This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

USD1

World Liberty Financial price

2e9VG7...pump

$0.000062961

+$0.000014116

(+28.90%)

Price change for the last 24 hours

How are you feeling about USD1 today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

USD1 market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$62,960.51

Network

Solana

Circulating supply

999,999,997 USD1

Token holders

216

Liquidity

$91,474.10

1h volume

$3.77M

4h volume

$3.77M

24h volume

$3.77M

World Liberty Financial Feed

The following content is sourced from .

ChainCatcher 链捕手

By Golem, Odaily Planet Daily

This morning, the Trump family's crypto project, World Liberty Financial (WLFI), posted that there was a major news release coming up and hinted at something related to the start of a token transfer. The community's enthusiasm for WLFI is back on the rise, chanting "The big one is coming."

In mid-June, there was already news in the market that WLFI was about to start circulating in advance, because the WLFI project team deleted the mandatory 12-month lock-up clause on the official website, and added an overlord statement that "the company can modify and update the terms of service at any time". Affected by the news, the WLFI unit price once rose to $0.15 on the sidelines, which has increased 10 times compared with the first round of pre-sale price ($0.015), and now the price has fallen back to around 0.12.

The launch of WLFI is imminent, and the price prediction after its launch has also become a topic of general concern in the market. In this article, Odaliy Planet Daily will review the tokenomics of WLFI and analyze its price and selling pressure after its launch in combination with position data for readers' reference.

WLFI pre-sale review, with a total of more than $550 million raised

The total WLFI is 100 billion, all of which are currently locked, and WLFI has gone through three rounds of pre-sales before, the details are as follows:

WLFI's first pre-sale opens in October 2024 at $0.015 per token for a total of 20 billion pieces (20% of the total supply). The first round of WLFI's presale was slow due to the fact that the market was flooded with many FUD voices at this time, but after Trump's coin, the popularity of WLFI gradually increased, and finally 20 billion WLFI tokens were successfully sold on January 20, 2025, raising $300 million.

After the first presale, WLFI opened the second presale at $0.05 per coin, with a total of 5 billion coins (5% of the total supply). The second presale sold out on March 14, 2025, raising $250 million.

The first two rounds of the WLFI presale are open to the public, and the third round of the presale is an institutional round that is not open to the public, and the price is $0.1 per token. What is known is that on April 9, DWF Labs subscribed for 250 million WLFI for $25 million, and a whale bought a total of 800 million WLFI on June 4 and June 12 for $80 million.

According to the above public information, WLFI sold a total of 26.05 billion tokens through three rounds of pre-sale, accounting for 26.05% of the total supply. However, because the third round of pre-sales is not open to the public, the actual pre-sale data may be biased.

WLFI's position holder data and selling pressure

Of the 100 billion WLFI tokens, excluding 26.05% of the presale, there are still 739.5 (73.95% of the total supply) "missing".

However, according to Trump's 2025 financial disclosure document (deadline of January 2025) released by the White House, Trump alone accounts for 15.75% of the total supply of 15.75 billion WLFI tokens held through his ETH wallet. The financial documents calculate the value of this part as around $1,000-$15,000, but at the current off-market price of about $0.12, it is worth about $1.89 billion.

Among the holders of WLFI, there is also an existence that cannot be ignored is Sun Yuchen. Justin Sun invested a total of $75 million in WLFI through HTX Nexus and TRON DAO between November 2024 and January 2025; According to public information, Sun currently holds a total of 3 billion WLFI, accounting for 3% of the total supply.

According to on-chain data, there are a total of 85,870 addresses holding WLFI tokens. Crypto blogger @pow_fan counted the funding brackets of users who participated in WLFI purchases, and although the data is as of May 27, it is also indicative, and he himself bought $1.91 million in WLFI tokens.

As shown in the figure above, if the number of addresses purchased from $0-1000 reaches 66,910, accounting for 77% of the total purchase addresses, the total number of purchases by these users is about 520 million, accounting for only 2% of the total purchase number. Therefore, even if this part is fully circulated, it will not have a big impact on the entire market. On the contrary, although there are only 64 addresses with a purchase capital of more than $1 million, the number of purchases accounts for 56.4%.

WLFI token selling pressure

Therefore, from the above data, it can be seen that WLFI is a token with a high concentration of token holdings in the hands of large investors, which is not only an advantage for pulling orders, but if it is sold, it can also instantly put pressure on the market, and retail investors will pay for large investors.

The circulating amount of tokens determines the selling pressure, and WLFI has not officially announced whether to choose a one-time full release or linear unlocking or a special restriction on large investors if the WLFI token is open for transfer, but if we consider the extreme case of full release at one time. Who among the big players will be the selling pressure?

According to the holder data, the likely selling pressure will come first from large investors such as Trump (15.75%), followed by Justin Sun (3%), and finally from institutions such as DWF Labs (0.25%).

In fact, the probability of Sun Yuchen selling WLFI is low, although Sun Yuchen has the habit of "selling HSR when he goes out" and "throwing TRUMP" after dinner, but this is also after the goal is achieved. The purpose of Justin Sun's purchase of WLFI is to show loyalty to the Trump family, so as to remove obstacles for TRON to comply with the United States and go public.

And the real selling pressure will come from Trump and the establishments. Trump is both the largest holder and the biggest selling pressure on WLFI, as it is already an indisputable fact that the Trump family uses the crypto industry as an ATM (related reading: Presidential Privilege Realization Notes: How the Trump Family Harvested the Crypto Market with TRUMP Tokens?). It's only given that it still has "value" for the crypto industry that crypto users haven't erupted in mass protests and FUDs. The 15.75% token may be a heavy blow to the market if it does sneak into the market, and WLFI will replicate the history of TRUMP, but it may be difficult to reach the heights of TRUMP before the crash.

Estimated market capitalization of WLFI listings

So, how much can WLFI be priced at once it goes live?

If the more than 26 billion tokens in the pre-sale will be fully circulated, at the current OTC price of $0.12, the circulating market capitalization will be $3.12 billion, which is equivalent to the market capitalization of Aptos, ranking 39th in crypto; If the price breaks through $0.5, the market capitalization will be $13 billion, which will surpass HYPE and rank 13th in crypto; If the price breaks through $1, the market capitalization will be $26 billion, and the circulating market capitalization will surpass the market capitalization of DOGE and TRX, ranking 8th in crypto.

The Trump family's last token, TRUMP, had a maximum price of $82, and the circulating market capitalization at the time was about $13 billion, which is equivalent to a WLFI price breaking through $0.5.

If combined with the business comparison, WLFI has a stablecoin product USD 1, which can be compared with Circle: Circle now has a market capitalization of $44.7 billion, with a circulating market capitalization of about $23.7 billion; Based on this benchmark, the WLFI price will be around 0.8 ~ 1 USD.

Of course, there are also extremely optimistic people in the community who believe that the WLFI will reach $0.47 at launch, then break through $4.7, and finally reach a height of $47. Why the number "47"? This may be due to the fact that WLFI previously airdropped 47 USD1 to holders, and that Trump is now in office as the 47th president of the United States.

Show original9.72K

0

0x政丨傻鸟会🦅🧪

At present, you can see the leading Alpha of each ecology

In addition to the SOL system, the ETH system is MONAD

It's the NUBIT of the BTC system

Trump's USD1 goes live on Thunderbolt

@nubit_org BTC ushered in a true stablecoin

It's not encapsulation, it's not a cross-chain stablecoin that's truly based on Bitcoin

Bitcoin has been used as a digital gold piggy bank in the past

And now with USD1 and programmability, we have the real BTCFi

Users can transfer and receive USD1 directly on the Bitcoin mainnet

It is also the only stable market currently operating on the Bitcoin network

In the future, if more defi applications are connected, BTC will really be able to move

Perhaps @nubit_org is BTCFi's last spring

In April this year, HSBC highly recognized it and carried out a lengthy publicity in its official press release, so pay more attention to it in the future

Show original

12.35K

7

币世王

Who is the biggest beneficiary of the rise of global stablecoin payments?

In the era of stablecoins gradually moving towards compliance and corporate payments are fully embracing crypto finance, the first to eat dividends is not Circle, not Solana, but low-key TRON!

