This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

PEPE

NEW ROYAL RECORDS CAT price

ATuJfr...3LXL

$0.00022822

+$0.00020058

(+725.68%)

Price change for the last 24 hours

How are you feeling about PEPE today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

PEPE market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$237,792.80

Network

Solana

Circulating supply

999,990,303 PEPE

Token holders

220

Liquidity

$193,268.43

1h volume

$14.09M

4h volume

$14.09M

24h volume

$14.09M

NEW ROYAL RECORDS CAT Feed

The following content is sourced from .

TechFlow

Author: Doc

Compilation: Tim, PANews

The purpose of this article is to give you an idea of how I identify key signals in the market. We need to understand the psychological mechanisms behind risk and use this to our advantage to identify potential market bottoms.

1. The lower the consensus, the first project to collapse

When uncertainty hits, sellers sell off their least bullish assets. For example, coins with low consensus will crash first and lose blood earlier.

Think about it logically: if you need money urgently, you won't sell your valuables, but sell things that you don't usually need and are worthless.

Similarly, when traders are unsure of market movements or want to reduce risk, they tend to sell the assets on which they are least emotionally dependent to cash out.

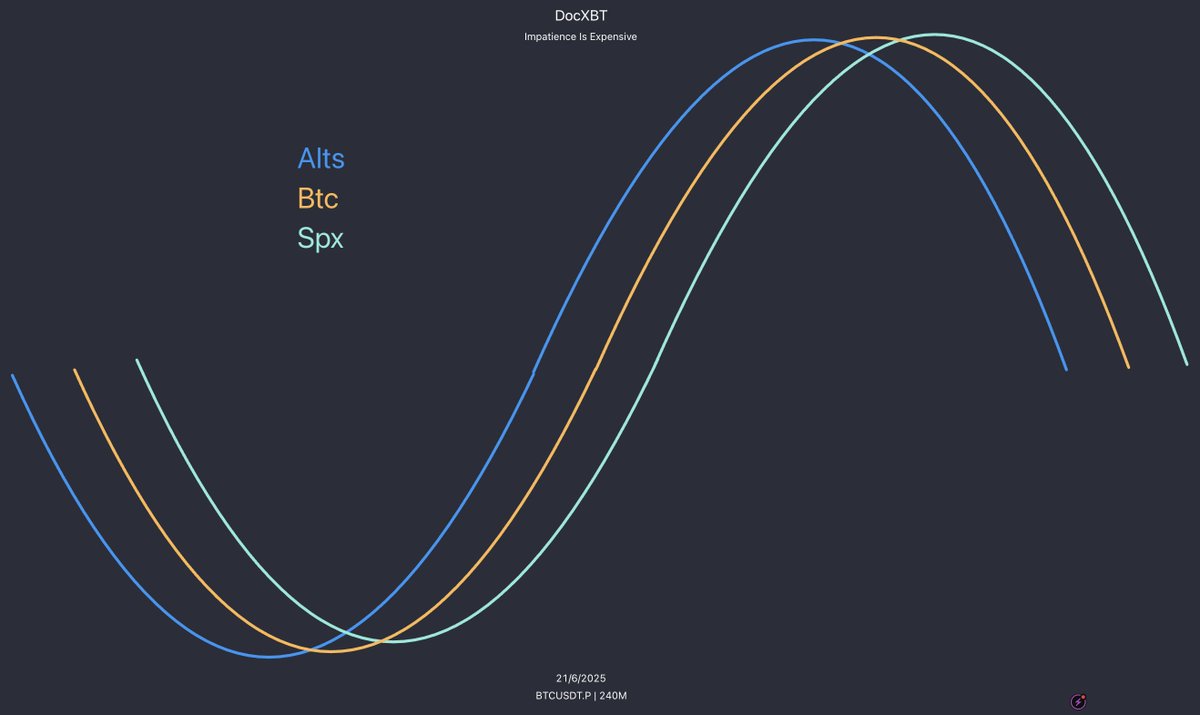

It's no coincidence that this phenomenon happens every time Bitcoin peaks. Altcoins did not rise after Bitcoin reached the top, but rose in tandem with Bitcoin's peak. They showed signs of fatigue in the face of bitcoin earlier, having peaked a few weeks ago.

