COMP

Compound price

$45.1200

-$1.2000

(-2.60%)

Price change for the last 24 hours

Compound market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$418.48M

Circulating supply

9,287,086 COMP

92.87% of

10,000,000 COMP

Market cap ranking

43

Audits

Last audit: 8 Apr 2021, (UTC+8)

24h high

$47.1300

24h low

$43.5400

All-time high

$911.64

-95.06% (-$866.52)

Last updated: 12 May 2021, (UTC+8)

All-time low

$22.7600

+98.24% (+$22.3600)

Last updated: 10 Jun 2023, (UTC+8)

How are you feeling about COMP today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Compound Feed

The following content is sourced from .

The Data Nerd

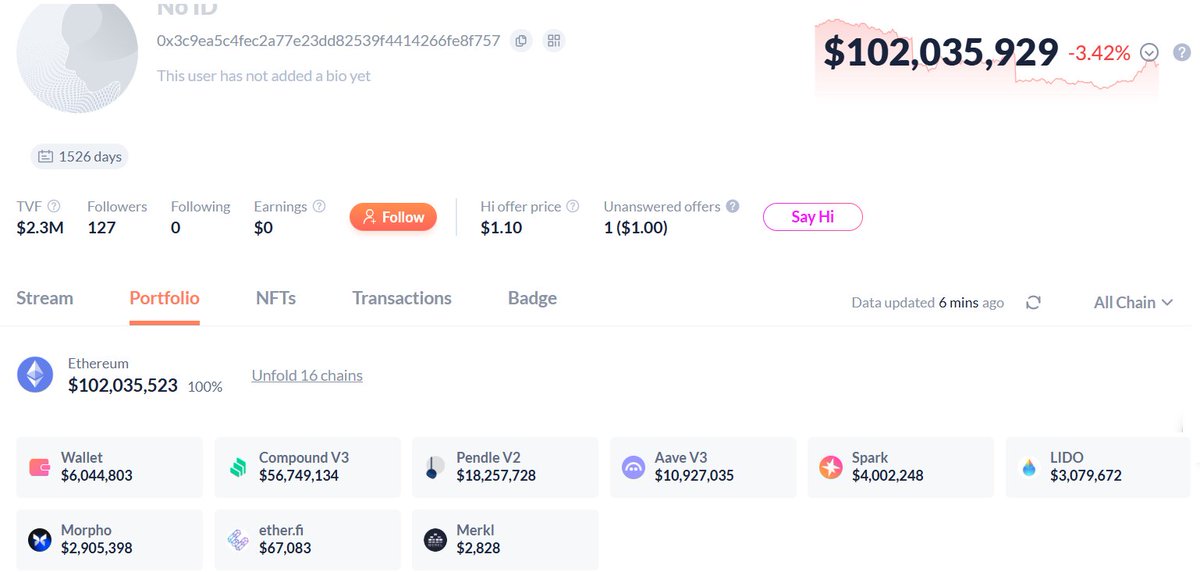

Within 24 hours, this $100M Whale 0x3c9 deposited 2k $ETH (~$5.04M) into #Binance.

This whale is a king of DEFI with a lot of assets in different protocols:

- $56.75M in #Compound

- $18.26M in #Pendle

- $10.93M in #AAVE

- $10M totally in #Spark, #Morpho and #LDO

Address:

