This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

PT

Penguin Tarrif price

0x4463...4444

$0.000020882

-$0.00021

(-91.06%)

Price change for the last 24 hours

How are you feeling about PT today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

PT market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$20,882.27

Network

BNB Chain

Circulating supply

1,000,000,000 PT

Token holders

458

Liquidity

$17,501.08

1h volume

$3,989.89

4h volume

$21,835.47

24h volume

$1.01M

Penguin Tarrif Feed

The following content is sourced from .

Tao

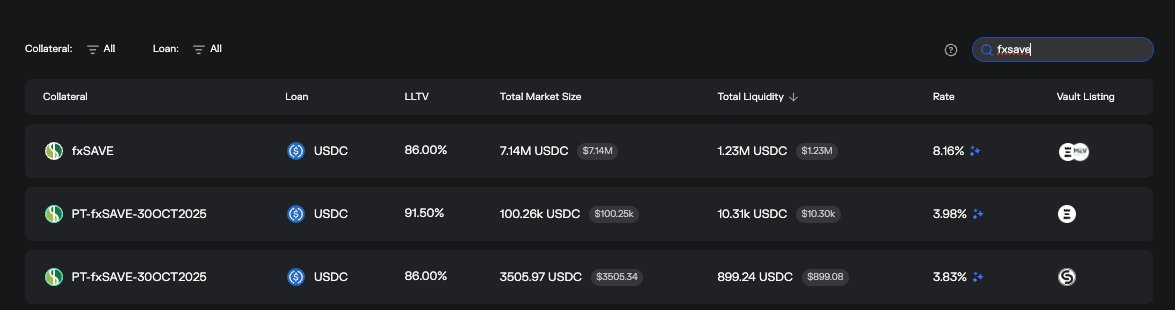

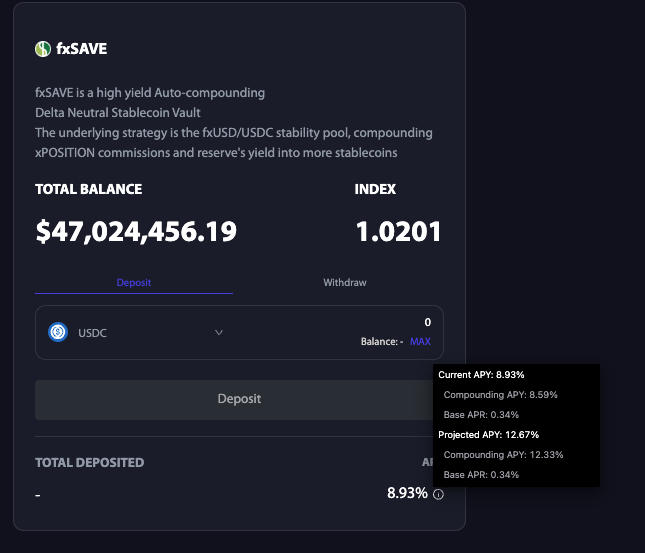

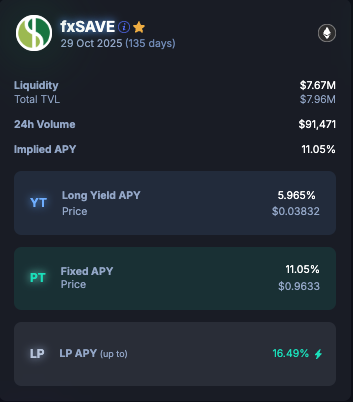

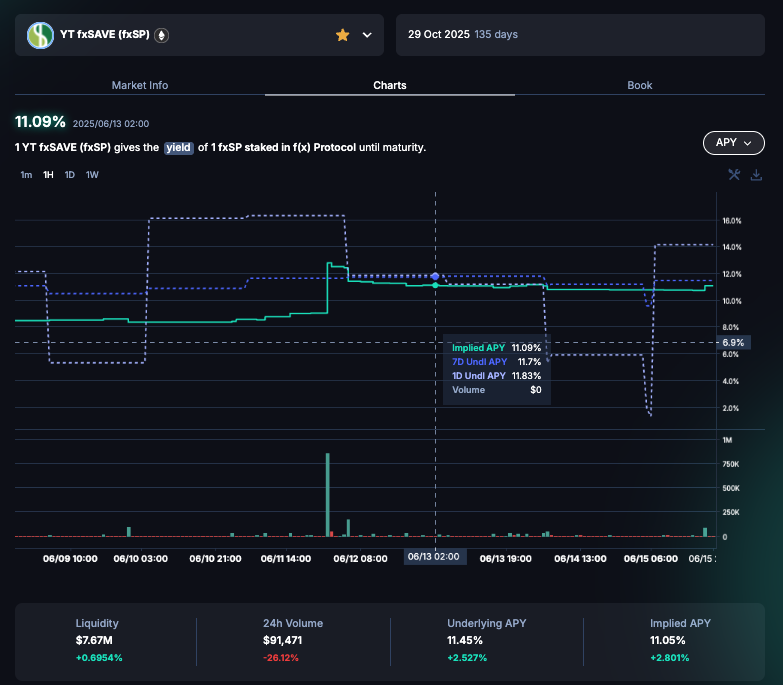

$fxSAVE from @protocol_fx in @pendle_fi - Jun 23 week

LP Side:

1. $8.1M (up from $7.67 M) with 12.89% max APY.

2. LP earns base APY when unwrapping fx stability pool to USDC/fxUSD.

3. $1000 bribe each for @Penpiexyz_io and @Equilibriafi

4. vePendle OTC deal continues.

YT Side:

1. fxSAVE offers 8.93% APY this week (Due to the concern of the war), but the projected APY is already over 12.65% (Starts this Thursday). Just be patient to long yield.

2. More market volatility increases underlying APY. Buy YT when prices are low.

3. The ongoing buy and hold YT airdrop campaign.

Check more details here:

Key point: Buy and Hold YT now for airdrop

