This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

SRM

SRM Entertainment price

3LNJzp...3Jij

$0.000081964

-$0.00032

(-79.73%)

Price change for the last 24 hours

How are you feeling about SRM today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

SRM market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$81,964.01

Network

Solana

Circulating supply

1,000,000,000 SRM

Token holders

6209

Liquidity

$40,958.99

1h volume

$221,609.67

4h volume

$1.04M

24h volume

$17.13M

SRM Entertainment Feed

The following content is sourced from .

乔帮主退休月球收租و 🔆

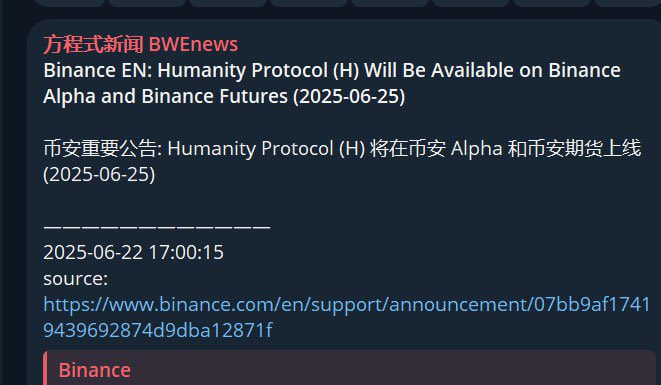

🙀🙀 The big one is here ‼️‼️‼️

Palm print @Humanityprot just announced the launch of $H in the alpha section and contracts on Binance.

Congratulations to some people again! ! !

At the same time, Humanity Protocol's official Twitter has updated to launch a platform called Fairdrops.

This is the first use case of palm print certification, aimed at ensuring the fair distribution of airdrops and preventing bots and fake accounts (sybils) from stealing airdrop tokens.

This is an important innovation as it utilizes Humanity Protocol's palm print certification technology to verify the authenticity of users, ensuring that only certified real users can participate in the airdrop.

- It reminds me of some previous cases.

1) During the airdrop of many projects in the Solana ecosystem in 2021, there were large-scale bot attacks, with the airdrops of Raydium and Serum dominated by bots and fake accounts, leaving real users with almost no tokens. This situation wasted the resources of the project parties and damaged the trust of the community.

2) Ethereum's @Uniswap and $Aave airdrops also faced similar issues.

From this perspective, Fairdrops utilizes Humanity Protocol's palm print certification, which indeed provides a certain guarantee for the fairness of airdrops. It is a promising use case that still needs more time and practice to validate.

It must be emphasized that the core value of Fairdrops is that "only certified users can receive tokens."

