This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

DAI

Dai Token price

0x1af3...dbc3

$1.0000

+$0.00039984

(+0.04%)

Price change for the last 24 hours

How are you feeling about DAI today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

DAI market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$36.00M

Network

BNB Chain

Circulating supply

35,999,893 DAI

Token holders

177243

Liquidity

$868,408.21

1h volume

$137,538.20

4h volume

$198,618.09

24h volume

$1.63M

Dai Token Feed

The following content is sourced from .

Overnight.fi (USD+) - Vanguard of DeFi

CBDCs vs. Stablecoins: The Quick & Dirty

CBDCs (e.g., digital dollar, e-CNY):

🔵 Issued by central banks, tied to fiat.

🔵 Fully centralized, state-backed trust.

🔵 Tracks transactions, loves regulation.

🔵 Use case: Gov-controlled payments, surveillance.

Stablecoins (e.g., USDT, DAI):

🔵 Private issuers, pegged to assets or algorithms.

🔵 Varies: centralized (USDC) or DeFi-native (DAI).

🔵 Trust hinges on reserves or code.

🔵 Use case: DeFi, cross-border txns, censorship resistance.

990

0

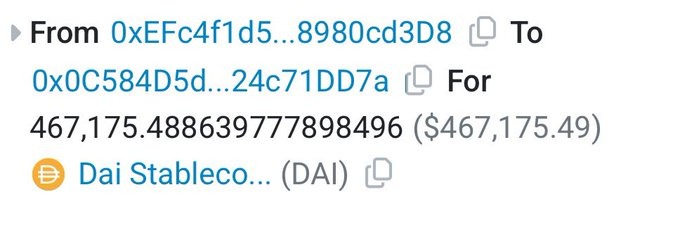

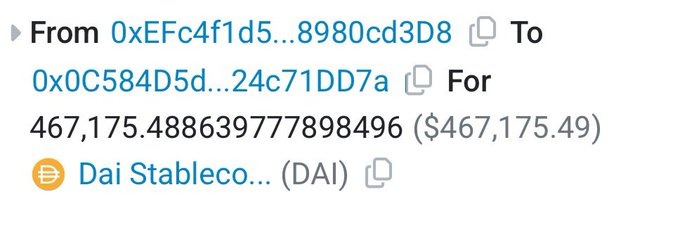

Cheeezzyyyy

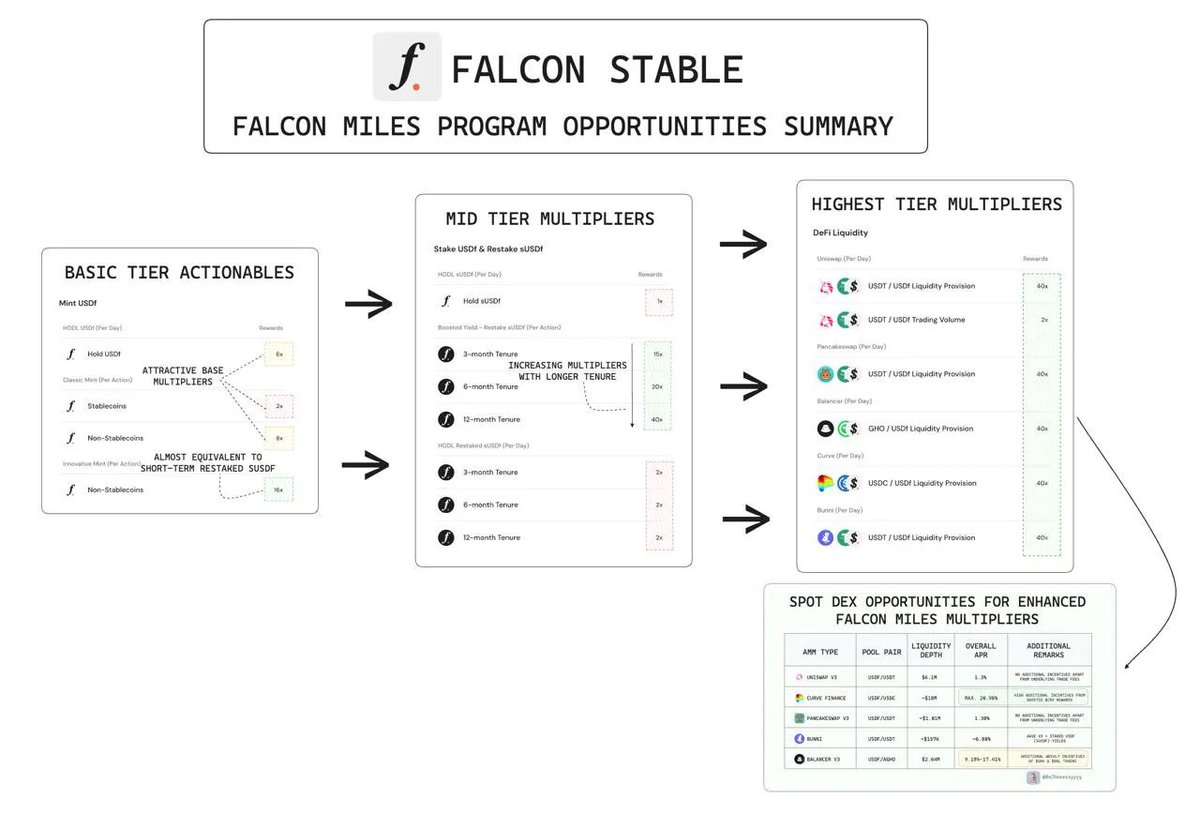

With stablecoin season heating up, @FalconStable YBS emerges as one to watch imo.

Both its yield mechanics & farming incentives offer unique opportunities for users seeking sustainable returns.

What is Falcon?

Falcon is a synthetic stablecoin protocol built for cyclical resilience.