This is an early warning sign. Smart traders reduce risk before anyone else even notices what's going on.

2. Risk VS Blue Chips

Let's go back to the previous logic: people will keep their cherished high-quality possessions for as long as possible, and will only cut their love when they are desperate.

The most sought-after coins usually try to hold on to their gains as much as possible. That's why Bitcoin always looks strong, and every few weeks before a market crash, the internet is always full of tweets like "What are you panicking, Bitcoin is obviously stable".

Selling Order:

a) First of all, Shittcoins

b) Then there are the blue chips

c) Eventually all coins are sold

3. Reflexivity effects appear

Weakness leads to more weakness.

When whales start to sell in the midst of depleted demand, it induces market weakness. This is typical of the characteristics of the chip distribution stage: lack of pick-up, exhaustion of demand, and the trend of moving away.

The change in the characteristics of risky assets will make the core decision-makers of experienced traders re-evaluate their strategies.

"I couldn't sell at the top, but the nature of the market has changed. It's time to lower your exposure or close your position. "

"If this kind of decline is considered a nuclear explosion-level crash, what mines are still hidden in my account?"

All of a sudden: a position correction triggers a bigger sell-off, which is reflexive, a positive feedback loop in which risk appetite fades.

4. Volatility: The Last Dance

When the Bitcoin crash is approaching, the market is often quiet: volatility plummets, the market fluctuates in a narrow range, and complacency peaks.

Then, bang~, it collapsed.

Now, let's focus on the nature of the market in equilibrium and imbalance.

The equilibrium is achieved when market participants gradually reach a consensus on what is expensive and what is cheap. It's a dance. This is equilibrium.

Equilibrium means calm. Known information has been digested, speculation has weakened, volatility has narrowed.

This dance goes on until one party gets bored, tired, or wants to go to the bar for another drink. i.e., the buyer or seller is exhausted; Or there is a change in supply and demand.

The equilibrium is disrupted. As soon as it is broken: there is an imbalance.

The price deviated sharply from its original position. Values become obscure; Volatility skyrocketed. The market craves balance and will actively seek it.

Prices often return to areas that have recently been overbalanced: such as high volume points, order blocks, composite value zones, etc.

It is in these areas that you will see the most violent rebounds.

"The first test is the best time". The response to subsequent tests will gradually wane. The situation tends to be structured. Prices stabilized at new points. Volatility contraction. Balance reappears in the city.

5. Selling process and bottom identification

Surrender and selling is not the beginning of the endgame, but the end of the middle game.

a) Copycat vs Bitcoin

In this cycle, altcoins tend to complete major sell-offs before the Bitcoin crash.

Recent example: Fartcoin has retreated 88% from its highs before the Bitcoin crash at the end of February. Since this pattern holds, we can use it as a trading signal when looking for a signal of market exhaustion (a sign of a bottom).

While Bitcoin is still volatile and finding a new equilibrium, the strongest altcoins will be the first to show signs of relative strength and exhaustion.

To put it simply, when Bitcoin enters the late stages of imbalance, it should look for high-quality altcoins to build a balanced position.

As participants, our goal is to capture these divergences.

"Is there a shift in market momentum?"

"Is volatility narrowing?"

"Is the pace of selling slowing down?"

"Will Bitcoin still hold steady when it hits new lows?"

Q2 bottoming signals:

Weakened momentum (e.g. Fartcoin)

SFP, deviation (e.g. Hype, Sui public chain)

Higher lows vs. lower bitcoin points (e.g. Pepe)

Altcoins usually fall first, and then slow down when Bitcoin bottoms out.

Here's the trick to spotting a good altcoin.

The weak are always weak.

The strong quietly laid out, preempting the start of the market.

b) Bitcoin VS S&P 500

Now let's arrange a little exercise for everyone.