PT side:

1. PT-fxsave on morpho, the borrow rate is low (3.95%). Feel free to grab some.

Tao

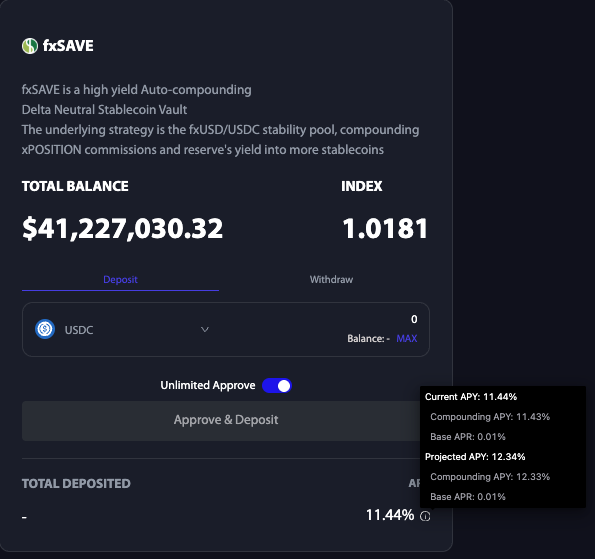

fxSAVE from @protocol_fx in @pendle_fi - Jun 16 week

LP Side:

1. $7.67M (up from $5.71M) with 16.49% max APY.

2. LP earns base APY when unwrapping fx stability pool to USDC/fxUSD.

3. $1000 bribe each for @Penpiexyz_io and @Equilibriafi.

4. vePendle OTC deal continues.

YT Side:

1. fxSAVE offers 11.44% APY, at least 12.34% next week.

2. More market volatility increases underlying APY. Buy YT when prices are low.

3. New promotion plan for YT-fxSAVE holder (Will send proposal to public).

6.08K

0

区块国宝(唯一号)💚

How to unlock $YU earnings with Yala + Pendle and earn 6 times Berries rewards! 🫐

I never thought I wouldn't be able to access Twitter overseas. It's one thing for it to be banned in my country, but Russia too? I can only scientifically return to Hong Kong to post this tweet. Let's talk about something hardcore— the $YU earnings revolution brought by the collaboration between Yala and Pendle. This partnership connects the liquidity of Bitcoin ($YU) to the yield engine of Ethereum (Pendle), it's simply a "divine combination" in the DeFi world! Not only can it activate your earnings, but it can also provide huge rewards, with up to 6 times Berries incoming! A step-by-step tutorial, come and take action!