Show original

16.81K

46

大宇

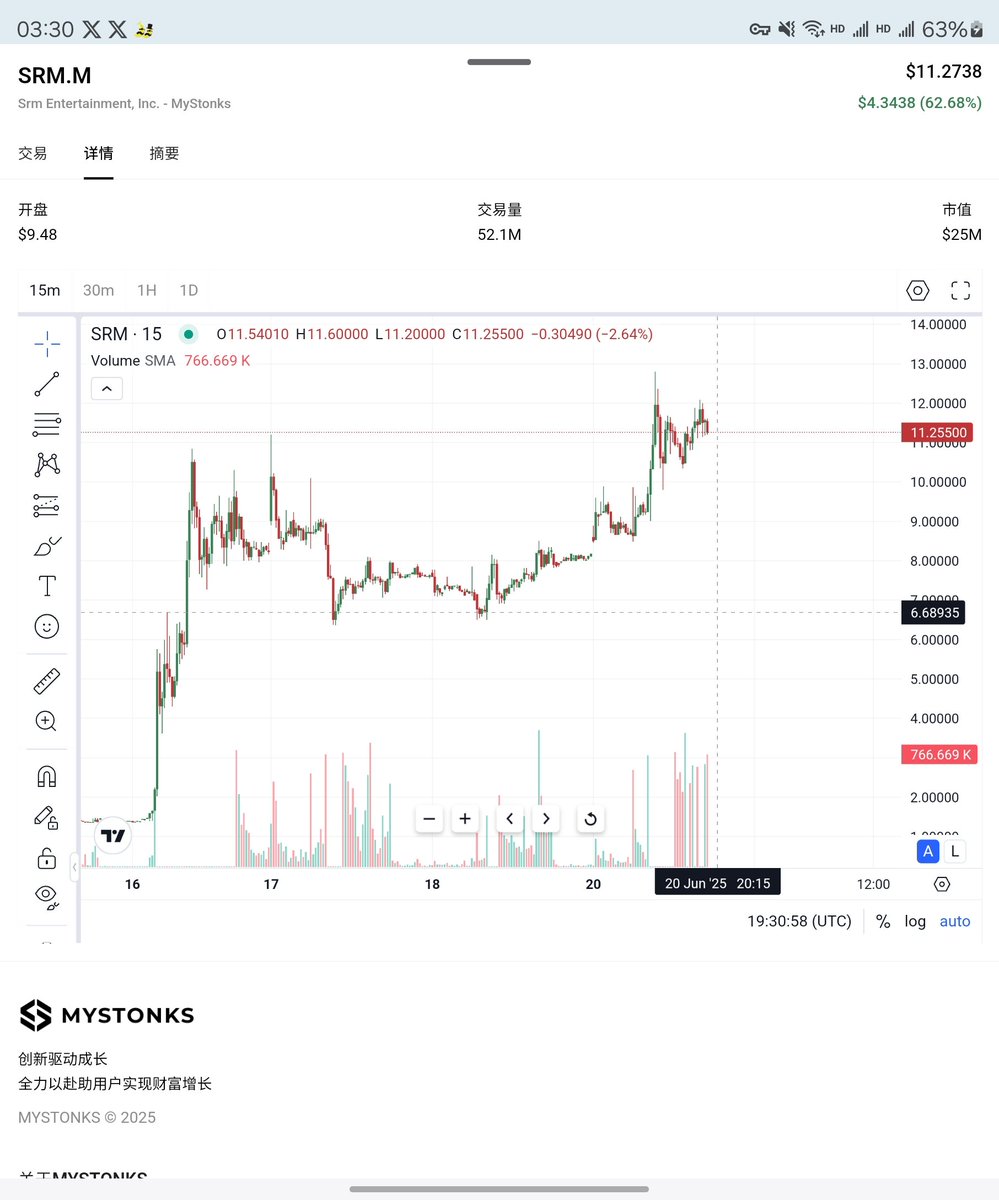

U.S. stock stud coinbase, logic:

1. SRM and CIRCLE are rising, and the mood is in

2. The higher the short-term circle, the more funds will overflow

3. Coinbase eats USDC 50% of the income

4. Coinbase is going to be on the perpetual contract - Wall Street uses this kind of 7*24-hour contract, and there is no way back, and the third quarter financial statements are going to be bright, although it is still early

5. SRM's words may be more demonic, but the first wave is over

All of the above is speculation and will be sold at any time.

Show original270.59K

214

王大有 reposted

AB Kuai.Dong

TRON TRX micro strategy, see that the stock price has directly pulled 48% today, and it has reached a new high. Mainly Tether, the parent company behind USDT a few days ago, said that it has no listing plan for the time being, which led to the direct involvement of the floating capital.

At present, there are 78.7 billion USDT in circulation on TRON, and SRM, a U.S. stock company, just announced that TRX, the public chain currency of TRON, will be used as a listing reserve.

TRX micro-strategy has been blown into USDT stock. I really don't understand

AB Kuai.Dong

After taking a look, this U.S. stock TRON company, like the ETH micro-strategy some time ago, is the company's side of the company's issuance of new shares, and then the official direct injection of capital to complete the backdoor to become the XX micro-strategy.

Now that ETH micro-strategy, SOL micro-strategy, and TRON micro-strategy are available, is the BNB micro-strategy also fast?

88.73K

53

TechFlow

Written by: Jingle Bell, Odaily

On June 5, 2025, stablecoin giant Circle was officially listed on the New York Stock Exchange at an issue price of $31 per share, significantly higher than the early estimate of $24 ~ $26. What's even more remarkable is that as of now, the price of CRCL has climbed to $214 after hours, and the market value has exceeded $48 billion, a cumulative increase of nearly 600% in just over ten days. At the same time, a new batch of crypto stocks such as SBET and SRM also performed strongly. (For details, refer to: "Crypto Bull Market, All in US Stocks: Ten Days of Circle from $31 to $165")

Against the backdrop of the continuous improvement of the regulatory environment in the United States and the acceleration of institutional funds, the trend of crypto companies "going to Wall Street" is accelerating in an all-round way. According to the main business positioning, exchanges, stablecoins, and mining have all been represented, and the crypto prime broker FalconX was revealed to be preparing a listing plan within the year. The $8 billion company, which serves global institutional investors, is trying to seize the window of time for this "institutionalization wave" and seize capital market opportunities.

From Silicon Valley, how does FalconX run out of the crypto prime brokerage route?

FalconX was born in Silicon Valley in 2018, a place that excels at translating tech narratives into capital myths. Co-founder Prabhakar Reddy has a strong background in cross-border financial infrastructure, and his early founding of OpenFX focused on technical services in the forex market, which also laid a solid foundation for FalconX's trading system.