▰▰▰▰▰

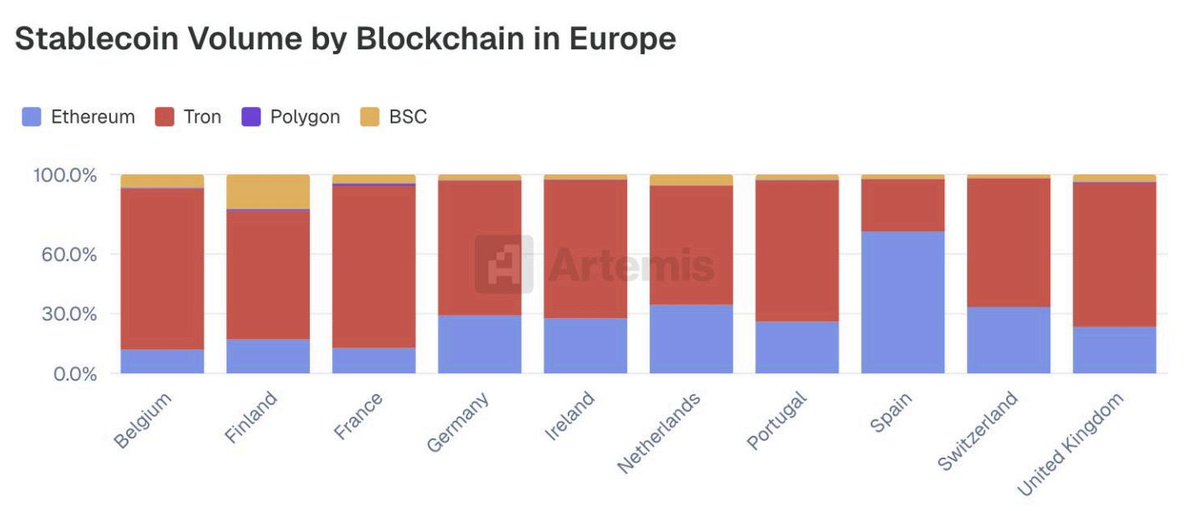

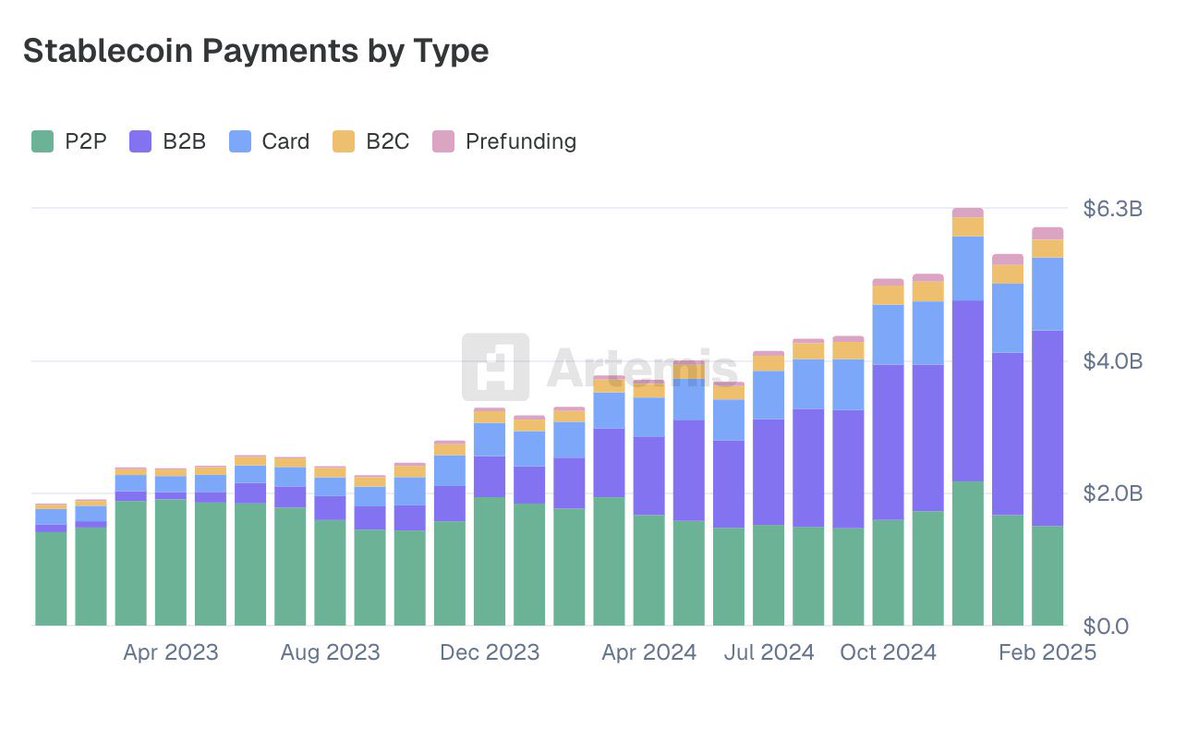

According to data published by Artemis,

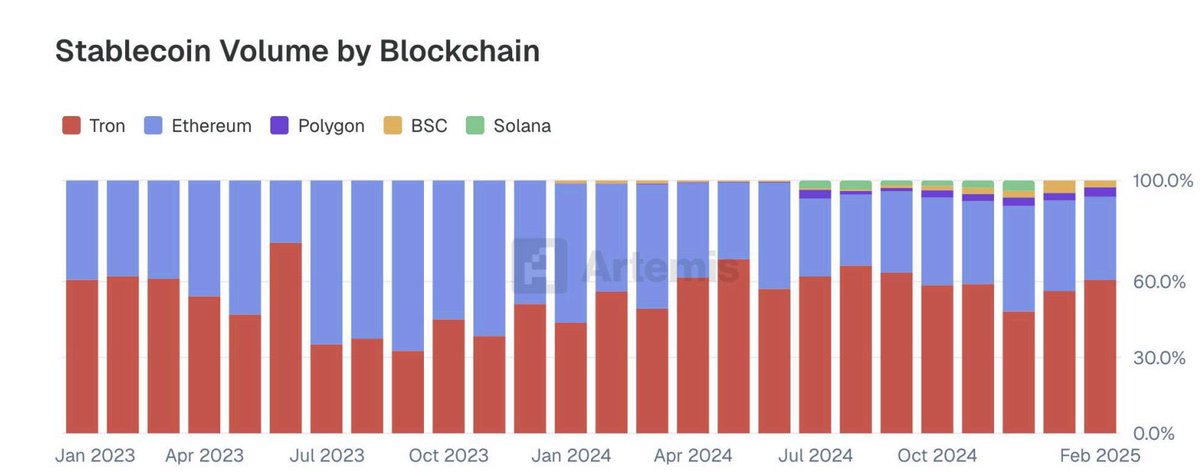

▪ TRON leads the world's strongest payment chains, not just in developing countries

In the past few years, we have always thought that USDT on TRON is a third world story, but from this picture, you will find that many developed countries in Europe; From Germany and France to Finland and Belgium, TRON is the largest public