This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

USDe

Ethena USDe price

EQAIb6...zP5f

$1.0012

+$0.00080036

(+0.08%)

Price change for the last 24 hours

How are you feeling about USDe today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

USDe market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$29.91M

Network

TON

Circulating supply

29,876,937 USDe

Token holders

0

Liquidity

$9.15M

1h volume

$64,591.93

4h volume

$251,037.76

24h volume

$1.36M

Ethena USDe Feed

The following content is sourced from .

雨中狂睡🌲Doom

Now GAIB $AID has supported $USR deposits, with a limit of 10M. The core of this matter is still about maximizing benefits; you can mine GAIB's Spice points (5x multiplier) and get on the Fremen Essence NFT FCFS whitelist (by depositing a full $1500), while also mining Resolv's points (30x multiplier).

This is a mutual support between GPU RWA type yield stablecoins and arbitrage yield stablecoins.

Resolv's stablecoin $USR is a Detal neutral strategy stablecoin, similar to $ENA's $USDe. Resolv focuses on ETH LST yields and fee arbitrage from ETH contracts. Recently, after some major exchanges participated in the TGE, Resolv's market attention and discussion have actually been quite good.

The essence of the collaboration with Resolv is stablecoin nesting, and GAIB may collaborate with more stablecoin projects in the future to introduce more incremental value to their products—driving product growth through maximizing benefits.

Currently, the yield expectation for $AID (USDC/USDT) on Pendle is around 10%, while the yield expectation for $USR on Pendle PT is around 8%. Considering the point multipliers, this yield is likely to be even higher. This yield expectation is still quite acceptable.

10.74K

13

庞教主

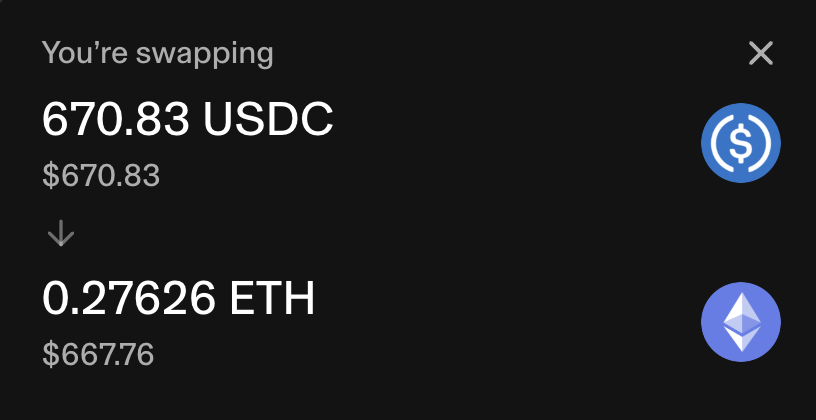

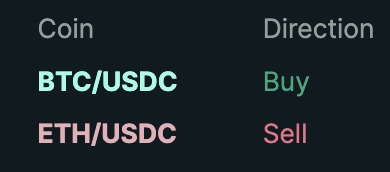

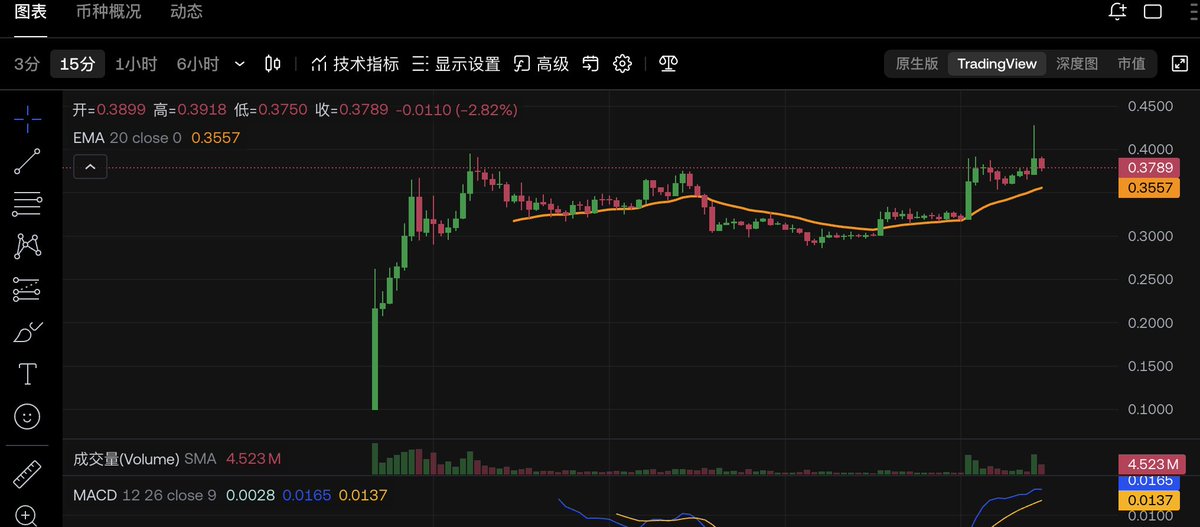

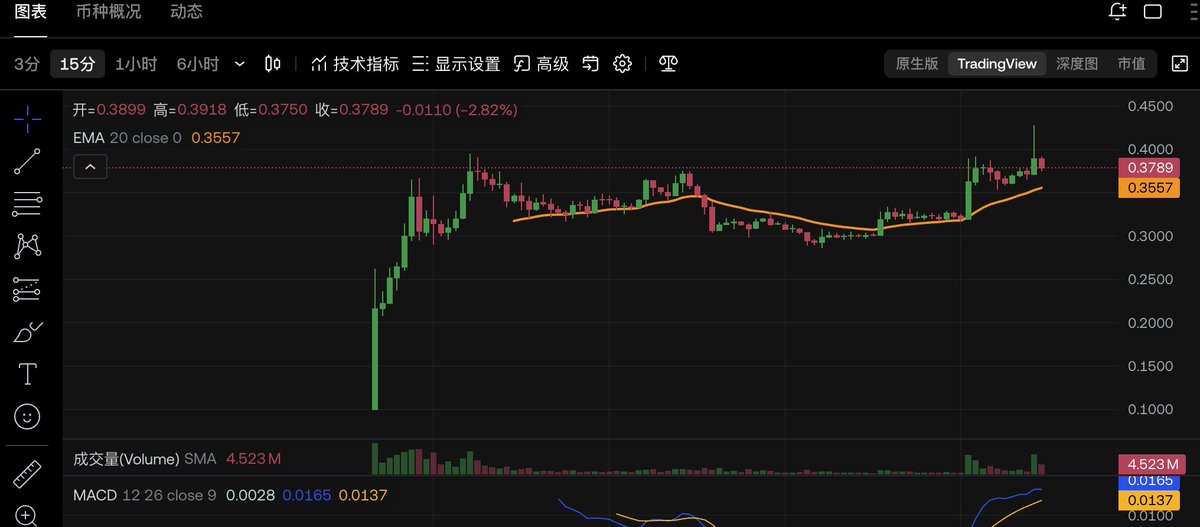

RESOLV price: 0.1654u

I feel like the timing is about right, so I bought a little. For those who want to follow, set your own stop-loss.

So, we still need to be patient and wait; opportunities are created by waiting. 😂

庞教主

Resolv officially pulls in the list of my observation potentials

In one sentence, Resolv: an enhanced version of on-chain Ethena, the largest alpha mark of stablecoins

At present, the price of Resolv is $0.38, the circulating market value is $50 million (low valuation), and the FDV is 380 million. Compared with similar projects Ethena, Ethena's circulating market value is 2.2 billion, FDV is 5.4 billion, and of course, Ethena's tvl is also higher, mainly because the track ceiling is relatively high, that is, the imagination is relatively large.

In terms of investment background, coinbase, Delphi have all invested, as well as Gumi Cryptos, Gumi is a veteran Web3 VC, and is extremely cautious in the fields of stablecoins, structured finance, and infrastructure

Why are you optimistic about the future price of Resolv?

1. The stablecoin track is too tempting, such as the recent listing of Circle, the parent company of usdc, which is traditional, that is, it does not use the assets of the currency circle as collateral and does not share benefits with the currency circle. The new school is Ethena, which adopts a delta-neutral strategy to maintain stability and transfer benefits to users in the cryptocurrency circle

@ResolvLabs is an enhanced and optimised version of Ethena, which is supported by ETH/BTC derivative holdings and RLP (Risk Control Insurance Pool), while Ethena only has a single token model (USDe), and all risk and reward flow into stablecoin holders

2. The overall valuation is relatively low, which is the biggest benefit of this round of investment, this round has indeed removed the huge bubble of the past VC disk in the currency circle, so the VC projects on this round are all low valuation online, which provides a good safety bottom line. The biggest advantage of Resolv is precisely that there is a pioneer like Ethena as an anchor, Ethena FDV is 5.4 billion, while Resolv is only 380 million, less than one-tenth of Ethena, and the safety bottom line and potential valuation are very suitable for price investment

Speaking of the fundamentals of Resolv itself, the agreement fee profit sharing plan has not yet been launched, and if it is implemented, it will greatly increase the intrinsic value; With the bundled growth of USR, the more USR is issued, the higher the governance value, which is a high probability event for the steady growth of USR in the visible time

