This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

UNI

Uni price

2Dq2eR...weqP

$0.00011830

+$0.000079418

(+204.27%)

Price change for the last 24 hours

How are you feeling about UNI today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

UNI market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$118.30K

Network

Solana

Circulating supply

999,999,821 UNI

Token holders

176

Liquidity

$141.59K

1h volume

$4.58M

4h volume

$4.58M

24h volume

$4.58M

Uni Feed

The following content is sourced from .

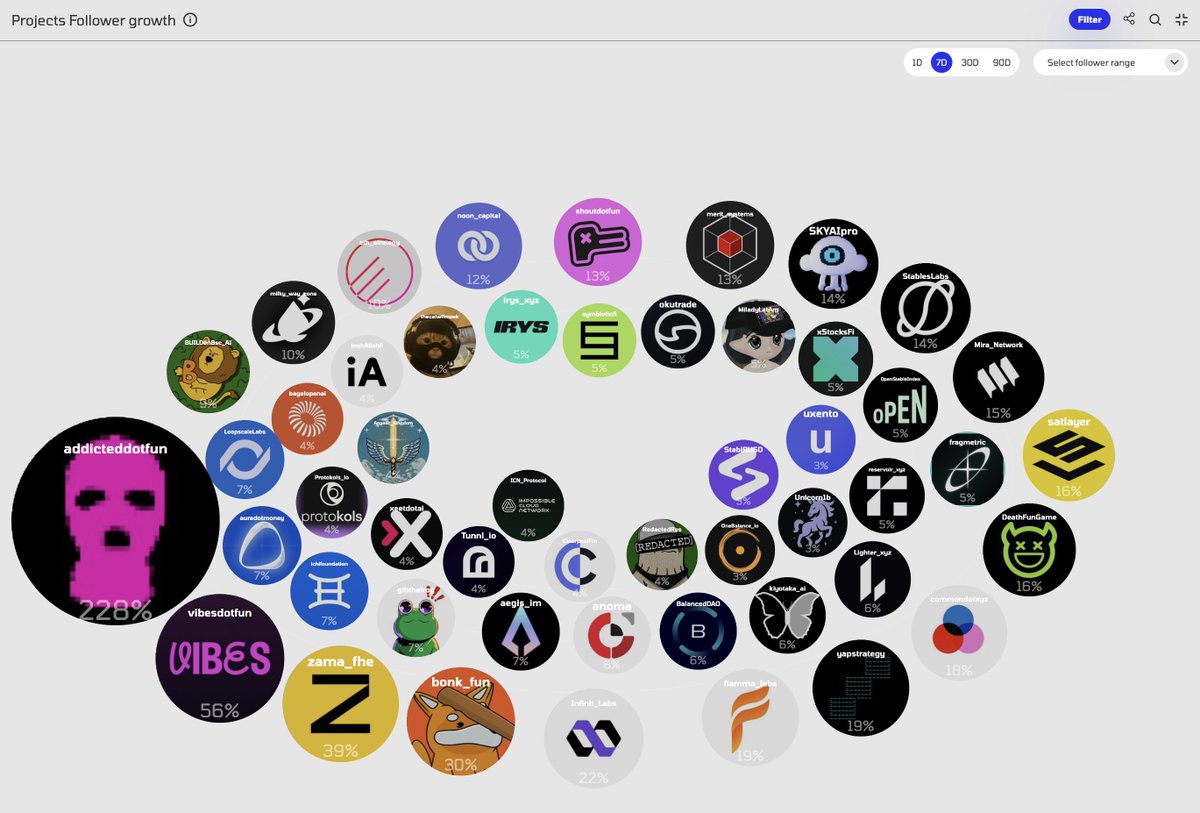

Dexu AI

Fastest growing projects in the last 7d:

🥇 @addicteddotfun

🥈 @vibesdotfun

🥉 @zama_fhe

4/ @bonk_fun

5/ @Infinit_Labs

6/ @fiamma_labs

7/ @yapstrategy

8/ @commondotxyz

9/ @DeathFunGame

10/ @satlayer

11/ @Mira_Network

12/ @StablesLabs

13/ @SKYAIpro

14/ @merit_systems

15/ @shoutdotfun

16/ @noon_capital

17/ @eth_strategy

18/ @milky_way_zone

19/ @BUILDonBsc_AI

20/ @LoopscaleLabs

21/ @auradotmoney

22/ @ichifoundation

23/ @gibthefrog

24/ @aegis_im

25/ @anoma

3.47K

2

𝕯𝖆𝖓𝖌𝖊𝖗

Every week we do on chain analysis: stablecoin flows, chain activity , farm flows

Find out if the market is feeling risk on or off, and which chains are outperforming

Today in DeFi

Ecosystem Update : Solana is Back, DeFi Rising Amidst Self-Custody Narrative

Stablecoin flows continues to surge with $2B (+0.8%) inflow this week vs $1.9B last week.