🎯 What is the Yala + Pendle collaboration?

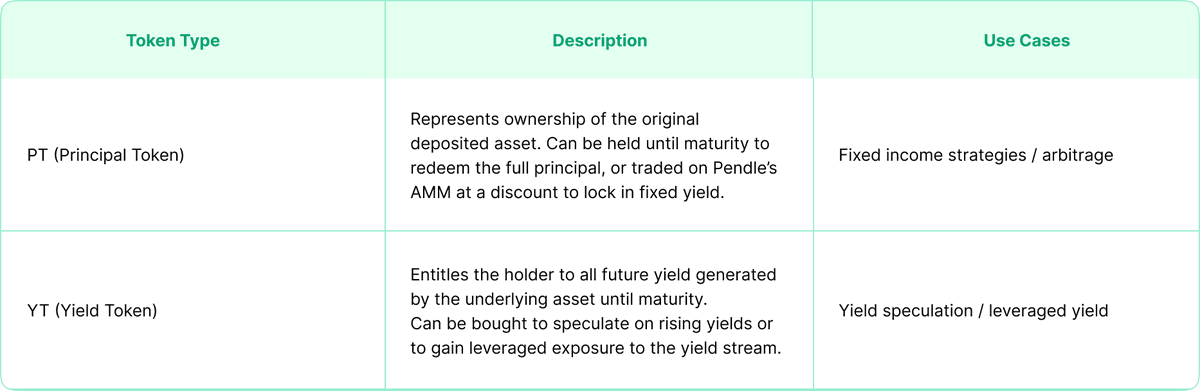

In simple terms, $YU (a stablecoin backed by Bitcoin) is a stablecoin that uses BTC as the underlying asset in YALA, allowing you to navigate yields in DeFi. Pendle is the strongest yield trading tool on Ethereum, allowing you to split $YU into Principal Tokens (PT) and Yield Tokens (YT), giving you the freedom to choose between fixed or floating yields. This collaboration is like giving you a "key to earnings"!

What is $YU?

$YU is Yala's stablecoin, backed by Bitcoin assets, and loosely pegged to the US dollar. You can use it to earn yields in the Yala ecosystem and unlock more opportunities through this collaboration.

The magic of Pendle

Pendle can split the earnings of $YU:

PT (Principal Token): locks in fixed earnings, and you get back the principal + interest at maturity.

YT (Yield Token): can't decide? Buy YT and enjoy the floating dividends of future $YU earnings.

You can also provide liquidity, earn trading fees + incentives, a guaranteed triple yield!

Big move: 6 times Berries rewards 🫐

Yala is ramping up benefits, participating in these strategies can stack up to 6 times Berries (Yala's reward token), this is a chance you can't miss!

12.34K

138

区块国宝(唯一号)💚

How to unlock $YU earnings with Yala + Pendle and earn 6 times Berries rewards! 🫐

I never thought I wouldn't be able to access Twitter overseas; it's one thing for it to be banned domestically, but Russia 🇷🇺 can't access it either? I can only scientifically return to Hong Kong to post this tweet. Let's talk about something hardcore— the $YU earnings revolution brought by the collaboration between Yala and Pendle. This partnership connects the liquidity of Bitcoin ($YU) to the yield engine of Ethereum (Pendle), making it a "divine combination" in the DeFi world! Not only can it activate your earnings, but it can also provide massive rewards, with up to 6 times Berries 🫐 coming in! A step-by-step tutorial, come and take action! 📑

🎯 What is the Yala + Pendle collaboration?

