This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

AAVE

Aave Token price

0x6370...814b

$319.88

-$4.0820

(-1.26%)

Price change for the last 24 hours

How are you feeling about AAVE today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

AAVE market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$9.54M

Network

Base

Circulating supply

29,814 AAVE

Token holders

83348

Liquidity

$13.01M

1h volume

$12.65K

4h volume

$278.37K

24h volume

$3.62M

Aave Token Feed

The following content is sourced from .

The Learning Pill 💊

TL;DR - it's a promising horizon for @pendle_fi

• Pendle's PT collateral has crossed $2.7B in TVL across DeFi

• Building towards cross-chain PTs (opening avenues for more

collateralisation and yield options for users + project bootstrapping

• TradFi will also get a taste of Pendle's product suite via "Pende Permissioned"

• Pendle LPs are now used as collateral, crossing the $50M mark across protocols like @maplefinance , @MorphoLabs , and @SiloFinance

• @boros_fi incoming - funding rates will be tradable (huge TAM)

in the midst of all the macro news, @pendle_fi stats have been improving (capital retention rate), gaining confidence from institutions and capital allocators, deploying new and renewing pools

one of the best stablecoin + DeFi plays right here

nfaaaaa

TN | Pendle

The Pencosystem continues to expand at a remarkable pace. What began as a niche protocol for yield tokenization is now evolving into a foundational layer of DeFi. Today, Pendle assets are increasingly recognized as reliable, yield-generating instruments, and are now accepted as collateral across some of the most prominent money markets in the space, including Aave, Morpho, Euler, and others.

Looking ahead, here are some of the exciting developments we have on the Horizon.

Fixed Yield for All: From Cross-Chain to Cross-Sector

Pendle's ecosystem continues to scale meaningfully. PT adoption as collateral now exceeds $2.7B across DeFi, with Aave alone contributing over $2.1B of that value, with proposals already in motion to onboard more Pendle assets. Demand for PT in the space is clear.

In Pendle 2025: Zenith, we shared that one of the Citadels would focus on expanding beyond EVM-compatible chains. Since then, our vision has broadened. Rather than limiting ourselves to non-EVM infrastructure, we’re now building toward cross-chain PTs. Portable, composable fixed yield assets that can be moved and utilized seamlessly across ecosystems. This unlocks a new design space: bridged PTs that can be used as collateral, yield farming tools, or capital-efficient building blocks across multiple chains.

The first wave of this initiative will focus on cross-chain expansion into EVM-compatible networks and then non-EVMs shortly after, all without requiring full Pendle deployment on each target chain.

But the appetite for fixed yield extends well beyond crypto’s borders.

PT for TradFi

In traditional finance, predictability is power. Institutions from pension funds to endowments rely on stable, recurring returns to meet obligations, optimize tax outcomes, and plan long-term portfolios. This is why fixed income dominates TradFi, with over $130 trillion in market size across instruments like treasuries, corporate bonds, and structured notes.

DeFi hasn’t historically catered to this need, at least not until recently.

Pendle's second Citadel addresses this gap. Our objective here is to create a dedicated PT distribution pipeline for regulated entities, that is a permissioned environment that gives TradFi allocators direct access to best-in-class, crypto-native fixed yields. Together with our DeFi partners, the “Pendle Permissioned” layer will operate with full KYC/AML compliance and serve as a gateway for institutional-grade capital to flow into DeFi yields.

Pendle LP as Collateral

Just last week, Morpho officially enabled the use of selected Pendle LPs as collateral. Curators like MEV Capital and K3 Capital have already stepped in, helping to bootstrap stablecoin liquidity for these new markets through their vaults.

In just one week, Pendle LPs have already amassed ~$57M in collateral across Syrup, Morpho and Silo. While that figure may still trail PTs, the significance goes beyond raw numbers. LP collateral opens up a new segment of users with a different risk profile from your regular fixed yield connoisseur, expanding Pendle’s reach into a broader, more dynamic user base.

From a user’s perspective, using LP as collateral enables access to leverage, boosting both yield and point farming potential without needing to deploy significantly more capital. For many who find YT exposure too risky, LP positions present a more balanced alternative with reasonable capital protection that still offers upside, but with comparatively lower risk. With looping now enabled, this has just become a much more powerful weapon in the hands of your average user.

The introduction of LP collateral also contributes meaningfully to the depth of usable liquidity on the Pendle AMM. This, in turn, enhances swap efficiency and reduces slippage – both critical factors in enabling smooth and scalable PT trades. As liquidity improves, larger trades can be facilitated, and protocol volume increases – all these improvements collectively establish a more robust foundation for the onboarding of institutional capital as mentioned above.

