Three Ways to Value Layer-1 According to Messario

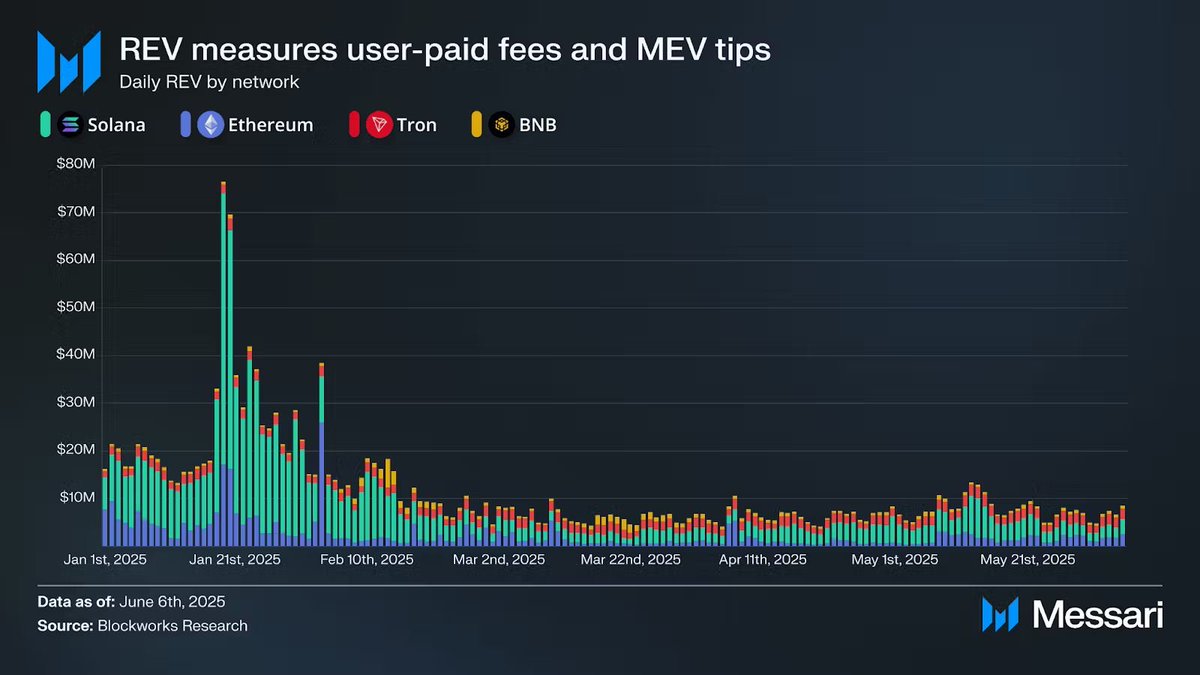

1. Real Economic Value Model (REV)

REV = Total transaction fees + MEV tips (i.e., network cash flow).

This is a quantitative valuation method, similar to traditional business valuation models based on expected income.

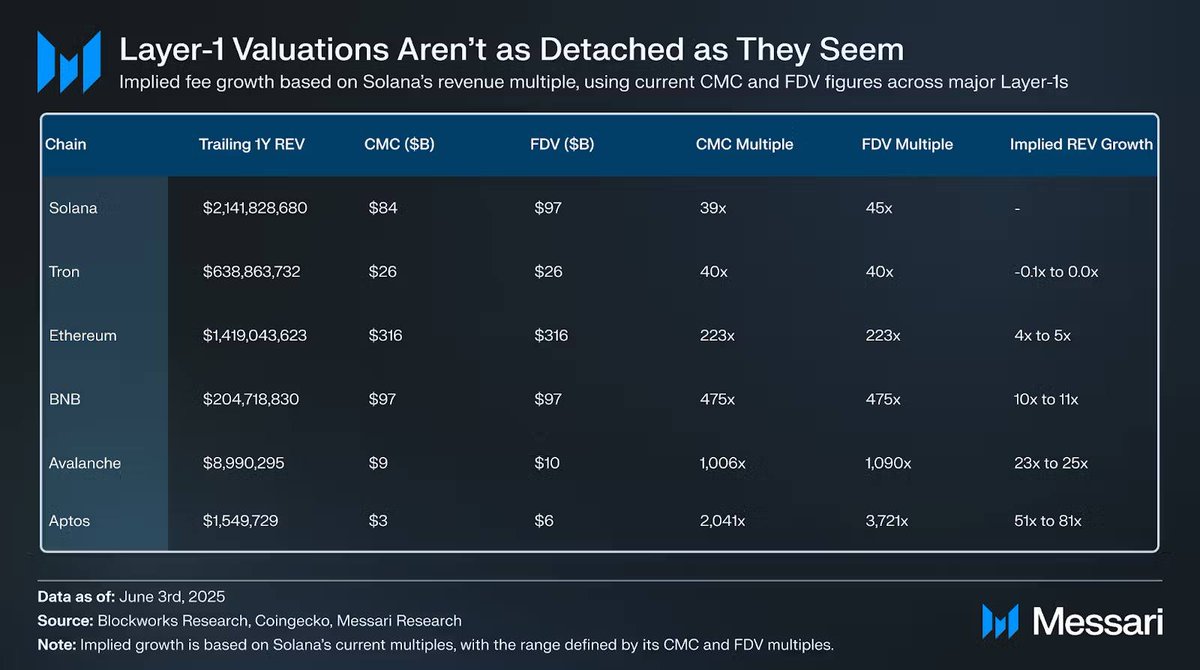

For example: Solana and Tron are currently trading at around ~40–45 times cumulative revenue — equivalent to high-growth tech stocks (Tesla's projected P/E is about ~160x).

Recently, these metrics have declined mainly due to reduced demand for non-financial transactions (such as inscriptions, runes).

2. Currency Value Proposition

L1 tokens can accumulate value beyond their utility if they achieve the role of a monetary asset (store of value, medium of exchange).

Bitcoin is the clearest example: limited on-chain utility, yet it dominates valuation because it is seen as a global monetary asset.

ETH and some alt-L1s like Solana are emerging as potential candidates for this role.

Currency fees allow tokens to achieve much higher valuations compared to revenue metrics.

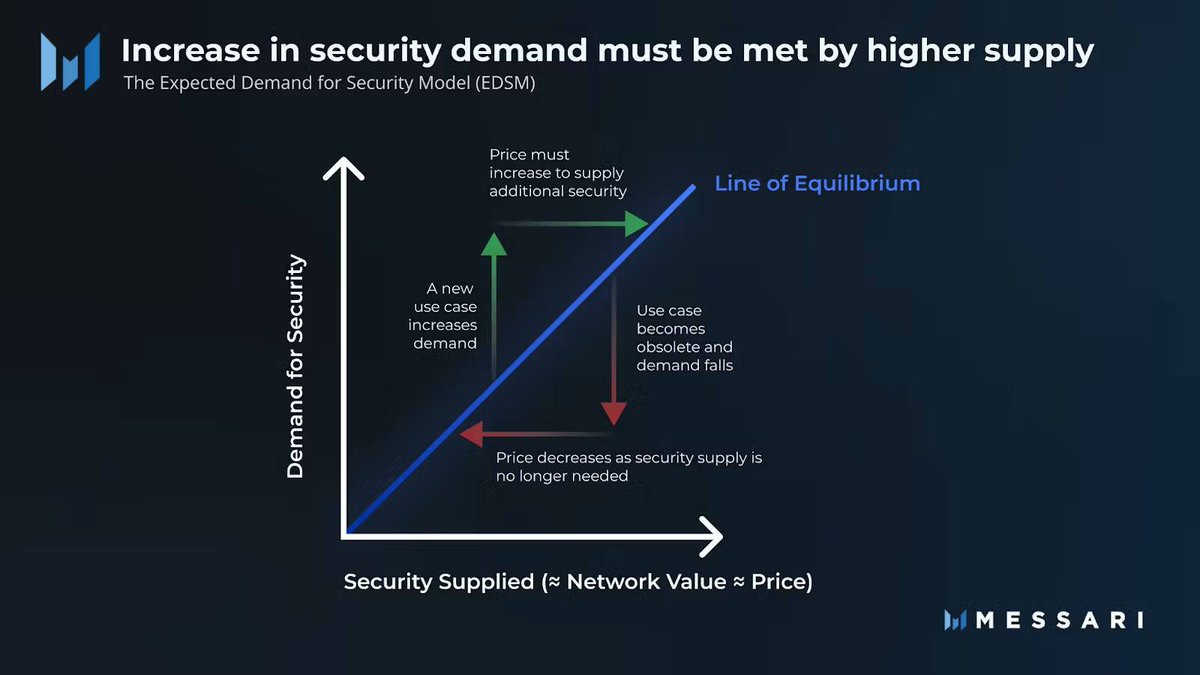

3. Network Security Demand

The value of a token reflects the demand for security across the entire ecosystem – including applications, assets, and on-chain infrastructure.

As the network expands, the token price needs to increase to ensure an appropriate level of security — creating a self-reinforcing cycle.

This emphasizes the crucial role of attracting developers, applications, and users to increase security demand.

This is often seen as a "valuation floor" — a foundational layer, rather than a growth-driving factor.

Important Note

These three valuation frameworks are not mutually exclusive – they often overlap.

REV serves as the foundational layer, while currency fees and security demand are the value-added layers above.

Market valuation is often a mix: traditional investors focus on revenue, others pay attention to security, while much of the market values based on expectations of future monetary roles.

In reality, much of the current valuation of L1 comes from the belief that the token will achieve a monetary premium, rather than near-term revenue or simple security demand.

Illustrating Ethereum's Potential for 10x Growth

REV: Generating cash flow surpassing many major global tech corporations (Mag 7).

Currency Fees: Competing with Bitcoin's monetary role.

Network Security: Protecting a larger economic value volume than tech corporations or gold.

#research

Show original

8.21K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.