USDT + USDC saw consistent growth, with USDT mainly deposited into RWA protocols on Ethereum. Not for trading — for farming.

That tells us one thing:

RWA protocols are winning while big DeFi yield sources shrink.

Stables on Aave, Morpho, etc. are offering lower base yields — so farmers are rotating to protocols offering higher RWA yield.

CEX losing ground again.

For the 3rd straight week, stablecoin supply on centralized exchanges is down.

DEX spot share hits 1-year high: 30% of total spot volume.

Traders prefer Uniswap, Hyperliquid, and self-custody.

Numbers and fact don't lie - a real shift is happening.

Meanwhile, lending TVL is up, but borrowing is up faster → leveraged farming is back.

To access this week's full ecosystem analysis and the yield farming strategies driving the growth, subscribe or get 7 days free trial :

3.89K

1

Blockbeats

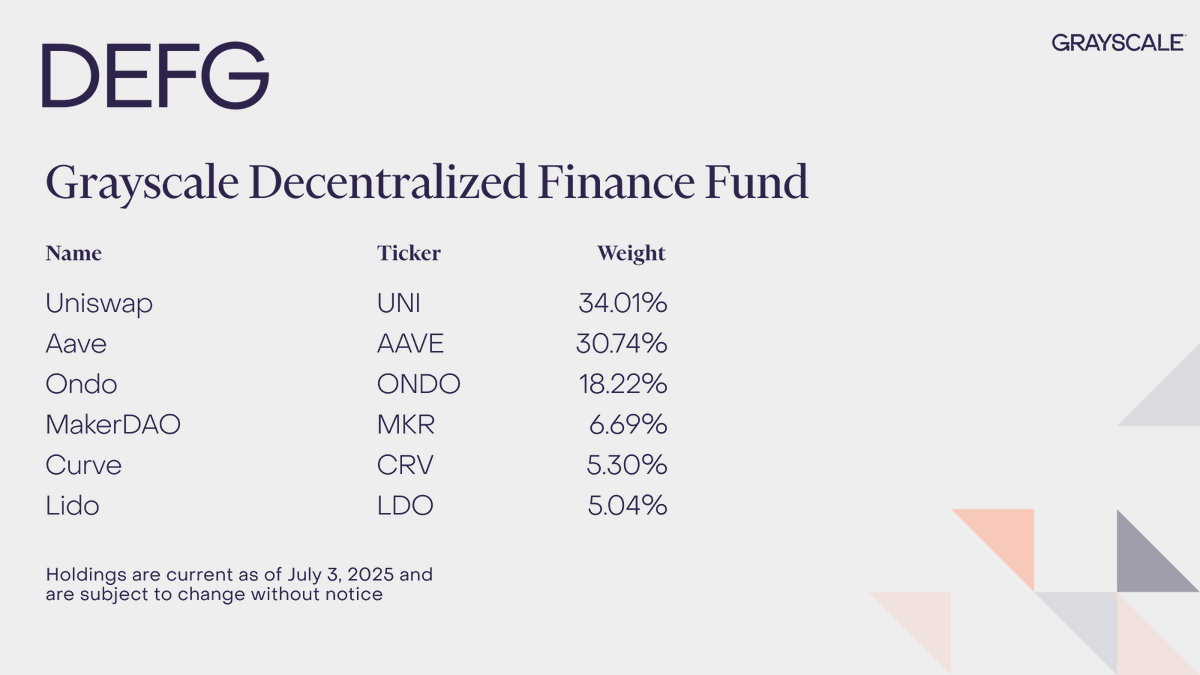

Grayscale Investments announced the results of the rebalancing adjustments for its multi-asset fund in the second quarter. Grayscale Investments is the manager of the Grayscale DeFi Fund, Grayscale Smart Contract Fund (GSC Fund), and Grayscale AI Fund, and today announced updates related to the product fund component weights for the second quarter of 2025.

