This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

SPX

SPX6900 price

0xe0f6...c56c

$1.0230

+$0.011731

(+1.16%)

Price change for the last 24 hours

How are you feeling about SPX today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

SPX market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$1.02B

Network

Ethereum

Circulating supply

1,000,000,000 SPX

Token holders

42133

Liquidity

$16.83M

1h volume

$143,806.45

4h volume

$561,601.99

24h volume

$6.90M

SPX6900 Feed

The following content is sourced from .

BITCOINLFG®

BREAKING: USELESS coin is officially back above $100 million market cap and now up 7%, significantly outperforming #FARTCOIN, $SPX, $DOGE, $PEPE, and $SHIB.

The market seems to be treating #USELESS as the best proxy for betting on risk, which has made it the fastest horse on this market bounce.

Analysts have predicted that USELESS is the next breakout memecoin to hit $1b+ market cap. Do you agree with them?

10.49K

1

YOMI🚮 reposted

Dr. 泵泵

Recently, two hotspots have been observed on the mainnet, one is the renaissance of OG meme coins such as $JOE $SPX, and the other is the new launch platform @klik_evm on the mainnet

Unlike other previous @pumpdotfun forks, Klik has a very distinct character.

1. 100% of the coins are added to the unilateral Uniswap V3 pool

2. Due to the nature of the v3 pool, no initial liquidity (ETH) is required. And the token comes with its own deflationary mechanism.

3. Composability

4. Expectations of future airdrop incentives

Let's talk about why KLIK is able to occupy a unique ecological niche and come out of it.

1️⃣ First, let's look at the first feature:

With the Uni V3 pool, it is equivalent to the absence of a Bonding Curve similar to the inner disk of a Pump. The entire value discovery process is more transparent.

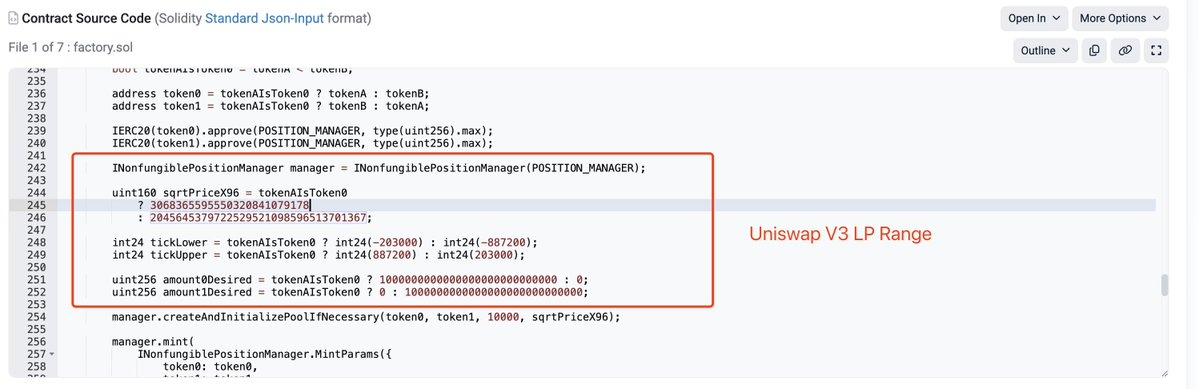

The specific setting of unilateral pools is not officially explained in the documentation. Let's look directly at the contract source code (Figure 1). You can see:

1. All single lots are used to add a one-legged LP position

2. The price span of this LP position is very large. The corresponding market capitalization ranges from an initial $3,400 to almost infinity.

Because the price of Uniswap V3 is calculated according to sqrtPriceX96, the initial market capitalization needs to be converted, which is approximately 1.53 * $ETH

Although this still does not avoid the problem of snipers, the process of price discovery is smoother than that of Pump.

2️⃣ Secondly, all tokens on Klik come with a deflationary mechanism.

