This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

TRX

TRX on Solana price

s7YA9H...pump

$0.0000034139

+$0.00000

(-3.37%)

Price change for the last 24 hours

How are you feeling about TRX today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

TRX market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$3,408.61

Network

Solana

Circulating supply

998,460,368 TRX

Token holders

676

Liquidity

$6,078.01

1h volume

$0.00

4h volume

$4.90

24h volume

$4.90

TRX on Solana Feed

The following content is sourced from .

alphanonce Intern

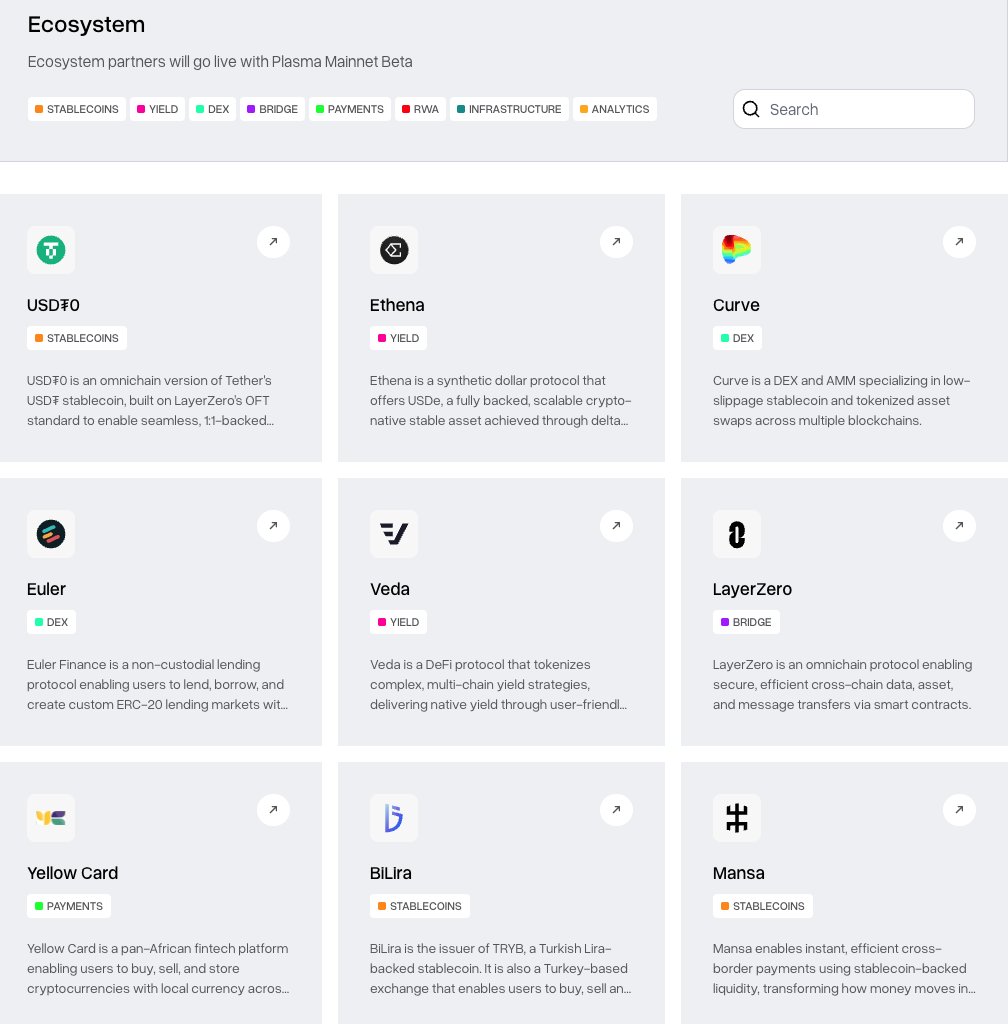

On the @PlasmaFDN ecosystem, focusing on native projects

Plasma

• L1 for stablecoin transactions with zero fees, secured by the $BTC network

• Raised $20M from @hiFramework, @foundersfund, and @bitfinex

• Partnering with @ethena_labs, @CurveFinance, etc.

