This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

coin

meme price

Dpf6va...pump

$0.0000063682

+$0.00000

(-0.33%)

Price change for the last 24 hours

How are you feeling about coin today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

coin market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$6,361.20

Network

Solana

Circulating supply

998,898,920 coin

Token holders

2131

Liquidity

$10,795.71

1h volume

$0.00

4h volume

$0.00

24h volume

$1.86

meme Feed

The following content is sourced from .

Jamie

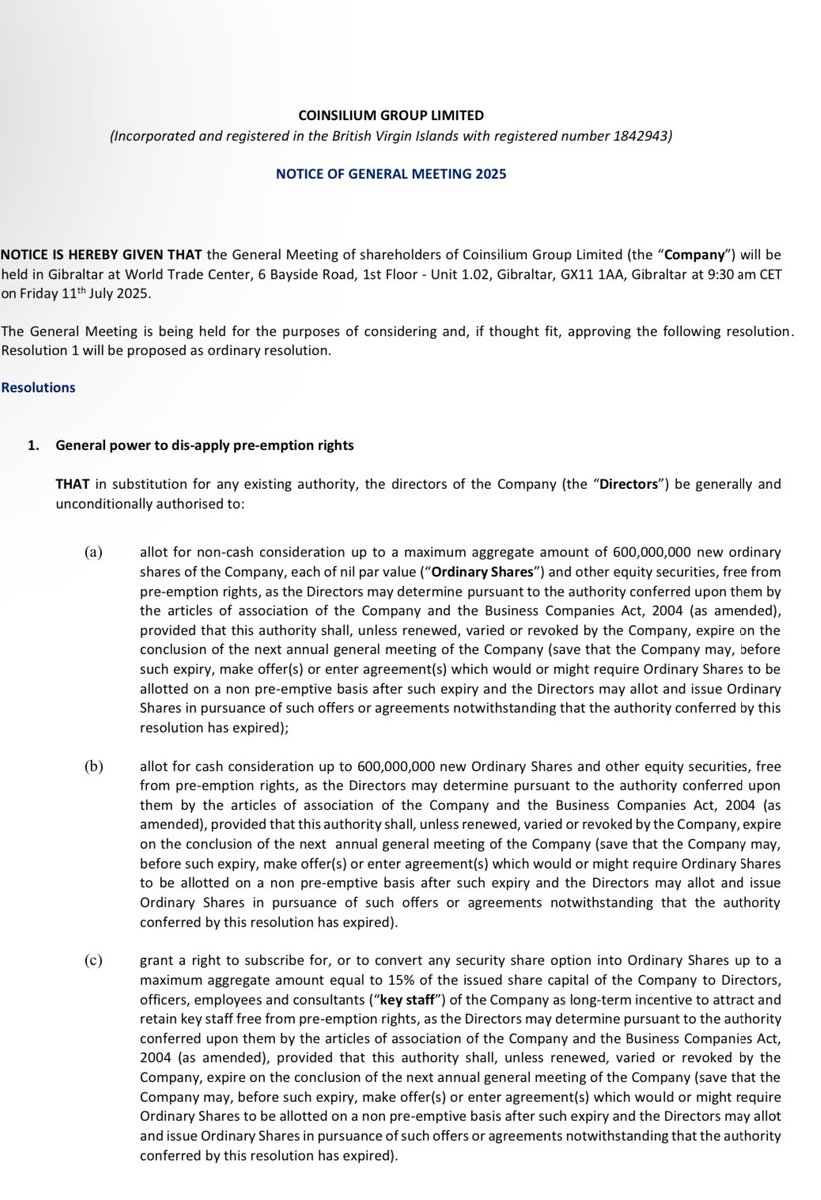

Coinsilium is down 25% today. Why?

I want to reiterate a point I made yesterday (see below) — “good news” doesn’t always translate to immediate positive price action. Look at Metaplanet, down another 6% today (-20% from last week’s high) even after announcing a massive 1,111 BTC buy that propelled them to #8 on the Bitcoin 100 list.

