What just happened?

The Dow just went from being up +300 points at the open to falling as much as -1,100 points in hours.

Between 10:00 AM and 3:30 PM ET, the S&P 500 erased a whopping $1.5 trillion in market cap.

Here's exactly what you need to know.

(a thread)

A timeline of what happened:

The S&P 500 opened ~30 points higher in what appeared to be a continuation of Friday's move.

Then, at 1:00 PM ET, selling pressure began ahead of Trump's "investment announcement."

By 3:40 PM ET, the index had lost -$1.5 trillion from its high.

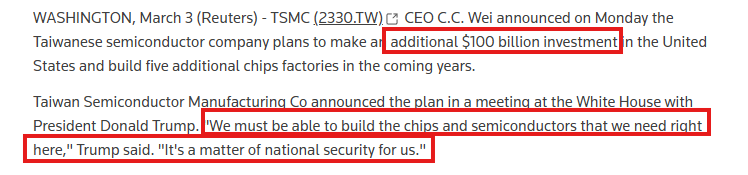

The investment announcement began on a strong note, with $TSM announcing a $100B investment in the US:

1. 5 facilities in Arizona

2. Creates thousands of jobs

3. Brings TSM's total US investment to $165B

4. Creates "hundreds of billions of Dollars of economic activity"

However, markets began selling off as President Trump transitioned to his Q&A segment.

As seen in the below clip, President Trump confirmed that 25% tariffs on Canada and Mexico will begin TOMORROW, March 4th.

Markets had been hoping that these tariffs were delayed again.

And it got even worse after the following:

Q: "On the tariffs, is there any room left for Canada and Mexico to make a deal before midnight?"

President Trump: "No room left for Mexico or for Canada. No. The tariffs you know, they're all set. They go into effect tomorrow."

In the middle of President Trump's announcement, the WSJ published a report on Ukraine.

The report said the Trump Administration has officially stopped financing new weapons sales to Ukraine.

Reuters also reported that the US is preparing a plan to loosen sanctions on Russia.

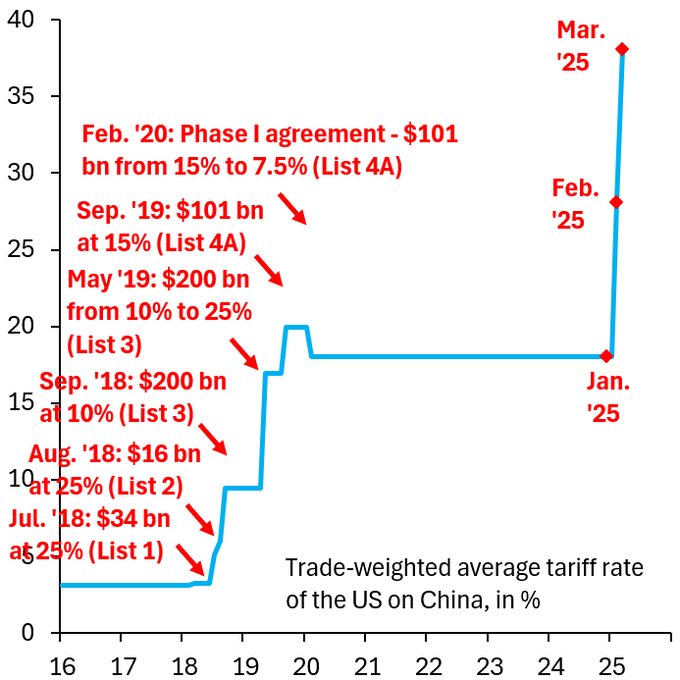

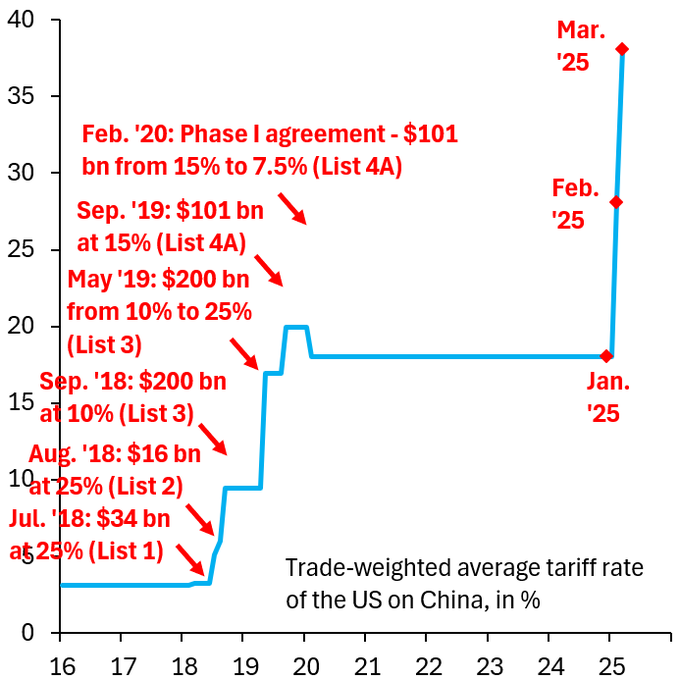

Minutes later, the White House said President Trump signed an Executive Order to raise tariffs on China to 20%.