However, June 27 will usher in a round of small unlocking (about 1.3% of the total amount) for investors and liquidity providers, so you need to pay attention to the market reaction and choose the opportunity to participate

The core reasons for pulling Resolv into the list of my observed potentials are that the relatively low valuation provides a safe floor, the price increase of the token due to the predictable growth of the USR bundle, and the success of Ethena as a reference anchor and model, which is very suitable for long-term ambushes

27.22K

16

🉐 Crypto Linn

Some guy called @Rightsideonly said "go enjoy vacation no need to post a Pendle Highlight this week"

LOL yeh right...anyway, here's the latest:

- Pendle enables the construction of yield curves (yuge)

- New pools: Yearn aGHO-USDf 25-SEP [ETH] | reUSDe 18-DEC [ETH] | Aave stkaUSDT & stkaUSDC 30-OCT [ETH]

TASTY on Pendle:

- Stables: sGHO [28-AUG] [ETH] @ 21.91% LP-APY | cwgUSD [26-JUN] [BASE] @ 11.15% PT-APY

- ETH: wstETH [25-DEC] [ETH] @ 5.91% LP-APY | superETH [31-JUL [ETH] @ 4.5% PT-APY

- Trending Markets: sUSDe [25-SEP] [ETH] 7.23% PT-APY | USDe [31-JUL] [ETH] 7.12% PT-APY | sUSDf [25-SEP] [ETH] 10.09% PT-APY

Last week:

- Pendle is 4 years old:

- Pendle back to $5B TVL:

- Pendle LPs can now be used as collateral in Silo:

- Additional thoughts of what Boros is:

- Pendle Print #71:

Wow, ok back to ze holibobs :))

TN | Pendle

DeFi is no longer in its infancy. We’ve moved past the chaotic Cambrian explosion of experimentation and hype, into what might be best described as the “Silver Age”, a period of growing maturity, structural refinement, and focus on practical economics.

Just as TradFi evolved over centuries, from barter trade to banks, money markets, and eventually interest rate derivatives, DeFi is now undergoing a similar process. Token-to-token swaps which heralded DeFi Summer marked our barter era. Lending protocols like Aave, Compound, Morpho, and Euler formed the bedrock of crypto’s banking layer. And now, the next great leap is underway: the emergence of a yield curve and a functioning market for interest rate pricing and hedging.

At the center of this shift is Pendle, which has pioneered and popularized DeFi fixed yield as well as yield trading, providing the tools for the price discovery of yield.

Price discovery is a cornerstone of financial maturity. It enables capital to flow where it’s most productive, creates the conditions for informed decision-making, and allows both individuals and institutions to manage risk effectively. Without a functioning pricing mechanism, any market remains speculative and inefficient.

Not so long ago in the early days of “Points” meta, ETH and stablecoin fixed yields regularly spiked past 100% APY. But today, yields on Pendle have stabilized into a much more sustainable 3-15% Fixed APY, a shift that reflects a maturing market underpinned by stable, reliable flows and real demand.

Thus, Pendle facilitates yield price discovery on both a microeconomic and macroeconomic level.

1. Microeconomic Level: Democratized Access to Emerging Protocols

With the rise of points and airdrop farming, Pendle has evolved into more than just a yield venue, effectively functioning as a platform for protocols to bootstrap liquidity.

Through YTs, users can speculate on future protocol rewards such as airdrops or points, while PTs offer predictable, fixed yields. This dual-token system allows the market to price yield components separately, offering a rich set of signals to both investors and protocols. In certain cases, users have chosen YT as a form of democratized access to protocol tokens, as it could offer a similar exposure as those heavily gated private rounds only available to venture capital firms or insiders.

With YT, Pendle users can:

- Enter positions at any point in time before maturity, often without lockups or vesting schedules

- Observe and gauge the protocol in action for a prolonged “DYOR” period before deciding to commit

- Buy-in later at a discount as YTs decay toward maturity, allowing latecomers to “catch up” even if they missed the boat the first time, second time, third time…

The result is a dynamic, open marketplace that actively facilitates pricing of project TGEs, unlocking early access to potential upside while enabling hedging and capital efficiency.

In TradFi, the yield curve is considered a leading economic indicator. It helps assess inflation expectations, recession risks, and future monetary conditions. It also serves as the benchmark for pricing everything from bonds to structured debt products.

Now, DeFi has the building blocks to replicate that onchain, providing a new layer of market intelligence far beyond what price charts or funding rates can offer.