Show original

23.72K

1

丰密KuiGas🔆

It's a bit hanging, and you can pick up your hair when you say a word

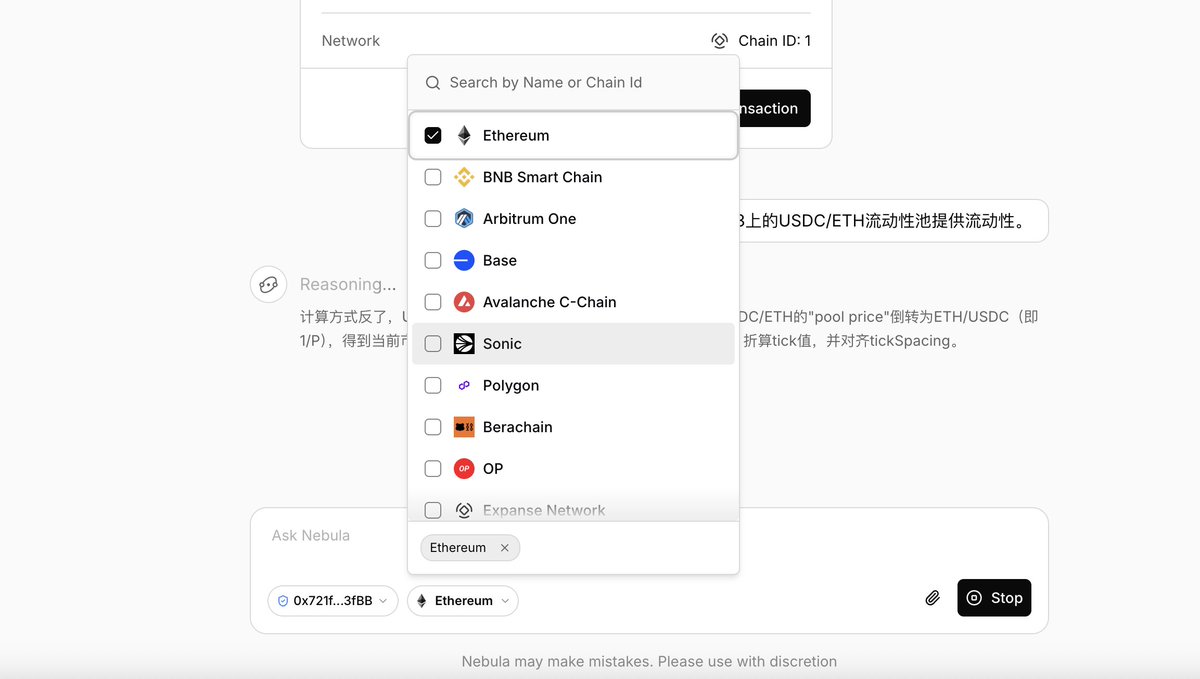

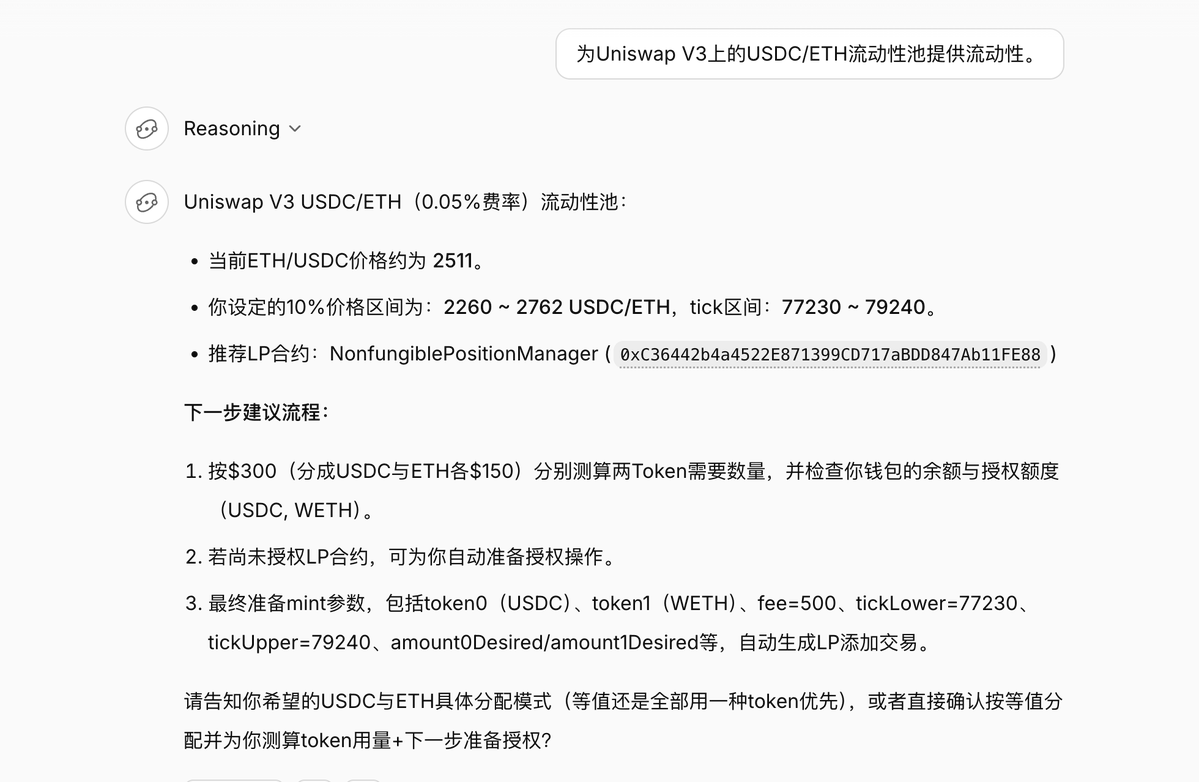

Thirdweb launches Nebula v0.1, a DeFi Ai product, with the core of simplifying complex on-chain financial operations into "natural language conversational interactions".

Meaning: Use spoken instructions to help you operate DeFi protocols, such as currency swaps, lending, market making, and asset management, without the need to manually click back and forth.

Make complex on-chain financial operations as easy as chatting with ChatGPT.

Use:

✅ Arbitrary chain asset swaps and bridges

> cross-chain bridging + token swaps

> example is the phrase: "Swap my 100 USDC on Ethereum for ETH on Optimism" to perform a cross-chain operation.

✅ Intelligent operation of lending protocols

> has built-in support for 50+ DeFi protocols, such as: Uniswap, Aave, Compound, Curve, Balancer, Lido, etc.

> can directly operate with words, such as: "Lend my WETH to Aave and stake USDC"

✅ Intelligently manage liquidity positions

> you could say: providing liquidity for the USDC/ETH liquidity pool on Uniswap V3.

> it automatically finds the best parameters, authorizes the token, sets the range, and submits the transaction.

✅ Perform complex operations in one sentence:

"Check my aUSDC balance" → to check the balance of borrowed and borrowed assets

"Collect fees" → collect all LP revenues

