What’s happening at @0xPolygon lately feels like a convergence point.

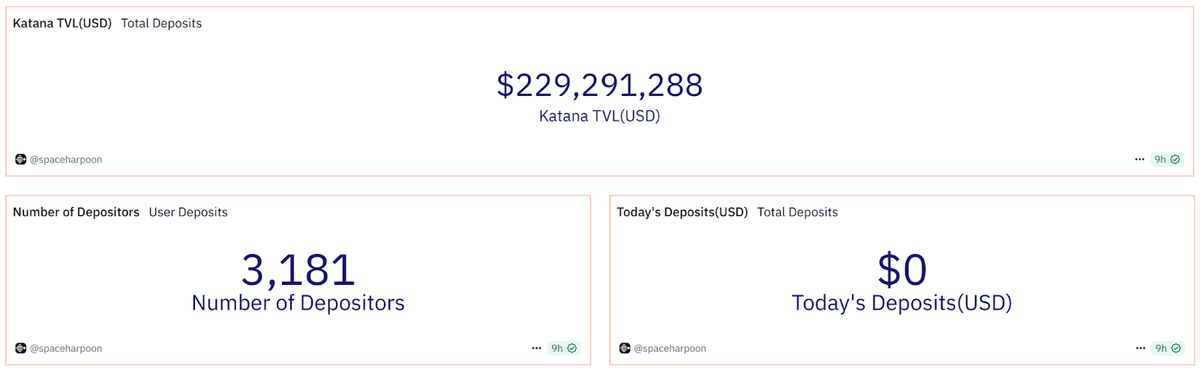

From MATIC → POL, to EIP-7702 support, to $200M productive TVL on Katana.

@sandeepnailwal, your fingerprints are all over this rollout! 👇

1. 𝐅𝐫𝐨𝐦 𝐌𝐀𝐓𝐈𝐂 𝐭𝐨 𝐏𝐎𝐋

Everything started here: the shift from MATIC to POL wasn’t a rebrand but a structural upgrade.

POL now powers gas and staking on Polygon PoS, fully backwards compatible so apps, users, and validators transition without friction.

Beyond that, it sets the foundation for a multi-chain staking layer.

Emissions (2% over 10 years) are designed to fund validator rewards and community grants, both governed by the community itself.

A simple 1:1 swap on paper, but a much bigger step under the hood.

2. 𝐁𝐡𝐢𝐥𝐚𝐢 𝐇𝐚𝐫𝐝𝐟𝐨𝐫𝐤

The Bhilai hardfork went live July 1st and it's seriously a big deal.

~50% throughput

~1,000 TPS live,

~Gas fees stay low and stable (even under load)

In the near future:

~5s finality is coming mid-July,

~5,000 TPS is already in sight for Q3.

What stood out to me though: Bhilai also brings in EIP-7702 support, introducing native account abstraction.

Feels like Polygon’s gearing up for actual real-world transaction volume, not only scale.

Payments, RWAs, money-to-money at speed, the infra’s lining up fast.

3. 𝐊𝐚𝐭𝐚𝐧𝐚 𝐌𝐚𝐢𝐧𝐧𝐞𝐭 𝐋𝐚𝐮𝐧𝐜𝐡

@katana mainnet launched with over $200M in productive TVL, making it a major liquidity moment for the Polygon ecosystem.

As a graduate of the AggLayer Breakout Program, Katana is designed to route idle capital into yield, integrating protocols like Sushi, Morpho, and VaultBridge from day one.

More importantly, Katana introduces productive TVL as a new metric.

This means that capital is not just parked, but deployed and drives sequencer fees, app revenue, and ecosystem-level sustainability.

With 15% of its token supply set aside for POL stakers, the tie to Polygon’s modular stack is deep and deliberate.

4. 𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐍𝐨𝐭𝐞

The moves from POL to Bhilai to Katana redefine how utility, liquidity, and governance are architected.

