This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

GHO

Gho Token price

0x40d1...6c2f

$0.99924

-$0.00010

(-0.01%)

Price change for the last 24 hours

How are you feeling about GHO today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

GHO market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$230.56M

Network

Ethereum

Circulating supply

230,735,378 GHO

Token holders

4739

Liquidity

$10.02M

1h volume

$29,913.97

4h volume

$442,311.98

24h volume

$4.16M

Gho Token Feed

The following content is sourced from .

仙橙多2222

How the head Defi giant $UNI $AAVE $SKY integrates with traditional finance

🌟Uniswap: Compliant infrastructure for on-chain liquidity

Uniswap, as a leading decentralized exchange (DEX), provides flexible compliance features for traditional finance (TradFi) integration through its V4 version of the "hooks" modular architecture. It supports real-time KYC/AML verification, transaction monitoring, and whitelisting pools, allowing for the creation of regulatory-compliant liquidity pools that attract institutional participation without compromising protocol neutrality.

Uniswap can serve as the core on-chain liquidity layer for RWA (real world assets) trading, supporting 24/7 trading and automated market making of tokenized assets such as US Treasuries and stocks. Its smart order routing and API can be embedded in the broker's platform as a back-end DEX service, providing real-time price discovery and liquidity to regulated firms. Uniswap's Unichain (Layer 2 based on OP Stack) further reduces transaction costs, enhances integration with the Ethereum ecosystem, and positions it as a compliant infrastructure for tokenized finance.

🌟Aave: A bridge to institutional-grade lending

Aave leads DeFi lending with $24 billion in total value locked (TVL), and its convergence with traditional finance is focused on institutional needs.

First, Aave provides a KYC/AML compliant environment through permissioned lending pools, allowing regulated entities such as banks and asset managers to participate in decentralized lending. Second, Aave supports tokenized RWA (e.g., government bonds, real estate) as collateral to attract traditional capital market participants and enable stablecoins, such as treasury bonds. Aave's Horizon project develops RWA solutions for institutions, such as access to GHO stablecoin liquidity secured by tokenized money market funds. In addition, Aave has partnered with new banks and fintech companies to integrate DeFi yield strategies into consumer platforms, so that users' fiat deposits can be seamlessly converted into stablecoins and lent on Aave, with interest returned directly, simplifying the user experience.

🌟Sky (MakerDAO): The Transformation of Compliant Stablecoins

Sky, which operates stablecoins DAI and USDS, faced challenges with 1:1 fiat reserves, licensed issuance, and KYC compliance required by the GENIUS Act.

In order to integrate into traditional finance, Sky is adjusting its strategy: increasing its reserves of traditional assets (such as US Treasuries, which currently account for 10% of DAI collateral) and moving closer to 1:1 reserves to meet regulatory standards. At the same time, USDS has introduced regulatory-friendly mechanisms such as freezing functions to meet KYC/AML requirements. Sky may further launch a compliant wrapper or parallel stablecoin, designed specifically for the U.S. market, to interface with regulated entities. These adjustments allow Sky to expand its stablecoin adoption while maintaining compatibility with the traditional financial system to serve both institutional and retail users.

Show original7.97K

1

头等仓First.VIP |We're hiring

However, from a broader perspective of the DeFi space, Aave V4 is not the only player in the concept of a unified liquidity layer. The Spark liquidity layer within the Sky (MakerDAO) ecosystem has already taken a step ahead in technical practice, achieving some success in the use of stablecoins and integration with other DeFi protocols. Additionally, some smaller projects are also exploring and practicing in the field of cross-chain liquidity layers. From a longer-term perspective, the competition between Aave, which is based on the lending sector, and Sky, which is based on the stablecoin sector, may truly determine who the ultimate winner in the future DeFi space will be.

头等仓First.VIP |We're hiring

At present, Aave is the leader in the Ethereum lending field.

Aave focused on the demand for DeFi leveraged arbitrage in the bull market that began in late 2023, and the lending business data showed significant growth, turning losses into profits in 2024, and maintaining the momentum into the first half of 2025. In addition, Aave has also achieved great results in multi-chain liquidity deployment relying on Portals, becoming the DeFi project with the highest lock-up volume on multiple chains, such as Arbitrum, Polygon, Avalanche, and Optimism.

