OP

Optimism price

$0.48730

-$0.02240

(-4.40%)

Price change for the last 24 hours

Optimism market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$851.39M

Circulating supply

1,752,186,819 OP

40.79% of

4,294,967,296 OP

Market cap ranking

38

Audits

Last audit: --

24h high

$0.52060

24h low

$0.45820

All-time high

$4.8636

-89.99% (-$4.3763)

Last updated: Mar 6, 2024, (UTC+8)

All-time low

$0.39530

+23.27% (+$0.092000)

Last updated: Jun 19, 2022, (UTC+8)

How are you feeling about OP today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Optimism Feed

The following content is sourced from .

Retarded Trader 📈📊

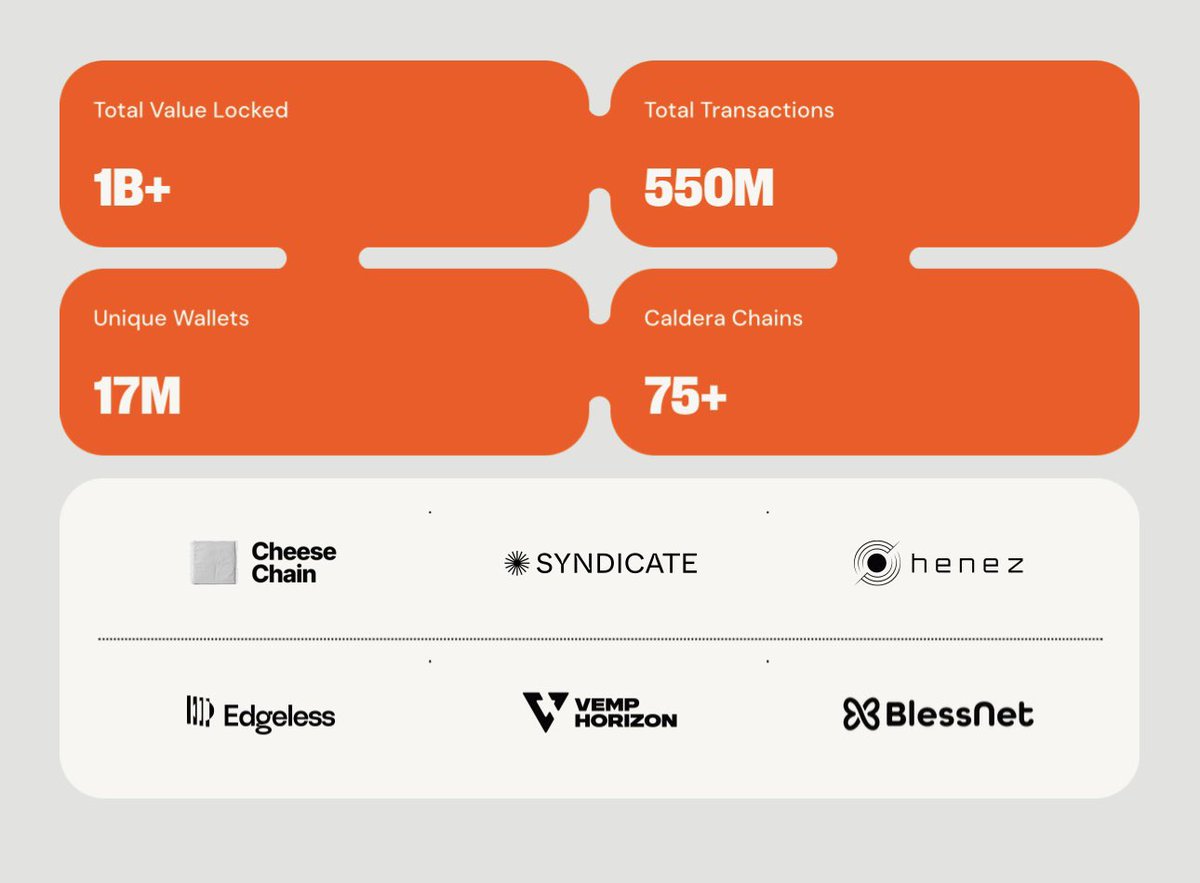

Everyone’s busy debating L3 vs L2 vs “modular meta,” but @Calderaxyz just quietly became the internet backbone of Ethereum’s rollup future.

