This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

sDAI

Savings xDAI price

0xaf20...3701

$1.1727

+$0.00000

(+0.00%)

Price change for the last 24 hours

How are you feeling about sDAI today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

sDAI market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$78.03M

Network

Gnosis

Circulating supply

66,539,287 sDAI

Token holders

0

Liquidity

$168,269.18

1h volume

$47,699.74

4h volume

$181,123.60

24h volume

$987,063.38

Savings xDAI Feed

The following content is sourced from .

BATMAN ⚡

With the second last post in my series about @sparkdotfi and the $SPK token, I'm continuing my series.

Building Amid the Chaos

Even as the token went through price discovery chaos, the Spark protocol itself kept growing. Savings vaults continued pulling in stablecoin deposits. Lending markets grew. Governance proposals started going live. And capital was being routed transparently, audibly, into real DeFi strategies.

Meanwhile, Spark was quietly laying down some serious infrastructure. They integrated with Fuel Network to launch what might be the first fully on-chain central limit order book on Ethereum. That's not a small feat. For institutional traders, CLOBs are essential, and the AMM model doesn't deliver what's needed. This showed Spark wasn't just targeting crypto-natives. They were building a bridge to a more mature DeFi ecosystem.

And importantly, it all remained open-source. The code, the documentation, the audits is all there. No black boxes. No private backdoors. Just code, capital, and consensus.

It's time to take Spark more seriously, and consider adding it as one of the main plays.

BATMAN ⚡

It's time to drop the next topic of my series about @sparkdotfi and $SPK token.

Building the Engine: Vaults, Lending, and Capital Deployment

The rollout of Spark's core products reflected a careful, layered approach. First, they introduced Spark Savings Vaults, places where users could deposit stablecoins and receive interest-bearing versions like sUSDC or sDAI. These weren't flashy degen farms. They were designed to be boring in the best possible way: predictable, transparent, and efficient.

Then came SparkLend, a money market built from the ground up to be cross-chain and over-collateralized. Rates weren't determined by the usual utilization curve, but rather governed by the community. It felt like an evolution of Maker's DSR, but more flexible and more open.

The third pillar, one that still doesn't get enough attention, is Spark's active capital deployment engine. Rather than just holding deposits passively, Spark routes capital to platforms like Aave, Morpho, and Ethena. It does this on-chain, with every move visible. It’s like Yearn's vault strategy, but cleaner, auditable, and optimized for stablecoins.

When you have some assets in your portfolio which you anyway tend to hold for long-term, staking them is a good way to earn passive income, giving you good yield on idle assets.

13.24K

2

天晴ETH

Spark () In-depth Analysis: The Liquidity Engine of Stablecoins in DeFi

1. Project Positioning: The "Liquidity Brain" of DeFi

Spark is a blockchain-based capital distribution system, with the core goal of optimizing the efficiency of stablecoin liquidity usage, connecting DeFi with traditional finance (RWA). It serves not only as a yield tool for ordinary users but also as a liquidity infrastructure for protocols, DAOs, and institutions, managing over $4 billion in TVL and generating annual income exceeding $180 million.

2. Three Core Products

SparkLend (Lending Market):

Fixed interest rate model (interest rates determined by governance), avoiding the extreme volatility of traditional DeFi lending, suitable for long-term allocation of large funds.

Supports mainstream stablecoins (DAI, USDC, USDT) and collateral assets like ETH.

Spark Savings (Savings System):

Users deposit USDC, DAI, etc., which are automatically converted to sUSDC, sDAI, earning on-chain yields.

Funds are automatically allocated to DeFi protocols like Aave, Morpho, Ethena, and RWA assets like BlackRock BUIDL.

Spark Liquidity Layer (Liquidity Distribution Engine):

Provides smart fund management for DAOs and protocols, optimizing yield strategies, replacing traditional passive deposits.

3. Core Advantages: Stability, Transparency, Institutional Grade

Stable Interest Rates: Unlike floating rate lending like Aave, Spark's rates are governed, reducing the impact of market volatility.

RWA Integration: Funds can flow into high-quality real-world assets (like US Treasuries), enhancing yield stability.

No Custodial Risk: All assets are verifiable on-chain, eliminating reliance on centralized institutions.

DAO Friendly: Helps decentralized organizations optimize fund utilization and actively manage yields.

4. Team Background: MakerDAO System, Solid Technology

The development team Phoenix Labs originates from the MakerDAO ecosystem, well-versed in stablecoin mechanisms and DeFi governance, with high technical maturity, not a "concept speculation" project.

5. Market Significance: Key Infrastructure of DeFi 2.0

Spark's innovation lies in:

Solving Capital Fragmentation: Aggregating liquidity and intelligently allocating it to optimal protocols.