This puts China tariffs up 20 percentage points in 2 months.

By comparison, it took Trump 2 YEARS to raise tariffs this much on China during his first term.

Meanwhile, crypto markets sold off sharply as there have been no additional details about the US Crypto Reserve.

Between the market open today and the low just now, crypto erased nearly -$300 BILLION of market cap.

The majority of yesterday's gains have been erased.

In fact, Ethereum has now erased ALL of its post-crypto reserve announcement gains.

Prior to Sunday's announcement, $ETH was trading as low as $2,170.

It just fell to a new low of $2,094, or -3.5% BELOW the levels seen prior to President Trump's announcement on Sunday.

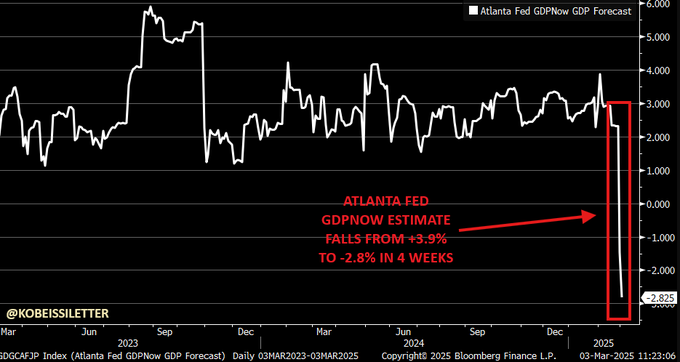

And to top it all off, the Atlanta Fed's GDP estimate fell deep into contraction territory.

The Atlanta Fed just revised their Q1 2025 GDP growth estimate lower AGAIN, from -1.5% on February 28th to -2.8% today.

This estimate has now dropped from +3.9% to -2.8% in 4 weeks.