There was imo positive news today. Coinsilium’s announcement for a vote (to disapply pre-emption rights for up to 600m new shares) is the key step to enable a UK subscription agreement, similar to the ATM facility recently launched by $SWC. Yes, this is potential dilution but it’s “accretive dilution” as it allows them to convert premium mNAV into BTC.

Moreover, zoom out. $COIN has rallied from 5p to 80p in just one month — a 16x move. Large pullbacks are both expected and healthy. Periods of volatility within an upward trend are essential — they drive liquidity, attract new participants, and elevate both realized and implied volatility profiles. This is particularly important for strategic initiatives like potential future convertible bond offerings. A key factor behind the strong uptake of MSTR’s previous convertible offerings was due to their realized and implied vol profiles - volatility is vitality!

Show original

726

0

Blockbeats

Original title: "In addition to BTC and ETH, what is the best crypto investment target in 3-5 years in the eyes of these bigwigs?" 》

Original source: TechFlow

"If you had to buy liquid/non-risky cryptocurrencies in a 3-5 year timeframe and were not allowed to buy BTC, ETH, HYPE, SOL or hold stablecoins, what would you buy? Why?"

On June 22, the well-known crypto KOL @Cobie raised the above question on X.

Crypto KOLs, traders, and VC investors have given their "wealth passwords" in the comment area.

We've taken a look at the opinions and choices of some of the biggest names in the industry to see if there's anything you're interested in.

Head of Base jesse.base.eth: Coinbase ($COIN)

Bullish on $COIN (Coinbase) because: (1) it has an incredibly diverse and robust product line that has formed a scaled user base and market-leading brands; (2) It is one of the most executing and visionary on-chain teams in this space, and perhaps even the strongest.

Crypto KOL Ansem: Worldcoin ($WLD)

Hedge OpenAI/Altman's risk in winning the AI race and monitor countries. In the post-AGI era, we need a verifiable way to distinguish between who is human and who is AI. If OpenAI were going to do something with their vast database of individuals in the future, it would most likely have something to do with decentralized identity (WLD).

AllianceDAO Founder qw: A token with strong revenue

In the 3-5 year timeframe, the only correct answer is a token with strong (future) revenue that is currently trading at a reasonable multiple.

Everything else will go to zero. Monetary premiums other than Bitcoin are a thing of the past.

Crypto trader Auri: Starknet ($STRK)

If you think decentralization and privacy are important, follow Starknet

Current Status:

- As an Ethereum L2, it can compete with Solana in terms of TPS (transactions per second).

- Deliver a top-tier user experience with unique AA (Account Abstraction) features and on-chain performance

- Relatively low valuation (fully diluted valuation of $1 billion vs. $3 billion for Arbitrum/Optimism)

There are three paths to success:

- Become a generic layer

- Bitcoin L2 (if settlement on Bitcoin becomes feasible and efficient), this alone I think could multiply Starknet's valuation several times

- If all other paths fail, it can be used as backend infrastructure for other on-chain applications

Mert, founder of Helius Labs: Jito ($JTO), Zcash ($ZEC)

JTO—If you believe that SOL will be around in the next 3-5 years (and it is), then that's pretty self-explanatory

Zcash — I think the privacy coin is coming back, and the chain is about to be redesigned under the new lab body, which is impressive from a technical standpoint

Alex Svanevik, founder of Nansen: Building L1 portfolios

Build a diverse portfolio of Layer 1 (L1) blockchain assets to achieve long-term investment returns. There are already BTC, ETH, HYPE, SOL, and new BNB, SUI, APT, TRX, AVAX, a total of 9 assets, covering mainstream and potential public chains, and staking all assets to obtain about 4.5% annualized return.

Crypto KOL Fishy Catfish: Chainlink ($Link)

Chainlink has maintained its top dominance in terms of market share and security for 6 years (even higher than in 2021)

Real-world asset (RWA) tokenization and stablecoins are two of the largest marketplaces for utility use cases, and Chainlink provides a complete platform for data, connectivity, and computing services in both areas.