Lowering Barriers: Ordinary users can achieve stable yields without complex operations.

Empowering Institutions: DAOs and protocols can manage assets like professional funds.

Summary

Spark is one of the few projects in the current DeFi space that combines stability, yield, and institutional adaptability, suitable for:

Individual Users: Seeking stable, transparent on-chain savings.

DAOs/Protocols: Optimizing fund utilization and enhancing yields.

RWA Explorers: Accessing traditional high-yield assets through DeFi with low barriers.

Following Spark means betting on the future of DeFi liquidity.

$SPK

@sparkdotfi

Show original

21.86K

2

RedStone ♦️

Hey, what stablecoins does RedStone support?

Only:

$USDT

$BUIDL

$USDC

$sUSDe

$SUDSz

$sfrxUSD

$gmdUSDC

$sUSDX

$USDe

$wUSDM

$sUSDs

$USD3

$sdeUSD

$tacUSD

$GUSD

$frxUSD

$USD1

$USD+

$scUSD

$deUSD

$USDtb

$USDP

$USDD

$eUSD

$crvUSD

$USDX

$fxUSD

$aUSD

$MUSD

$ALUSD

$USDB

$LUSD

$TUSD

$DOLA

$OUSD

$USDM

$CUSD

$DAI

$sDAI

$USR

Show original17.61K

88

Lucy

The first phase of the Spark @sparkdotfi Ignition Airdrop eligibility check is now open, come and take a look.

Eligibility criteria include: having used SparkLend, holding USDS, sUSDS, sUSDC, DAI, sDAI, xDAI, or SAI, and interacting with specified chains and protocols.

Complete eligibility details:

Ecosystem partners: @SkyEcosystem @pendle_fi @MorphoLabs @arbitrum @aave @0xfluid @CurveFinance @LidoFinance @base @0xPolygon @GnosisDAO @Optimism @ethena_labs

After claiming, you can also stake the airdrop to unlock the second phase Overdrive acceleration rewards, check it out now:

#SparkFi #CookieDAO #Cookie #Spark #SNAPS @cookiedotfun @sparkdotfi

Show original

33.46K

80

NingNing

Given that the speed and magnitude of the Federal Reserve's interest rate cuts in 2026 are likely to be significantly greater than this year's, when making long-term investments in the YBS stablecoin segment, prioritize allocating assets to market delta-neutral strategies like @ethena_labs, rather than to other YBS protocols that tokenize U.S. Treasury bonds.

