Aave Is Preparing to Enter the Bitcoin Ecosystem

In my opinion, Aave DAO is the most well-run and forward-thinking DAO in all of Web3 and DeFi. When Aave deploys on a new network, it's not just a technical decision—it’s a strategic signal that the ecosystem has been validated for security, economic viability, and long-term growth potential.

So far, @aave has not launched on any Bitcoin Layer 2. But that may soon change.

Recent Proposal: Aave x BOB

Just a few days ago, the BOB team submitted three new proposals on the Aave governance forum, suggesting the addition of:

- openUSDT

- xSolvBTC

- SolvBTC

These proposals are still in the early stages—just discussion posts, not formal votes—but they’re a meaningful signal. And to fully appreciate their weight, it’s worth revisiting the background.

Aave’s Initial Review of BOB (January 2025)

In January 2025, BOB formally applied for Aave deployment. The ecosystem received broad support:

- @wintermute_t and @KeyrockTrading , few of the largest Web3 market makers, endorsed the proposal.

- @chaos_labs conducted an in-depth economic analysis and recommended onboarding assets like LBTC, tBTC, and WBTC.

- @LlamaRisk, a respected risk evaluation group working with major stablecoin-related companies, also gave a green light.

Despite this strong support, two key issues held the proposal back:

1. Lack of Chainlink Feed integration

2. Low stablecoin TVL on the BOB network

These were seen as critical infrastructure gaps that needed to be addressed before full Aave deployment could proceed.

BOB’s Progress Since Then

Fast forward to today—and it appears @build_on_bob has taken concrete steps to resolve both concerns:

Chainlink Oracle Integration:

BOB has been actively deepening its partnership with Chainlink. Their blog and updates suggest that Chainlink feeds are either already integrated or close to being deployed—clearing a major hurdle for Aave compatibility.

Stablecoin TVL Expansion:

The inclusion of @OpenUSDT (oUSDT) in the latest proposal is especially notable. This is the official stablecoin of Optimism’s Superchain, which BOB is integrating early. As one of the first networks to adopt oUSDT, BOB positions itself as a key player in the Superchain ecosystem—opening the door to rapid growth in stablecoin liquidity.

Why BOB Could Be Aave’s First BTC L2

Given its infrastructure improvements and maturing DeFi ecosystem, BOB is a natural candidate to become Aave’s first deployment in the Bitcoin ecosystem. No other BTC L2 currently offers the same combination of:

- Robust DeFi primitives

- Active protocol integrations

- Good TVL and user activity

As I said earlier, BOB has the best DeFi ecosystem among BTC L2 at the current moment

If Aave officially deploys on BOB, the implications are massive:

1. Validation of Bitcoin L2s as serious contenders in DeFi

2. A likely wave of capital inflows from LPs and borrowers

3. A signal to other protocols and builders that BTCfi and BTC L2 are ready for adoption

This could be the inflection point the BTC eco has been waiting for.

Conclusion

All signs suggest that Aave on BOB is no longer a matter of "if," but "when." The necessary groundwork is being laid, the proposals are on the table, and the ecosystem is ready.

When this goes live, it won’t just be a big win for BOB—it’ll mark a breakthrough moment for the entire BTC L2 and BTCfi movements.

Now, we wait.

P.S. Stani is angel investor of BOB

===================================

If you liked the research, plz like/retweet and follow to @Eugene_Bulltime

And follow on strong visioners and analysts:

@0xBreadguy

@poopmandefi

@TheDeFISaint

@DoggfatherCrew

@0xSalazar

@DefiIgnas

@Defi_Warhol

@Moomsxxx

@hmalviya9

@Mars_DeFi

@eli5_defi

@JayLovesPotato

@Steve_4P

@TheDeFinvestor

@0xAndrewMoh

@0xCheeezzyyyy

@0xKaveh

@arndxt_xo

@tervelix @StaniKulechov @alexeiZamyatin you can read this here

How will BOB’s innovations strengthen Bitcoin and bring unity to the crypto industry?

The Bitcoin ecosystem is currently experiencing a notable boom, with developers and investors actively participating and gradually attracting more users. There are now above 80 L2s are building on Bitcoin, and their numbers are growing rapidly.

However, these solutions have yet to address the primary challenge: creating a reliable bridge. Currently, most L2s rely on simple multisig setups, which do not guarantee security in case of collusion. This is the key issue that many L2 teams are focused on solving.

