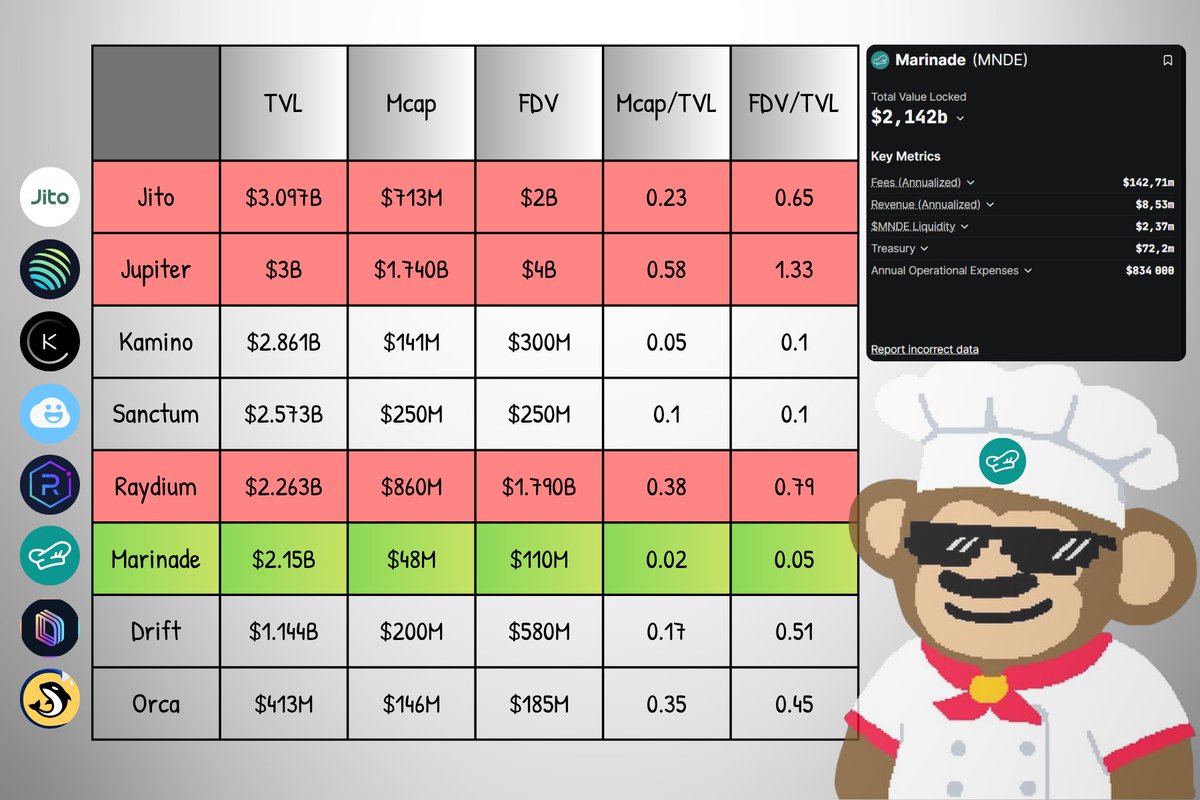

Clearly the most undervalued project on Solana.

Have you ever seen a protocol with a $2.1B FDV and only a $48M Mcap?

But major updates are coming. Why @MarinadeFinance is criminally undervalued. 🧵🔽

These fundamentals generate an annualized revenue of $10M.

But neither the $2.1B in TVL nor the $10M in yearly revenue are reflected in the native token’s price.

MNDE market cap is just $48M. It's easily the most undervalued project among Solana’s top 10.

Just look at the data.

The Mcap/TVL ratio is 0.02, the lowest by far.

And if you're thinking about FDV/TVL, that's also the lowest at 0.05. For comparison, Jito sits at 0.65, and Jupiter at 1.33.

This undervaluation partly comes from a shift in MNDE’s utility, moving from direct stake allocation to influencing validator stake caps, which reduced direct value accrual.

But that’s about to change, with new proposals reintroducing value via revenue-backed buybacks.

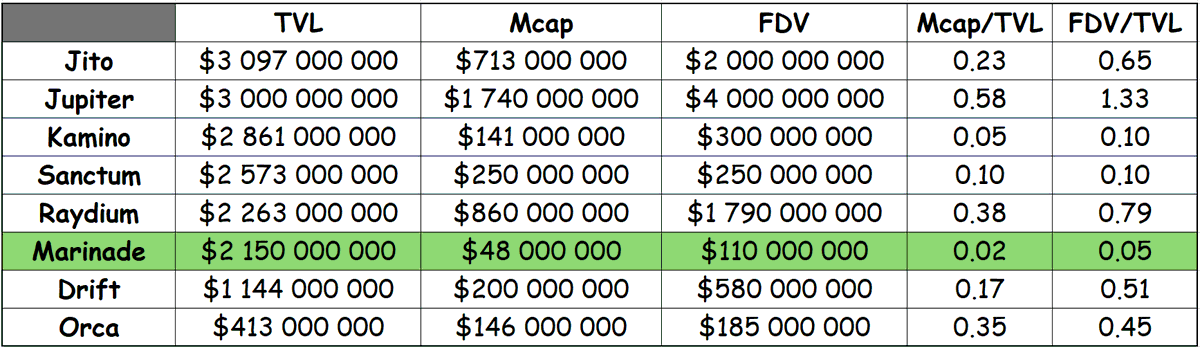

A new proposal introduces a 50% MNDE buyback mechanism.

With $10M in annual revenue, this means $5M in yearly buybacks, 10% of current market cap.

That’s huge. The first buyback is set for September 2025.

On top of that, governance participation will be rewarded.

25M MNDE tokens have been allocated for active voters in 2025.

Rewards will scale with voting power and participation frequency, encouraging more holding and deeper engagement.

Add to that a 5% token burn to reduce total supply.

All of this combined points to a clear supply shock.

Undervalued token + buybacks + deflation + real utility = only one outcome: bullish.

Fundamentally, Marinade is strong.

It was named the exclusive staking provider for the first U.S. Solana ETF (Canary), marking a major leap for institutional adoption of Solana and positioning Marinade as a go-to player in this sector.

BitGo has also integrated Marinade Native to offer institutional-grade, non-custodial Solana staking to its clients.

This solidifies Marinade’s legitimacy, and as BitGo expands its offering, others are likely to follow.

And personally, I’ve always respected bootstrapped projects with no VC backing, Marinade is one of them.

A strategic OTC round is expected in Q3 2025.

MNDE is already listed on Coinbase, Kraken, KuCoin, Gate, and HTX.

In short: Marinade is aligning every catalyst for a massive re-rating, institutional adoption (ETF + BitGo), major buybacks, governance rewards, a token burn, and revamped tokenomics designed for real value accrual.

Criminally undervalued today, but not for much longer.

That's a wrap!

Mention some CTs friends:

@0xJok9r

@belizardd

@AlphaFrog13

@zucl1ck

@Mr_Lumus

@poopmandefi

@defiprincess_

@Hercules_Defi

@Only1temmy

@TweetByGerald

@0xAndrewMoh

@Haylesdefi

@DeRonin_

@kem1ks

@cryppinfluence

@0xDefiLeo

@alphabatcher

@DOLAK1NG

@splinter0n

I hope you've found this thread helpful.

Follow me @the_smart_ape for more.

Like/Repost the quote below if you can:

15.6K

119

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.