chain in terms of stablecoin payment volume, and its market share far exceeds that of Ethereum, BSC and Polygon!

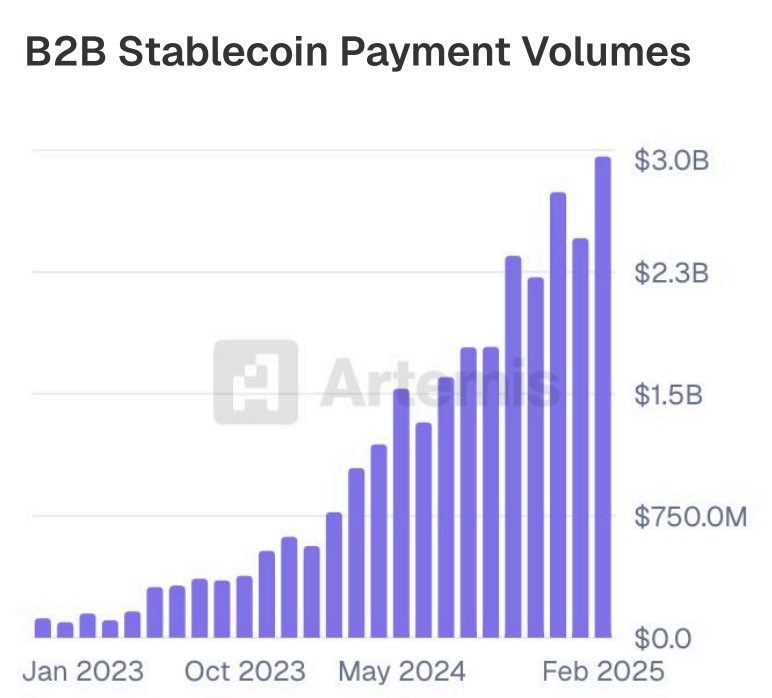

▪ B2B payments are growing rapidly, and TRON is the biggest beneficiary

Since 2023, global stablecoin-based B2B payment transaction volume has grown by 215%, with monthly transaction volume surging from less than $2 billion to more than $6.3 billion. Of the data we were able to attribute, $9.42 billion was settled through the TRON network!

