This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

USDC

Tethered Cheese price

GsWhLn...pump

$0.000092549

+$0.000048576

(+110.47%)

Price change for the last 24 hours

How are you feeling about USDC today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

USDC market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$92,548.73

Network

Solana

Circulating supply

1,000,000,000 USDC

Token holders

140

Liquidity

$134,598.10

1h volume

$2.55M

4h volume

$2.55M

24h volume

$2.55M

Tethered Cheese Feed

The following content is sourced from .

jiayi 加一 🔆

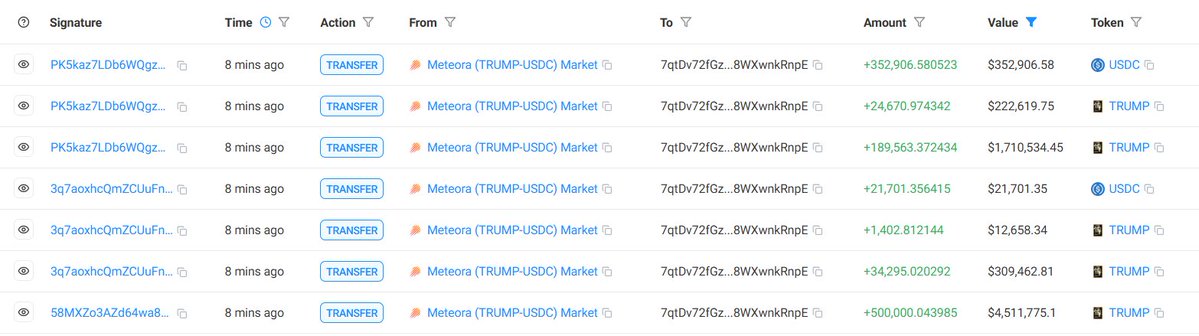

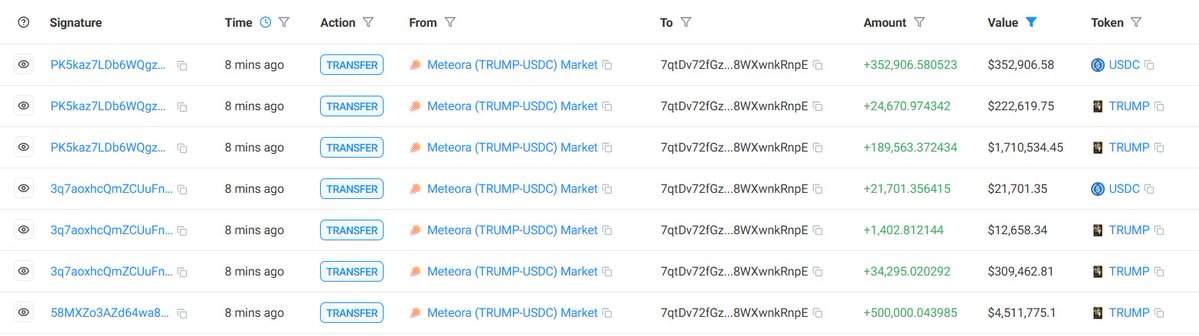

Following the path of MicroStrategy, financing to buy tokens and using the purchased tokens as valuation anchors in financial reports.

Tokenization of stocks is transitioning from an individual case to a new direction in capital operations. 📈

Many "token-bound companies" have emerged in the market, which either finance through issuing shares, asset restructuring, or merger transactions to incorporate certain tokens into their company valuation system, telling a capital story similar to MicroStrategy.

Today, I attempt to clarify MicroStrategy with a long tweet.

——————————————🤔———————————

If you are also struggling with whether to get on board, why not analyze a few mainstream routes currently available? 👇

Among them, I personally chose @Circle behind $USDC, @NanoLabsLtd for $BNB, and @Trondao for $TRX.

💡 Regarding @Circle, it has risen very quickly, with the price soaring from $31 at IPO to a peak of $300. However, I chose it not because of the short-term increase, but because it is indeed doing the most solid work.

First, @Circle's core is real income: the dollar reserves behind USDC earn interest daily, relying on the interest spread from U.S. Treasury bonds. It also charges for tools like APIs, wallet services, and cross-chain settlement protocols.

USDC is not just a stablecoin; what it is doing is "modularizing" the dollar system, enabling settlement and API integration, effectively rebuilding a financial foundation on-chain.

Moreover, its compliance system backed by @Circle means it is not only easier to gain acceptance in regulatory aspects, but its use cases are also the broadest among these companies, being the only one integrated by Visa, Stripe, and BlackRock at the same scale. ✅

⚡ As for @Nanolabsltd, I am more focused on short-term opportunities.

It's simple, for a few reasons:

First, this just happened, and the market reaction has not fully caught up. Low valuation and new expectations are points I will pay attention to.

Second, the structure is not complicated: $500 million in non-interest convertible bonds, aiming to buy 5-10% of BNB's circulating supply. In other words, it's following Saylor's path.