Chainlink has been years ahead of its competitors in serving TradFi demand:

A. Coming soon to an automated compliance engine (ACE): Proof of Identity, Proof of Onboarding, Accredited Investor Verification and Sanctions Checks

B. Coming soon to CCID: Cross-Chain Identity System

C. Chainlink has a complete privacy suite (CCIP Private Transactions, Blockchain Privacy Manager, DECO (patented zkTLS))

In addition, it is well ahead of other competitors (including SWIFT, DTCC, JPMorgan Chase, ANZ, UBS, etc.) in terms of traditional finance adoption

Blockchain capture is decreasing, while Chainlink and applications are increasing. For example, the liquidation arbitrage MEV generated by oracle updates, which was previously owned by blockchain validators, is now shared by Chainlink and Aave.

Crypto KOL Murad: $SPX

Why: SPX, as the first "Movement Coin", aims to disrupt the entire stock market. The impact of SPX on GME is comparable to that of BTC on gold, if not worse. It's arguably the most passionate community on crypto Twitter, and it's still in its early stages. It is the only "meme" coin with a real mission. It's the perfect meme vehicle to represent a cultural pushback to the millennial dilemmas and challenges faced by Gen Z around the world. It merges finance with the spiritual world and targets a larger potential market than any other crypto asset ever before. As millions of people begin to lose their jobs and meanings, many will seek tokenized digital shelters, which are one of the strongest rising forces.

APG Capital Trader Awawat: $BNB, $LEO, $AAVE, $MKR, $XMR

Considering this time span, only a few options make sense:

· PAXG/XAUT (Gold Token), it's easy to see why

· BNB/LEO, the upside is limited but the downside risk is also small

· AAVE/MKR: It should be here to stay

· XMR (Monero)

Many of the responses are pitching their portfolios, but objectively speaking, those coins will go to zero over this time horizon

Crypto KOL W3Q: $HOOD, $TSLA

In 5 years, with the exception of Bitcoin, the pure cryptocurrency space will not consider holding.

$HOOD (Robinhood) - Shovels and pickaxes (infrastructure) in retail finance

From betting to mortgages to scaling crypto products, they're moving into all the money-making verticals and have a better user experience and distribution channels than most.

$TSLA (Tesla) - The field of AI robotics covers both software and hardware. Musk may be interested in cryptocurrencies again in the next hype cycle.

If not subject to self-custody, it will be selected

Bitcoin ETF with 2x leverage

Use a portion of your portfolio layout at market cycle lows or extreme sell-offs.

Vance Spencer, Partner, Framework Ventures: $SKY

$SKY, it's important to note that it's not currently on any CEXs.

Arthur, founder of DeFiance Capital: $AAVE, $ENA, $PENDLE, $JUP

The above are their investment choices, so what do you see as a long-term investment target for 3-5 years?

Link to original article

Show original

5.7K

0

TechFlow

"If you had to buy liquid/non-risky cryptocurrencies in a 3-5 year timeframe, and you weren't allowed to buy BTC, ETH, HYPE, SOL, or hold stablecoins, what would you buy? Why? ”

On June 22, the well-known crypto KOL @Cobie raised the above question on X.

Crypto KOLs, traders, and VC investors have given their "wealth passwords" in the comment area.

We've taken a look at the opinions and choices of some of the biggest names in the industry to see if there's anything you're interested in.

Head of Base jesse.base.eth: Coinbase ($COIN)

Bullish on $COIN (Coinbase) because: (1) it has an incredibly diverse and robust product line that has formed a scaled user base and market-leading brands; (2) It is one of the most executing and visionary on-chain teams in this space, and perhaps even the strongest.

Crypto KOL Ansem: Worldcoin ($WLD)

Hedge OpenAI/Altman's risk in winning the AI race and monitor countries. In the post-AGI era, we need a verifiable way to distinguish between who is human and who is AI. If OpenAI were going to do something with their vast database of individuals in the future, it would most likely have something to do with decentralized identity (WLD).