USDT0

• Native stablecoin of @Tether_to

• Direct bridge with $ETH, $TRX, and $TON

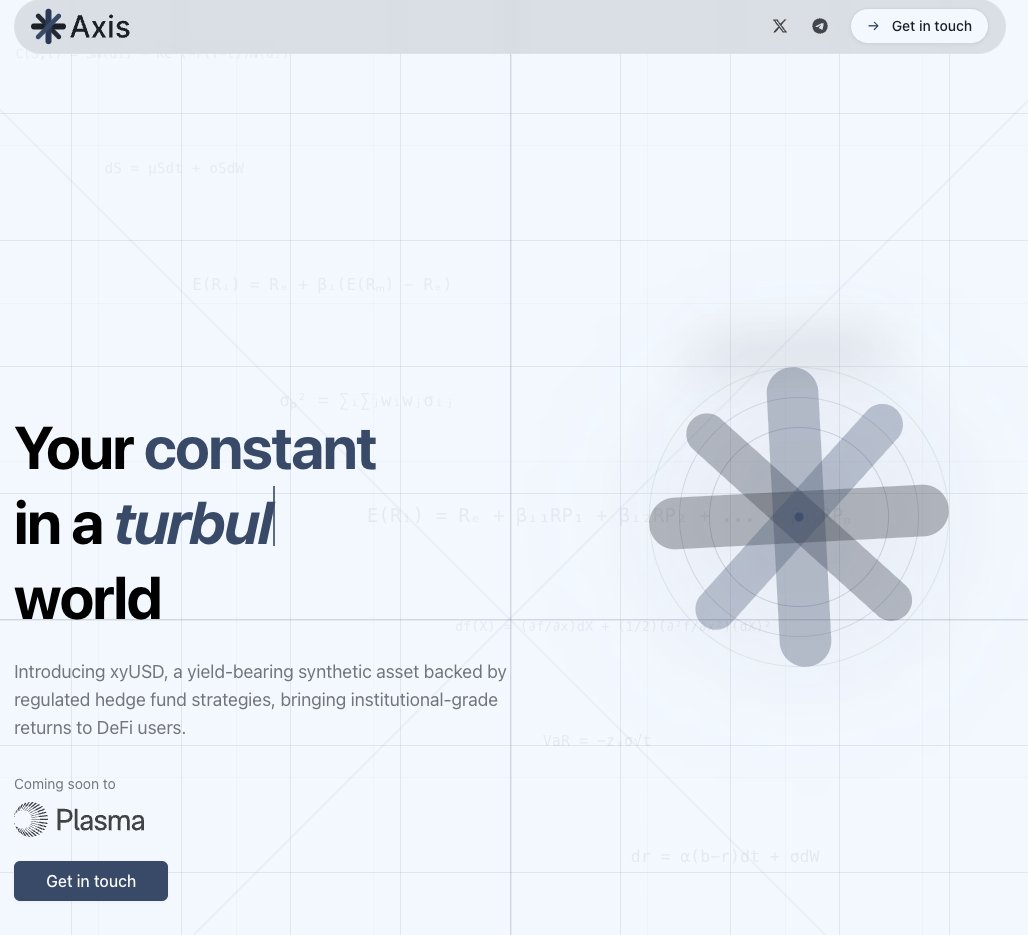

@AxisFDN

• Stablecoin $xyUSD, reflecting tokenized hedge fund

• Basically, on-chain structured credit

@hadron_tether

• Asset tokenization protocol by @tether

• Stock, bond, commodities, etc. for tokenization

@BiLira_Kripto

• $TRY stablecoin with onramp & offramp

@USDai_Official

• GPU collateral-backed stablecoin

• Estimated APR 15-25%

• Developed by @permianlabs, on Hyperliquid & Plasma

@MANSA_FI

• Global stablecoin payment infrastructure

• Liquidity infrastructure for cross-border settlement

• Backed by @Tether_to

@uraniumdigital_

• Tokenized uranium with physical reserve in Canada

• Regulatory compliant RWA solution

Show original

389

0

David Tran

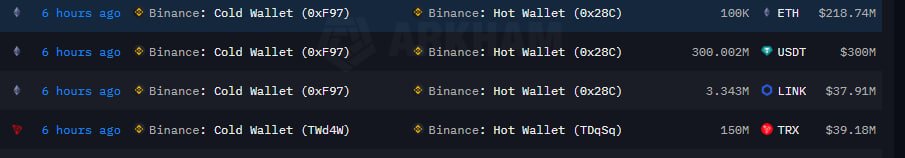

#Binance continues to aggressively sell $ETH into the market at this time

6 hours ago, at 4 AM on June 23, 2025

Binance continues to send 100k $ETH~218M$ from Binance Cold wallet (0xF97) to Binance hot wallet (0x28C)