TL;DR? They’ve:

→ Launched 75+ custom rollups

→ Hit $1B+ TVL

→ Processed 550M txns

→ Onboarded 17M unique wallets

→ Shipped intent-based bridging (Metalayer magic)

→ AND now power infra for AI agents via GenLayer’s testnet

The Metalayer is wild as it’s a unifying mesh for the rollup multiverse. It makes Optimism, Arbitrum, Polygon, and every EVM chain feel like neighborhoods on the same cosmic block.

With <2s finality and “dApp teleports” across chains, it’s less bridging, more Stargate.

@evans1vn nailed it the other day saying, intent-based bridging flips UX from “manual mode” to “autopilot.” You don’t pick chains. You just do things. And @jimmyboolish dropping stats like $517M in TVL and 45 rollups live? Let’s just say the receipts are loud.

Also, let’s not forget that GenLayer testnet has now commenced.

It’s a fully agentic AI trust infra, built on Caldera.

AI agents making real-world calls, decisions, and transactions but rollup-native. Not vaporware. Not waitlist hype.

Also their one-click rollup deployment saves devs from gray hairs. As @hodl_strong put it, “this is where the gold is.” No more setting up chains like it’s 2019. You deploy and go. Imagine if AWS let you spin up a chain instead of a server.

10x–100x cheaper txs. Instant bridging. Full EVM compatibility. 2s blocks. Rollups on rails. And VCs like Sequoia and Dragonfly backing the entire stack.

Gmera Frens

1.63K

12

OpenCover

🚀 Play it safe, unlock peace of mind and premium opportunities with @vfat_io 🚀

KenK

Protecting your DeFi farms just became easy

On-chain insurance has typically been difficult for retail to access with now having built in coverage provided by @OpenCover making for effortless on-chain protection (currently on arb, base or op)

This typically could be an investor looking to deploy capital into a farm or liquidity pool, but is seeking protection from third-party smart contract risk, which is considered as protocol hacks, oracle manipulation, liquidation issues or governance attacks

Sure there's a cost, but with 150% APR available on ETH/USDC farms, if you are thinking about depositing large amounts of capital, the risk:reward on this just significantly shifted

4.6K

1

KenK

Protecting your DeFi farms just became easy

On-chain insurance has typically been difficult for retail to access with now having built in coverage provided by @OpenCover making for effortless on-chain protection (currently on arb, base or op)

This typically could be an investor looking to deploy capital into a farm or liquidity pool, but is seeking protection from third-party smart contract risk, which is considered as protocol hacks, oracle manipulation, liquidation issues or governance attacks

Sure there's a cost, but with 150% APR available on ETH/USDC farms, if you are thinking about depositing large amounts of capital, the risk:reward on this just significantly shifted

1.36K

6

区块链火焰探险者

Circle announces the official launch of its cross-chain transfer protocol CCTP V2 on Solana!

It supports developers and users in achieving fast transfers and post-transfer smart contract integration, further promoting the development of cross-chain interoperability.

The currently supported blockchains include:

Arbitrum, AVAX, Base, Ethereum, Linea, Optimism, Sonic Labs, World Chain

#Circle #CCTP #Solana #CrossChain #Web3

Circle

CCTP V2 is now available on @solana!

Key benefits for developers and users:

⚡Fast Transfer: crosschain @USDC settlement in seconds

🔀Hooks: smart contract integrations for post-transfer actions

💸Capital Efficient: 1:1 burn-and-mint, no liquidity pools or fillers

🔒Secured by Circle: no additional trust assumptions

Day 1 apps, bridges, and infra providers include: @CCTPMoney, @InterportFi, and @routerprotocol with more expected in the coming weeks.

Solana is now securely connected to a network of CCTP V2 supported blockchains, including: @arbitrum, @avax, @base, @ethereum, @LineaBuild, @Optimism Mainnet, @SonicLabs, and @world_chain_

Start building now:

45.23K

15

A Bao 阿饱🍊(🔆)

Yesterday I took a day off, feeling too tired. The market isn't terrible, but as for altcoins, only those who play know, it's a pile of dog shit.