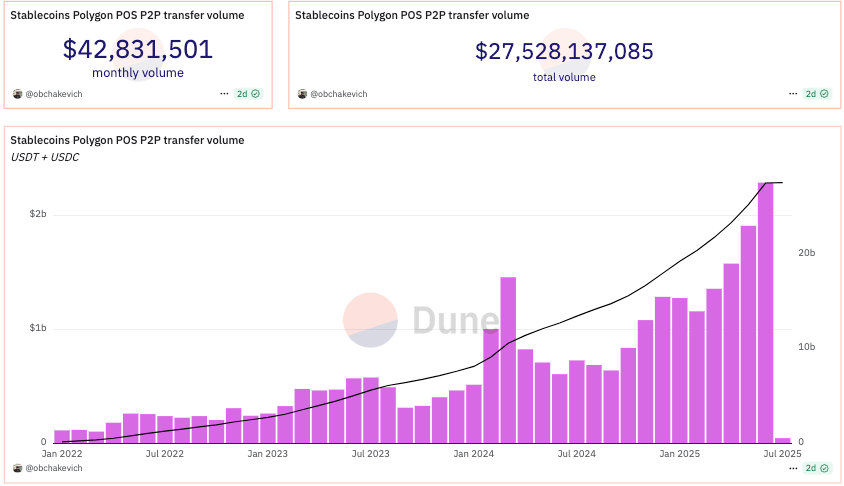

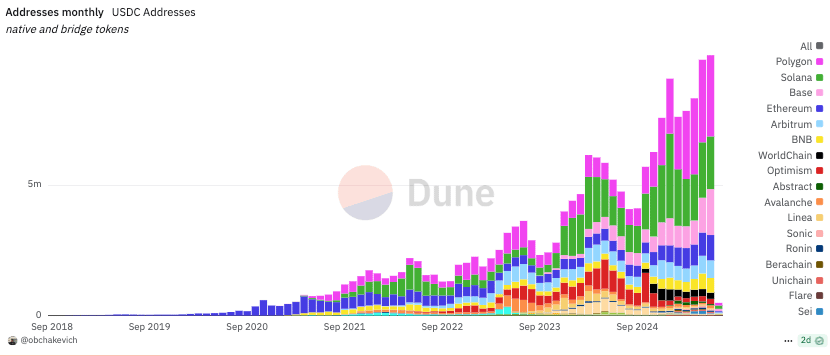

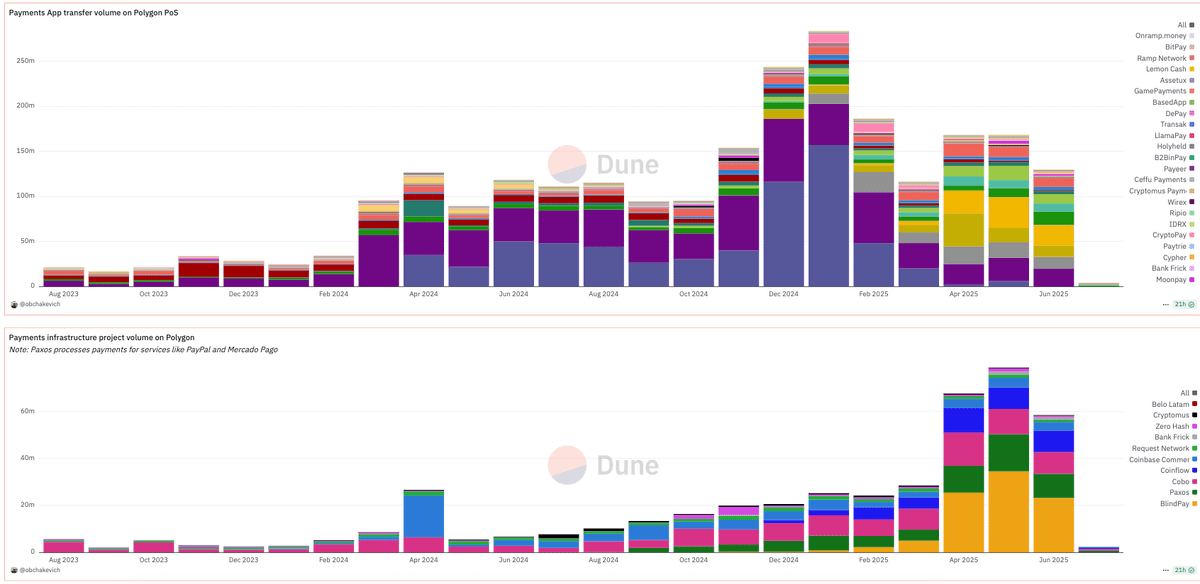

And when you zoom out to the onchain data??

Payments volume across both apps and infra on Polygon has scaled significantly in the past 12 months, driven by players like Paxos, Ripio, and Coinbase Commerce.

@sandeepnailwal, how far are we from seeing Polygon become the default execution layer for institutional-grade DeFi?

Show original

64.89K

210

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.