"Remove my position" → to undo all liquidity

"Burn my unused NFTs" → clean up your wallet of useless NFTs

I don't know much about code personally, but it's interesting to take a look at it, and a few highlights below 👇

1. Support full-chain support: L1 + L2 network full coverage

2. AI intelligent understanding + execution of transactions: There is no longer a need to open multiple DApps, calculate slippage, process authorization, sign and other cumbersome steps

3. Suitable for beginners and veterans: new users can easily complete complex operations, and experts can execute strategies more efficiently.

Thirdweb @thirdweb is a Web3 development platform, in fact, Thirdweb has always been a very well-known platform for deploying tokens and NFTs. I've been tracking me for a long time.

The project was @HaunVentures by @katie_haun-led Haun Ventures, the queen of crypto, who was once the general partner of the famous a16z.

Practical operation:

Open it

1. Find a network with low gas, L2 that has not issued coins, such as BASE and Linea

2. Connect the wallet and try a small amount.

3. A few blind instructions, operated by Thirdweb Nebula. This is Defi Ai

If you lose a bit of gas @kuigas, that's normal. If you lose some money, that's normal

thirdweb

LAUNCH 🚀

AI for DeFi.

◆ Swap/bridge any token on any chain

◆ Use 50+ lending protocols on L1s and L2s

◆ Create, manage and earn rewards from liquidity positions

Manage your money with natural language.