$USDf & $sUSDf (staked ver.) are designed to accrue competitive yields from both positive & negative funding conditions.

Falcon leverages a multi-asset collateral model w/ optimised yield strategies. This approach has already pushed its TVL past $559M, supported by its ongoing Falcon Miles program that hints a potential airdrop.

Falcon employs a dual-mechanism to mint $USDf:

1⃣Stablecoins (USDT, USDC, DAI): Minted 1:1

2⃣Volatile Assets (BTC, ETH, etc.): Overcollateralised to ensure protocol integrity

where diff. mint types come with its resp. multipliers:

🔹Classic Mint: 2x for stables, 8x for volatiles

🔹Innovative Mint: 16x (only possible via non-stablecoin deposits)

*HODL-ing $USDf itself holds a base 6x multiplier on a daily basis

Likewise, staking ($sUSDf) has much amplified multipliers (15x-40x) depending on staked tenure.

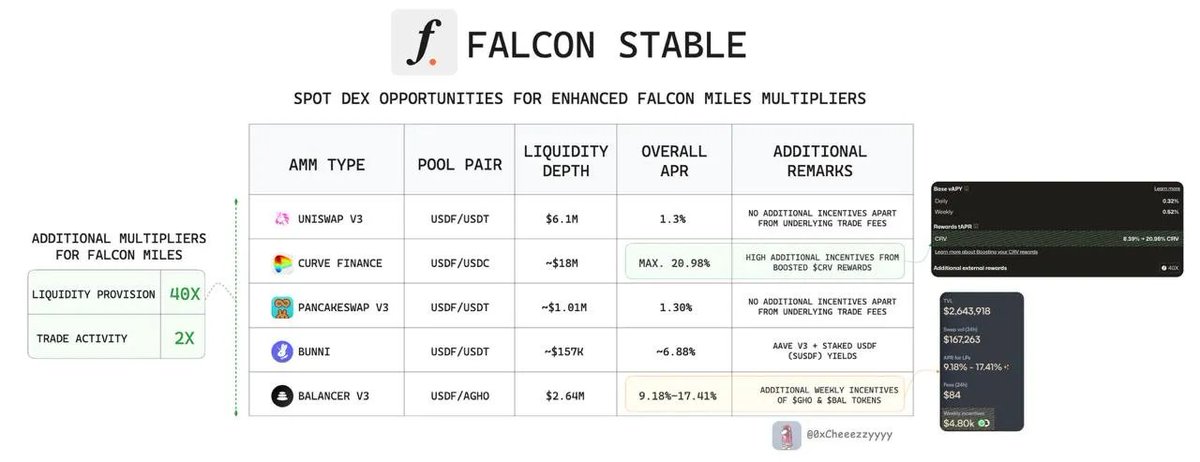

Max Yield & Miles Farming via LP Opportunities:

The highest tier multipliers are associated in liq. provision (up to 40x per dollar LP-ed, per day) where it includes:

🔸 @Uniswap V3 (USDf/USDT): ~1.4% APR

🔸 @CurveFinance (USDf/USDC): max. 20.98% APR (w/ boosted $CRV rewards)

🔸 @PancakeSwap V3 (USDf/USDT): ~1.3% APR

🔸@bunni_xyz (USDf/USDT): ~6.88% APR (@aave V3 + staked $USDf yields)

🔸 @Balancer V3 (USDf/aGHO): 9.18-17.41% APR (weekly $GHO & $BAL incentives)

with coverage across major AMMs, capital can be deployed where you hold the most strategic edge.

