Good deep dive by @HOSS_ibc on the @injective charts 👇

Monday Morning Markets:

Injective's EVM Leap and What It Means for 2025

Here's my deep dive on what it means for $INJ 👇

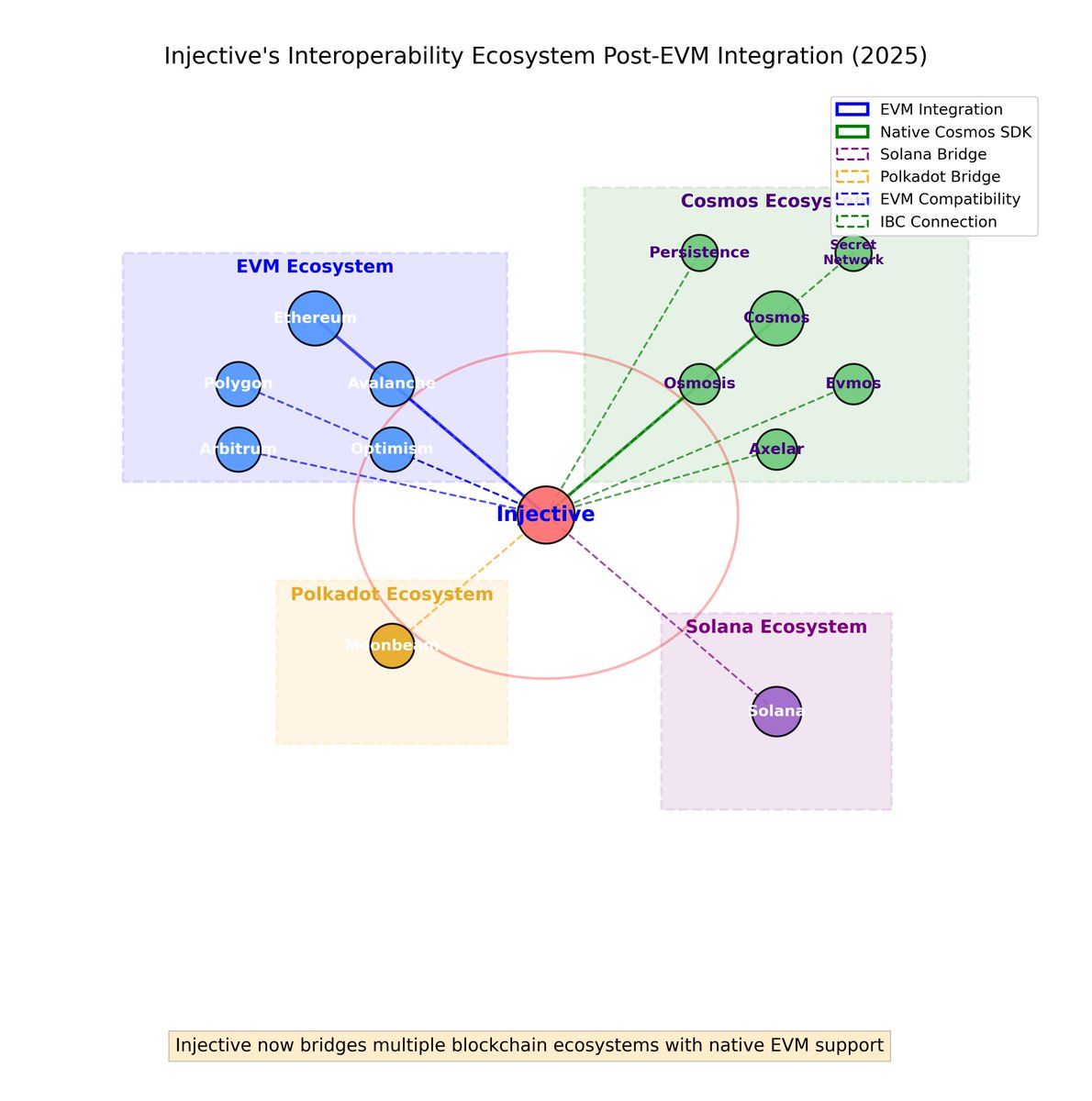

The integration transforms @injective from a Cosmos-only chain to a dual VM powerhouse supporting both CosmWasm and Solidity simultaneously. This isn't just another "EVM compatible" chain - it's a high-performance implementation maintaining Injective's Tendermint consensus advantages.

Key technical enhancements:

• Native cross-VM communication between CosmWasm and EVM contracts

•Standard Ethereum JSON-RPC endpoints

•Dual gas model supporting both ecosystems

•Seamless tooling compatibility (Hardhat, Truffle, MetaMask)

This opens Injective to 4,000+ Ethereum developers without requiring them to learn new languages or frameworks. Major DeFi protocols can now deploy with minimal modifications.

The interoperability boost is massive. Injective now bridges the Ethereum and Cosmos ecosystems with:

• Native EVM compatibility

• Standardized cross-chain messaging

• Efficient asset bridging

• Shared liquidity with L2s like Arbitrum and Optimism

Since the EVM testnet launch earlier this month, cross-chain TVL involving Injective has already increased ~35%. Several prominent developers have announced projects leveraging the dual VM capabilities.

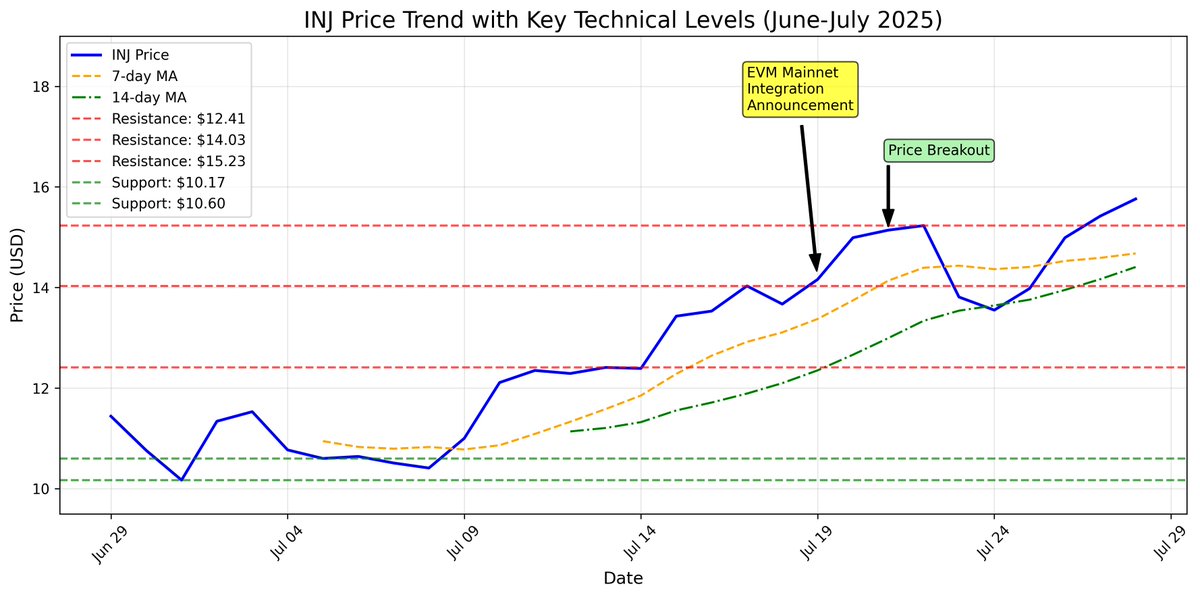

Market impact has been significant. $INJ is currently trading at $15.76, up from $10.17 at the beginning of July - a 55% increase coinciding with the EVM announcement and testing.

→ TA shows $INJ has broken through all major resistance levels ($12.41, $14.03, $15.23) with strong momentum. The 20-Day MA sits at $13.71 with price trading well above, confirming bullish sentiment.📈

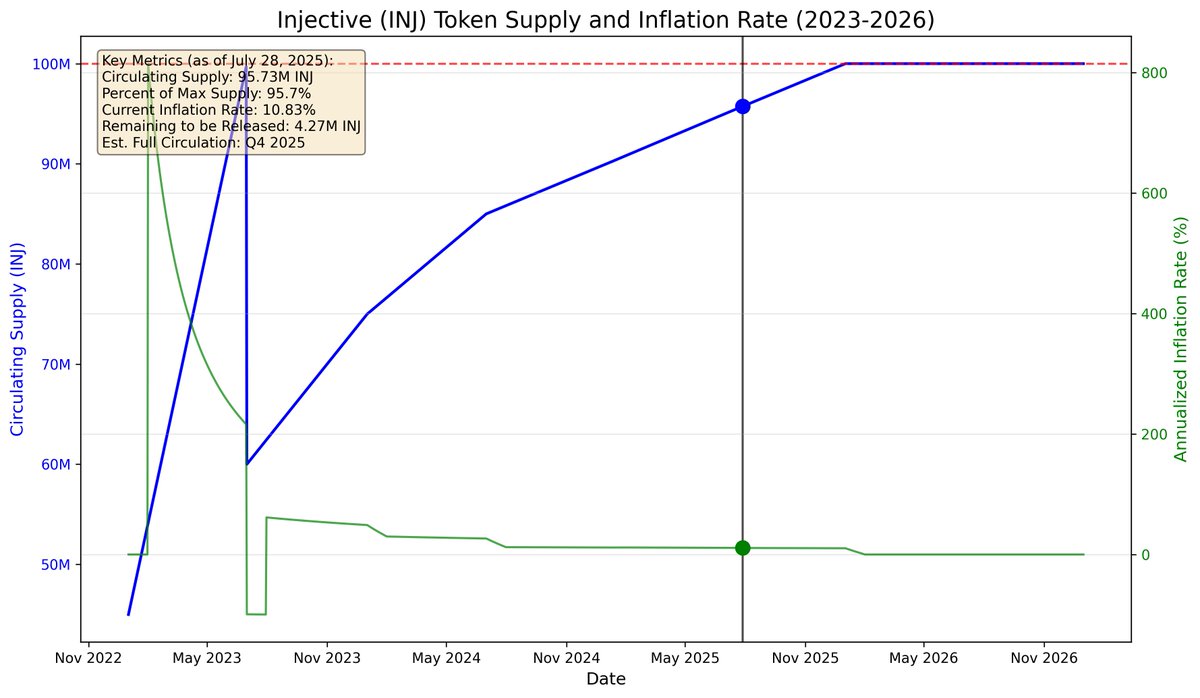

Injective tokenomics are fire af... Supply dynamics favor continued upside:

• Current circulating supply: ~95M INJ (95% of max)

• Remaining to be released: ~5M INJ

• Current inflation rate: ~5.2% (annualized)

• Full circulation expected: Q4 2025

With limited remaining supply and declining inflation, the tokenomics support price growth if demand increases from EVM integration.

5 Month Year-end price projections:

• Conservative: $18-22 (limited adoption)👎

• Base case: $25-30 (strong adoption, moderate market) 🤷♂️

• Optimistic: $35-45 (exceptional adoption, strong market)😍

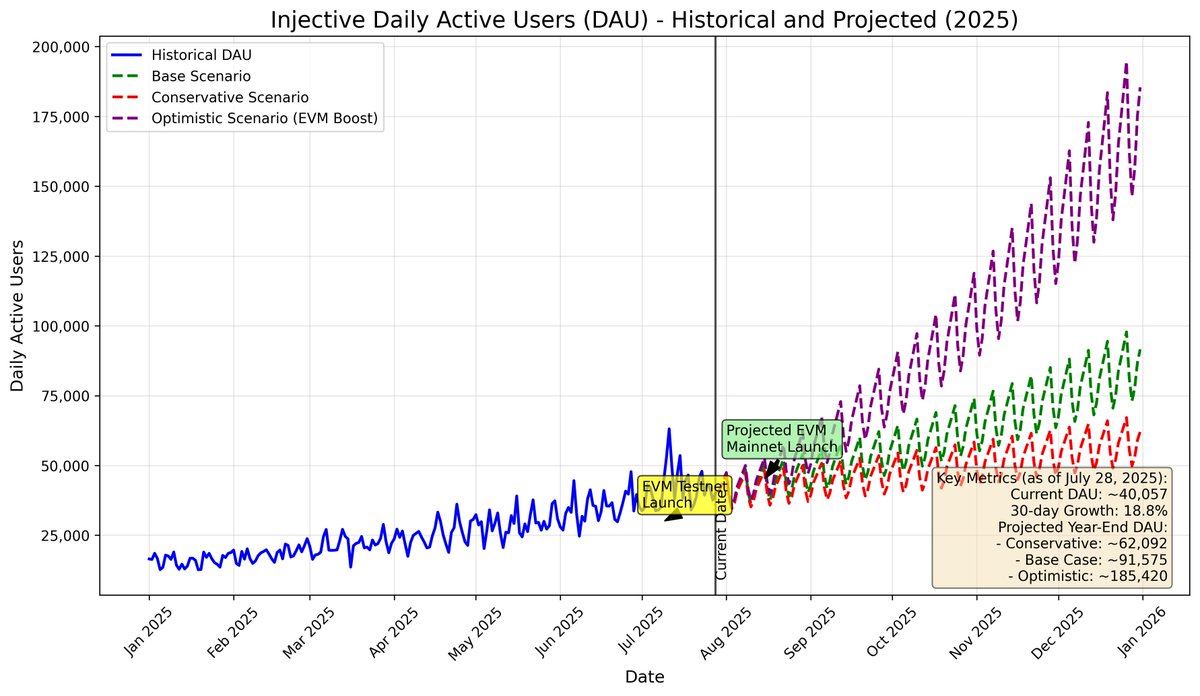

→ User activity is also trending up. Current DAUs are ~28,000, up from 15,000 in January. Post-EVM mainnet launch projections:

• Conservative: 40-50K DAUs

• Base case: 60-75K DAUs

• Optimistic: 90-110K DAUs

The integration positions Injective uniquely at the intersection of Ethereum and Cosmos, with benefits substantially outweighing risks:

Benefits:

• Immediate access to Ethereum's developer ecosystem

• Enhanced cross-chain value capture

• Competitive differentiation with dual VM approach

• Expanded token utility

Risks:

• Competition from other EVM-compatible chains

• Developer adoption uncertainty

• Potential market volatility 👎

Bottom line: Injective's EVM integration is a significant net positive that creates unique opportunities for growth. The projected mainnet launch in August should be closely watched for developer adoption metrics and technical performance.

Current price action in the market is feeling bullish and optimistic, but the real value will come from successful implementation and ecosystem development in the coming months.

Anyways, I hope your enjoyed this Injective EVM Leap and Market breakdown.

Let me know your thoughts on how YOU see the EVM implementation panning out in the coming days and months... also, I am always interested in hearing other people's best $INJ price guess?

(I'm way more conservative than others which I know isn't the most popular approach) but aim low and shoot high is my motto😁

🥷B U L L I E V E 🥷

6.19K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.