This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

rETH

Rocket Pool ETH price

0xec70...ffa8

$1,815.82

+$28.4197

(+1.59%)

Price change for the last 24 hours

How are you feeling about rETH today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

rETH market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$19.43M

Network

Arbitrum

Circulating supply

10,699 rETH

Token holders

0

Liquidity

$2.65M

1h volume

$0.00

4h volume

$556.08

24h volume

$1.20M

Rocket Pool ETH Feed

The following content is sourced from .

Sharpe AI

DeFi Summer: The Yield Hunt Just Got Easier with Sharpe Search

In DeFi, yield is everything. It's what traders chase, what funds optimize for, and what keeps power users glued to dashboards. But ironically, the more yield strategies there are, the harder it gets to find the good ones.

Today, we asked Sharpe Search:

"Which yield strategies are trending in DeFi?"

The answer wasn’t a messy dashboard. It wasn’t a giant CSV file. It wasn’t another rabbit hole of protocols you’ve never heard of.

It was this:

Sharpe Search: Top Yield Narratives This Week

Fixed Yield Farming

Think traditional bonds, but on-chain. Protocols like Notional, Element, and Exponent now offer 4–10% stable returns. Boring? Sure. But in a market full of volatility, boring might just be brilliant.

Liquid Staking Derivatives (LSDs)

ETH is still king, but now staked ETH (like stETH, rETH, sfrxETH) is being used as collateral in DeFi. So you earn staking rewards and LP/APY returns simultaneously. This is where a lot of capital is quietly compounding.

Stablecoin Yield Farming

Everyone’s favorite risk-off play. With Aave, Curve, and Compound, stablecoin pools are still delivering 5–15%, and without impermanent loss. Quiet yield, steady returns.

Advanced Liquidity Provision

For those willing to go deeper. High-yield Curve and Uniswap pools (blending blue chips with stablecoins) are clocking up to 20%. But you need to understand the risk curve, pun intended.

Yield Trading & Vaults

Not just farming anymore. Now users are trading yield, speculating on rates, and deploying into automated vaults with variable returns. Think Exponent and RateX. For power users only.

The Old Way of Doing This

Before Sharpe Search, yield research was a manual grind.

- You’d check 4 dashboards.

- Compare 10+ protocols.

- Cross-check token risks.

- Build your own spreadsheet to track APYs across pools and strategies.

- Hope the farm doesn’t rug.

There’s a reason why most yield threads on twitter are outdated or only focus on one protocol: the research cost is too high. Most users never even see the full picture.

What This Means for You

If you’re a yield farmer, you now have a starting point that’s contextual, not just numerical.

If you’re a fund or allocator, Sharpe helps you identify new primitives like fixed yield farming before the rest of the market catches on.

If you’re a builder, seeing how capital flows into structured products or staking derivatives can shape what you launch next.

Sharpe compresses the complexity of DeFi yield into a single, simple question.

And that’s the unlock.

gsharpe.

28.5K

29

头等仓First.VIP |We're hiring

#ENS DAO Releases Meta-Governance Update (6/24):

1. The Endowment fund's asset management scale is $87 million (of which 72% is ETH and 28% is stablecoins). Portfolio operations include: exiting the rETH Aura pool and selling rewards; reinvesting ETH unstaked from anrkETH and ETH retrieved from the rETH Aura pool into Compound V3 WETH. The Endowment's largest position remains Sky. The fund received 202,000 SPK airdrop tokens.

2. SPP2 funding flow update: Due diligence and paperwork have been completed. A proposal regarding adjustments to flow rates and allowances will be released soon.

3. The community proposes to establish an OpenBox Investment Committee to review the transaction, assess OpenBox's finances, plans, and open-source stack, and report whether DAO investment is needed.

4. Tally proposed a service agreement to improve the trading experience through webhooks, deep integration, and support.

5. Hats Protocol offers programmable on-chain role management, integrating Safe for multi-signature control. Features include ENS gated access, reusable roles, increased permissions, risk mitigation, and nested structures, aimed at secure, scalable DAO operations.

Show original10.21K

2

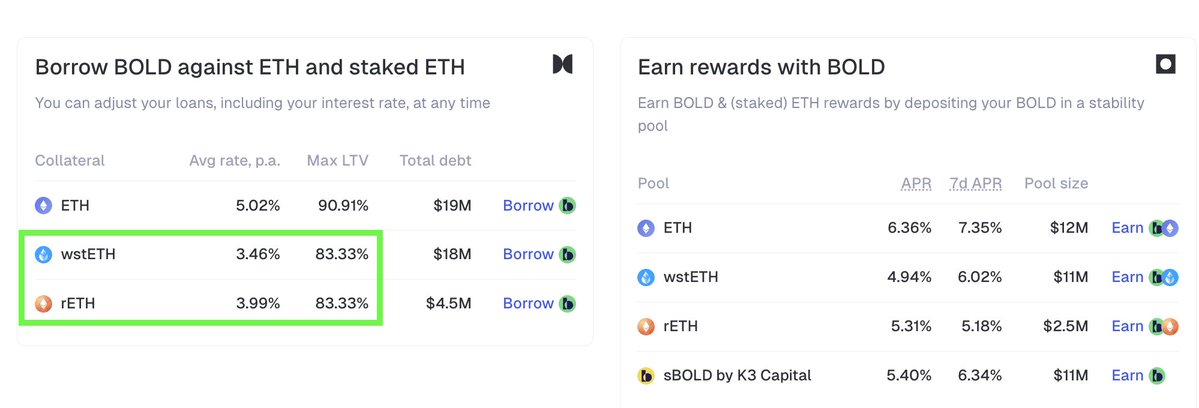

Liquity

Capture the spread (and airdrops) 🟢

Along with being immutable, Liquity V2 allows borrowers to set their own interest rates.

This has led to borrowing rates for wstETH & rETH to average ~ 3.5% & 4% respectively - the lowest across DeFi.

Stability Pool yield-bearing variants of $BOLD in sBOLD and ysyBOLD currently earn ~5.5%.

These can be further utilized on the likes of @spectra_finance and @pendle_fi to get 15% +

Alternatively, BOLD holders can also provide liquidity for BOLD / USDC on @CurveFinance and @EkuboProtocol to earn similar yield.

💡 All these actions are also eligible for airdrop rewards from the 20+ forks on top of the yield

Keep your exposure to ETH → set your own rates → mint BOLD → capture the yield

Links to the yield venues below👇

8.48K

9

rETH price performance in USD

The current price of rocket-pool-eth is $1,815.82. Over the last 24 hours, rocket-pool-eth has increased by +1.59%. It currently has a circulating supply of 10,699 rETH and a maximum supply of 10,699 rETH, giving it a fully diluted market cap of $19.43M. The rocket-pool-eth/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

+0.88%

24h

+1.59%

About Rocket Pool ETH (rETH)

rETH FAQ

What’s the current price of Rocket Pool ETH?

The current price of 1 rETH is $1,815.82, experiencing a +1.59% change in the past 24 hours.

Can I buy rETH on OKX?

No, currently rETH is unavailable on OKX. To stay updated on when rETH becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of rETH fluctuate?

The price of rETH fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Rocket Pool ETH worth today?

Currently, one Rocket Pool ETH is worth $1,815.82. For answers and insight into Rocket Pool ETH's price action, you're in the right place. Explore the latest Rocket Pool ETH charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Rocket Pool ETH, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Rocket Pool ETH have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.