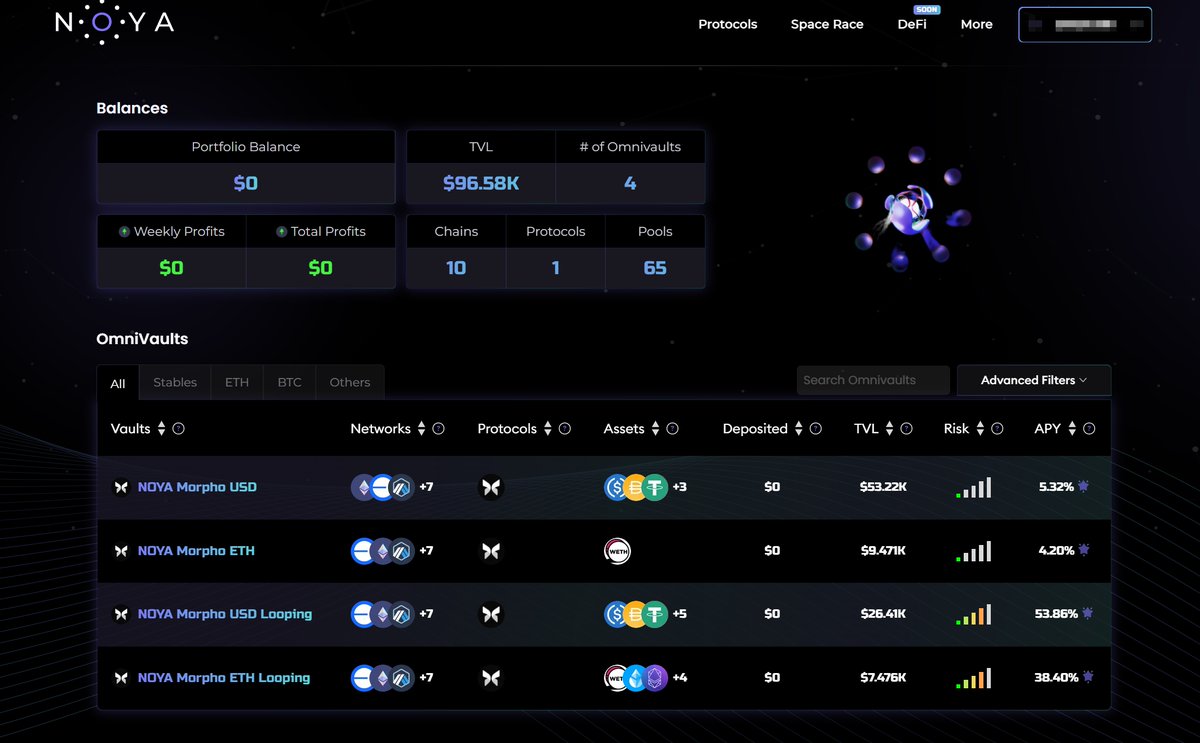

By the way, I researched a new DeFi protocol, Noya @NetworkNoya, how to play it.

(AI and DeFi combined)

Currently, the deposit pool isn't large, still in the early stages. Also, there hasn't been any funding. You can do some tasks to earn points, it's not competitive right now.

However, on the flip side, if you deposit, the points will be substantial. It seems that if you deposit 100 USDT, you can earn 5000 points in a day.

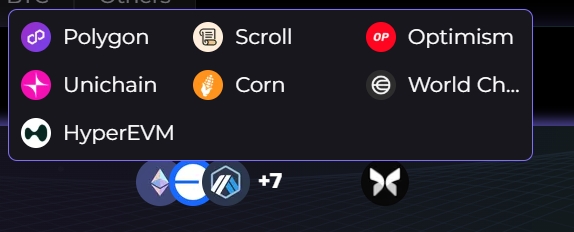

Just deposit stablecoins (preferably on the OP chain or ARB chain).