I have a detailed study on the behavior between these two wallet addresses from June 15 before the market crashed, everyone can check it to understand the money flow

Check:

Not stopping there, #Binance also continues to take action by selling tokens $LINK and $TRX, sending 3.34M $LINK~37.91M$ and 150M $TRX~39.18M$ out of its cold wallet

A short-term downtrend will last at least 1-2 months in this cycle, the price has just broken the upward structure, and the liquidity for bottom fishing is large, so it is understandable that #Binance continues to sell aggressively into thick liquidity

To truly catch the bottom correctly and avoid losses, we need to understand liquidity

Continue researching and waiting for MMs to confirm that liquidity is no longer thick enough to sell and switch to buying back

We definitely will not buy in at this time when the price has just escaped the sideways area and MMs are still continuing to sell into the price path

We need more time, the market needs to get used to a new price area before breaking out

My goals and vision remain the same, June-July will be two difficult months

In August, we will start to invest again

Prepare for the strongest wave of the year 2025 at the end of this year

If you like this post, don't forget to leave me a heart and share your thoughts below the post.

Follow all of David's actions as soon as possible here:

Show original

701

21

Followin 华语 - 热点风向标🫡

You can not speculate on the list of "hottest crypto concept stocks" in the United States, but you must pay attention to these high-quality "market sentiment indicators"!

1⃣Coinbase Global(COIN)

2⃣Circle(CRCL)

3⃣MicroStrategy (MSTR)

4⃣Galaxy(GLXY)

5⃣Amber(AMBR)

6⃣MARA, Note: Bitcoin Mining

7⃣SharpLink Gaming (SBET), Note: ETH reserves

8⃣UPXI, Note: SOL Reserves

9⃣DFDV, Note: SOL Reserve

🔟SRM, Note: TRX Reserve

1⃣1⃣GameStop (GME), Note: BTC reserves

1⃣2⃣CEP, Note: BTC Reserve + Trump Concept

1⃣3⃣Trump Media & Technology Group (DJT), Note: Trump Concept

What other targets do you think are worth paying attention to?

Show original

29.08K

0

Odaily

Original author: Blockworks

Original compilation: Felix, PANews

The U.S. Securities and Exchange Commission's (SEC) approval of spot Solana exchange-traded funds (ETFs) appears to be in its final stages, with the initial seven potential issuers filing revised S-1 filings in recent days, and a new entrant, namely CoinShares, joining the fray.

It is worth noting that each document contains content about staking, and as previously reported, the SEC requires issuers to include such content.

As the crypto industry prepares for a third crypto-asset ETF that could be approved by the SEC, here are eight companies that have applied for the issuance of Solana ETFs, in order of first filing:

VanEck

VanEck was the first company to apply for the Solana ETF, about a year ago this month. At the time, while the SEC insisted that Solana was a security, some compared the filing to a call option on Trump's victory in the November election.

The bet paid off, but it could have been a pyrrhic victory if the SEC had followed its lead and approved both Bitcoin and Ethereum exchange-traded funds (ETFs) instead of in the order in which applications were filed.

The bet paid off, but it could have been a pyrrhic win if the SEC followed the precedent and approved Bitcoin and Ether ETFs all at once, rather than in the order in which issuers filed their applications first.

To this end, VanEck has been advocating for the SEC to adopt a "first-to-file" principle, arguing that it is more conducive to innovation and competition.

VanEck leverages Kiln to provide Solana staking services for its European exchange-traded products (ETPs).

Related Reading: Institutional Entry, Tokenized Equities and the Liquidity Revolution: VanEck Investment Managers Look Ahead to the Future of Crypto Markets

21 Shares

Two days after VanEck's filing, 21 Shares also filed an application for the Solana ETF, and it also hopes that the SEC will adopt a "first-to-file" principle.

The Core Solana ETF of the 21 Shares program will be traded on the Cboe BZX exchange, and redemption will take place in the form of SOL tokens.

Coinbase is listed as a staking service provider mentioned in 21 Shares' underlying prospectus filed in Europe.

Related reading: Spot ETF will land as soon as July, can Solana repeat the BTC playbook?

Canary Capital

Canary Capital filed an application for the SOL ETF a few days before the U.S. election.

Canary Capital is smaller than some of the funds on the list, but has recently gained prominence by applying for multiple altcoin ETFs. Its ETF applications have been filed include SUI, SEI, INJ, TRX, PENGU, HBAR, LTC, and XRP, among others.

Related reading: Canary Capital frequently submits ETF applications, and copycat ETF applications become a disguised advertising business?

Bitwise

Bitwise first applied for an exchange-traded fund (ETF) shortly after Trump's election. In an interview, the company's CEO, Hunter Horsley, called Solana an "incredibly emerging asset and story."

Bitwise also launched a Solana-based staking ETP in December, with Marinade providing staking services. If the U.S. approves staking ETFs, this could bode well for Marinade.

Related Reading: Bitwise CIO: A former skeptic, now wants to buy BTC too

Grayscale

Grayscale is looking to convert its SOL trust into a spot ETF, similar to how its Bitcoin and Ether trusts are handled. Currently, the GSOL Trust is trading at a premium to its net asset value, which means that investors are willing to pay a higher price for the product than the underlying SOL.

Last month, the U.S. Securities and Exchange Commission postponed its decision on Grayscale's exchange-traded funds (ETFs), saying it had not yet "reached any conclusions" on the 19 b-4 application documents for the cash SOL ETF to be listed.

Related reading: Grayscale Selection's latest report: Q1 list underperforms, Q2 focuses on RWA, DePIN, and IP tokenization

Franklin Templeton

Franklin Templeton Investments offers exchange-traded funds (ETFs) for Bitcoin and Ether and has submitted application documents for exchange-traded funds (ETFs) for SOL and XRP.

The $1.5 trillion fund has a number of other crypto-related initiatives, and its digital asset core SMA also has a small allocation to SOL. Its tokenized money market fund also increased its support for Solana earlier this year.

The $1.5 trillion fund also invests in a number of other crypto projects, and its crypto segregated managed account (SMA) also has a small allocation to SOL. Its tokenized money market fund was also backed by Solana earlier this year.

Related reading: Behind the "undervalued" Solana DeFi: How to break the "ecological internal friction" between high-yield staking and lending protocols?

Fidelity

In the current competition, Fidelity is the giant. Its Bitcoin exchange-traded funds (ETFs) are second only to BlackRock in terms of AUM, while its Ethereum ETFs lag behind BlackRock and Grayscale's conversion trusts.

Fidelity, a leading provider of brokerage, trust, and IRA accounts, is likely to be a major driver of inflows into approved SOL exchange-traded funds (ETFs).

Related Reading: The State of the Copycat ETF Boom: A Closer Look at 2025 Crypto ETF Applications

CoinShares

CoinShares is the latest company to join the Solana exchange-traded fund (ETF) race, joining the fray as existing issuers race to file revised Form S-1s.

The crypto-focused European asset manager has now launched an ETP for BTC, ETH, and a range of altcoins – Tezos ETP, anyone want to try it?

The crypto-focused European asset manager has launched exchange-traded products (ETPs) for BTC, ETH, and a range of altcoins.

Show original19.93K

0

TRX price performance in USD

The current price of trx-on-solana is $0.0000034139. Over the last 24 hours, trx-on-solana has decreased by -3.37%. It currently has a circulating supply of 998,460,368 TRX and a maximum supply of 998,460,368 TRX, giving it a fully diluted market cap of $3,408.61. The trx-on-solana/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

-3.37%

24h

-3.37%

About TRX on Solana (TRX)

TRX FAQ

What’s the current price of TRX on Solana?

The current price of 1 TRX is $0.0000034139, experiencing a -3.37% change in the past 24 hours.

Can I buy TRX on OKX?

No, currently TRX is unavailable on OKX. To stay updated on when TRX becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of TRX fluctuate?

The price of TRX fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 TRX on Solana worth today?

Currently, one TRX on Solana is worth $0.0000034139. For answers and insight into TRX on Solana's price action, you're in the right place. Explore the latest TRX on Solana charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as TRX on Solana, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as TRX on Solana have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.