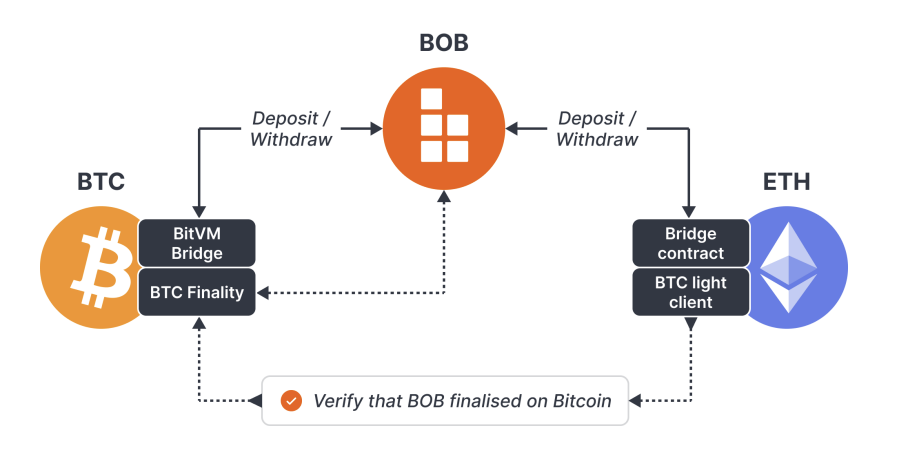

One promising solution is being developed by the @build_on_bob or just BOB team. They describe themselves as the first hybrid rollup, leveraging both the Bitcoin and Ethereum networks. Here’s how it works:

BOB’s architecture comprises three key technical components:

- A bridge based on BitVM

- Transaction settlement on the Bitcoin blockchain

- A native bridge based on Optimism

The workflow next:

1. Users submit transactions on the BOB network.

2. The BOB sequencer bundles these transactions and sends them to the Bitcoin network via BitVM.

3. BitVM verifies the bundle and records the proof on the Bitcoin network. (Detail about BitVM is here:

4. On Ethereum, the native bridge (smart contract) verifies that the bundle has been finalized on Bitcoin. This is enabled by Simplified Payment Verification (SPV), allowing external verification of the payment.

BOB effectively integrates two bridges—one on Bitcoin and one on Ethereum—allowing both BTC and ETH to be deposited into the BOB network. The BitVM2 bridge to Bitcoin has an additional, critical role in this rollup, finalizing transactions on the Bitcoin network.

Why use such a complex structure instead of a simple BitVM bridge?

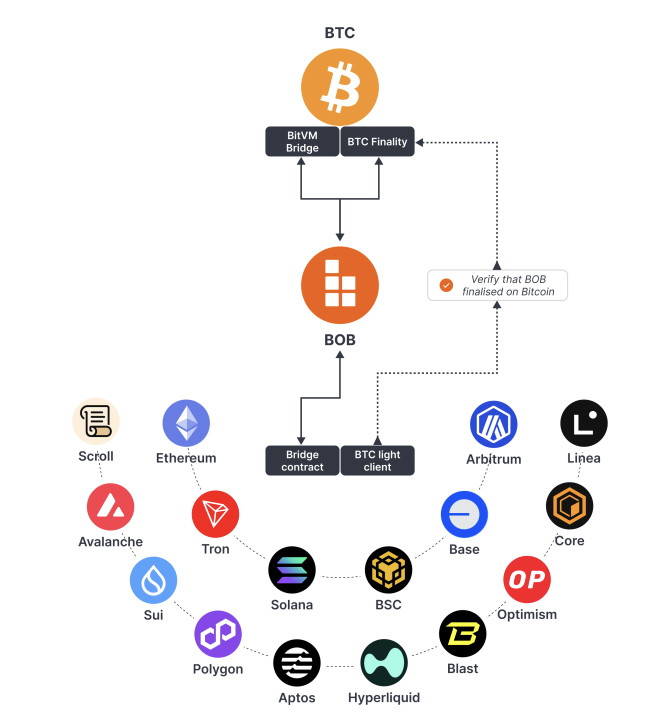

This architecture enables connections to any L2/L1 network, with finalization occurring on Bitcoin. For example, BOB could support native bridges for networks like Solana, Aptos, Sui, TON, and more.

Ultimately, BOB could act as an L2 for all L1 networks, with Bitcoin’s highly secure blockchain finalizing all transactions. SPV functionality further allows each network’s bridge to verify that transactions on BOB are executed accurately and securely.

This approach positions BOB as a potential liquidity hub for the entire DeFi sector, through which significant transaction flows could pass. I’d call this architecture an “umbrella” model.

Investors (such as Coinbase, CMS, IOSG, Mechanism, and others) see the potential here. Also, just yesterday, it was announced that BOB will join the Optimism's Superchain.