*Bonus: If you're LP-ing on Uniswap/PancakeSwap, you're cur. eligible for extra ~30% APY in USDf incentives on @Merkle_Trade (only for a limited period)

---

On Transparency & Protocol Credibility

While the stablecoin landscape saw many new entrants w/ innovative yield mechanisms, security & trust here is non-negotiable imo.

Notably, Falcon stands out with its strong emphasis on institutional-grade custody & operational transparency:

a. Off-chain Reserves: Industrial-grade custodial solutions @CeffuGlobal @FireblocksHQ @ChainUpOfficial

b. Operational management: via tier-1 CEX @binance

This foundation is also reinforced with consistent audits & accountability efforts handled by top-tier security firm/independent auditors @zellic_io @pashovkrum @htdgtl.

This is a green flag I look out for when choosing which protocol to entrust my $$$.

----

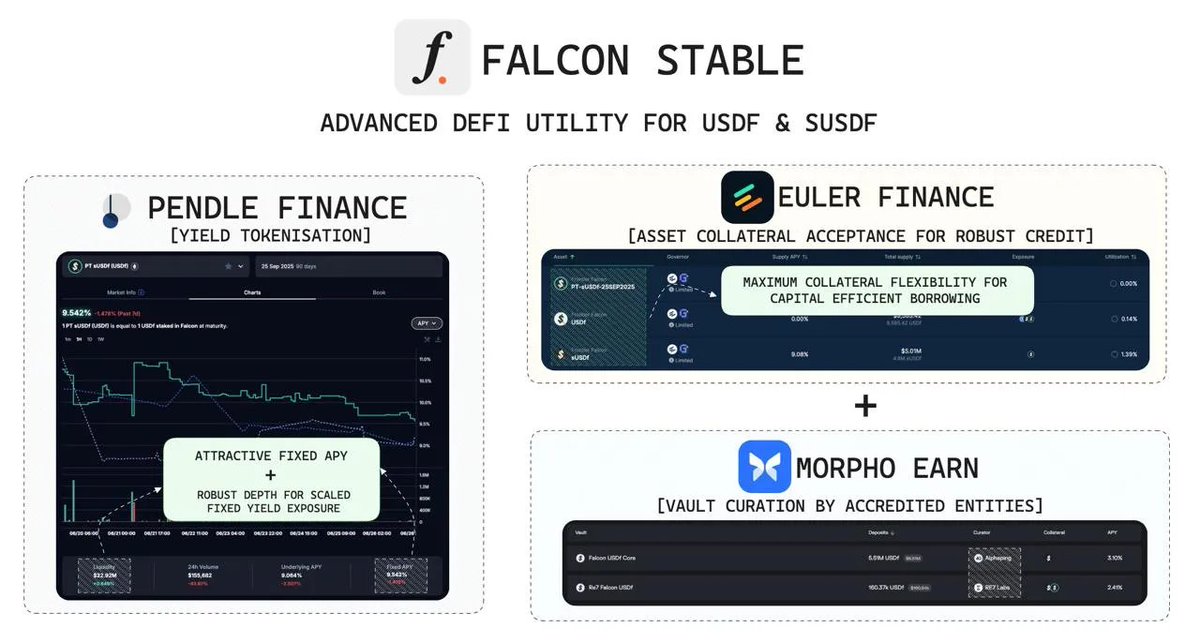

On Expanding DeFi Integrations

The premise of YBS is to enhance itself in DeFi integrations where:

More DeFi Opportunity breath = More utilisation & multi-layered combinations for enhanced productivity.

where emerging advanced DeFi utility for $USDf are already made available:

🔸Yield Tokenisation via @pendle_fi: 9.06% fixed APY on $sUSDf w/ robust $22.1M depth

🔸Lending on @eulerfinance: $USDf $sUSDf & PT-USDf supported as collateral

🔸 Earn on @MorphoLabs: $USDf vaults curated by @0xAlphaping @Re7LabsCurated $USDf vaults via @0xAlphaping & @Re7Labs

these will only expand significantly in time to come as it leverages on its foundational liquidity base.

IMO, its only a matter of time before new, more complex multi-level strategies emerge.

This will further unlocks deeper asset composability + further cementing Falcon's relevance in the evolving YBS landscape.

7.66K

69

TechFlow

By Alex Liu, Foresight News

The Sky ecosystem (formerly MakerDAO) launched Grove Finance, a new decentralized finance protocol, on June 25 and received a $1 billion initial funding grant from the Sky ecosystem to drive investments in tokenized credit assets, primarily collateralized loan vouchers (CLOs).

Grove is incubated by Grove Labs, a division of blockchain institution Steakhouse Financial, and its co-founders include Mark Phillips, Kevin Chan, and Sam Paderewski, among others. The core team has a rich background in traditional finance and DeFi, and has worked for Deloitte, Citigroup, BlockTower, Hildene and other institutions.

