This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

DBR

deBridge price

DBRiDg...nUu5

$0.014788

-$0.00143

(-8.79%)

Price change for the last 24 hours

How are you feeling about DBR today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

DBR market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$147.88M

Network

Solana

Circulating supply

9,999,970,679 DBR

Token holders

102430

Liquidity

$5.14M

1h volume

$28,118.36

4h volume

$257,115.20

24h volume

$1.09M

deBridge Feed

The following content is sourced from .

远山洞见

From a data perspective, why I dare to increase my position in $DBR

Solana's attention has once again returned to the market center, driven by the wealth effect of the meme fork chain $GOR and the acceleration of ETF approvals.

In this context, my determination to remain bullish on $DBR has been further solidified. From the data, the hotter Solana gets, the more important #deBridge becomes, and the more $DBR is worth holding; this is also a structural closed loop.

The core reasons I choose to increase my position in $DBR are as follows:

1. Following Bitcoin and Ethereum, corporate treasuries have begun to increase their positions in $SOL, bullish on the Solana ecosystem;

2. deBridge has firmly grasped the bridging dominance of Solana;

3. $DBR is at a historical low, and under various favorable conditions, it offers extremely high cost-effectiveness;

4. The upcoming staking mechanism may become the starting point for revaluation.

--------------------------------------------

01|First, let's talk about the upstream logic: some corporate treasuries have started to treat SOL as their main holding.

Yesterday, the Canadian listed company SOL Strategies submitted a Nasdaq listing application to the SEC, with the code STKE. The company currently holds 420,000 SOL and operates its own validation node.

Friends who pay attention to Solana naturally know that after Bitcoin and Ethereum, corporate treasuries have begun to gamble on Solana, with companies like SOL Strategies, DeFi Development Corp, and Upexi leading the third wave.

They choose Solana as they see it as a "high-performance financial operating system" and attempt to deeply participate in and build the future on-chain economy by holding SOL.

Meanwhile, the SEC has requested multiple ETF applicants to submit revised S-1 documents within 7 days, focusing on the staking structure of SOL.

This can be compared to the path adjustments before the approval of the ETH ETF, indicating that the Solana ETF is officially entering the final stage of regulatory alignment.

-Upstream has ETFs,

-Downstream has corporate treasuries heavily invested,

-The market's perception of Solana is shifting from "asset" to "infrastructure."

--------------------------------------------

02|So the next question is: how does capital flow from off-chain into Solana?

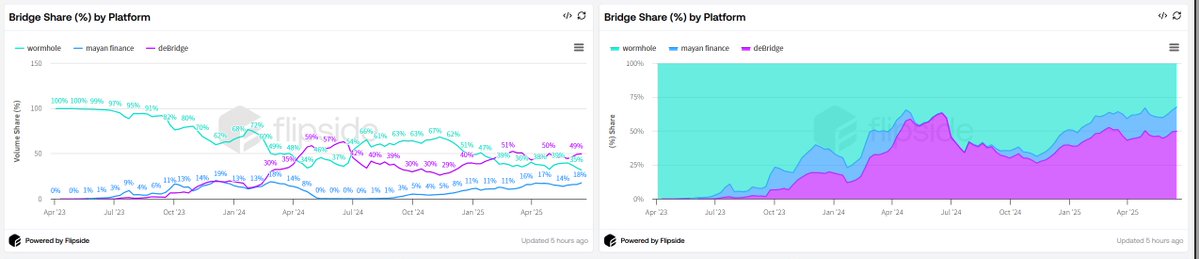

After sorting out the bridging data of Solana over the past three months, it was found that:

deBridge has become the main bridge for Solana, with a trading volume exceeding $947 million, accounting for nearly 50%.

For comparison:

-#Wormhole only $742 million during the same period

-#Mayan even lower, only $323 million

-#deBridge's share has grown from single digits over the past year to now being the leader.

More importantly: Solana only accounts for 22% of deBridge's total volume, while deBridge has captured half of Solana's traffic.

This indicates that deBridge is not "Solana-specific" but rather a main routing structure in a multi-chain bridging system, with Solana being just the most active segment.

--------------------------------------------

03|Returning to the token side: $DBR is showing structural undervaluation.

deBridge's token $DBR currently has a circulating market cap of just over $40 million, with a total market cap of $140 million and a release ratio of 28.48%.

The current price of the token is only $0.01402, close to its historical low (historical minimum $0.01327), showing a clear mismatch between fundamentals and valuation.