AllianceDAO founder qw: A token with strong revenue

In the 3-5 year timeframe, the only correct answer is a token with strong (future) revenue that is currently trading at a reasonable multiple.

Everything else will go to zero. Monetary premiums other than Bitcoin are a thing of the past.

Crypto trader Auri: Starknet ($STRK)

If you think decentralization and privacy are important, follow Starknet

Current Status:

- As an Ethereum L2, it can compete with Solana in terms of TPS (transactions per second).

- Deliver a top-tier user experience with unique AA (Account Abstraction) features and on-chain performance

- Relatively low valuation (fully diluted valuation of $1 billion vs. $3 billion for Arbitrum/Optimism)

There are three paths to success:

- Become a generic layer

- Bitcoin L2 (if settlement on Bitcoin becomes feasible and efficient), this alone I think could multiply Starknet's valuation several times

- If all other paths fail, it can be used as backend infrastructure for other on-chain applications

Mert, founder of Helius Labs: Jito ($JTO), Zcash ($ZEC)

JTO — If you believe that SOL is here to be around in the next 3-5 years (and it is), then that's pretty self-explanatory

Zcash — I think the privacy coin is coming back, and that's impressive from a technical point of view, with the chain being redesigned under the new lab body

Alex Svanevik, founder of Nansen: Building the L1 portfolio

Build a diverse portfolio of Layer 1 (L1) blockchain assets to achieve long-term investment returns. There are already BTC, ETH, HYPE, SOL, and new BNB, SUI, APT, TRX, AVAX, a total of 9 assets, covering mainstream and potential public chains, and staking all assets to obtain about 4.5% annualized return.

Crypto KOL Fishy Catfish: Chainlink ($Link)

Chainlink has maintained its top dominance in terms of market share and security for 6 years (even higher than in 2021)

Real-world asset (RWA) tokenization and stablecoins are two of the largest marketplaces for utility use cases, and Chainlink provides a complete platform for data, connectivity, and computing services in both areas.

Chainlink has been leading the competition for several years in serving TradFi needs:

A. Coming soon to an automated compliance engine (ACE): Proof of Identity, Proof of Onboarding, Accredited Investor Verification and Sanctions Checks

B. Coming soon to CCID: Cross-Chain Identity System

C. Chainlink has a complete privacy suite (CCIP Private Transactions, Blockchain Privacy Manager, DECO (patented zkTLS))

In addition, it is well ahead of other competitors (including SWIFT, DTCC, JPMorgan Chase, ANZ, UBS, etc.) in terms of traditional finance adoption

Blockchain value capture is decreasing, and value capture for Chainlink and applications is increasing. For example, the liquidation arbitrage MEV generated by oracle updates, which was previously owned by blockchain validators, is now shared by Chainlink and Aave.

Crypto KOL Murad: $SPX

Why: SPX, as the first "Movement Coin", aims to disrupt the entire stock market. The impact of SPX on GME is comparable to that of BTC on gold, if not worse. It's arguably the most passionate community on crypto Twitter, and it's still in its early stages. It is the only "meme" coin that has a real mission. It's the perfect meme vehicle to represent a cultural pushback to the millennial dilemmas and challenges faced by Gen Z around the world. It merges finance with the spiritual world and targets a larger potential market than any other crypto asset ever before. As millions of people begin to lose their jobs and meanings, many will seek tokenized digital shelters, which are one of the strongest rising forces.

APG Capital Trader Awawat: $BNB, $LEO, $AAVE, $MKR, $XMR

Considering this time span, only a few options make sense:

PAXG/XAUT (Gold Token), it's easy to see why

BNB/LEO, the upside is limited but the downside risk is also small

AAVE/MKR: It should be here to stay

XMR (Monero)

Many of the responses are pitching their portfolios, but objectively speaking, those coins will go to zero over this time horizon

Crypto KOL W3Q: $HOOD, $TSLA

In 5 years, except for Bitcoin, the pure cryptocurrency space will not consider holding.