Note that the fee for the above Uniswap V3 pool is 1%. 75% of the ETH fee will go to the creator and 25% will be distributed by the platform. Whenever the platform or user withdraws the fee, the corresponding part of the token will be directly destroyed.

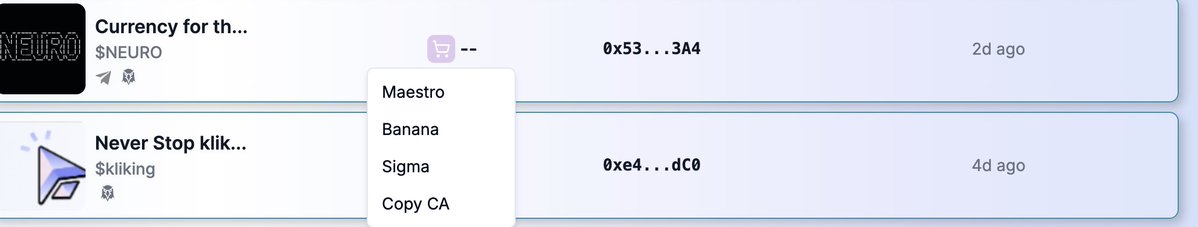

3️⃣ The third feature that Klik focuses on is composability.

Because the pool is Uniswap V3. All Kanban boards (Dexscreener/Geckoterminal) and trading bots (Maestro/Banana/Sigma) are seamlessly supported.

The upside of this is that GTM is much flatter and simpler, and you don't have to pay for third-party integrations with the tools you already have. Compared to previous EVM launch platforms such as @lambodotwin or Sol's launch platforms, @boopdotfun third-party tools need to be manually connected to the transaction router. That's a very clever thing to do.

4️⃣ Finally, the anticipation of the airdrop.

When the official release on June 12, it was stated that the transactions in the next 30 days will be included in the incentive plan, and specifically mentioned that the whole process will be very similar to @HyperliquidX. This is a direct benchmark for last year's largest airdrop feast, leaving enough room for the community's imagination. Brush it up as a family!

The most subtle thing about Klik is the background of the team. Judging from the whole process above, the founder @AlexF044 has done a lot of thinking about the market/trading, not just innovating in the mechanism.

At present, the dragon that has run out is $ERC-69, and it has rushed to a market value of nearly 10M in one day. Half a day ago, the official tweet forwarded it.

Dragon II is $JOKSJUQURBFIFSA similar to $USELESS which focuses on a nonsensical concept of pure MEME. The current market capitalization is around 700k. This also seems to be the only platform token that the official focuses on (?). )

I heard that there are group friends p 0.5e one night and took out 10wu out. Next time, can you call me to get in the car 😭😭😭 first

#KLIK

Show original

933

0

Greeny

What memecoin and altcoin dips are you buying?

I'm favoring strength here. What's holding up the strongest during this correction? What's bounced the strongest since we dumped in April?

That leads me down the path of:

1. $BTC (below 100k is a steal in the years to come)

2. $HYPE an obvious play considering their model

3. $SPX (huge 0.5 fib correction already, but one of the only memes to retest it's previous ATH)

4. $FARTCOIN (the leader on $SOL)

5. $MOG (culture coin and nicely poised here at in between it's 0.786 and 0.886)

6. $PENGU + $REKT (IP Coins that will continue to gain traction as their brands grow)

7. $SOL + $ETH + $SUI (obvious leaders in the L2 space)

What else should I add to my list?

19.64K

17

Magus

Very few people are sharing such value for free

Learn this lesson so you understand how to outperform to the upside and protect during the downside

This approach is at the core of everything I do

Doc

Market Selloff Dynamics + Bottoming

The goal of this write up is to give you a bit of insight on how I spot HTF pivot points in markets. We want to understand the psychology behind risk unwinding and use that to our advantage to potentially spot bottoms.

1. Low Conviction Sells First

- When uncertainty hits, sellers dump what they least desire i.e., lower conviction coins will top first and bleed early.

- Think about it logically. If you're in a pinch and needed cash irl, you're not going to sell your prized possessions, you're gunna sell the crap you never use.