Steakhouse Financial has previously played a key role in bringing real-world assets (RWAs) to the Sky ecosystem, so the launch of Grove is seen as another important attempt by Sky to connect more traditional credit markets to DeFi.

Grove's product positioning and technology architecture

Grove is committed to building an "institutional-grade credit infrastructure" that functionally connects decentralized finance with the regulated traditional credit asset market. The protocol allows DeFi projects and asset managers to route idle funds through on-chain governance and invest in credit products that have undergone strict compliance (currently focusing on AAA-rated CLO strategies) to earn yields independent of crypto market volatility.

According to reports, the Sky ecosystem will invest start-up capital in the Anemoy AAA-rated CLO Strategy Fund (JAAA), managed by Janus Henderson (Aberdeen Standard Investments), which was launched in partnership with the Centrifuge platform and is the first AAA-rated CLO strategy to be tradable on-chain.

The Grove Protocol operates in an open-source, non-custodial form, aiming to build a "DeFi-traditional financial capital channel" to improve capital efficiency, reduce transaction friction, and provide programmatic and diversified fund allocation capabilities for asset managers and DeFi protocols. According to official information, Grove can establish new global distribution channels for asset managers, provide high-end on-chain capital partnerships for various protocols/DAOs, and enhance credibility and sustainability for the entire DeFi ecosystem.

In a nutshell, Grove's technology architecture revolves around on-chain governance and automated capital routing, transforming stablecoins or other idle capital held by crypto protocols into institutional-grade credit asset investments to optimize returns and risks.

Similarities and differences between Grove and Spark

The Spark protocol in the Grove ecosystem and the Spark protocol in the Sky ecosystem both belong to the autonomous sub-unit (subDAO, also known as "Star") under MakerDAO's (Sky) "Endgame" transformation plan, but the positioning and mechanism of the two are obviously different.

Launched in 2023, Spark is the first Star in the Sky ecosystem, featuring a revenue engine of "stablecoins + RWAs". Relying on the DAI/USDS stablecoin reserve issued by Sky, Spark has launched products such as SparkLend, Spark Savings and Spark Liquidity Layer (SLL). Users can deposit USDS, USDC, or DAI to participate in lending or farm earnings, and allocate funds to asset pools such as DeFi lending, CeFi lending, and tokenized treasury bonds through the dynamic risk engine, so as to obtain relatively stable income.

Deployed across multiple chains, Spark currently manages more than $3.5 billion in stablecoin liquidity, and has launched its native governance token, SPK (and airdropped to the community), where users can earn additional rewards by staking SPK, participating in governance, and Community Boost. With an emphasis on transparency and auditability, the Spark team targets a slightly higher level of return than U.S. Treasuries to meet the need for risk-adjusted returns

In contrast, Grove is more focused on large amounts of institutional-grade credit. Its first deployment of US$1 billion to connect with Aberdeen's AAA-rated CLO fund demonstrates that Grove is targeting users with larger capital and higher income stability requirements, such as asset managers and DeFi protocols. Grove has just been launched, and it is too early to launch a governance token, and its incentive mechanism is mainly reflected in allowing DeFi projects to "revitalize idle reserves and obtain returns on higher-quality assets".

To put it simply, Spark can be seen as a yield product of the Sky ecosystem for ordinary stablecoin holders, while Grove is an infrastructure protocol that builds on-chain credit channels for large-scale projects and institutions. Both are part of Sky's "Endgame" strategy, which focuses on introducing real assets on-chain: Spark enriches stablecoin yields with RWAs such as treasuries, and Grove enriches DeFi asset allocation with credit assets such as secured loans.

It can be seen that Grove is on the RWA track, focusing on completing the institutional credit puzzle outside the Spark system.

Show original5.91K

0

DAI price performance in USD

The current price of dai-token is $1.0000. Over the last 24 hours, dai-token has increased by +0.04%. It currently has a circulating supply of 35,999,893 DAI and a maximum supply of 35,999,972 DAI, giving it a fully diluted market cap of $36.00M. The dai-token/USD price is updated in real-time.

5m

-0.18%

1h

-0.18%

4h

-0.01%

24h

+0.04%

About Dai Token (DAI)

DAI FAQ

What’s the current price of Dai Token?

The current price of 1 DAI is $1.0000, experiencing a +0.04% change in the past 24 hours.

Can I buy DAI on OKX?

No, currently DAI is unavailable on OKX. To stay updated on when DAI becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of DAI fluctuate?

The price of DAI fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Dai Token worth today?

Currently, one Dai Token is worth $1.0000. For answers and insight into Dai Token's price action, you're in the right place. Explore the latest Dai Token charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Dai Token, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Dai Token have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.