2. Macroeconomic: Building the Yield Curve of Crypto

The DeFi yield market is still in its nascent stage compared to its traditional counterpart,but it's a critical piece in nurturing a mature and sustainable financial ecosystem. At a macro level, Pendle is in the process of establishing something DeFi has lacked: a yield curve.

Currently, the most commonly viewed aspects in crypto are:

a) Token prices

b) Funding rates

c) Fear and greed index

In TradFi, the yield curve is considered a leading economic indicator. It helps assess inflation expectations, recession risks, and future monetary conditions. It also serves as the benchmark for pricing everything from bonds to structured debt products. Now, DeFi has the building blocks to replicate this infrastructure.

Pendle’s yield markets enable participants to:

- Lock in yields across various maturities (e.g., 3-month, 6-month, etc.)

- Observe how short-term vs long-term rates evolve

- Infer macro signals like future liquidity tightening or easing

The curve provides a layer of market intelligence beyond what price charts can offer. More interestingly, with the upcoming launch of Boros, DeFi will see the creation of the world’s first funding rate curve, another first for the crypto economy. This curve will chart market expectations of perp funding rates over time, opening the door to a richer, more dynamic layer of yield analytics, strategy construction, and market interpretation.

In TradFi, yield curves shape everything from debt issuance to equity valuations. For crypto to reach its “Golden Age,” it needs similar tooling to support its own growing economy.

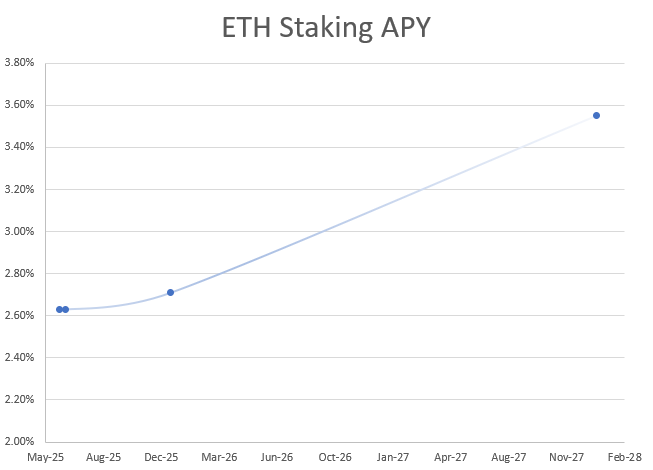

Importance of Yield Curve in Crypto

An upward-sloping yield curve of ETH staking APY plotted with Pendle’s stETH markets. The longer-dated maturity pools have higher yields due to greater uncertainty of yield changes over longer periods, which is how a “normal” yield curve would look like.

With the funding rate curve, deeper insights can be gathered on:

1. How the market is pricing various durations of funding rates and how this plays into short and long term market sentiment.

2. Liquidity health across tenures and where demand is greatest during times of market stress.

3. Brand new dynamics which form as more transparency and efficiency is created in the Funding markets

In my previous piece, I argued that stablecoin-denominated fixed yields will form the backbone for onboarding TradFi institutions into DeFi. These institutions are already searching for uncorrelated, attractive returns, and stablecoin fixed yields offer exactly that. But to participate meaningfully, they need more than just raw return figures. They require infrastructure that mirrors the analytical rigor and risk frameworks of traditional fixed income markets.

That’s where Pendle comes in.

Pendle enables the construction of yield curves, the discovery of interest rates, and the tools for institutional-grade risk management. This combination lowers the barrier for TradFi to enter, offering familiar frameworks in a novel, blockchain-native economy.

By establishing yield pricing at scale, Pendle is laying the rails for institutional adoption, ushering in the next “Golden Age” of DeFi, where yield becomes not just an opportunity, but a cornerstone of the new global financial system.

Job’s not done.

56.43K

26

USDe price performance in USD

The current price of ethena-usde is $1.0012. Over the last 24 hours, ethena-usde has increased by +0.08%. It currently has a circulating supply of 29,876,937 USDe and a maximum supply of 29,876,937 USDe, giving it a fully diluted market cap of $29.91M. The ethena-usde/USD price is updated in real-time.

5m

-0.01%

1h

+0.00%

4h

-0.01%

24h

+0.08%

About Ethena USDe (USDe)

USDe FAQ

What’s the current price of Ethena USDe?

The current price of 1 USDe is $1.0012, experiencing a +0.08% change in the past 24 hours.

Can I buy USDe on OKX?

No, currently USDe is unavailable on OKX. To stay updated on when USDe becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDe fluctuate?

The price of USDe fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Ethena USDe worth today?

Currently, one Ethena USDe is worth $1.0012. For answers and insight into Ethena USDe's price action, you're in the right place. Explore the latest Ethena USDe charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Ethena USDe, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Ethena USDe have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.