While PTs remain the instrument of choice for institutions and large capital allocators focused on capital preservation, LPs are emerging as a complementary offering geared toward a broader user base. Their accessibility and performance potential make them particularly well-suited for your average user.

With regulatory developments trending in a positive direction (in particular, the US), the timing has never been better for DeFi to bridge into the broader financial world. There’s still plenty of work ahead, but the pieces are coming together.

Job’s not done, but it'll be.

1.53K

8

Hên Vãi

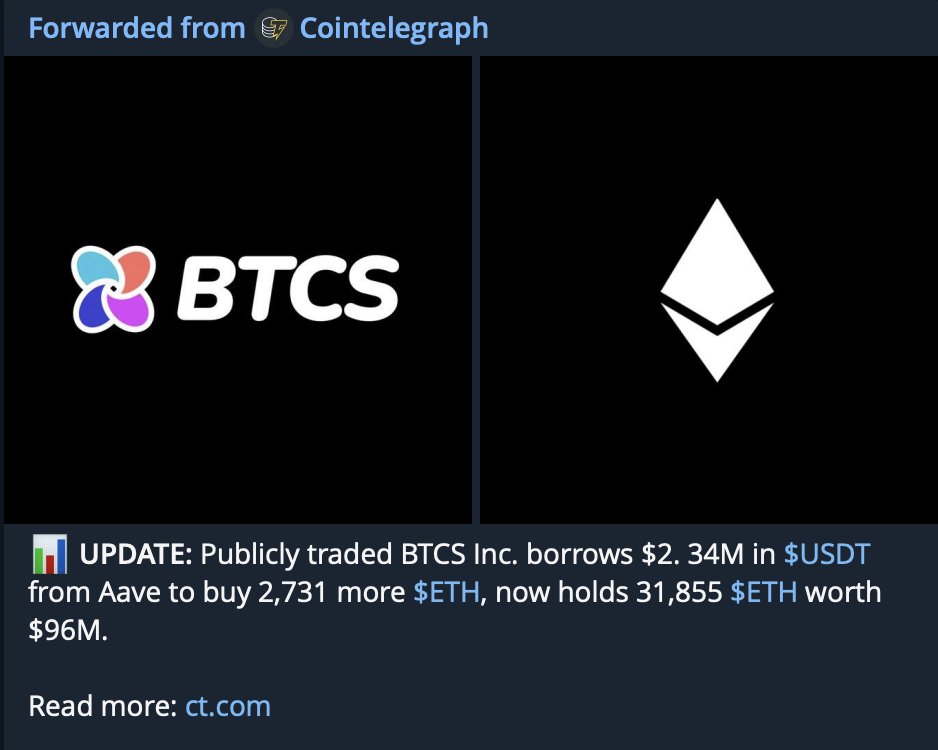

🔥 Top 10 Lending Projects by Highest Earnings (30d) 🔥

1. Aave (@aave ): $12.3M (+45.6%)

2. Compound (@CompoundFinance): $9.8M (+32.1%)

3. Maker (): $7.5M (+18.9%)

4. Venus (@VenusProtocol): $6.2M (+25.4%)

5. JustLend (@DeFi_JUST ): $5.1M (+15.7%)

6. Radiant Capital (@RDNTCapital ): $4.8M (+9.3%)

7. Benqi (@BenqiFinance): $4.0M (-5.2%)

8. Cream Finance (@CreamdotFinance ): $3.7M (+11.8%)

9. Alchemix (@AlchemixFi ): $3.2M (+7.6%)

10. Euler Finance (@eulerfinance ): $2.9M (+3.1%)

#Crypto #DeFi #Lending #Earnings

Source: @tokenterminal

1.68K

1

Pendle Intern

Extracting the juiciest points for your TLDR needs:

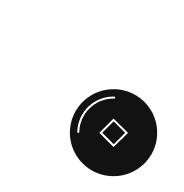

1. PT as collateral totaling $2.7B now, with over $2.1B on @Aave (and they just introduced a new PT-sUSDe Sep 2025 market too)

2. Citadel for non-EVM PT is now “cross-chain PT” targeting both EVMs and non-EVMs, allowing these fixed yield money legos to be deployed elsewhere - with or without the presence of Pendle in that ecosystem

3. Pendle Permissioned getting cooked to onboard KYCed clients

4. LP as collateral off to a quick start at $58M after just one week, allowing different use case from PT collateral that since it maintains points/airdrop upside. More money market support soon

TN | Pendle

The Pencosystem continues to expand at a remarkable pace. What began as a niche protocol for yield tokenization is now evolving into a foundational layer of DeFi. Today, Pendle assets are increasingly recognized as reliable, yield-generating instruments, and are now accepted as collateral across some of the most prominent money markets in the space, including Aave, Morpho, Euler, and others.

Looking ahead, here are some of the exciting developments we have on the Horizon.

Fixed Yield for All: From Cross-Chain to Cross-Sector

Pendle's ecosystem continues to scale meaningfully. PT adoption as collateral now exceeds $2.7B across DeFi, with Aave alone contributing over $2.1B of that value, with proposals already in motion to onboard more Pendle assets. Demand for PT in the space is clear.

In Pendle 2025: Zenith, we shared that one of the Citadels would focus on expanding beyond EVM-compatible chains. Since then, our vision has broadened. Rather than limiting ourselves to non-EVM infrastructure, we’re now building toward cross-chain PTs. Portable, composable fixed yield assets that can be moved and utilized seamlessly across ecosystems. This unlocks a new design space: bridged PTs that can be used as collateral, yield farming tools, or capital-efficient building blocks across multiple chains.

The first wave of this initiative will focus on cross-chain expansion into EVM-compatible networks and then non-EVMs shortly after, all without requiring full Pendle deployment on each target chain.

But the appetite for fixed yield extends well beyond crypto’s borders.

PT for TradFi

In traditional finance, predictability is power. Institutions from pension funds to endowments rely on stable, recurring returns to meet obligations, optimize tax outcomes, and plan long-term portfolios. This is why fixed income dominates TradFi, with over $130 trillion in market size across instruments like treasuries, corporate bonds, and structured notes.

DeFi hasn’t historically catered to this need, at least not until recently.

Pendle's second Citadel addresses this gap. Our objective here is to create a dedicated PT distribution pipeline for regulated entities, that is a permissioned environment that gives TradFi allocators direct access to best-in-class, crypto-native fixed yields. Together with our DeFi partners, the “Pendle Permissioned” layer will operate with full KYC/AML compliance and serve as a gateway for institutional-grade capital to flow into DeFi yields.

Pendle LP as Collateral

Just last week, Morpho officially enabled the use of selected Pendle LPs as collateral. Curators like MEV Capital and K3 Capital have already stepped in, helping to bootstrap stablecoin liquidity for these new markets through their vaults.

In just one week, Pendle LPs have already amassed ~$57M in collateral across Syrup, Morpho and Silo. While that figure may still trail PTs, the significance goes beyond raw numbers. LP collateral opens up a new segment of users with a different risk profile from your regular fixed yield connoisseur, expanding Pendle’s reach into a broader, more dynamic user base.

From a user’s perspective, using LP as collateral enables access to leverage, boosting both yield and point farming potential without needing to deploy significantly more capital. For many who find YT exposure too risky, LP positions present a more balanced alternative with reasonable capital protection that still offers upside, but with comparatively lower risk. With looping now enabled, this has just become a much more powerful weapon in the hands of your average user.

The introduction of LP collateral also contributes meaningfully to the depth of usable liquidity on the Pendle AMM. This, in turn, enhances swap efficiency and reduces slippage – both critical factors in enabling smooth and scalable PT trades. As liquidity improves, larger trades can be facilitated, and protocol volume increases – all these improvements collectively establish a more robust foundation for the onboarding of institutional capital as mentioned above.

While PTs remain the instrument of choice for institutions and large capital allocators focused on capital preservation, LPs are emerging as a complementary offering geared toward a broader user base. Their accessibility and performance potential make them particularly well-suited for your average user.

With regulatory developments trending in a positive direction (in particular, the US), the timing has never been better for DeFi to bridge into the broader financial world. There’s still plenty of work ahead, but the pieces are coming together.

Job’s not done, but it'll be.

5.91K

22

AAVE price performance in USD

The current price of aave-token is $319.88. Over the last 24 hours, aave-token has decreased by -1.26%. It currently has a circulating supply of 29,814 AAVE and a maximum supply of 29,814 AAVE, giving it a fully diluted market cap of $9.54M. The aave-token/USD price is updated in real-time.

5m

+0.29%

1h

+0.73%

4h

-2.01%

24h

-1.26%

About Aave Token (AAVE)

AAVE FAQ

What’s the current price of Aave Token?

The current price of 1 AAVE is $319.88, experiencing a -1.26% change in the past 24 hours.

Can I buy AAVE on OKX?

No, currently AAVE is unavailable on OKX. To stay updated on when AAVE becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of AAVE fluctuate?

The price of AAVE fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Aave Token worth today?

Currently, one Aave Token is worth $319.88. For answers and insight into Aave Token's price action, you're in the right place. Explore the latest Aave Token charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Aave Token, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Aave Token have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.