EGLD

MultiversX price

$11.9600

-$1.1700

(-8.92%)

Price change for the last 24 hours

How are you feeling about EGLD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

MultiversX market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$339.47M

Circulating supply

28,359,751 EGLD

90.27% of

31,415,926 EGLD

Market cap ranking

54

Audits

Last audit: Aug 14, 2021, (UTC+8)

24h high

$13.2200

24h low

$11.8400

All-time high

$561.88

-97.88% (-$549.92)

Last updated: Nov 23, 2021, (UTC+8)

All-time low

$5.6000

+113.57% (+$6.3600)

Last updated: Oct 9, 2020, (UTC+8)

MultiversX Feed

The following content is sourced from .

Crypto Patel

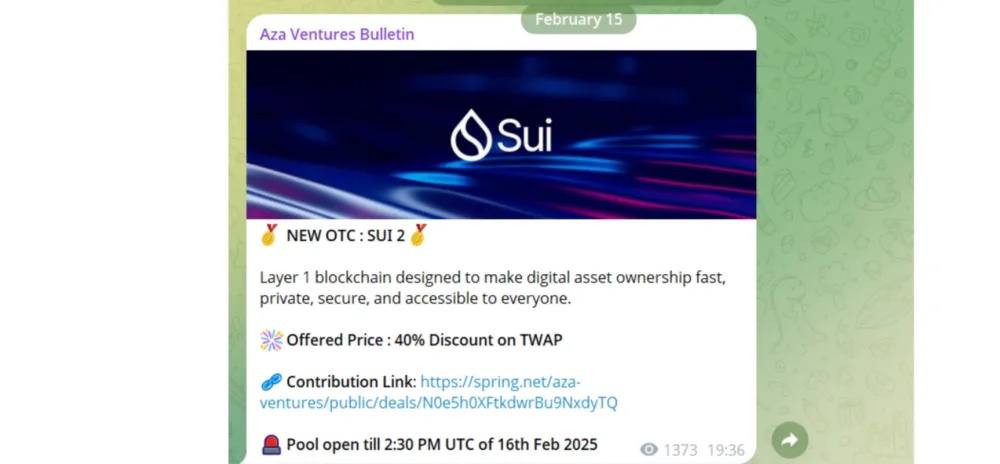

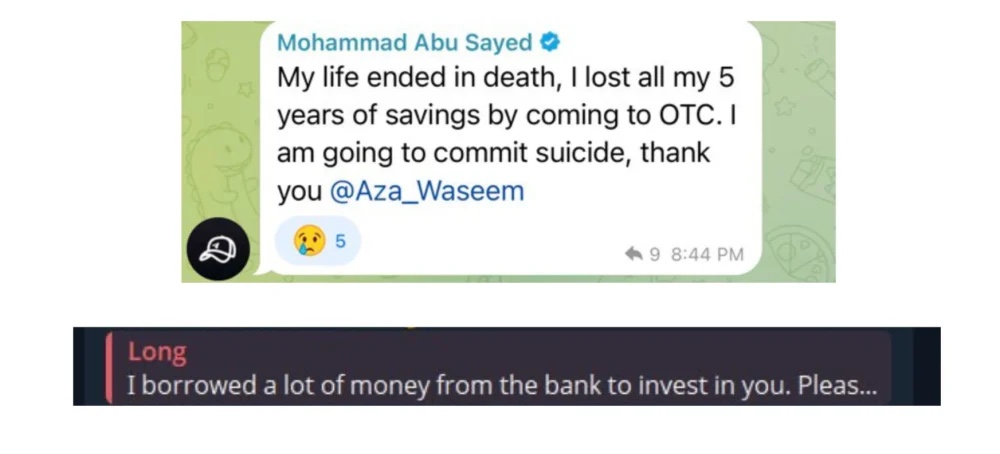

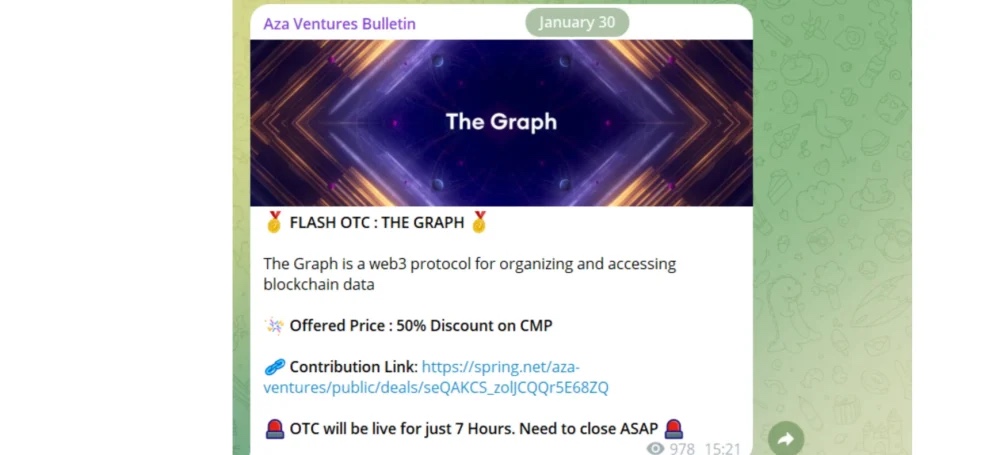

SCAM ALERT: SUI, NEAR, SEI Victims Robbed in Massive OTC Ponzi!

If you’re buying “cheap tokens” on Telegram… STOP NOW.

Here’s how they fooled whales, VCs & KOLs 👇

- A Telegram group called Aza Ventures Bulletin offered discounted SUI, NEAR, SEI, Axelar, & more.

- Early deals looked legit — tokens were actually delivered.

But it was a trap. A slow-burn Ponzi.

No tokens. No refunds. Just silence.

Victims lost over $50M.

The scam may be linked to a known Indian crypto founder (under investigation).

Even official teams like $SUI & $EGLD confirmed:

❌ No such token deals exist.

❌ They’re not involved.

Reminder: If it sounds too good to be true, it is.

Stay smart. Stay safe.

What’s your take? Tag someone who needs to see this.

Retweet to warn others.