In simple terms, $YU (a stablecoin backed by Bitcoin) is a stablecoin that uses BTC as the underlying asset in YALA, allowing you to navigate earnings in DeFi. Pendle is the strongest yield trading tool on Ethereum, allowing you to split $YU into Principal Tokens (PT) and Yield Tokens (YT), giving you the freedom to choose between fixed or floating yields. This collaboration is like giving you a "key to earnings"!

What is $YU?

$YU is Yala's stablecoin, backed by Bitcoin assets, and loosely pegged to the US dollar. You can use it to earn yields in the Yala ecosystem and unlock more opportunities through this collaboration.

The magic of Pendle 🪄

Pendle can split the earnings of $YU:

PT (Principal Token): locks in fixed earnings, and you get back the principal + interest at maturity.

YT (Yield Token): can't decide? Buy YT and enjoy the floating dividends of future $YU earnings.

You can also provide liquidity, earn trading fees + incentives, a guaranteed triple yield!

Big move: 6 times Berries rewards 🫐

Yala is ramping up benefits; participating in these strategies can stack up to 6 times Berries (Yala's reward token), this is a chance you can't miss!

Show original6.65K

1

Martain 💤🥕

🚀 @sparkdotfi Core Mechanism Analysis

▸ Platform Positioning: Smartly allocating liquidity to DeFi/CeFi/RWA markets to achieve transparent returns

▸ Three Core Products:

1. Savings: Deposit USDC/USDS/DAI, withdraw earnings anytime (APY 5-8%)

2. SparkLend: Decentralized lending protocol (supports USDS/DAI collateral)

3. Liquidity Layer (ALM): Multi-chain protocol-level capital allocation tool

---

User Operation Guide

① Maximizing Savings Returns

→ Exchange USDC for USDS → Convert to YT/PT USDS via Pendle (automatic interest + earn Points)

→ YT/PT USDS can be re-staked for lending

② Dual Earnings from Lending

→ Collateralize tokens to lend USDC/USDS/DAI

→ Earn returns simultaneously during the lending period

③ $SPK Staking Rewards

→ Airdrop tokens in the first phase of staking

→ Earn returns + Points + eligibility for the second phase airdrop (must hold until August 12)

---

Technical Highlights and Transparency

• SLL Capital Allocation System:

→ Dynamically allocate reserve funds (for withdrawals + investing in RWA/Pendle/CeFi)

→ Real-time tracking of high-yield low-risk targets

• All Data Public:

→ Data Spark panel displays savings/lending/liquidity layer data in real-time

→ $SPK token distribution and circulation are transparent and verifiable

Official Entry:

#Spark #COOKIE @cookiedotfun

Show original

69.53K

108

区块国宝(唯一号)💚

RateX @RateX_Dex is integrated into the Yala DeFi Marketplace, allowing users to trade leveraged yield (YT), lock in fixed returns (PT), and provide liquidity to earn additional rewards, all while simplifying operations through the Yala platform and offering dual incentives of 6x Berries🫐 and 5x RateX points💚.

Yala

Yetis, say hi to @RateX_Dex.

Leverage yield, lock-in fixed returns & farm Berries with high-efficiency strategies on Solana.

Get started here:

7.43K

113

PT price performance in USD

The current price of penguin-tarrif is $0.000020882. Over the last 24 hours, penguin-tarrif has decreased by -91.06%. It currently has a circulating supply of 1,000,000,000 PT and a maximum supply of 1,000,000,000 PT, giving it a fully diluted market cap of $20,882.27. The penguin-tarrif/USD price is updated in real-time.

5m

+0.00%

1h

+9.77%

4h

+8.54%

24h

-91.06%

About Penguin Tarrif (PT)

PT FAQ

What’s the current price of Penguin Tarrif?

The current price of 1 PT is $0.000020882, experiencing a -91.06% change in the past 24 hours.

Can I buy PT on OKX?

No, currently PT is unavailable on OKX. To stay updated on when PT becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of PT fluctuate?

The price of PT fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Penguin Tarrif worth today?

Currently, one Penguin Tarrif is worth $0.000020882. For answers and insight into Penguin Tarrif's price action, you're in the right place. Explore the latest Penguin Tarrif charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Penguin Tarrif, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Penguin Tarrif have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.