89.6K

63

ChainCatcher 链捕手

1. Project Introduction

Spark Protocol is a blockchain-based decentralized lending platform that aims to enable intermediary-free asset lending through smart contracts. Users can obtain loans by staking digital assets (such as ETH, BTC, etc.), and the interest rate and collateral ratio are automatically adjusted by market supply and demand

The core advantage of Spark Protocol is its decentralized architecture, which allows users to efficiently borrow and manage their assets without relying on traditional financial institutions. This model not only improves the efficiency of lending, but also ensures the safety of users' funds

2. Market background and trends

With the rapid development of decentralized finance (DeFi), the demand for decentralized lending continues to grow globally. According to a report by QYResearch, the global NFT lending decentralized application market size is expected to reach $15 billion by 2025, with a compound annual growth rate (CAGR) of 25%. This trend shows that the decentralized lending market is experiencing explosive growth.

In addition, many mainstream DeFi protocols (such as Aave, Compound, Synthetix, etc.) have proven the viability of decentralized lending and have attracted the attention of a large number of institutional and individual investors. Spark Protocol, as an emerging decentralized lending protocol, is poised to occupy a place in this wave.

3. Project Highlights

Decentralized architecture

Spark Protocol uses smart contract technology, which allows users to borrow and borrow directly on-chain without relying on third-party intermediaries. This model not only increases transparency, but also reduces transaction costs

Dynamic pricing mechanism

Spark Protocol's interest rate and collateral ratio are automatically adjusted by market supply and demand, ensuring liquidity in the lending market. This mechanism helps to avoid price manipulation and market manipulation

Multi-asset support

Spark Protocol supports a variety of crypto assets as collateral, including Bitcoin, Ethereum, stablecoins, and more. This flexibility allows users to choose the right collateral asset for their needs

Security & Compliance

Spark Protocol uses advanced encryption technology and a decentralized governance model to ensure the security and compliance of the system. In addition, the project team worked with a number of compliance agencies to ensure that their operations met regulatory requirements

Fourth, industry analysis

According to Chainalysis, the total trading volume of the global DeFi lending market in 2024 will exceed $100 billion, with decentralized lending accounting for a large proportion. This data shows that decentralized lending is becoming one of the mainstream financial models.

In addition, many emerging decentralized lending protocols (such as Freatic, Exactly Protocol, etc.) are constantly optimizing their products and services to meet the market's demand for efficient, secure, and transparent lending.

As an emerging representative, Spark Protocol has a good technical foundation and market potential, and is expected to achieve greater development in the next few years.

5. Risks and challenges

Despite the promising D&R market, Spark Protocol also faces some challenges:

Regulatory uncertainty

The regulatory policies for DeFi in each country are not yet clear, which may affect the long-term development of the project. Spark Protocol needs to keep a close eye on policy changes and take compliance measures accordingly

Market volatility

The decentralized lending market is highly dependent on the price fluctuations of crypto assets. If the price of the collateral asset falls significantly, the user may be exposed to liquidation risk. Spark Protocol needs to mitigate this risk through dynamic pricing mechanisms and risk management strategies

Competition is fierce

Currently, there are several mature decentralized lending protocols in the market, such as Aave, Compound, etc. Spark Protocol needs to attract users through differentiated products and services

6. Summary and outlook

Spark Protocol is a potentially decentralized lending protocol that stands out from the competitive DeFi market with its decentralized architecture, dynamic pricing mechanism, and multi-asset support. As global interest in decentralized finance continues to grow, Spark Protocol is poised for even greater growth in the coming years.

For investors, Spark Protocol provides a low-barrier, high-transparency lending platform that is worth paying attention to and researching. At the same time, investors should also pay close attention to its compliance, market performance, and competitive environment to make informed investment decisions.