$HOOD (Robinhood) - Shovels and pickaxes (infrastructure) in retail finance

From betting to mortgages to scaling crypto products, they're moving into all the money-making verticals and have a better user experience and distribution channels than most.

$TSLA (Tesla) - The field of AI robotics covers both software and hardware. Musk may be interested in cryptocurrencies again in the next hype cycle.

If not subject to self-custody, it will be selected

Bitcoin ETF with 2x leverage

Use a portion of your portfolio layout at market cycle lows or extreme sell-offs.

Vance Spencer, Partner, Framework Ventures: $SKY

$SKY, it's important to note that it's not currently on any CEXs.

Arthur, founder of DeFiance Capital: $AAVE, $ENA, $PENDLE, $JUP

The above are their investment choices, so what do you see as a long-term investment target for 3-5 years?

Show original

14.57K

0

Thomas Braziel

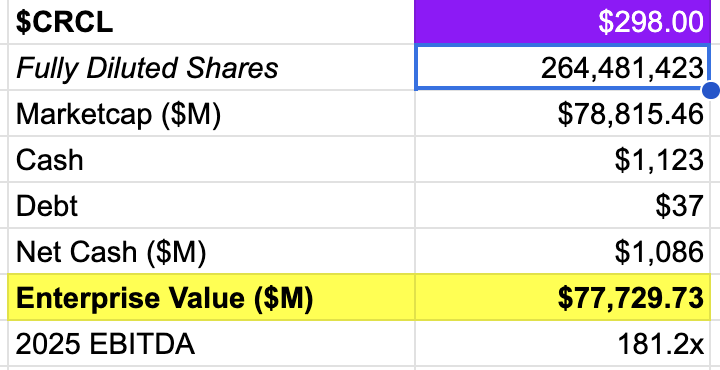

$COIN is a clear buy here, long $COIN <> short $CRCL

@coinbase can spin up a tracking stock linked to its USDC rev-share with @circle - It could surface a steady, rate-driven cash machine the market’s burying inside $COIN—yet management keeps the core empire intact. 🧐 #USDC #Stablecoins #FinTwit

Rob Hadick >|<

On a fully diluted basis, at this morning's high, Circle's market cap flipped Coinbase, the company that gets over 50% of their gross revenue.