Third, CZ has also expressed support; although he hasn't directly invested, you can feel that this is not just a hollow move. BNB has its own fan base and is the main token of the exchange, and just this attention is enough to push a short-term reaction. 🎯

More than one company wants to use $BNB as a company reserve asset; for example, Build & Build Corporation previously planned to invest $100 million to purchase $BNB and complete the listing. Meanwhile, Binance's ambition to enter the U.S. stock market has also been revealed in various market information. Therefore, as an early player and practitioner, Nano is suitable for short-term investment, securing a position in advance.

🎭 Now looking at @trondao's TRX MicroStrategy, the most dramatic and complex line is actually this one.

TRON entered through a reverse merger with SRM Entertainment, in other words, it directly borrowed a shell to create a "Sung Brother-style MicroStrategy."

Why choose it? I can understand, mainly for a few points:

The valuation is low enough, the foundation is light, and there is plenty of room to tell a story;

The merger path is straightforward; SRM was originally in the children's toy business and is basically in shell status. After transforming into Tron Inc., it directly started fundraising to buy TRX, planning to achieve a holding level of $210 million;

The storyteller is Sung Brother, who is best at using market actions to narrate and has indeed been building the financial narrative of the TRON ecosystem. 🧢

Its biggest problem is opacity; all details rely on external speculation, and the custody structure and fund usage are not fully disclosed. But its advantage lies precisely here: if it can be understood, the flexibility is unmatched by other projects.

Sung Brother's most famous saying, which I always remember:

"Do I care about your trifling gains?"

He has never played fundamentals but rather flow, sentiment, and table order. So if you want to invest in TRX MicroStrategy, your mindset must be right: it's not about financial report arbitrage, but entering a game. ♟️

Because he has this attitude, when the valuation of such projects is not high and has not reached expected fundamentals, he will not easily crash the market or cut losses.

From this perspective, I actually think this is his "political sacrifice": not for financial returns, but to shape a new position for TRON in the capital market.

You can understand this as Sung Brother setting up a game; you just need to have patience and know what you are participating in.

——————————————🤒———————————

Speaking of this, if you still don't quite understand what "MicroStrategy" is all about, its core can actually be summarized in one sentence:

Using the company's financing ability to amplify your bet on a certain token.

Saylor issued bonds and shares back then, most of which were used to buy BTC. Later, when BTC rose, the asset sheet looked good, and the stock price followed suit.

Then another round of financing, buying more BTC.

This is its flywheel: financing → buying tokens → balance sheet expansion → stock price increase → refinancing. ♻️

You might think this approach is too aggressive, but the market believes in it. The stock price trend of MSTR is basically a high beta of BTC.

So you see so many projects imitating this now. Some have changed the tokens (HYPE, ETH, TRX, BNB), while others have changed the structure (mergers, PIPE, preferred shares), but the underlying logic is the same:

Make tokens the engine of stock prices. 🔧

📌 So, which token do you think will be written into the U.S. stock report next and take you on a ride with its stock price? 🛫

Show original

51

0

M.F.L✺♦️

Optimizing returns with a smartphone

If you save in Japanese yen, the interest rate is 0.001%.

If you convert it to USDC and deposit it in fungi, you get 6-7%.

Considering taxes, if you want to keep your profits under 200,000 yen a year,

you can deposit up to 20,000 USDC!!

If you deposit around 2.85 million yen, you can expect a return of about 200,000 yen a year.

It's definitely better than saving.

I'm still a bit scared about the safety, so I can't deposit that much yet.

But it really does optimize returns automatically.

Just think if this were a Japanese bank...

Genius.

Fungi

If you’re gonna doomscroll, at least watch your money grow while you’re at it.

Mobile is live!

✅ Smoother auth flow

✅ Optimized deposit flow

✅ Upgraded profile section

✅ Cleaner background

✅ Sleeker buttons

Everything’s enhanced tbh

896

1

USDC price performance in USD

The current price of tethered-cheese is $0.000092549. Over the last 24 hours, tethered-cheese has increased by +110.47%. It currently has a circulating supply of 1,000,000,000 USDC and a maximum supply of 1,000,000,000 USDC, giving it a fully diluted market cap of $92,548.73. The tethered-cheese/USD price is updated in real-time.

5m

+20.39%

1h

+110.47%

4h

+110.47%

24h

+110.47%

About Tethered Cheese (USDC)

USDC FAQ

What’s the current price of Tethered Cheese?

The current price of 1 USDC is $0.000092549, experiencing a +110.47% change in the past 24 hours.

Can I buy USDC on OKX?

No, currently USDC is unavailable on OKX. To stay updated on when USDC becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDC fluctuate?

The price of USDC fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Tethered Cheese worth today?

Currently, one Tethered Cheese is worth $0.000092549. For answers and insight into Tethered Cheese's price action, you're in the right place. Explore the latest Tethered Cheese charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Tethered Cheese, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Tethered Cheese have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.