- Likewise, traders will sell what they’re least emotionally invested in to build cash when uncertain or want to decrease risk.

- It’s not a coincidence that this has happened every HTF top this cycle. Alts don't rally after, they rally during. They also top weeks before BTC even shows an ounce of weakness.

- It’s an early warning. Smart traders de-risk before the crowd even knows what's happening.

2. Risk vs. Quality

- Let's go back to the earlier metaphor. People will hold onto their quality prized possessions for as long as they possibly can. It's not until they're desperate that they will part with them.

- The most desirable coins, more often than not, will attempt to hold their gains for as long as possible. This is why BTC always looks fine and you see dozens of "Why is everyone panicking, BTC looks great" tweets weeks before sell offs.

In selloffs:

a) Junk sells early

b) Quality sells late

c) Everything sells eventually

Watch the order of events. It’s a map of stress flow.

3. Reflexivity Kicks In

- Early weakness causes more weakness.

- Once a whale starts to unload into exhausted demand they begin to induce weakness. Classic signs of distribution, absorption, exhaustion, trend loss etc.

- A character shift in a risk asset will make the first order of experienced traders reassess.

- "I didn't sell top, but the character of the trend has shifted. Time to reduce exposure/close"

- “If this is nuking, what else am I exposed to?”

Suddenly:

Rebalancing triggers more selling

This is reflexivity.

A feedback loop of diminishing risk appetite.

4. Volatility: The Dance

Before many big selloffs in BTC, markets go quiet. Volatility drops. Trends become ranges. Complacency peaks.

Then, boom.

Let's talk a bit about balance and imbalance.

- Balance is achieved once the market begins to agree on what's expensive and what's cheap. It's a dance. Equilibrium.

- Equilibrium is calm. What's known is known. Speculation diminishes. Volatility compresses.

- The dance continues until one party gets bored, tired or wants to go to the bar to get another drink. i.e. buyers or sellers get exhausted; changes to supply/demand.

- Equilibrium is damaged- and once it breaks: Imbalance.

- Price displaces violently. Value becomes unclear; volatility explodes. The market craves balance and will actively seek it.

- Price often returns to areas where recent balance was formed- hvn, orderblock, composite value etc.

- This is where you get the sharpest bounces.

"First test, best test"

- Subsequent tests will provide diminishing reactions. Things become structural. Price accepts its new home. Volatility compresses. Balance is found once again.

5. The Flow of a Selloff & Spotting Bottoms

Capitulation isn’t the beginning of the end; it’s the end of the middle.

a) Alts vs. Bitcoin

- This cycle alts often do the bulk of their selling before BTC capitulates.

- Recent example: Fartcoin sold off 88% from its top before the late February BTC capitulation. Since this is true, we can begin to use it as an edge when looking for exhaustion (bottoming)

- The strongest alts will begin to show relative strength (exhaustion) earlier as BTC is still being hyper-volatile and looking for new balance.

- In order words, look for good alts to begin to achieve balance as BTC is in the later stages of imbalance.

As participants, our goal is to spot these divergences:

“Has momentum shifted?”

“Is volatility compressing?”

"Is the velocity of selling diminishing?"

“Is it holding while BTC makes new lows?”

Signs of bottoming in Q2:

- Momentum loss (Fartcoin)

- SFP/Deviation (Hype/Sui)

- Higher lows vs BTC’s lower lows (Pepe)

In short: alts front-load their pain, then decrease in velocity as BTC bottoms.

Remember this how we spot "good" alts.

The weak stay weak.

The strong start whispering before the market speaks.