Stacy Muur

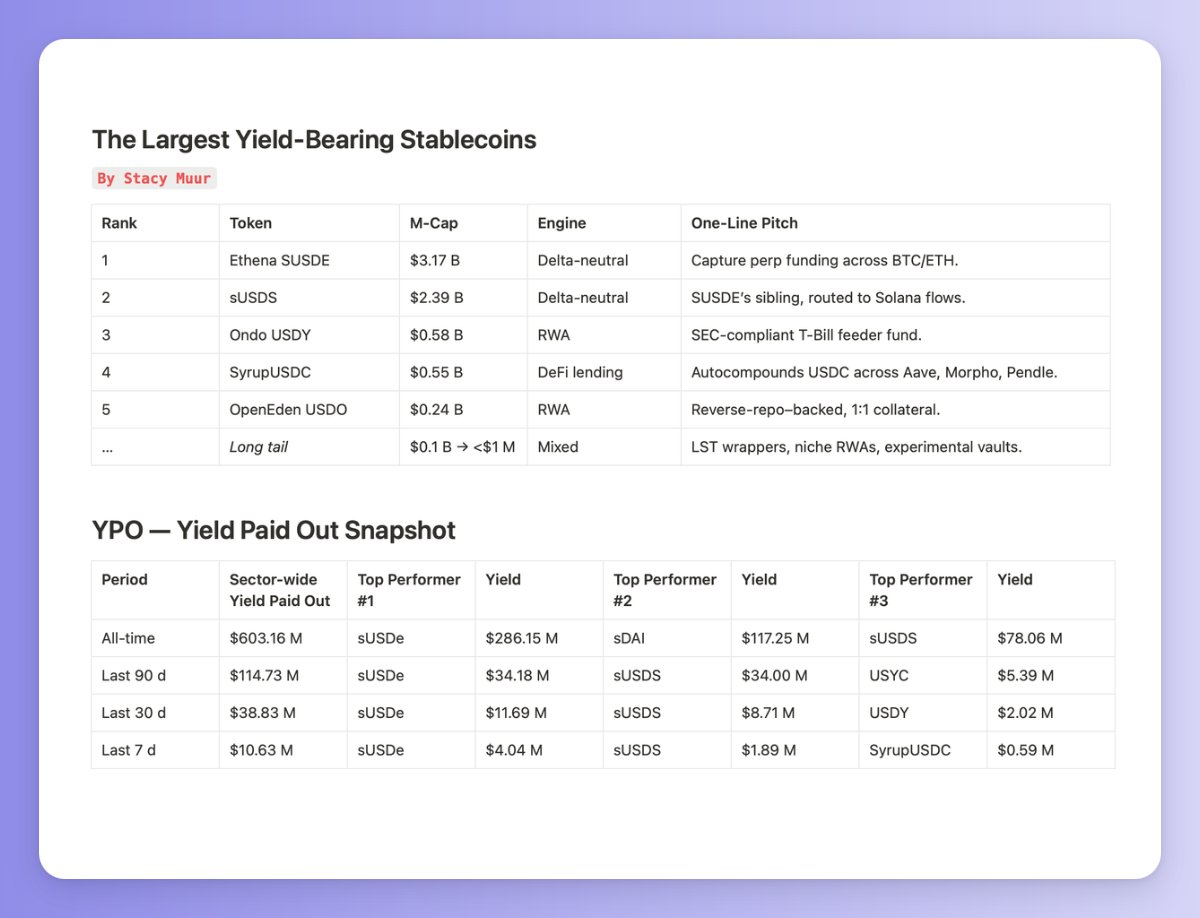

The 2025 Master List of Yield-Bearing Stablecoins is here.

Market snapshot:

• Total YBS market cap: $7.19B

• 24h volume: $56.18M

• Dominance: Ethena’s SUSDE and sUSDS control ~77% of all liquidity

• Real yield paid to holders: $603M

So, what makes a stablecoin “yield-bearing”?

Simple: it stays pegged to the dollar and pays passive income, 3-15% net APY, without manual farming. The main engines driving this are:

→Delta-neutral hedging (SUSDE, sUSDS)

→Tokenized T-Bills (USDY, USDO)

→DeFi lending vaults (SyrupUSDC, sDOLA)

→Validator staking (SFRXUSD, SLVLUSD)

The Big 5:

• @ethena_labs SUSDE ($3.17B): The largest YBS by far, capturing perp funding on BTC/ETH. It’s a synthetic stablecoin with yields from ETH staking and funding rates.

• sUSDS ($2.39B): SUSDE’s sibling, integrated into the @SkyEcosystem ecosystem. Provides passive income from USDS deposits while staying pegged to USD.

• @OndoFinance USDY ($0.58B): Real-world asset (RWA) wrapper for T-Bills. SEC-registered and targeting non-US investors. Yields around 5% APY.

• @SyrupalOfficial USDC ($0.55B): DeFi lending vault that auto-compounds USDC across Aave, Morpho, and Pendle. Bridges CeFi yields into DeFi.

• @OpenEden_X USDO ($0.24B): Fully collateralized by tokenized Treasuries. Licensed in Bermuda. 4–5% APY with real-time proof-of-reserves.

The big picture?

Basis trades have fueled SUSDE/sUSDS from <$500M to >$5.5B YTD but they’re sensitive to funding rates.

Meanwhile, RWAs like USDY and USDO prove that tokenized T-Bills are still the easiest, regulator-friendly way to earn on-chain yield.

But beware: yields can compress as US rates peak, and smart contract risk is real. Always check audits and insurance.

And don’t just chase APY, look at what’s actually been paid.

SUSDE’s lifetime payout tops $286M. sDAI trails at $117M, with sUSDS at $78M.

Yield-bearing stablecoins are the cash management killer app, but the sector’s still young.

Stay diversified, watch funding spreads, and demand transparency.

DYOR.

3.85K

3

sDAI price performance in USD

The current price of savings-xdai is $1.1727. Over the last 24 hours, savings-xdai has decreased by +0.00%. It currently has a circulating supply of 66,539,287 sDAI and a maximum supply of 66,539,287 sDAI, giving it a fully diluted market cap of $78.03M. The savings-xdai/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

+0.00%

24h

+0.00%

About Savings xDAI (sDAI)

sDAI FAQ

What’s the current price of Savings xDAI?

The current price of 1 sDAI is $1.1727, experiencing a +0.00% change in the past 24 hours.

Can I buy sDAI on OKX?

No, currently sDAI is unavailable on OKX. To stay updated on when sDAI becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of sDAI fluctuate?

The price of sDAI fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Savings xDAI worth today?

Currently, one Savings xDAI is worth $1.1727. For answers and insight into Savings xDAI's price action, you're in the right place. Explore the latest Savings xDAI charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Savings xDAI, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Savings xDAI have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.