▰▰▰▰▰

What's more:

▪ Visa: The global B2B payments market is $145 trillion

This means that the market in which TRON operates today is only the tip of the iceberg. B2B stablecoin payments are less than 0.01%, and TRON has firmly established itself as the first public chain in the payment infrastructure of this emerging track!

▪ The market gives a signal, and the user gives an answer

➤ 2023~2025, 215% monthly growth in stablecoin payments

➤ TRON's market share continues to expand, far surpassing ETH and upstart Solana

➤ Even under regulatory and macro pressures, on-chain transaction stability remains >96%

➤ From Lebanon to Argentina, from Germany to Portugal, TRON is the dollar payment track used by countless ordinary people and businesses

▰▰▰▰▰

The first year of compliance began; Stablecoin legislation is coming

THE GENIUS BILL OFFICIALLY PASSED THE U.S. SENATE, AND STABLECOINS OFFICIALLY USHERED IN FEDERAL-LEVEL LEGISLATION. This is an anchor of trust and a door to legitimacy for public chains like TRON, which have long undertaken sovereign-level stablecoins such as USDT, USDD, and USD1!

In his statement, Trump said:

“This is American Brilliance at its best, and we are going to show the world how to WIN with Digital Assets like never before!”

In such a context, a strong dual-track cooperation system has been formed between TRON and Tether, with a chain-level stablecoin payment chain on one side and an asset-level USD stabilizer on the other!

▰▰▰▰▰

summary

TRON is already a hidden giant in the global stablecoin track! It doesn't rely on marketing, it doesn't rely on narrative, but every transaction on the chain is accumulating real market fruits. In the next 1~3 years, as the USD stablecoin becomes the new default channel for global B2B transactions, the chain that supports it all is called TRON!

@justinsuntron @sunyuchentron @trondao @sunpumpmeme #TRON #TRONEcoStar

Show original

23.87K

151

TRON DAO

At #IXO2025, @justinsuntron spotlighted TRON’s role in powering over 55% of global #USDT volume.

He introduced #USD1 — the latest stablecoin on TRON — and shared how #T3FCU is setting new standards with $160M+ frozen across five continents.

TRON’s just getting started — are you paying attention? 👀

37.54K

206

USD1 price performance in USD

The current price of world-liberty-financial is $0.000062961. Over the last 24 hours, world-liberty-financial has increased by +28.90%. It currently has a circulating supply of 999,999,997 USD1 and a maximum supply of 999,999,997 USD1, giving it a fully diluted market cap of $62,960.51. The world-liberty-financial/USD price is updated in real-time.

5m

-41.53%

1h

+28.90%

4h

+28.90%

24h

+28.90%

About World Liberty Financial (USD1)

Latest news about World Liberty Financial (USD1)

Trumps May Have Sold Platform Stake as U.S. Stablecoins See Wave of Good News

Based on close readings of World Liberty Financial's website disclosures, the family of President Donald Trump may have dropped out of its majority holding.

Jun 21, 2025|CoinDesk

Trump-affiliated company cuts stake in World Liberty Financial to 40%

DT Marks DEFI LLC, a company linked to President Donald Trump and his sons, including...

Jun 20, 2025|Crypto Briefing

World Liberty Financial to ‘Align’ With TRUMP Memecoin, Add It to Treasury

The move could bring institutional weight to the token and aligns with the project’s vision for “crypto, patriotism and long-term success.”

Jun 7, 2025|CoinDesk

USD1 FAQ

What’s the current price of World Liberty Financial?

The current price of 1 USD1 is $0.000062961, experiencing a +28.90% change in the past 24 hours.

Can I buy USD1 on OKX?

No, currently USD1 is unavailable on OKX. To stay updated on when USD1 becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USD1 fluctuate?

The price of USD1 fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 World Liberty Financial worth today?

Currently, one World Liberty Financial is worth $0.000062961. For answers and insight into World Liberty Financial's price action, you're in the right place. Explore the latest World Liberty Financial charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as World Liberty Financial, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as World Liberty Financial have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.