10.28K

14

币到家 BDJ

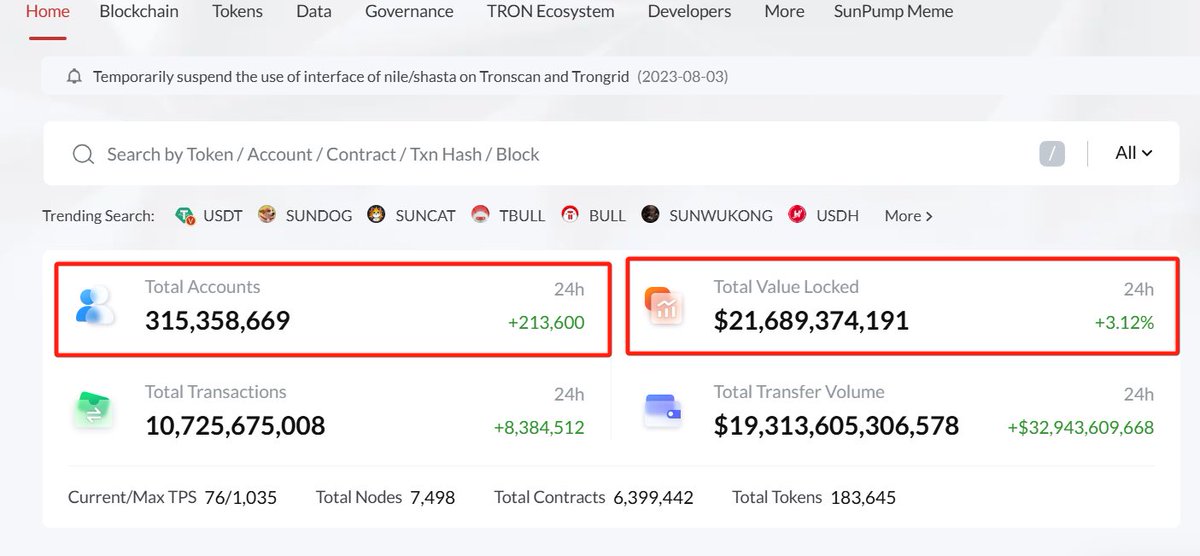

Brother Sun's every breakthrough in the direction brings reasonable and evidence-based practical support and future trends that most people can't understand; This month, SRM Entertainment, the "Tron Micro Strategy", officially completed the backdoor listing of the U.S. stocks, and everyone thinks that this is to emulate MicroStrategy, but the real significance lies in the fact that the blockchain market based on the TRON (trx) ecology has once again entered the traditional capital market, and New money attracts old money, behind which is Brother Sun's determination to vigorously promote the TRON ecosystem. This is just the beginning!

The current situation in the currency circle is very clear, and the Trump family's policy for the currency circle is favorable, which also indicates that the next four years of cryptocurrencies will be dominated by web2 + web3, but the compliance of the currency circle is a very big problem, and the emergence of SRM Entertainment solves this problem

Why SRM Entertainment is just getting started, you can take a look at two worthy references: MicroStrategy (BTC) and coinbase (coin, Circle) and some keywords: TRON (TRX), HTX, USDT, USDD

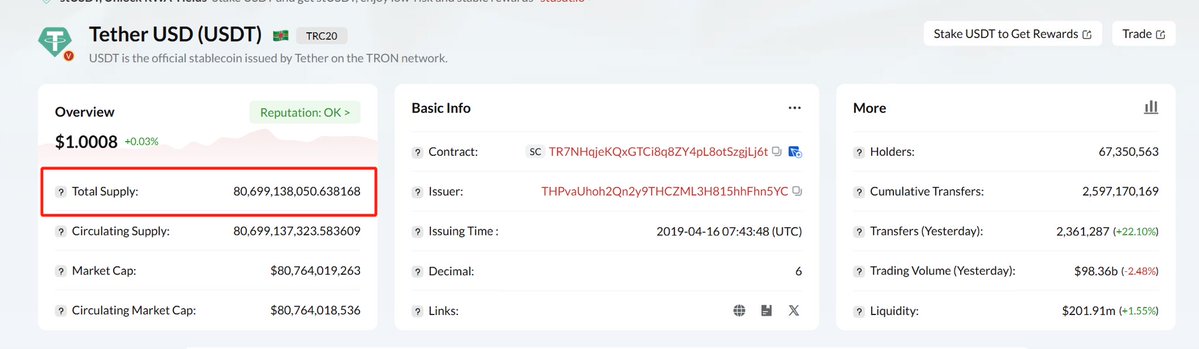

TRON: The world's top three public chains, with 310 million+ users, 21.7 billion TVL, and the top 8 in the market capitalization of token trx

HTX: Ranked among the top three in the world by trading volume of euro stablecoins, and was selected as one of the 25 most trusted crypto exchanges in the world by Forbes in 2025

USDT: The supply of TRON is 80.69 billion, and the global supply is about 155.95 billion, accounting for 51.74%, and more than half of the USDT in the currency circle is on TRON

USDD: 390 million supply, 378,000 holders,

The importance of these important assets in the currency circle is self-evident, and their correlation is also supporting the development of the entire ecology to a larger space, and the positive flywheel constitutes a powerful system of the ecology, so after SRM Entertainment officially started, it is also very strong, and the well-deserved hot spot in the crypto sector has doubled in just a few days, and we look forward to Brother Sun bringing us greater surprises.