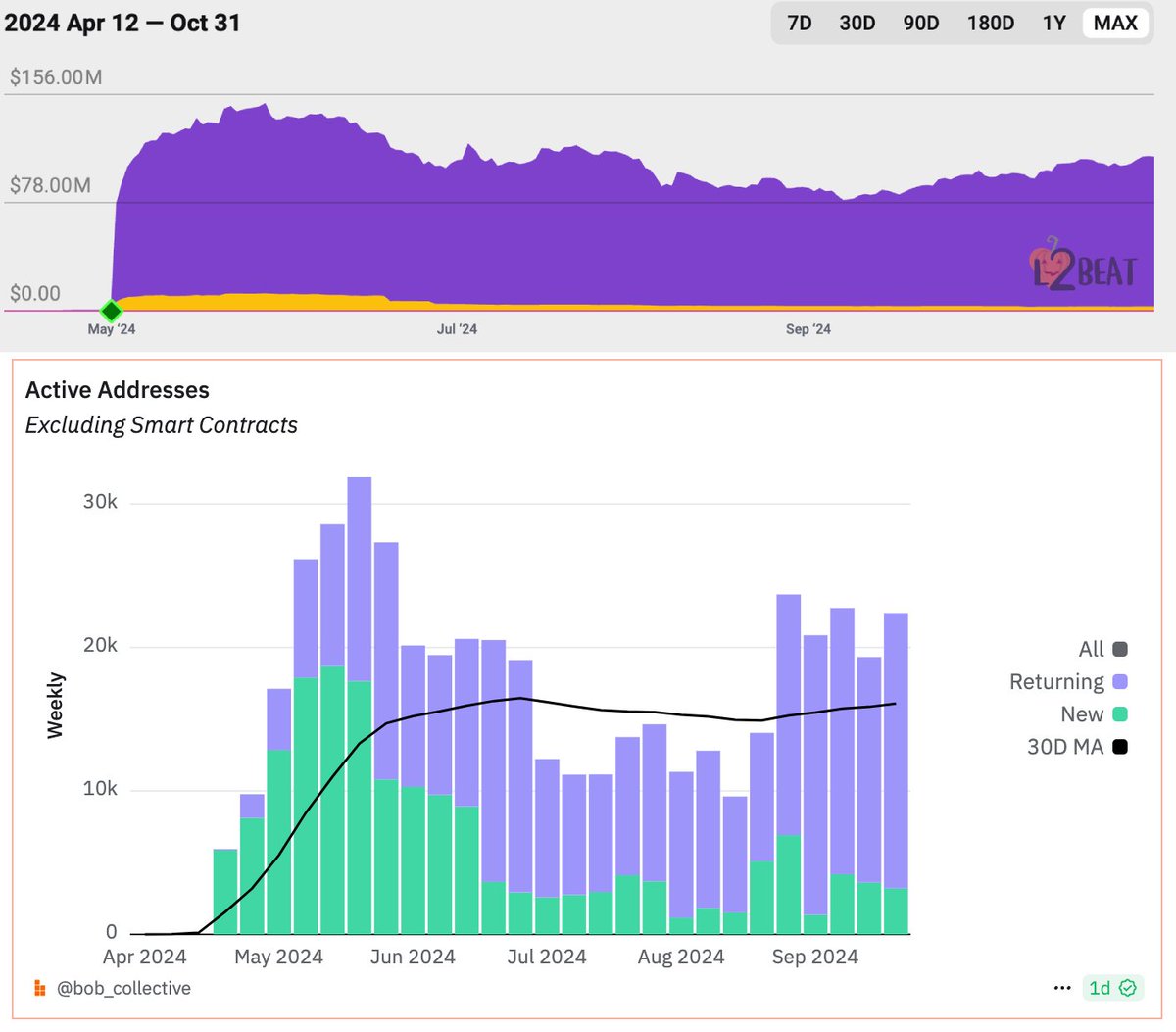

Already, BOB has attracted over $100 million in liquidity and tens of thousands of users, marking it as a key player among Bitcoin L2s. And this is just the beginning.

I believe that as the Bitcoin ecosystem expands through 2025-2026, these metrics will grow tenfold. Innovations like these are what drive the industry forward.

============================

If you liked the research, like and subscribe to @Eugene_Bulltime

Data source: @build_on_bob @Bitvmclub @alexeiZamyatin @ZeroSync_

And follow on strong visioners and analysts:

@0xBreadguy @alpha_pls @ayyyeandy @stacy_muur @poopmandefi @TheDeFISaint @Slappjakke @0xSalazar @DefiIgnas @Defi_Warhol @TheDeFiKenshin @ViktorDefi @hmalviya9 @defi_mochi @llamaonthebrink @cyrilXBT @Mars_DeFi @Crypt0_Andrew @2lambro @563defi @DeFi_Cheetah @blocmatesdotcom @jake_pahor

10.86K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.