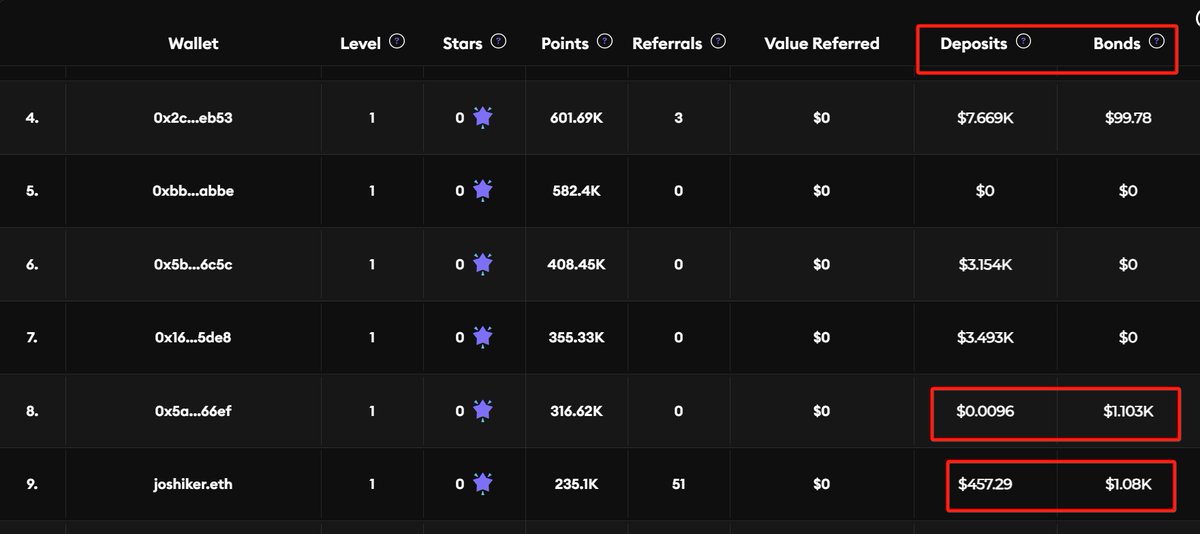

Be careful not to deposit in the loop pool; two smart guys got liquidated (see picture three). A slight fluctuation in the loop pool can lead to liquidation.

Show original

21.53K

56

Convert USD to OP

Optimism price performance in USD

The current price of Optimism is $0.48730. Over the last 24 hours, Optimism has decreased by -4.39%. It currently has a circulating supply of 1,752,186,819 OP and a maximum supply of 4,294,967,296 OP, giving it a fully diluted market cap of $851.39M. At present, Optimism holds the 38 position in market cap rankings. The Optimism/USD price is updated in real-time.

Today

-$0.02240

-4.40%

7 days

-$0.10160

-17.26%

30 days

-$0.26870

-35.55%

3 months

-$0.41850

-46.21%

Popular Optimism conversions

Last updated: 06/23/2025, 07:17

| 1 OP to USD | $0.48590 |

| 1 OP to PHP | ₱27.7799 |

| 1 OP to EUR | €0.42394 |

| 1 OP to IDR | Rp 7,977.34 |

| 1 OP to GBP | £0.36262 |

| 1 OP to CAD | $0.66869 |

| 1 OP to AED | AED 1.7845 |

| 1 OP to VND | ₫12,696.63 |

About Optimism (OP)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Latest news about Optimism (OP)

Bitcoin Quickly Plunges Below $103K, With Volatility Burst Spurring $450M in Crypto Liquidations

The sharp reversal from above $106,000 wiped out early optimism, with bulls and bears mostly continuing in a stalemate.

Jun 21, 2025|CoinDesk

Every Fintech Firm Will Run Its Own Blockchain 'in Next Five Years:' Optimism

The logic behind this assertion is straightforward and simple, says OP Labs head of product Sam McIngvale.

Jun 18, 2025|CoinDesk

Litecoin Price Struggles Despite ETF Optimism as War Tensions Rattle Market

Despite a brief rebound, LTC's recovery stalled at $97.80, indicating a potential consolidation phase.

Jun 15, 2025|CoinDesk

Optimism FAQ

What is Optimism?

Optimism, also known as Optimistic Ethereum (OE), is a Layer 2 scaling solution for Ethereum that aims to increase transaction throughput and reduce fees without sacrificing security and decentralization.

How does Optimism improve Ethereum’s scalability?

Optimism improves Ethereum’s scalability through the use of optimistic rollups. These rollups are a Layer 2 solution that perform most computation off-chain while keeping the same level of security as the main Ethereum network.

What is the OP price prediction?

While it’s challenging to predict the exact future price of OP, you can combine various methods like technical analysis, market trends, and historical data to make informed decisions.

How much is 1 Optimism worth today?

Currently, one Optimism is worth $0.48730. For answers and insight into Optimism's price action, you're in the right place. Explore the latest Optimism charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Optimism, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Optimism have been created as well.

Will the price of Optimism go up today?

Check out our Optimism price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Convert USD to OP

Socials