend line?

A trend line is a straight line drawn on a chart to connect significant price points, such as highs or lows. It serves several important functions in market analysis:

Direction: Identifies the current market trend, whether upward, downward, or sideways.

Support and resistance: Functions as dynamic support in uptrends and as resistance in downtrends.

Reversal signals: Suggests potential trend reversals when a breakout occurs.

Upward (bullish) trend lines

Description: Formed by connecting a series of higher swing lows, reflecting an overall rise in prices.

When to use: Use upward trend lines to spot potential buying opportunities and assess the strength of an uptrend, because they function as dynamic support levels.

Downward (bearish) trend lines

Description: Created by connecting a series of lower swing highs, indicating a decline in prices.

When to use: These lines help identify potential selling opportunities and gauge the strength of a downtrend, serving as resistance levels.

Horizontal (sideways) trend lines

Description: Drawn by connecting swing highs or lows at similar price levels, indicating consolidation.

When to use: Use horizontal trend lines to pinpoint key support and resistance levels in a range-bound market, signaling potential breakout or breakdown points.

The different types of trend line tools on OKX

A trend line is plotted on the chart to indicate the general course of direction and identify the key support and resistance. There are different trend line tools you can use to plot potential price movements.

Arrow: Similar to the basic trend line but with an arrowhead at one end of the line to indicate the direction

Ray: The ray tool enhances precision by anchoring the starting pixel, allowing you to pivot and adjust your trend line seamlessly.

Extended: The extended trend line tool allows you to project the trend line in both directions, enabling you to plot a trend line over a broader area quickly.

Horizontal ray: The horizontal ray tool confines your trend line to a horizontal orientation.

Horizontal extended: The horizontal extended tool confines your extended trend line to a horizontal orientation

Vertical extended: The vertical extended tool confines your extended trend line to a vertical orientation.

How to use trend line tools

To effectively use trend lines, follow these steps:

Select the appropriate trend line type according to the market's direction.

Draw a trend line by connecting at least two points.

Determine the overall trend by analyzing price action.

Recognize chart patterns. In the chart above, patterns such as the ascending triangle and double bottom have emerged.

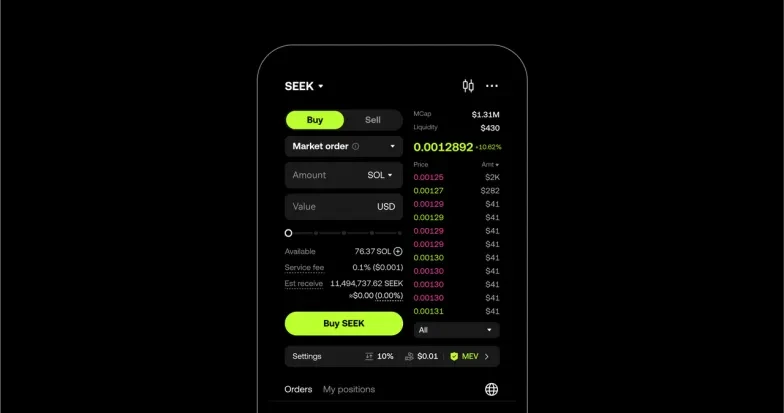

How to chart trend lines on OKX app

Head over to the trading screen and select the charting tool on the top right of the screen

Select the drawings tool

Select the trend line tool you want to use.

Identify the trend and connect at least two points using the trend tool. Notice the floating tool bar. Use the tool bar to edit the colour of your trendline.

Additional tips

Combine with other indicators: Use trend lines alongside other technical tools (like moving averages or oscillators) for more robust signals. Consider displaying RSI and EMA for added insights.

Adjust for market conditions: Be flexible and adapt your trend lines as new price data emerges. Remember, trend lines are guides, not rigid barriers, and should be adjusted if trends change.

Leverage multiple time frames: Check trend line breaks across various time frames. A break on a higher time frame (such as daily or weekly) is more significant than one on a lower time frame (such as 1-hour or 15-minutes).

Practice makes perfect: Charting trend lines requires practice, and it's wise to avoid relying solely on automatic drawing tools. Manually draw and adjust your trend lines according to price action.

The final word

Identifying trend lines is crucial for making informed trading decisions. By effectively applying this trading tool, you can enhance your market analysis and potentially improve your trading outcomes. Remember that although trend lines are powerful indicators, they should be used in conjunction with other analytical methods to confirm trends and reversals. Happy trading!

© 2025 OKX. Acest articol poate fi reprodus sau distribuit în întregime sau pot fi folosite extrase ale acestui articol de maximum 100 de cuvinte, cu condiția ca respectiva utilizare să nu fie comercială. Orice reproducere sau distribuire a întregului articol trebuie, de asemenea, să precizeze în mod vizibil: "Acest articol este © 2025 OKX și este utilizat cu permisiune." Extrasele permise trebuie să citeze numele articolului și să includă atribuirea, de exemplu „Numele articolului, [numele autorului, dacă este cazul], © 2025 OKX.” Unele conținuturi pot fi generate sau asistate de instrumente de inteligență artificială (AI). Nu este permisă nicio lucrare derivată sau alte utilizări ale acestui articol.