Combining all the concepts in this article, perhaps the following becomes reasonable:

Summer '23: Bitcoin peaked ahead of the S&P 500 and bottomed earlier

Summer '24: Bitcoin peaked ahead of the S&P 500 and digested the S&P's macro-induced plunge at the low end of the range

25 years to date: Bitcoin peaked ahead of the S&P 500 and withstood a 20% S&P plunge at the low end of the range

Key conclusions:

Market bottoming is a process, not an instant: altcoins come first→ Bitcoin relay → S&P comes behind

Operational Essentials: Focus on observing the evolution of market structure, rather than simply tracking sentiment fluctuations

Show original

9.24K

0

付付

How to capture the bottom signal from the "Shitcoin Collapse -> $BTC Cover Fall-> U.S. Stock Crash".

1) Altcoins are the first to surrender - low-confidence assets are bleeding

- When the risk comes, funds will give priority to abandoning low-consensus coins (such as Meme coins and high-valuation narrative coins), which is like selling idle items for cash;

- Institutions compete for stablecoins, funds migrate to safe-haven crypto assets, and the liquidity of shitcoins dries up;

> If #BTC goes sideways and the cottage continues to fall, it indicates that a large level of risk is coming!

2) The last bastion of the pie is lost - the liquidity crisis is in full swing

- #BTC As digital gold, it is strong to bear the fall, but when institutions are forced to deleverage, the cover of the decline begins.

- The current escalation of the situation in the Middle East (attack on Iranian nuclear facilities + crisis in the Strait of Hormuz), Wall Street's risk aversion triggered a BTC sell-off (24H has fallen 8%);

> #BTC has a correlation of 0.75 with the S&P 500, and BTC could test $93,000 support if U.S. stocks continue to fall (inflation expectations of 5%).

3) The lagged crash of U.S. stocks – the last darkness before the crypto bottom

- The three cycles of 2023-2025 all verify that BTC peaked before U.S. stocks, but bottomed out earlier than U.S. stocks;

- The Fed hinted at only one rate cut in 2025, and deteriorating liquidity expectations weighed on risk assets;

- The passage of the stablecoin bill is good for the long-term hegemony of the US dollar, but it is withdrawn from the market in the short term.

> BlackRock and other institutional ETF holdings account for 3.25% of BTC circulation, and the giant whale may accelerate the formation of a bottom.

🟢 Bottom-buying strategy

1) Altcoin stabilization test:

- Observe whether strong meme coins such as PEPE have BTC falling and the coin price trading sideways;

2) U.S. stock panic peaks:

- If the S&P 500 crashes and then the Vix index rises and falls, the crypto market may be the first to rebound.

> Alts First -> Bitcoin Next -> SPX Last is not only the selling order, but also the bottom map!

> is currently in the middle of BTC covering losses (target 93,000-95,000), patiently waiting for the volatility explosion - > the gold rebound point for rebalancing reconstruction.

It's true that my energy has been a little lower recently, but I have a group of very good friends who have been encouraging me in different ways, and everything will get better and better!!

The same is true for the crypto market, as long as we don't cut the meat and don't have stage fright, the spot is okay

Believe in the power of believing.

Show original

26.16K

21

PEPE price performance in USD

The current price of new-royal-records-cat is $0.00022822. Over the last 24 hours, new-royal-records-cat has increased by +725.68%. It currently has a circulating supply of 999,990,303 PEPE and a maximum supply of 999,990,303 PEPE, giving it a fully diluted market cap of $237,792.80. The new-royal-records-cat/USD price is updated in real-time.

5m

+37.89%

1h

+725.68%

4h

+725.68%

24h

+725.68%

About NEW ROYAL RECORDS CAT (PEPE)

PEPE FAQ

What’s the current price of NEW ROYAL RECORDS CAT?

The current price of 1 PEPE is $0.00022822, experiencing a +725.68% change in the past 24 hours.

Can I buy PEPE on OKX?

No, currently PEPE is unavailable on OKX. To stay updated on when PEPE becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of PEPE fluctuate?

The price of PEPE fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 NEW ROYAL RECORDS CAT worth today?

Currently, one NEW ROYAL RECORDS CAT is worth $0.00022822. For answers and insight into NEW ROYAL RECORDS CAT's price action, you're in the right place. Explore the latest NEW ROYAL RECORDS CAT charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as NEW ROYAL RECORDS CAT, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as NEW ROYAL RECORDS CAT have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.