BOME

BOOK OF MEME price

$0.0012660

-$0.00016

(-11.29%)

Price change for the last 24 hours

BOOK OF MEME market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$87.15M

Circulating supply

68,999,659,569 BOME

100.00% of

68,999,659,569 BOME

Market cap ranking

--

Audits

Last audit: Jun 3, 2021, (UTC+8)

24h high

$0.0014290

24h low

$0.0012500

All-time high

$0.012573

-89.94% (-$0.01131)

Last updated: Nov 14, 2024, (UTC+8)

All-time low

$0.00089000

+42.24% (+$0.00037600)

Last updated: Apr 7, 2025, (UTC+8)

How are you feeling about BOME today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

BOOK OF MEME Feed

The following content is sourced from .

TechFlow

Written by ChandlerZ, Foresight News

Recently, Bybit CEO Ben Zhou posted on the X platform, "Byreal, the first on-chain DEX incubated by Bybit, will be launched at the end of this month. Born from scratch in the Solana ecosystem.

It pointed out that what makes Byreal special is that it is 1/ CEX + DEX synergy. Byreal is more than just "another DEX". It combines CEX-grade liquidity with DeFi-native transparency. This is true hybrid finance. More CEX + DEX projects are coming soon in the future. 2/ Uniform fluidity and velocity are designed with RFQ + CLMM routing. Byreal will provide users with low-slippage, MEV-protected swap transactions at supernatural speeds.

According to official information, the Byreal testnet will go live on June 30, and the mainnet is expected to be released in Q3.

Bybit isn't the first centralised exchange to venture into the DEX space. As decentralised exchanges continue to grow, DEXs are gradually narrowing the gap with CEXs in terms of liquidity and user activity.

The DEX market share is rising, and Solana is one of the main choices

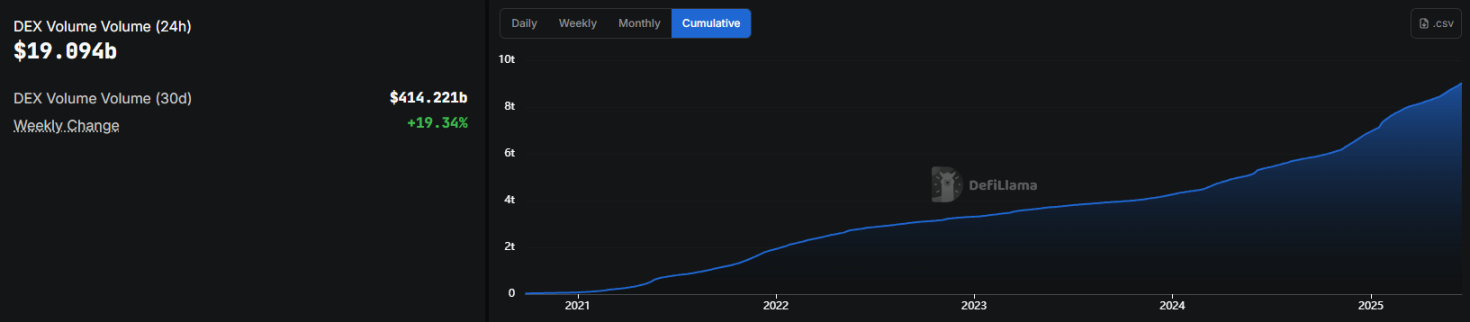

According to DeFiLlama data, the trading volume of DEXs has maintained a steady growth trend. In May 2024, DEX monthly trading volume reached $405.3 billion, accounting for about 25% of the total global spot trade, a record high. At the same time, the total value of the DEX locked exceeded $20 billion.

In terms of blockchain distribution, Ethereum is still the dominant chain, with Solana in second place, with a TVL of about $3.3 billion, of which more than half is occupied by Raydium.

Bybit chose Solana as Byreal's underlying infrastructure based on its significant growth. In 2024, there will be a significant increase in activity on Meme token trading and on-chain token issuance platforms such as Pump.fun, pushing DEXs as the main channel for token IPOs. Mainstream meme assets, including WIF, BOME, BONK, etc., have formed initial liquidity on Solana DEXs such as Raydium and Jupiter, and have been launched on centralised exchanges one after another.

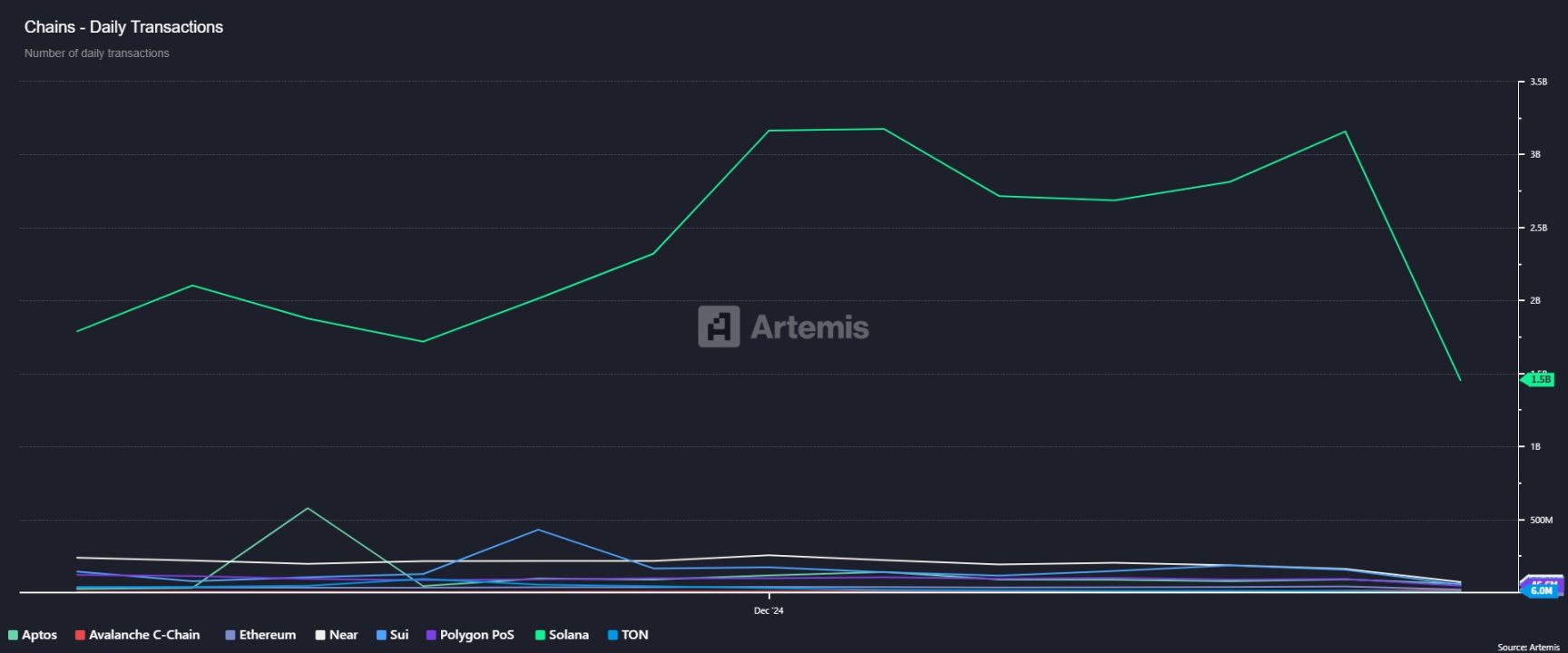

Solana has maintained high activity and developer growth over the past year, becoming one of the fastest-growing blockchains in the DEX ecosystem. Solana's average daily trading volume is stable at around 80 million, with a cumulative transaction of more than 30 billion, ranking among the top public chains. In contrast, Base and Sui have an average daily trading volume of around 7 million and 6 million transactions, respectively, and although they are relatively small, they are growing faster and have a high level of activity.

In terms of daily active address data, Solana averaged more than 4 million daily active addresses, peaking at more than 9.4 million. For CEXs looking to scale on-chain, Solana offers a relatively mature high-performance execution environment and liquidity foundation.

