[USDT on the TRON chain exceeds $80 billion: the "aqueduct" of a new round of bull market? 】

1. The additional issuance of USDT is a prelude to the bull market

The start of each round of bull market is accompanied by the continuous issuance of USDT. In 2025, this historical pattern repeats itself again – but the main stage becomes TRON.

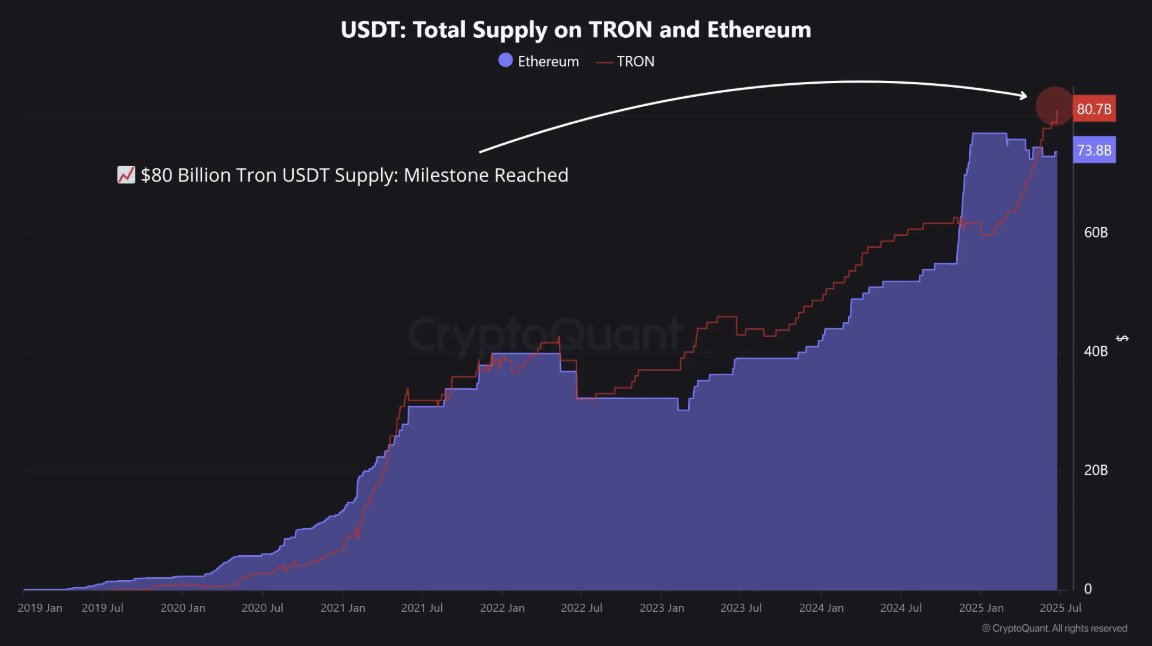

According to CryptoQuant data, as of June 2025, USDT (i.e., TRC20-USDT) deployed on the TRON network has grown from $59.76 billion at the beginning of the year to $80.76 billion, an increase of more than 35%. This does not include USDT on other networks such as Ethereum, Solana, Avalanche, etc., but clearly points to the dominance of the TRON network as the current primary issuance location of stablecoins.

Historically, the massive expansion of USDT has often been a precursor to market sentiment and capital inflows. Whether it was the initial increase in volume before the ICO boom in 2017 or the surge before the DeFi explosion in 2020-2021, USDT was one of the earliest signals that the market was heating up. And the current round of surge is quietly unfolding on the TRON chain.

Second, TRON has become the main road for capital injection

Why is the TRON network the preferred choice for stablecoins? The reason boils down to three words: efficient and stable.

Compared with Ethereum's expensive and congested trading environment, TRON's low fees and high-performance architecture make it a natural choice for centralized exchanges, wallet systems, and on-chain users when transferring money and clearing settlements. OTC scenarios, quantitative arbitrage, cross-border payments, and other demand scenarios that rely heavily on low-cost and high-frequency transactions have formed a large-scale aggregation on TRON.

What's more, this USDT issuance is not concentrated in a single institutional address, but presents a natural inflow pattern of multi-wallet distribution, which means that this round of funds is real and has an expected goal, rather than a pure "on-chain brush" or short-term knock.

3. TRON becomes the logical basis of the bull market engine

If USDT is the "fuel" for the start of the bull market, then the TRON network is the "oil pipeline" for these fuels to be injected into the market.

It doesn't rely on "storytelling", but on a proven trading infrastructure to earn the trust of funds. At present, more than 70% of the world's USDT is deployed on the TRON network, and USDT is the most important settlement and trading medium on the chain at this stage.

When we see the USDT stock on TRON surpass $80 billion, it conveys much more than just a number, but: funds are gathering, liquidity is being prepared, and a market inflection point is brewing.

@justinsuntron @trondao @trondaoCN @Tether_to #TRON #TRONEcoStar $TRX

$80 Billion TRON USDT Supply: Milestone Reached

“In 2021, the supply rose from $6.71 billion to $39.41 billion, a 487.48% increase. In 2025, it increased from $59.76 billion to the recent high of $80.76 billion, and we’re only halfway through the year.” – By @JA_Maartun

21.06K

34

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.