market rotation is finally here - and most timelines still look like 2023

that’s the tell. when feeds drag their feet, alpha hides in the cracks

what’s actually working right now

1. infofi, post-loud era

kaito just nerfed engagement spam. no more ‘gm rt ser’ points. the algo now scores insight density, not emoji volume. if your tweet can’t survive a screenshot without context, it won’t survive the new ranking either.

2. delta-neutral farming on new rails

hyperEVM loops at 40 %+ apr, pendle rate-shopping, plasma presale hedges - all pay more than waiting for an “altseason” that looks good only in tradingview mock-ups.

3. reputation layers

@ethos_network score is turning into a bright-blue filter on the whole feed. i just hit 1600, aiming for 1800. every 50-point jump puts your replies higher in smart-account notifications. the compounding is invisible until you’re suddenly unavoidable.

how i’m positioning

> i split capital: 70 % delta-neutral income (hyperEVM loop + skaIto pendle PT), 20 % presale tickets (plasma, echo sonar drops), 10 % pure narrative swing.

> i write one high-signal thread a day, then spend twice as long in replies. reply > thread > tweet in 2025.

> every sunday i export my twitter analytics, match top posts to kaito mindshare bumps, and kill any format that doesn’t move the needle. ego is expensive; data is free.

biggest mistake i still see: people wait for “the next big airdrop” like it’s a once-a-year festival. that mindset is the new waiting-for-godot. the faucet never turned off - it just moved to points dashboards and loyalty sheets.

stick with the boring systems, stack your score, and let the tourists hunt the fireworks.

waiting for “the next big airdrop” is the new waiting for godot

we’ve all met that friend who checks prices ten times a day, flips one memecoin for 40 %, then gives it all back on the next candle

same energy shows up on kaito right now - people jumping from pool to pool, praying a single leaderboard snapshot will save the month

that’s not a strategy. that’s roulette with extra clicks

real edge in 2025 is attention allocation. you choose a few compounding reward streams, learn the products better than the teams do, and let the algo work for you. yaps stack, pools refill, your risk stays close to zero. boring? maybe. profit-per-hour? undefeated

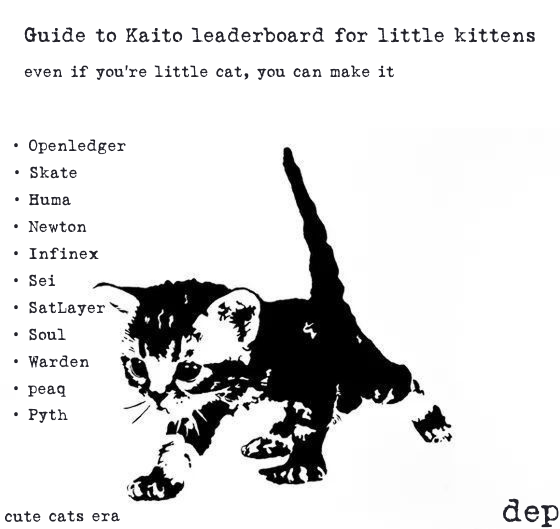

below are the twelve kaito pools i’m farming, why they matter, and one little piece of alpha for each:

1. @infinex

1 b µpatrons ≈ 6 m usd at tge. gas-less perps go public in july

alpha → record a 20-sec screen cap of the passkey wallet; cex refugees eat it up

2. @PythNetwork

10 k pyth monthly. fee switch already live

alpha → tweet adoption metrics, not token talk. numbers beat narratives in the new algo

3. @peaq

0.55 % of supply over eleven months. machines pay fees in their own tokens

alpha → call it “helium minus the inflation bug” and watch iot maxi replies bump reach

4. @wardenprotocol

2.5 % \$WARD. zk custody rails for apps

alpha → one-liner comparing their MPC to fireblocks pulls in institutional lurkers

5. @0xSoulProtocol

up to 1.5 % \$SO. cross-chain lending testnet works today

alpha → gif of borrowing on base with eth collateral on arbitrum. jaw-drop demo

6. @satlayer

0.75 % sat token. btc restaking

alpha → post a bar chart: 19 m idle btc vs <40 k restaked. nothing triggers orange coiners like wasted yield

7. @OpenledgerHQ

2 m \$OPEN for top 200. cheap verifiable AI inference

alpha → run their demo llm, tweet latency numbers; devs retweet benchmarks for free clout

8. @CampNetworkxyz

0.25 % camp + 40 k usdc/mo. ip-native l1

alpha → mint a public-domain meme and show royalties in real time; creator economy loves proof not promises

9. @Skate_chain

up to 1 % \$SKATE. evm + svm + tvm in one chain

alpha → clip a single wallet signing tx on all three vms. cross-vm crowd goes wild

10. @HumaFinance

0.5 % \$H over three seasons. invoice-backed rwas

alpha → quote their live stripe data oracle; fintech twitter joins instantly

11. @MagicNewton

0.75 % \$NEWT. autonomous trading agents

alpha → share a backtest from their sandbox; traders will debate params and boost engagement

12. @SeiNetwork

26 k usdc to top 50 each month. ignored since points meta cooled

alpha → daily 30-sec clips of your perp fills—volume farming still prints

quick prioritization

Tier:

> high → infinex, pyth, soul, peaq → two quality posts + three replies per day

> mid → satlayer, openledger, newton, camp → post every other day, jump on news threads

> easy → sei, skate, warden, huma → farm with smart comments; low effort, free upside

extra juice

* cross-post every main thread to farcaster; “spread” score quietly matters

* stake sKaito first—many pools give stealth multipliers to stakers

* recycle your clips into opensea points tweets; double dip or stay poor

/ altseason mints gamblers

/ attention season pays consistently

what three pools are you compounding this week?

My fav ct guys

/ @belizardd @DeRonin_ @kem1ks @splinter0n @terra_gatsuki @0xAndrewMoh @KingWilliamDefi @0xJok9r @0xDefiLeo @cryppinfluence @CryptoShiro_ @the_smart_ape @AlphaFrog13 @0xTindorr @Hercules_Defi @eli5_defi @CryptoGideon_ @0x99Gohan @rektdiomedes

9

1.98K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.