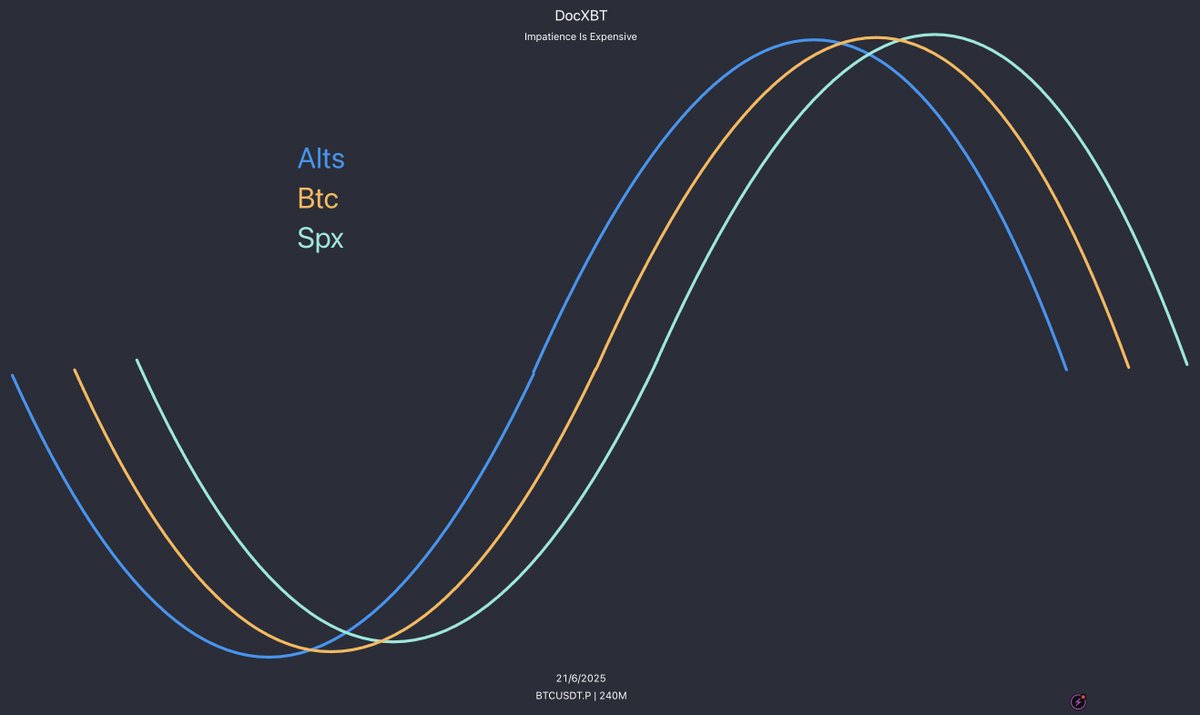

b) Bitcoin vs. SPX

Now a little exercise for you all

Combine all the concepts in this thread and maybe the following begins to make sense:

Summer '23: BTC topped before SPX, bottomed earlier

Summer '24: BTC topped before SPX, absorbed the macro related SPX crash at range low

So far in '25: BTC topped before SPX, absorbed a 20% SPX crash at range low

TL;DR

Bottoms are a process, not a moment.

Alts First

Bitcoin Next

SPX Last

Watch for the structure, not just the sentiment.

12.1K

12

SPX price performance in USD

The current price of spx6900 is $1.0230. Over the last 24 hours, spx6900 has increased by +1.16%. It currently has a circulating supply of 1,000,000,000 SPX and a maximum supply of 1,000,000,000 SPX, giving it a fully diluted market cap of $1.02B. The spx6900/USD price is updated in real-time.

5m

-0.66%

1h

-0.24%

4h

-2.08%

24h

+1.16%

About SPX6900 (SPX)

SPX FAQ

What’s the current price of SPX6900?

The current price of 1 SPX is $1.0230, experiencing a +1.16% change in the past 24 hours.

Can I buy SPX on OKX?

No, currently SPX is unavailable on OKX. To stay updated on when SPX becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of SPX fluctuate?

The price of SPX fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 SPX6900 worth today?

Currently, one SPX6900 is worth $1.0230. For answers and insight into SPX6900's price action, you're in the right place. Explore the latest SPX6900 charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as SPX6900, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as SPX6900 have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials