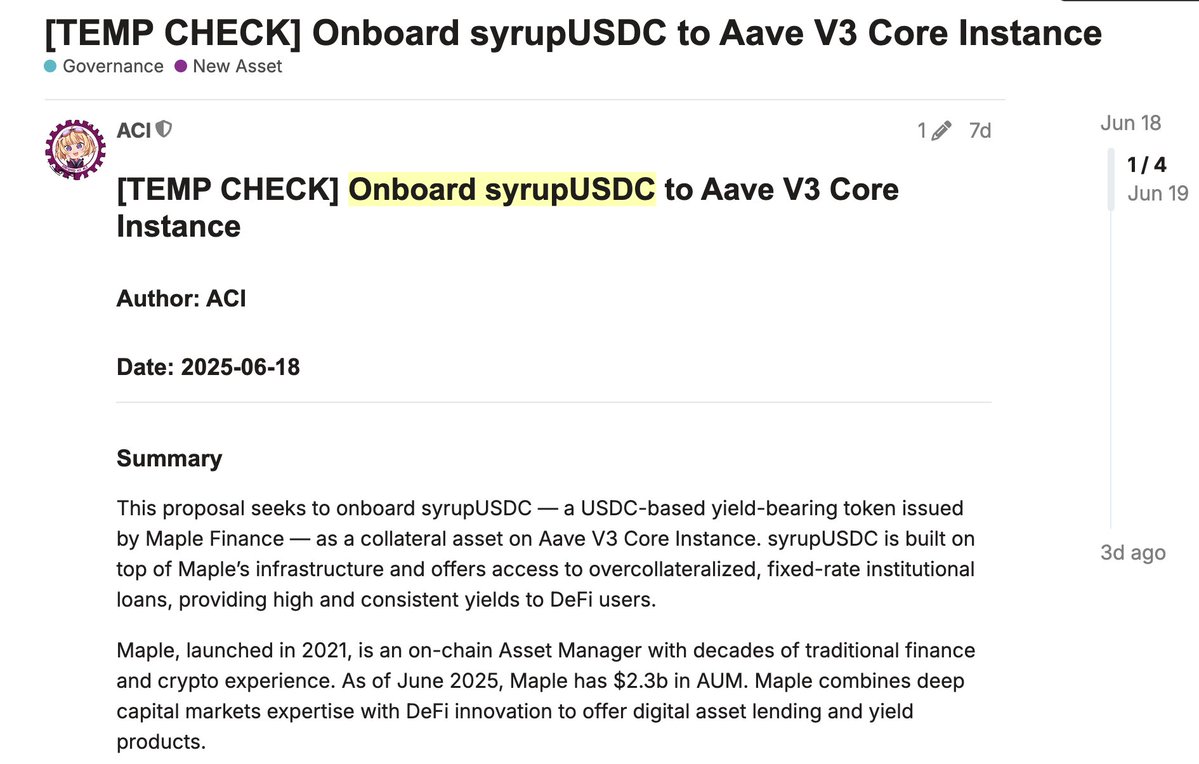

. @maplefinance's syrupUSDC has proposed to go live on Aave V3, and currently, the underlying yield of syrupUSDC is 8%-10%. The Lego strategies brought by going live on Aave will visibly increase, and there are some hidden details in this proposal:

(1) Maple can help Aave promote the adoption of GHO, for example, by providing GHO loans to institutions.

(2) In the future, Aave may fully support Maple-related assets, such as Maple BTC.

In addition to normal product iterations, the adoption of Aave GHO has always been a strategic priority. Even after the stablecoin bill, the market generally believes that the development of decentralized stablecoins will be restricted. However, Aave has not given up on the stablecoin business. Firstly, the formal implementation of the bill will take a considerable amount of time. Secondly, from a product perspective, there are still countless ways to circumvent regulation. The stablecoin market is too large for anyone to easily exit.

9.61K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.