CEX's battle for decentralisation

When choosing on-chain trading products, users usually prioritise familiar platforms and a good user experience. This trend has driven the leading centralised exchanges to deploy decentralised exchange products. There are several precedents for CEXs to enter the decentralised exchange space. Binance's BSC-based PancakeSwap has maintained a leading position in the DEX market for a long time, OKX has launched OKX DEX, and Coinbase has relied on the DEX Aerodrome, which is backed by the Base Chain, with rapid growth in trading volume and market share.

These CEXs gradually gather market liquidity through self-built on-chain platforms or strategic partnerships, covering on-chain and off-chain user groups. At the product level, it is also actively exploring innovative features such as dark pool trading, cross-chain aggregation and hybrid liquidity pools to improve transaction depth and execution efficiency to meet the increasingly diversified market demand.

From a competitive perspective, CEXs still maintain an advantage in terms of overall transaction volume and user size. However, the past CEX liquidity crises and risk events have increased users' attention to trustless, on-chain transparency, and relatively low compliance thresholds, and the competition between the two sides has become increasingly fierce.

Combined with the above data, it can be seen that emerging gameplay is more inclined to DEXs that are convenient and have lower compliance requirements, and traffic also flows to on-chain products earlier, resulting in the embarrassing situation of "not being able to eat meat and drink soup" in some CEXs. In order to seize the opportunity in the on-chain market, CEXs have to speed up their layout to avoid the continuous erosion of market share by DEXs, which will lead to the pressure of shrinking profits.

brief summary

Simon Kim, CEO of crypto venture capital firm Hashed, predicts that DEX trading volume could surpass CEXs by 2028. Combined with CEX's increased investment in DEXs and the current trajectory of the DEX ecosystem, the likelihood of this prediction is increasing.

From the perspective of industry development trends, the form of exchanges in the future may no longer strictly distinguish between centralised and decentralised, and hybrid trading platforms may become a new development direction. At the end of the day, the needs of trading users are still the key factor in the success or failure of the platform. Platforms that can provide stable, secure, and user-friendly products will have a better chance of gaining an advantageous position in the market competition.

Show original

16.09K

0

Faster100x English Officials

🔔 Daily On-Chain Liquidity Analysis 2025.6.17

1. #ETH ⭐⭐⭐⭐⭐

- On-chain activity: 25 million transactions, 790,000 active addresses, and $30 million in gas consumption.

- Capital flow: Net inflow of $330 million, stable cross-chain bridge.

- Sector performance: DeFi TVL at $4.78 billion (+2.0%), high activity in stablecoins, weak meme coins ($40 million).

- Summary: The Iran-Israel conflict continues to depress the market. The demand for DeFi as a safe haven has driven capital inflows, and on-chain activity remains high due to selling pressure.

2. #Solana ⭐⭐⭐⭐

- On-chain activity: 33 million transactions (highest), 1.3 million active addresses.

- Capital flow: Net outflow of 400 million US dollars, flowing to Ethereum and CEX.

- Sector performance: Meme coin trading volume 320 million US dollars (-20%), $BOME, $MEW FOMO sluggish, Raydium TVL +2%.

- Summary: The market crash severely hit the trading volume of Meme coins, the craze stalled, capital outflow was severe, but activity remained high.

3. #Base ⭐⭐⭐

- On-chain activity: 11 million transactions, 530,000 active addresses, TPS 1,600.

- Capital flow: Net outflow of 120 million US dollars, weakening support from the Coinbase ecosystem.

- Sector performance: AI application token trading volume 60 million US dollars (-22%), $KTA and $GRT are relatively resilient, Aerodrome TVL +4%.

- Summary: The market crash has dragged down AI tokens (such as $KTA), DeFi is relatively resilient but capital outflow has intensified, TPS has dropped, and the potential of L2 is suppressed.

4. #BSC ⭐⭐

- On-chain activity: 5 million transactions (-20%), 400,000 active addresses (-15%).

- Capital flow: Net outflow of 350 million US dollars, flowing to Ethereum and CEX.

- Sector performance: Meme coin trading volume 30 million US dollars (-22%), PancakeSwap TVL -13%.

- Summary: USD1 stablecoin supports DEX trading volume (1.6 billion US dollars), the market crash intensifies the double decline in on-chain and capital.

- Community sentiment:

- $BOME and $MEW plummeted, FOMO fizzled out, and Solana's popularity sharply declined.

- Base's $KTA and $GRT were supported by the AI narrative; the community was bullish but sentiment was low.

- Ethereum DeFi saw a surge in risk-averse sentiment, and expectations for ETFs weakened.

- The BSC USD1 stablecoin craze couldn't stop the sell-off, while Solana and Base received some attention.

💥 Mainstream currencies and altcoin market sentiment impact #CryptoVibes

- Bitcoin (BTC): The ongoing Iran-Israel conflict has caused panic, with BTC dropping by 3.5% (to $106,600), absorbing liquidity from Solana ($400 million) and BSC ($350 million), and seeing $330 million flow into Ethereum DeFi as a safe haven.

- Altcoin market: Altcoins fell by over 10% (ETH down 9%, ANIME down 19.5%), with trading volumes shrinking for Solana ($320 million) and Base ($60 million), and selling pressure intensifying (80% of new coins crashing), severely hitting BSC.

- Summary: The BTC crash dominated capital outflows, with the altcoin market dragging down Meme and AI tokens. Selling pressure has depressed on-chain activity, with Ethereum and Base DeFi being the most resilient, while BSC has the weakest liquidity.

Faster100x Community Group:

40.44K

0

zq

to goat to memesai to fartcoin to virtuals to gnon to act to cents to shoggoth to zerebro to ai16z to griffain to pippin to alch to arc to heyanon to fai to limitus trade

sgp

let me guess u missed the pepe to bonk to wif to wynn to usedcar to myro to boden to shark cat to popcat to nub to brett to keyboard cat to apu to slerf to bome to mumu to michi to retardio to giga to sigma to usa to billy to chud to lockin to aura to fwog to luce to moodeng to pnut to chillguy to fartcoin to pengu to trump to melania trade 😭🙏🏼😎

51.3K

22

ali

let me guess u missed the pepe to bonk to wif to wynn to usedcar to myro to boden to shark cat to popcat to nub to brett to keyboard cat to apu to slerf to bome to mumu to michi to retardio to giga to sigma to usa to billy to chud to lockin to aura to fwog to luce to moodeng to pnut to chillguy to fartcoin to pengu to trump to melania trade.

51.16K

85

sgp

let me guess u missed the pepe to bonk to wif to wynn to usedcar to myro to boden to shark cat to popcat to nub to brett to keyboard cat to apu to slerf to bome to mumu to michi to retardio to giga to sigma to usa to billy to chud to lockin to aura to fwog to luce to moodeng to pnut to chillguy to fartcoin to pengu to trump to melania trade 😭🙏🏼😎

138.63K

687

Convert USD to BOME

BOOK OF MEME price performance in USD

The current price of BOOK OF MEME is $0.0012660. Over the last 24 hours, BOOK OF MEME has decreased by -11.28%. It currently has a circulating supply of 68,999,659,569 BOME and a maximum supply of 68,999,659,569 BOME, giving it a fully diluted market cap of $87.15M. At present, BOOK OF MEME holds the 0 position in market cap rankings. The BOOK OF MEME/USD price is updated in real-time.

Today

-$0.00016

-11.29%

7 days

-$0.00035

-21.66%

30 days

-$0.00117

-47.97%

3 months

-$0.00030

-19.01%

Popular BOOK OF MEME conversions

Last updated: 06/23/2025, 01:07

| 1 BOME to USD | $0.0012630 |

| 1 BOME to PHP | ₱0.072208 |

| 1 BOME to EUR | €0.0010959 |

| 1 BOME to IDR | Rp 20.7355 |

| 1 BOME to GBP | £0.00093861 |

| 1 BOME to CAD | $0.0017344 |

| 1 BOME to AED | AED 0.0046384 |

| 1 BOME to VND | ₫33.0024 |

BOOK OF MEME FAQ

How much is 1 BOOK OF MEME worth today?

Currently, one BOOK OF MEME is worth $0.0012660. For answers and insight into BOOK OF MEME's price action, you're in the right place. Explore the latest BOOK OF MEME charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as BOOK OF MEME, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as BOOK OF MEME have been created as well.

Will the price of BOOK OF MEME go up today?

Check out our BOOK OF MEME price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Convert USD to BOME