Now that Aave V4 is expected to be launched within the year, the throne is going to sit more securely?!

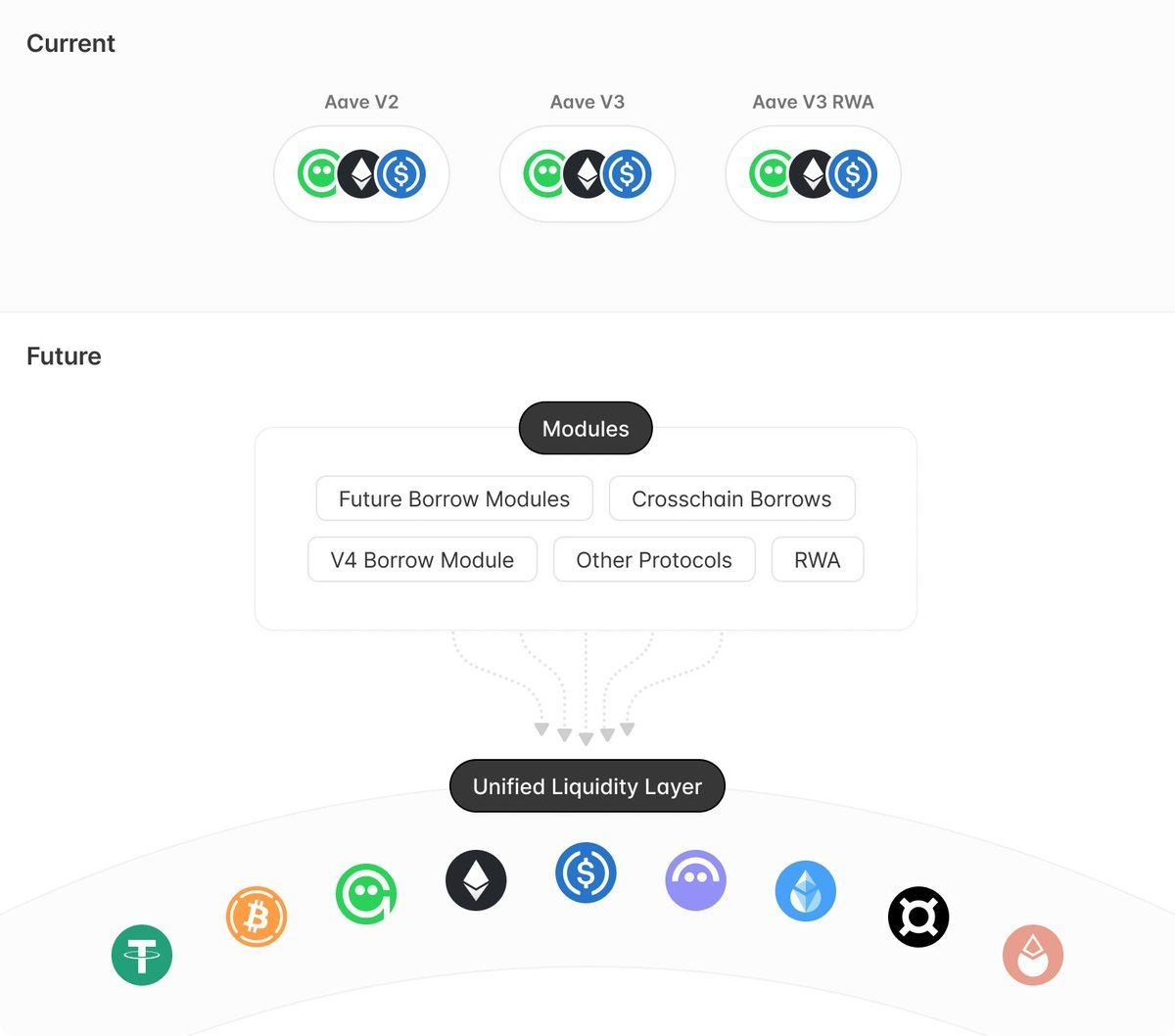

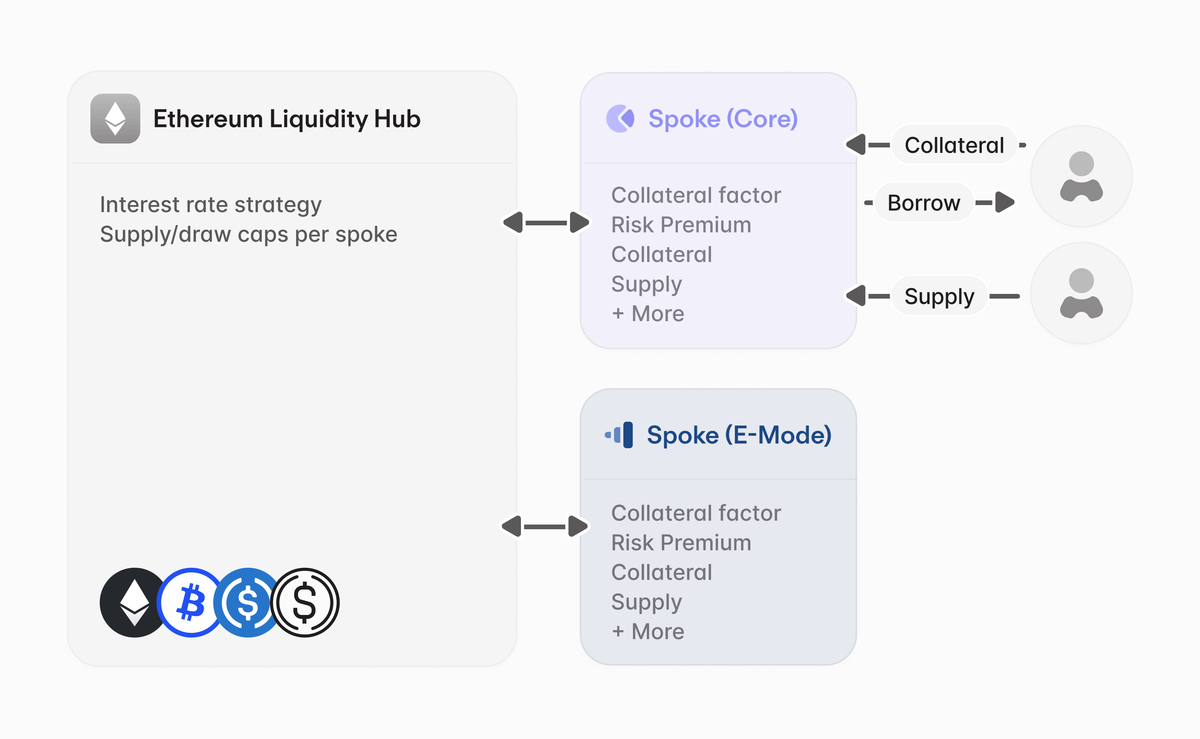

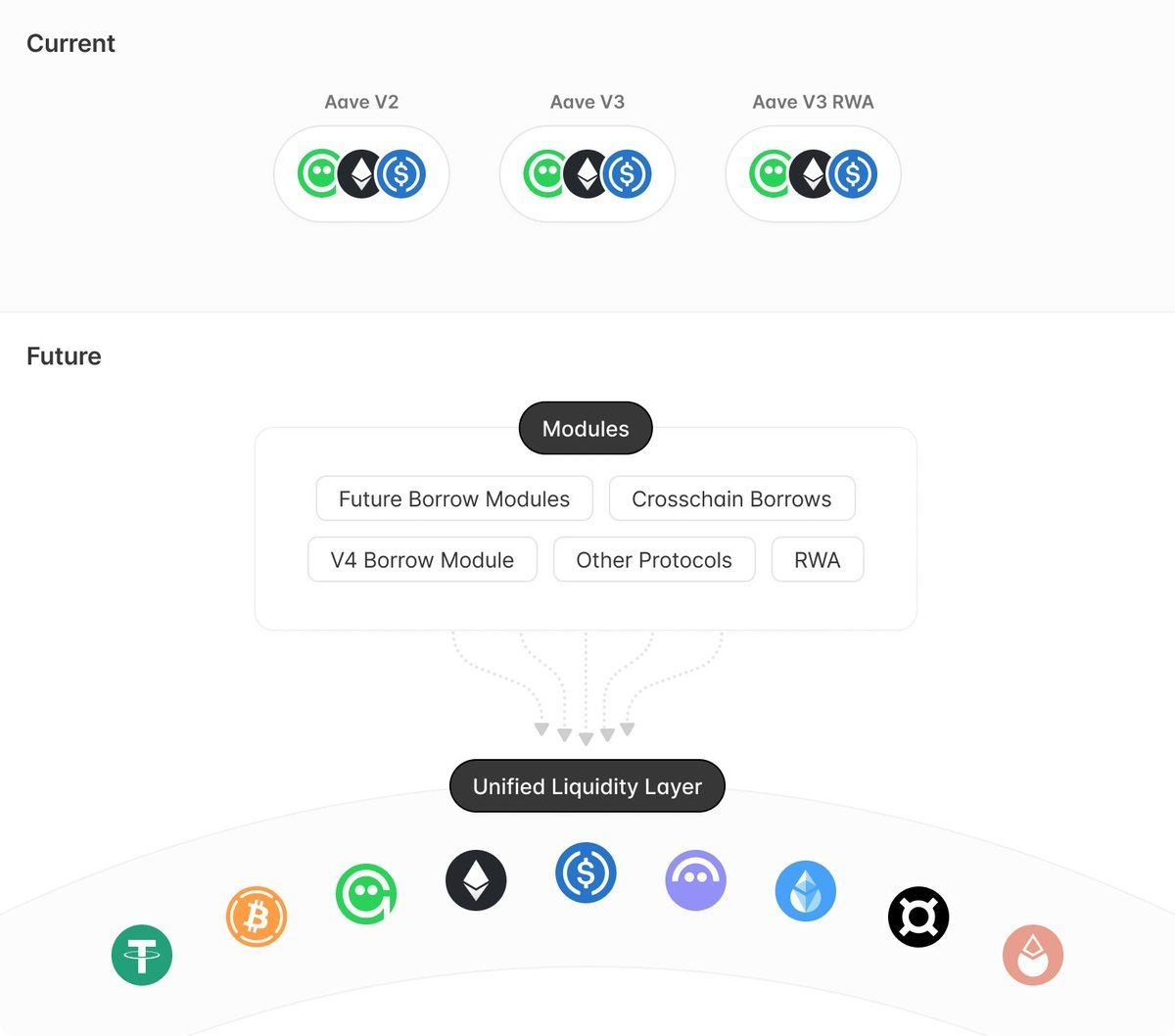

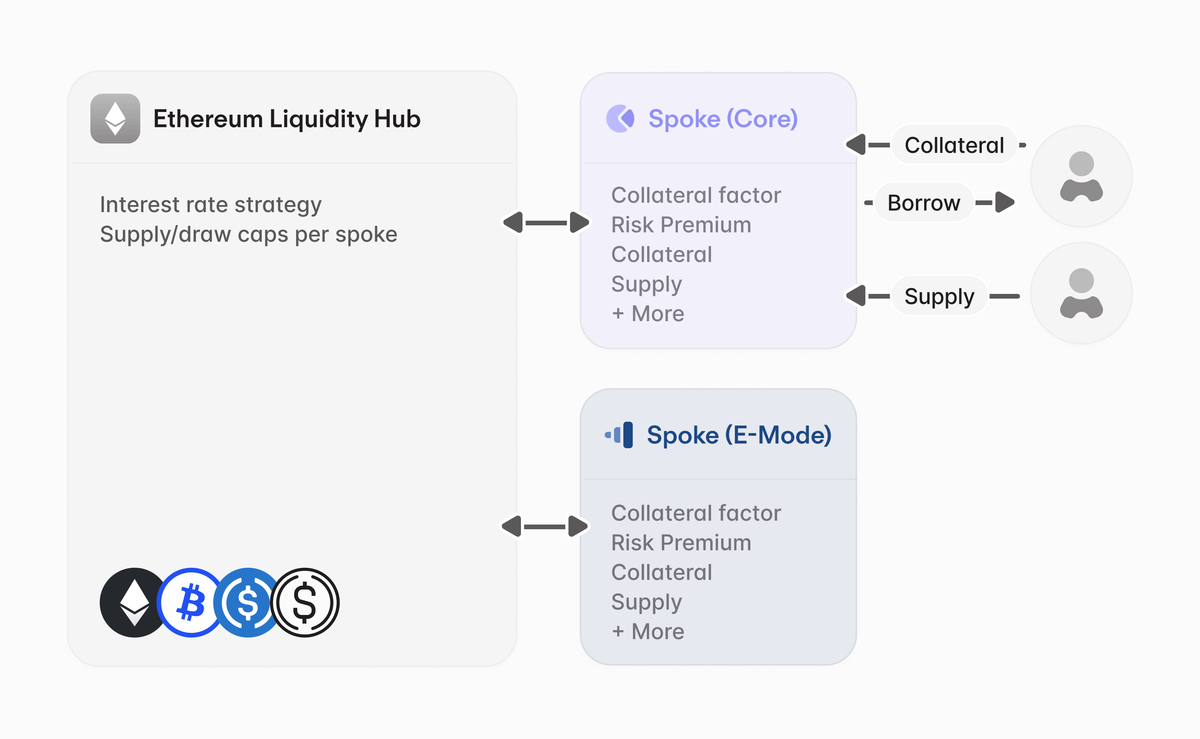

Aave basically maintains a large-scale product iteration cycle of 2~3 years, and the main version running now is still V3, but from the proposal of the development team in 2024, we have glimpsed the prototype of Aave V4, that is, a unified modular liquidity layer.

Aave V4 adopts a new architecture of hub & spoke, which enhances modularity, reduces governance overhead, and optimizes capital efficiency. Aave V4 will rely more on the automatic dynamic adjustment of on-chain smart contracts according to the market environment (interest rates, risk parameters, asset lists, financial management, etc. are no longer adjusted by governance), introduce chain abstraction concepts to improve user experience, integrate GHO stablecoins more deeply into the ecosystem, and will also introduce new risk management tools and a more efficient clearing engine.

In the long run, once the design of Aave V4 is actually implemented, it is possible that various parameters that dynamically and automatically adapt to the market environment and open up multi-chain liquidity will once again help Aave to gain a technical and liquidity advantage with other lending protocols.

16.06K

1

头等仓First.VIP |We're hiring

At present, Aave is the leader in the Ethereum lending field.

Aave focused on the demand for DeFi leveraged arbitrage in the bull market that began in late 2023, and the lending business data showed significant growth, turning losses into profits in 2024, and maintaining the momentum into the first half of 2025. In addition, Aave has also achieved great results in multi-chain liquidity deployment relying on Portals, becoming the DeFi project with the highest lock-up volume on multiple chains, such as Arbitrum, Polygon, Avalanche, and Optimism.

Now that Aave V4 is expected to be launched within the year, the throne is going to sit more securely?!

Aave basically maintains a large-scale product iteration cycle of 2~3 years, and the main version running now is still V3, but from the proposal of the development team in 2024, we have glimpsed the prototype of Aave V4, that is, a unified modular liquidity layer.

Aave V4 adopts a new architecture of hub & spoke, which enhances modularity, reduces governance overhead, and optimizes capital efficiency. Aave V4 will rely more on the automatic dynamic adjustment of on-chain smart contracts according to the market environment (interest rates, risk parameters, asset lists, financial management, etc. are no longer adjusted by governance), introduce chain abstraction concepts to improve user experience, integrate GHO stablecoins more deeply into the ecosystem, and will also introduce new risk management tools and a more efficient clearing engine.

In the long run, once the design of Aave V4 is actually implemented, it is possible that various parameters that dynamically and automatically adapt to the market environment and open up multi-chain liquidity will once again help Aave to gain a technical and liquidity advantage with other lending protocols.

Show original

12.05K

2

GHO price performance in USD

The current price of gho-token is $0.99924. Over the last 24 hours, gho-token has decreased by -0.01%. It currently has a circulating supply of 230,735,378 GHO and a maximum supply of 230,735,388 GHO, giving it a fully diluted market cap of $230.56M. The gho-token/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

-0.01%

24h

-0.01%

About Gho Token (GHO)

GHO FAQ

What’s the current price of Gho Token?

The current price of 1 GHO is $0.99924, experiencing a -0.01% change in the past 24 hours.

Can I buy GHO on OKX?

No, currently GHO is unavailable on OKX. To stay updated on when GHO becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of GHO fluctuate?

The price of GHO fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Gho Token worth today?

Currently, one Gho Token is worth $0.99924. For answers and insight into Gho Token's price action, you're in the right place. Explore the latest Gho Token charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Gho Token, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Gho Token have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.