The Grayscale DeFi Fund added Ondo (ONDO), with adjusted major holdings including Uniswap (UNI, 34.01%), Aave (AAVE, 30.74%), and Ondo (ONDO, 18.22%);

The Grayscale Smart Contract Fund (GSC Fund) added Hedera (HBAR) and removed Polkadot (DOT), with adjusted major holdings being Ether (ETH, 30.22%), Solana (SOL, 29.87%), and Cardano (ADA, 18.57%);

The Grayscale AI Fund maintains its existing asset proportions, with major holdings including Bittensor (TAO, 29.10%), NEAR Protocol (NEAR, 28.41%), and Render (RENDER, 17.34%).

Show original6.99K

0

動區動趨 BlockTempo

🗡️ Grayscale is aggressively cutting $DOT! Fully betting on $ONDO, is DeFi officially moving towards the RWA era?

Grayscale @Grayscale adjusted its DeFi fund (DEFG) in Q2 2025, with the core change being the inclusion of $ONDO in its holdings, while completely removing $DOT, which was once seen as a representative of multi-chain interoperability, shifting from decentralization to RWA and compliant structures.

$ONDO is characterized by its focus on "on-chain U.S. Treasury bonds" as RWA, allowing traditional financial products to operate on the blockchain. Grayscale not only included it but also allocated over 18% of the fund's weight to it, even believing it will become one of the core infrastructures of future DeFi.

The complete removal of $DOT reflects its inability to keep pace with developments in the DeFi space. Although technically strong, its usage and actual financial applications are limited, leading to its gradual marginalization in the market. Grayscale's direct exclusion this time is also a response to capital efficiency.

$HBAR, although not included in DEFG, has joined Grayscale's smart contract fund, clearly indicating that Grayscale is increasingly inclined to support blockchain protocols that can connect with the real world and attract enterprise or government-level collaborations.

Show original

5.3K

1

UNI price performance in USD

The current price of uni is $0.00011830. Over the last 24 hours, uni has increased by +204.27%. It currently has a circulating supply of 999,999,821 UNI and a maximum supply of 999,999,821 UNI, giving it a fully diluted market cap of $118.30K. The uni/USD price is updated in real-time.

5m

+15.03%

1h

+204.27%

4h

+204.27%

24h

+204.27%

About Uni (UNI)

Latest news about Uni (UNI)

CoinDesk 20 Performance Update: AAVE Gains 9.4% as All Assets Trade Higher

Uniswap (UNI) joined AAVE (Aave) as a top performer, rising 6.5% over the weekend.

Jul 7, 2025|CoinDesk

CoinDesk 20 Performance Update: Uniswap (UNI) Drops 11.4% as All Assets Trade Lower

Internet Computer (ICP) joined Uniswap (UNI) as an underperformer, declining 8.2% over the weekend.

Jun 23, 2025|CoinDesk

CoinDesk 20 Performance Update: Uniswap (UNI) Gains 4.3%, Leading Index Higher

Polygon (POL) joined Uniswap (UNI) as a top performer, rising 2.8% from Wednesday.

Jun 19, 2025|CoinDesk

Learn more about Uni (UNI)

What is Uniswap (UNI): how does the popular DEX work?

Decentralized Exchanges (DEXs) have cemented their place in the blockchain and cryptocurrency industry. They provide a solution to centralization by allowing users to interact with their platform in a

Apr 24, 2025|OKX|

Beginners

Uniswap Faces Price Turmoil as $48M UNI Moves to Coinbase Prime

Uniswap Price Under Pressure: Whale Transfers $48M UNI to Coinbase Prime Uniswap (UNI), one of the leading decentralized exchange tokens, is facing heightened scrutiny after a whale wallet transferred

Jun 17, 2025|OKX

What is Uniswap (UNI): how does the popular DEX work?

Decentralized Exchanges (DEXs) have cemented their place in the blockchain and cryptocurrency industry. They provide a solution to centralization by allowing users to interact with their platform in a

Apr 24, 2025|OKX|

Beginners

UNI FAQ

What’s the current price of Uni?

The current price of 1 UNI is $0.00011830, experiencing a +204.27% change in the past 24 hours.

Can I buy UNI on OKX?

No, currently UNI is unavailable on OKX. To stay updated on when UNI becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of UNI fluctuate?

The price of UNI fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Uni worth today?

Currently, one Uni is worth $0.00011830. For answers and insight into Uni's price action, you're in the right place. Explore the latest Uni charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Uni, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Uni have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.