#ScamWarning

17.73K

112

EGLD calculator

MultiversX price performance in USD

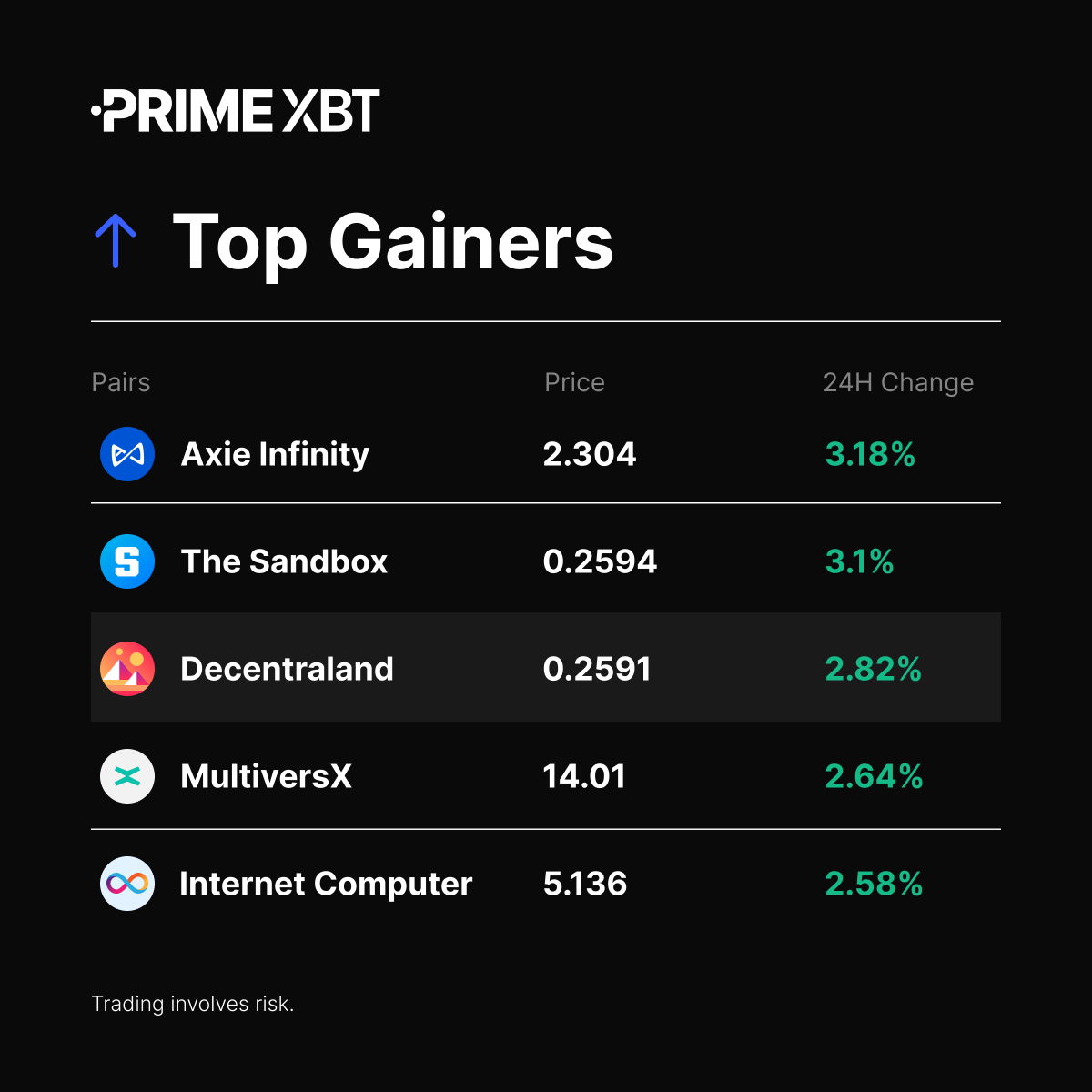

The current price of MultiversX is $11.9600. Over the last 24 hours, MultiversX has decreased by -8.91%. It currently has a circulating supply of 28,359,751 EGLD and a maximum supply of 31,415,926 EGLD, giving it a fully diluted market cap of $339.47M. At present, MultiversX holds the 54 position in market cap rankings. The MultiversX/USD price is updated in real-time.

Today

-$1.1700

-8.92%

7 days

-$1.9600

-14.09%

30 days

-$6.7900

-36.22%

3 months

-$7.3600

-38.10%

Popular MultiversX conversions

Last updated: 06/22/2025, 23:43

| 1 EGLD to USD | $11.9700 |

| 1 EGLD to PHP | ₱684.35 |

| 1 EGLD to EUR | €10.3866 |

| 1 EGLD to IDR | Rp 196,519.5 |

| 1 EGLD to GBP | £8.8957 |

| 1 EGLD to CAD | $16.4378 |

| 1 EGLD to AED | AED 43.9598 |

| 1 EGLD to VND | ₫312,777.6 |

About MultiversX (EGLD)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

MultiversX FAQ

What is the total supply of EGLD?

Elrond has a capped total supply of 31.4 million tokens and a circulating supply of 23.15 million. The remaining EGLD will be gradually released over the next ten years until it reaches its maximum supply.

What is the EGLD price prediction?

While it’s challenging to predict the exact future price of EGLD, you can combine various methods like technical analysis, market trends, and historical data to make informed decisions.

Should I buy EGLD?

When buying EGLD or any other cryptocurrency, it is crucial to approach the decision thoughtfully. Consider personal financial circumstances, risk tolerance, and trading goals thoroughly. Conducting rigorous research, evaluating the project's fundamentals, analyzing market conditions, and seeking guidance from a financial advisor, if necessary, are recommended steps before making any trading decisions.

How much is 1 MultiversX worth today?

Currently, one MultiversX is worth $11.9600. For answers and insight into MultiversX's price action, you're in the right place. Explore the latest MultiversX charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as MultiversX, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as MultiversX have been created as well.

Will the price of MultiversX go up today?

Check out our MultiversX price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

EGLD calculator

Socials