Show original25.08K

0

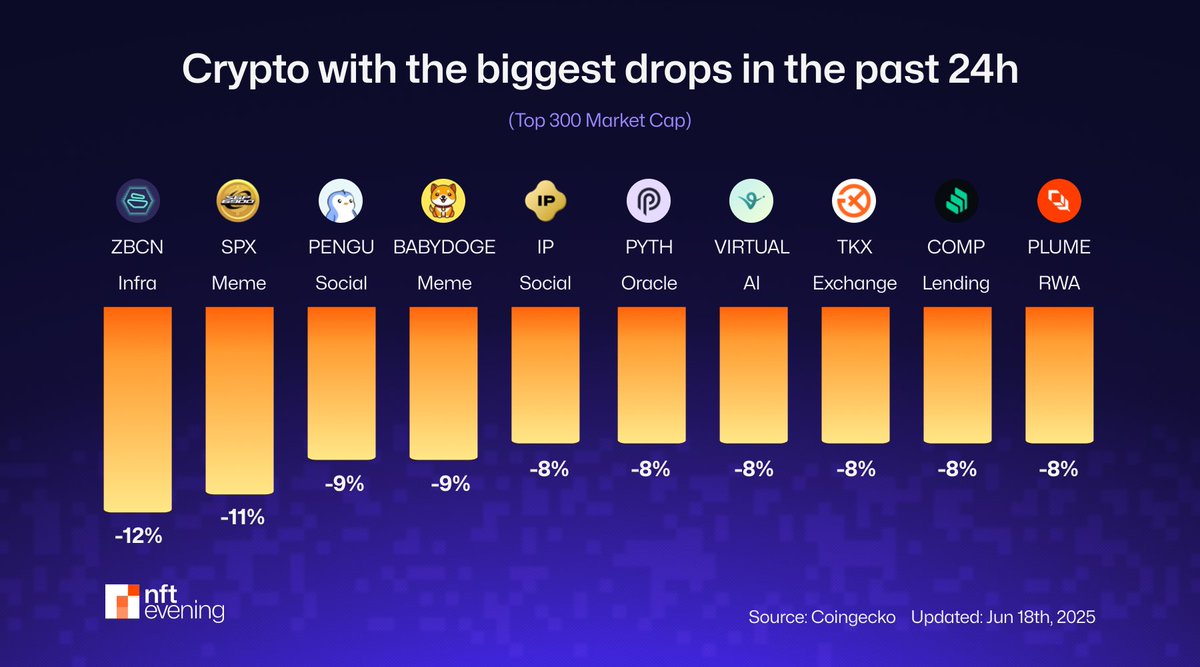

NFTevening ɢᴍ

🚨 Biggest drops in the Past 24h — Pain or Opportunity? 🔻

From $ZBCN to $COMP, even solid narratives like Infra, AI & Lending took a hit.

But in every dip lies a question: Is this panic or prime accumulation? 🧠

Which one are you watching for that bounce? 👇

- @Zebec_HQ

- #SPX6900

- @pudgypenguins | $PENGU

- @BabyDogeCoin | #BABYDOGE

- @StoryProtocol | $IP

- @PythNetwork | $PYTH

- @virtuals_io | #VIRTUAL

- @TokenizeXchange | $TKX

- @Compound

- @plumenetwork | $PLUME

Show original

81.55K

11

Convert USD to COMP

Compound price performance in USD

The current price of Compound is $45.1200. Over the last 24 hours, Compound has decreased by -2.59%. It currently has a circulating supply of 9,287,086 COMP and a maximum supply of 10,000,000 COMP, giving it a fully diluted market cap of $418.48M. At present, Compound holds the 43 position in market cap rankings. The Compound/USD price is updated in real-time.

Today

-$1.2000

-2.60%

7 days

-$7.6000

-14.42%

30 days

+$3.0000

+7.12%

3 months

+$0.59000

+1.32%

Popular Compound conversions

Last updated: 23/06/2025, 07:44

| 1 COMP to USD | $45.0600 |

| 1 COMP to SGD | $58.0753 |

| 1 COMP to PHP | ₱2,576.17 |

| 1 COMP to EUR | €39.3142 |

| 1 COMP to IDR | Rp 739,780.0 |

| 1 COMP to GBP | £33.6274 |

| 1 COMP to CAD | $62.0113 |

| 1 COMP to AED | AED 165.48 |

About Compound (COMP)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Compound FAQ

How much is 1 Compound worth today?

Currently, one Compound is worth $45.1200. For answers and insight into Compound's price action, you're in the right place. Explore the latest Compound charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Compound, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Compound have been created as well.

Will the price of Compound go up today?

Check out our Compound price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Convert USD to COMP

Socials