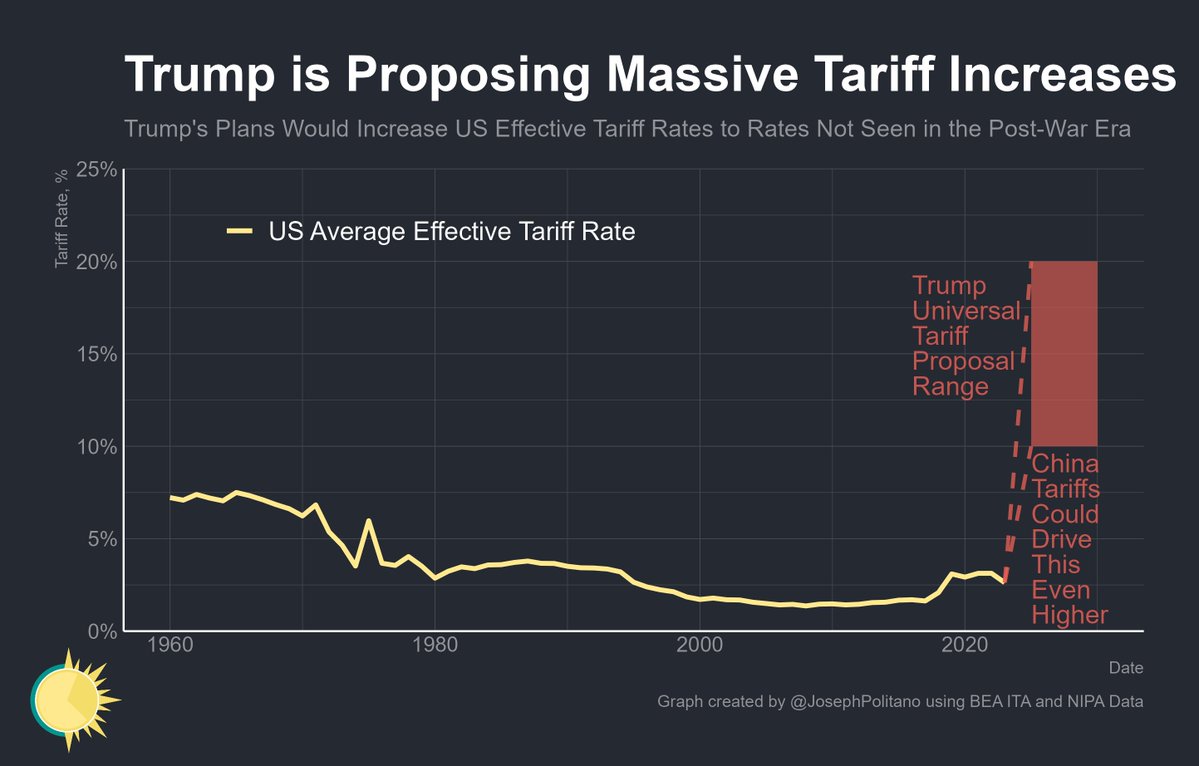

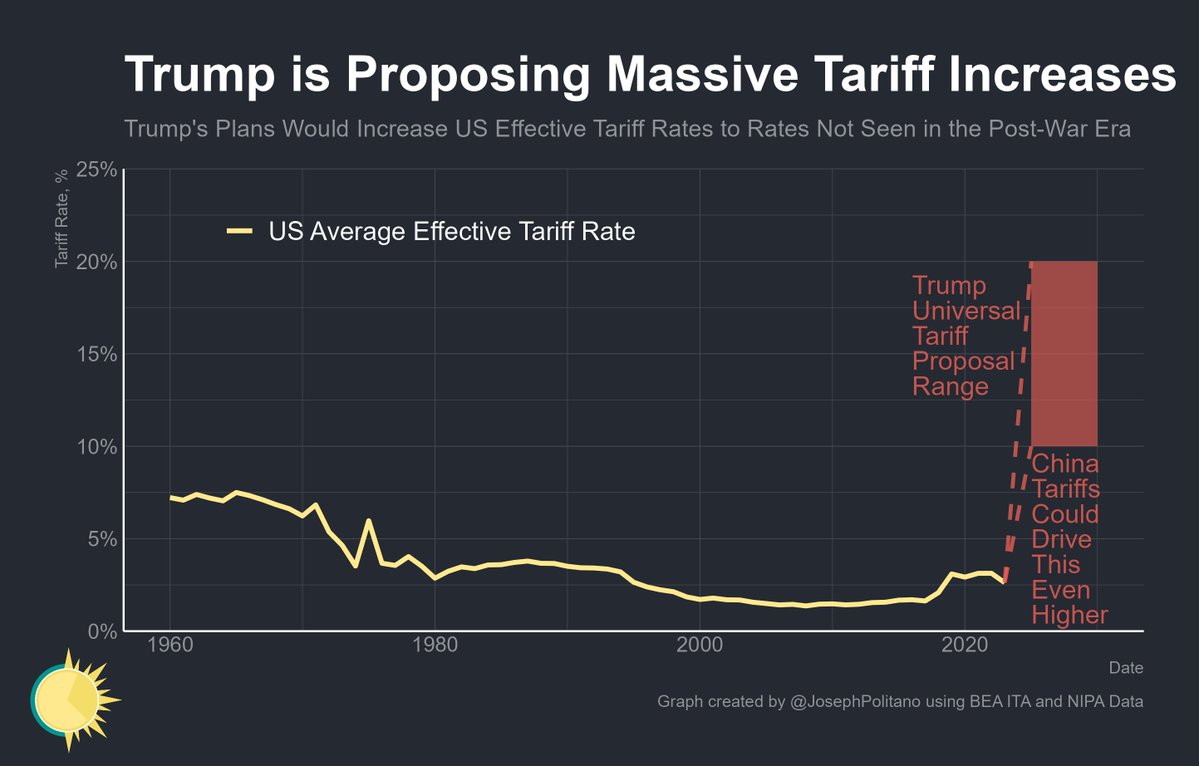

As the trade war ramps up, the US average tariff rate is set to rise to levels not seen since the Great Depression.

Currently, the US average effective tariff rate is set to rise as high as 20% or more.

This does not even include the potential 100% tariff on BRICS countries.

With that said, we expect more volatility with opportunity to trade it.

As we saw in Trump's first term, trading these headlines CAN be very profitable.

Want to see how we are trading it?

Subscribe to our premium analysis and alerts at the link below:

Today's move puts the Volatility Index, $VIX, up a whopping +54% since February 14th.

We expect even more headlines as tariffs go live at 12:01 AM tonight.

Trump also said "tomorrow night will be BIG."

Follow us @KobeissiLetter for real time analysis as this develops.

34.95K

7.51M

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.