Several points worth noting:

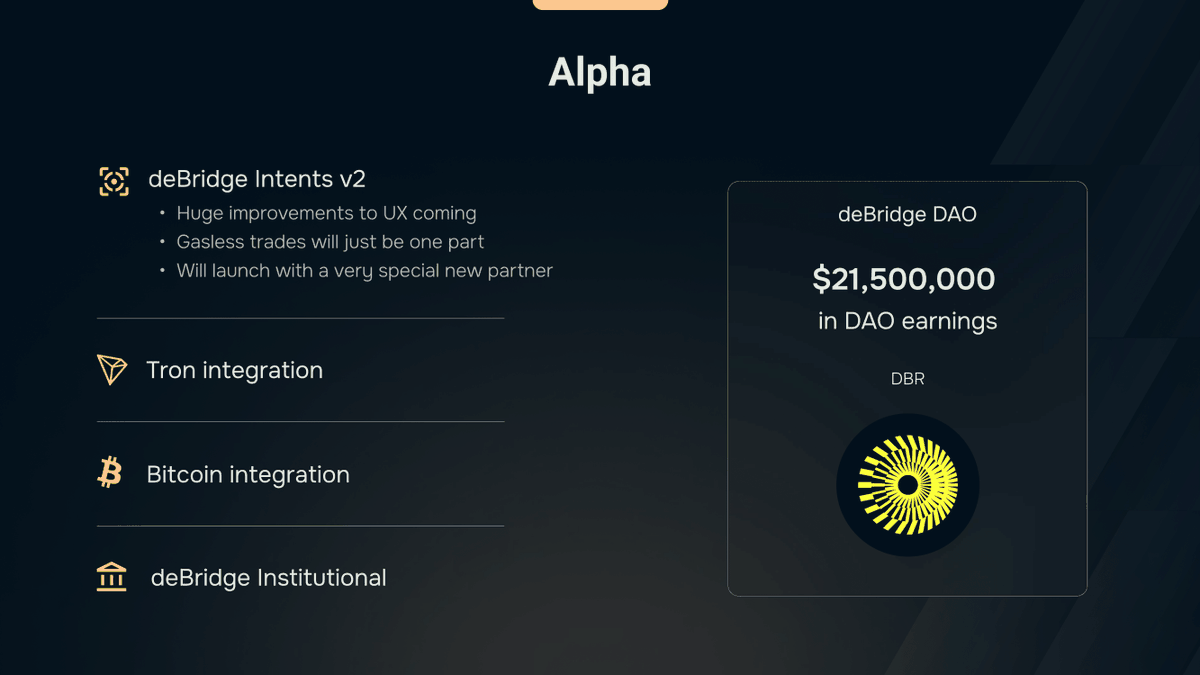

-The token is about to launch staking;

-It has not yet been listed on major exchanges, leaving room for pricing;

-Protocol data is growing rapidly, but the token is currently at a historical position, offering outstanding cost-effectiveness;

From market behavior, funds are using deBridge but have not yet given $DBR a reasonable price.

--------------------------------------------

Finally, the logic for increasing my position is not FOMO or emotional trading, but rather that there is indeed a situation of token valuation misalignment.

At the same time, from my interactions with the team, deBridge's delivery capability and speed of advancement are particularly strong. The team has been continuously building, with a clear rhythm, and you can feel their spirit of quietly getting things done and a long-term mindset.

If you are also paying attention to the upcoming round of "on-chain infrastructure revaluation" for Solana, then $DBR is worth putting on your watchlist.

Show original

91.38K

13

mleejr

apparently someone thinks i hold the keys to the @grok wallet with hundreds of thousands of dollars in eth and drb…

but the grok wallet is authenticated by grok’s X login credentials 🤣🤣🤣

that’s why it’s “the grok wallet” not “the mlee wallet”

protected by @privy_io which was just acquired by @stripe

4.67K

107

DBR price performance in USD

The current price of debridge is $0.014788. Over the last 24 hours, debridge has decreased by -8.79%. It currently has a circulating supply of 9,999,970,679 DBR and a maximum supply of 9,999,970,679 DBR, giving it a fully diluted market cap of $147.88M. The debridge/USD price is updated in real-time.

5m

+0.00%

1h

-0.10%

4h

-4.57%

24h

-8.79%

About deBridge (DBR)

DBR FAQ

What’s the current price of deBridge?

The current price of 1 DBR is $0.014788, experiencing a -8.79% change in the past 24 hours.

Can I buy DBR on OKX?

No, currently DBR is unavailable on OKX. To stay updated on when DBR becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of DBR fluctuate?

The price of DBR fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 deBridge worth today?

Currently, one deBridge is worth $0.014788. For answers and insight into deBridge's price action, you're in the right place. Explore the latest deBridge charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as deBridge, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as deBridge have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials