This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

sUSDS

Savings USDS price

0xa393...7fbd

$1.0566

+$0.00021128

(+0.02%)

Price change for the last 24 hours

How are you feeling about sUSDS today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

sUSDS market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$2.40B

Network

Ethereum

Circulating supply

2,272,668,371 sUSDS

Token holders

4417

Liquidity

$50.76M

1h volume

$123,386.51

4h volume

$1.27M

24h volume

$2.46M

Savings USDS Feed

The following content is sourced from .

Entropy Advisors

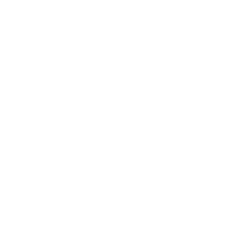

🧵 Weekly DAO update on @arbitrum!

On @tallyxyz:

✅ DRIP passed

🔹 Register the Sky Gateway contracts is live

🔹 Constitutional Quorum Threshold Reduction is live

On @SnapshotLabs:

✅ OpCo Ops Update passed

🔹 Treasury Management Council consolidation is live

🔹 Remove Cost Cap on Nova is live

Quick breakdown below 👇

38

0

币世王

The Ultimate SparkFi Edition!

After several weeks of discussions, it's clear that everyone is really giving their all and using their best skills to stick with it until now! It's truly wonderful to sprint and communicate together! The last few hours of Spark SNAPS, leave a comment on this post to interact together!

This article will summarize all the pieces I've written so far~

▰▰▰▰▰

Three Major Protocols Achieve SparkFi!

▪ SparkLend Lending Platform: Connecting real users with asset liquidity needs, it is the largest usage place for USDS!

▪ SLL (Spark Liquidity Layer): An on-chain capital deployment engine that dynamically allocates billions of dollars in liquidity to the most optimal yield markets!

▪ SSR (Sky Savings Rate): Building the most attractive stablecoin yield system, supporting the confidence of USDS and sUSDS depositors!

The three form a self-circulating on-chain financial yield:

Depositors deposit USDS → SLL allocates funds → Deployed to SparkLend/Morpho/BlackRock, etc. → Yield flows back → Supports SSR → Enhances USDS attractiveness → Continuous user growth

▰▰▰▰▰▰

Real On-Chain Yield Data!

As of now, the total amount of funds allocated by Spark has exceeded 3.1 billion dollars, of which:

▪ 900 million dollars allocated to SparkLend

▪ 800 million dollars deployed to BlackRock BUIDL

▪ 500 million dollars entered Morpho strategy pool

▪ 300 million dollars directly allocated to Ethena's sUSDe/sUSDS

Total yield has exceeded 100 million!

▰▰▰▰▰▰

Ecosystem Integration, Complementary and Beneficial

SparkFi's integration strategy is not a one-way access but a two-way collaboration:

▪ With Chainlink: Achieving high-security oracle services for collateral asset price updates

▪ With Lido / Rocket Pool: Accessing stETH and other staked assets for compounded yields

▪ With Balancer / Curve: Integrating liquidity pools to enhance USDS usage

▪ With Morpho / Aave / Pendle / Ethena: Deploying efficient structured yield pools

▪ With Symbiotic: Launching Ignition / Overdrive staking airdrop mechanisms

These integrations allow every asset of Spark to flow, no longer just idle funds, but a machine for generating liquid yields!

▰▰▰▰▰▰

Final Words

I have written about Spark's lending system, SLL's capital allocation, SSR's yield model, SPK's value logic, and even tracked every staking data and transaction dynamics!

From the story to the structure, I have witnessed its transformation from a DeFi module to an on-chain system alongside everyone. If this is the first chapter of SparkFi, then now, SPK has just turned the page!

What you see is not just an ordinary token, but a yield aggregator of the new generation of on-chain financial systems!

@cookiedotfun @cookiedotfuncn #sparkfi @sparkdotfi $SPK

Show original

67.51K

0

币世王

The Spark protocol is making money, but the market hasn't noticed it yet, and institutions are sneaking in?

As the DeFi market shifts to a new cycle and narrative focused on real revenue and protocol sustainability; stablecoins, Spark's USDS & sUSDS are becoming the next potential beneficiaries! The fundamentals of SPK are impeccable, but the technical aspects are currently lacking a bit – however, I still firmly believe that fundamentals are primary, and technicals are secondary!

▰▰▰▰▰

Spark's profit model!

Users deposit USDS/sUSDS

↓

Spark mints, schedules, and deploys across chains

↓

Funds flow into high-yield scenarios like Aave / Morpho / Ethena

↓

Returns flow back to users (sUSDS) & the protocol (SPK stakers)

↓

SPK staking earns SSR (Sustainable Spark Rewards)

↓

TVL continues to rise, enhancing capital allocation capabilities

↓

Token value accumulation strengthens

In simple terms: capital grows → returns increase → SPK dividends increase → the market buys SPK

▰▰▰▰▰

Real revenue distribution of Spark

Let's take a look at Spark's current deployment data:

▪ Over $4.5 billion USDS minted (from Sky Allocation Vault)

▪ Over $3.1 billion deployed into on-chain strategies

▪ $900 million entered SparkLend

▪ $800 million entered BlackRock's BUIDL (government bond yields)

▪ Hundreds of millions deployed to high-yield scenarios like Ethena, Morpho, Pendle

▪ sUSDS has cumulatively distributed over $82 million in returns (data: Stablewatch)

These returns are not in the future but are already being distributed daily to users and stakers as dividends!

▰▰▰▰▰

When the market wakes up, what stage will SPK be in?

Currently, SPK's growth is still in a phase of market recognition lag:

▪ Ecological cooperation has been established (deep integration with Aave, Morpho, Pendle, Ethena, etc.)

▪ The yield flywheel has already started (sUSDS annualized stable at 5% - 8%)

▪ The number of users is continuously increasing (especially through leveraged plays with Morpho and Pendle)

However, SPK's valuation has not fully reflected:

▪ The unique SSR revenue mechanism

▪ The market share of yield-generating stablecoins is continuously rising (sUSDS is second only to sUSDe)

▪ Cross-chain deployment + RWA compliance routes give Spark the potential for institutional participation

This could be one of the most cost-effective timing points for SPK! Not giving buy/sell advice but it can be a reference!

▰▰▰▰▰

Here are a few observation points that I will continue to monitor:

▪ SSR yield: observe if staking returns can ramp up quickly

▪ sUSDS market share: can it capture more market from sUSDe?

▪ Capital flow: is there continued large-scale deployment into Pendle / Ethena / RWA?

SPK market cap: are people starting to notice the flywheel running smoothly, and is that expectation reflected in the price?

▰▰▰▰▰

Conclusion

You may have missed Lido, missed Pendle, missed ENA, but Spark is a yield aggregator you can still pay attention to, one that can truly sustain itself through profitability! So don't just look at surface-level hype; learn to look at revenue streams, dividend structures, and token economics, and you'll realize this is a DeFi alpha!

Show original

25.13K

3

火山⭕518.btc|Bird🕊️

SLL (Spark Liquidity Layer) is the core engine of the Spark lending protocol, integrating the functions of a "central control center, funding source, and yield factory," driving capital flow and yield generation in the DeFi space.

Core Functions of SLL

Cross-chain liquidity allocation: Achieved through SkyLink (self-developed cross-chain bridge) and Circle's CCTP technology, enabling rapid, secure, and slippage-free transfers of USDS, sUSDS, and USDC across multiple chains, automatically chasing high-yield opportunities.

Stable growth of funds: SLL dynamically schedules funds in real-time, optimizing liquidity, yield, and reserve levels by combining on-chain monitoring with off-chain data.

High-yield stablecoin: sUSDS offers substantial returns through diversified strategies, while USDS maintains stable exchanges with USDC.

RWA and DeFi strategies: Engaging in real-world assets (such as U.S. Treasury-related products) and high-yield on-chain protocols (like Aave, Morpho) to achieve yield diversification.

Three Major Components

Sky Allocation Vault:

Spark borrows USDS at low cost through the Sky main protocol (over $4.5 billion minted).

Funds are allocated to DeFi protocols across the chain to mine yields, similar to a "DeFi Federal Reserve window."

SkyLink:

A native cross-chain bridge that automates and transfers assets without intermediaries, combining CCTP technology.

Maximizing fund efficiency, with yields prioritized for high-chain allocation.

Spark PSM (Peg Stability Module):

Ensures slippage-free exchanges between USDS, sUSDS, and USDC.

Reduces cross-chain exchange and arbitrage costs, maintaining peg stability.

Sources of Yield

Asset allocation: $3.1 billion deployed in:

SparkLend ($900 million, lending and borrowing yields).

BlackRock's BUIDL ($800 million, U.S. Treasury yields).

Other DeFi (Aave, Morpho, Ethena) and RWA (Superstate, Maple, Centrifuge) products.

Diversified strategies: Combining U.S. Treasury yields, high-yield DeFi positions, and strategic Vaults, balancing safety and returns.

Dynamic Scheduling

SLL monitors on-chain liquidity, yield rates, and reserve changes in real-time, automatically reallocating across chains, supplementing funds, or adjusting leverage.

Example: A surge in deposits in the Base chain PSM prompts SLL to automatically bridge funds from Ethereum; idle USDC in Arbitrum is automatically transferred to high-yield chains.

User Benefits

Stable high yields: USDS/sUSDS offers safer and higher returns.

Quality lending platform: SparkLend has strong liquidity and low risk.

Passive investment returns: SLL optimizes capital allocation, allowing users to benefit without active management.

Future Outlook

The Spark Data Hub will soon open, showcasing on-chain fund distribution, yield performance, and strategy details, enhancing transparency.

SLL drives a positive feedback loop for USDS, sUSDS, SparkLend, and RWA markets through intelligent scheduling and yield amplification, reshaping the yield standards for stablecoins.

In summary: SLL is the core of Spark's capital aggregation and yield distribution, combining cross-chain scheduling, diversified strategies, and dynamic optimization, granting Spark a leading position in the DeFi and RWA sectors. Understanding SLL is to understand Spark's core value.

#SparkFi #CookieSnaps $SPK

Show original29.63K

127

sUSDS price performance in USD

The current price of savings-usds is $1.0566. Over the last 24 hours, savings-usds has increased by +0.02%. It currently has a circulating supply of 2,272,668,371 sUSDS and a maximum supply of 2,272,668,371 sUSDS, giving it a fully diluted market cap of $2.40B. The savings-usds/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

+0.01%

24h

+0.02%

About Savings USDS (sUSDS)

sUSDS FAQ

What’s the current price of Savings USDS?

The current price of 1 sUSDS is $1.0566, experiencing a +0.02% change in the past 24 hours.

Can I buy sUSDS on OKX?

No, currently sUSDS is unavailable on OKX. To stay updated on when sUSDS becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of sUSDS fluctuate?

The price of sUSDS fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Savings USDS worth today?

Currently, one Savings USDS is worth $1.0566. For answers and insight into Savings USDS's price action, you're in the right place. Explore the latest Savings USDS charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Savings USDS, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Savings USDS have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.