@justinsuntron @HTX_Molly @qingyang007

Show original

23.87K

70

coin price performance in USD

The current price of meme is $0.0000063682. Over the last 24 hours, meme has decreased by -0.33%. It currently has a circulating supply of 998,898,920 coin and a maximum supply of 998,898,920 coin, giving it a fully diluted market cap of $6,361.20. The meme/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

+0.00%

24h

-0.33%

About meme (coin)

Latest news about meme (coin)

Token That’s Literally USELESS Is Crypto’s Latest Meme Cult

In a flat market, where most tokens promise the moon and deliver a tweet, USELESS has found its niche: no promises, no pretenses — just a meme that’s worth tens of millions.

18 Jun 2025|CoinDesk

X accounts tied to Pump.fun, ElizaOS, and GMGN suspended

Several X accounts associated with meme coin launchpad Pump.fun and open-source operating system ElizaOS were...

17 Jun 2025|Crypto Briefing

Dogecoin Drops 7% After Brief Rally Amid Rising Hopes of a DOGE ETF

Market volatility intensifies as meme token faces critical resistance levels amid institutional interest.

12 Jun 2025|CoinDesk

Learn more about meme (coin)

Meme Coins: The High-Risk, High-Reward Crypto Trend Shaping the Future of Digital Assets

Can Meme Coins Make You Rich? Exploring the Potential and Risks The Rise of Meme Coins in the Crypto Space Meme coins have become a captivating phenomenon in the cryptocurrency world, blending internet culture with blockchain technology. These digital assets, often inspired by viral memes, have gained immense popularity due to their community-driven nature and potential for explosive returns. From Dogecoin’s rise to Shiba Inu’s staggering gains, meme coins have demonstrated their ability to create wealth—but not without significant risks. This article delves into the dynamics of meme coins, their potential, challenges, and strategies for navigating this volatile market.

23 Jun 2025|OKX

Meme Coins in 2025: From Internet Jokes to Blockchain Powerhouses

Overview of the Meme Coin Market and Its Growth Potential Meme coins, once dismissed as mere internet jokes, have evolved into a significant segment of the cryptocurrency market. With a total market capitalization exceeding $75 billion, these tokens are no longer a passing trend. Their growth is fueled by strong community engagement, viral marketing, and the integration of real-world utility. As we move into 2025, meme coins are proving their staying power, attracting both retail and institutional investors.

23 Jun 2025|OKX

Pepe Coin: The Meme Coin Revolution and Its Deflationary Tokenomics Explained

Can PEPE Coin Reach $1? A Comprehensive Analysis Introduction to Pepe Coin and Its Meme Origins Pepe Coin, launched in April 2023, is a cryptocurrency inspired by the iconic 'Pepe the Frog' meme. This meme, which originated in the early 2000s, has become a symbol of internet culture, humor, and, at times, controversy. By leveraging its cultural relevance, Pepe Coin has attracted a community of meme enthusiasts and speculative investors. Unlike traditional cryptocurrencies, Pepe Coin thrives on social media trends, hype, and community engagement rather than intrinsic utility or technological innovation.

23 Jun 2025|OKX

Memecoins Unleashed: How Community, Tokenomics, and Social Media Drive Viral Success

Introduction to Memecoins: The Internet's Favorite Cryptocurrencies Memecoins have become a cultural phenomenon in the cryptocurrency world, blending humor, internet culture, and community-driven hype. Unlike traditional cryptocurrencies that derive value from utility or technological innovation, memecoins thrive on virality and social engagement. From Dogecoin to Shiba Inu, these tokens have demonstrated the power of online communities in shaping financial markets. But what drives memecoins' success, and how can investors identify the next big opportunity in this volatile yet exciting space?

23 Jun 2025|OKX

coin FAQ

What’s the current price of meme?

The current price of 1 coin is $0.0000063682, experiencing a -0.33% change in the past 24 hours.

Can I buy coin on OKX?

No, currently coin is unavailable on OKX. To stay updated on when coin becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of coin fluctuate?

The price of coin fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 meme worth today?

Currently, one meme is worth $0.0000063682. For answers and insight into meme's price action, you're in the right place. Explore the latest meme charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as meme, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as meme have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.