Unlike a crypto exchange for retail investors, FalconX has been targeting institutional clients since its inception and is clearly positioned as a "Prime Broker", focusing on providing a full range of services to professional investors, and its business covers three core segments:

Aggregate liquidity and intelligent order routing from multiple exchanges to achieve efficient matching and cost optimization;

Provide structured financing and crypto-asset mortgage services to meet the flexible financing needs of institutions;

Expand asset management and derivatives strategy products to create a complete solution for institutional investment portfolios.

As of 2025, FalconX has set up global offices in seven places, including New York, London, Singapore, Silicon Valley, Bangalore, and Valletta, and has basically completed the initial construction of its institutional service network.

The FalconX team integrates the dual genes of traditional finance and technology, with core members from top companies such as JPMorgan Chase, Citigroup, PayPal, Kraken, Affirm and Microsoft, with rigorous risk control capabilities and excellent technical execution.

In 2022, the company closed a $150 million funding round and its valuation jumped to $8 billion, backed by investors including GIC, Tiger Global, Accel, Lightspeed and other well-known institutional capital, adding weight to the brand image favored by its institutions.

Accelerating M&A expansion, FalconX's 2025

Entering 2025, FalconX has significantly accelerated the pace of business expansion, focusing on three major sectors: derivatives market, institutional finance and asset management, and its strategic intent is becoming clearer:

In January 2025, it acquired derivatives start-up Arbelos Markets to further strengthen its capabilities in structured product design and risk hedging;

In March 2025, it cooperated with StoneX to launch Solana futures products on the Chicago Mercantile Exchange (CME) and completed the first block trade, while becoming the main liquidity provider of CME crypto derivatives;

In May 2025, partnered with Cantor Fitzgerald to complete the first Bitcoin-backed financing transaction, with plans to offer up to $2 billion in funding to institutional clients. During the same period, it established a strategic partnership with Standard Chartered, a global bank, to further open up the channel between traditional finance and the crypto market with the help of its banking and foreign exchange service capabilities;

In June 2025, it acquired a majority stake in asset management company Monarq Asset Management (formerly LedgerPrime, formerly part of the FTX ecosystem) to expand FalconX's product capabilities in the field of asset management and quantitative trading to reach customers.

Through a series of mergers and acquisitions, product launches and strategic partnerships, FalconX is gradually transforming from a single deal matchmaking "broker" role to a platform-based financial service provider covering multiple assets and multiple service modules. These moves not only enrich its business matrix, but also build a more convincing capital narrative for the upcoming IPO preparations.

Why go public at this time? The capital logic and rhythm control behind the IPO

According to sources, FalconX has been in informal contact with investment banking advisers to assess the feasibility of an IPO and may submit an IPO application within the year.

Choosing to start preparations for listing at this moment is not a hasty move. The past few months have seen a series of landmark events in the crypto industry.

Circle successfully landed on the New York Stock Exchange, and its market capitalization soared to $48 billion in the first ten days of listing, far exceeding market expectations. This feat has greatly boosted investor confidence and quickly changed the capital market's risk pricing logic for crypto companies; Leading platforms such as Kraken, Gemini, and Bullish have also announced IPO preparation plans, and the capital window is gradually opening.

At the same time, there are subtle changes in the regulatory environment. The new U.S. administration has sent a more friendly signal, and the SEC has tended to be more moderate, providing crypto companies with more clear room to expect. The demand structure of institutional clients is also quietly changing, from a single transaction to structured financing, derivatives management and comprehensive risk allocation, and the position of prime brokers is becoming increasingly prominent.

With all these signals intertwined, FalconX seems to have found its own time. Not as followers, but as an attempt to be a forerunner in this cycle of institutionalization. For FalconX, the IPO is not only a fundraising opportunity, but also a key milestone in its rebranding and strategic leap: from a "high-growth startup" to a "global crypto financial infrastructure provider", and the recognition of the public market will be an important endorsement of its credibility.

Of course, the window is open, but it won't last long. The emotional dividends ignited by Circle are still continuing, and the pace of capital markets has always been fast-moving. If FalconX is unable to enter the market during this cycle, it may take years or even a full market cycle for the next window to open.

So far, FalconX has not formally engaged an investment bank to underwrite, which is the usual first step in the process of initiating the listing process, meaning that the IPO is still in the early stages of preparation and there is still a lot of uncertainty.

Potential concerns: Organizational restructuring and the wave of executive departures

It is worth noting that while FalconX is expanding rapidly, it is also facing organizational management challenges.

In March 2025, the company was exposed to a mass exodus of senior executives, including more than a dozen employees including the head of Europe, the head of credit, the general counsel and the chief compliance officer. The company has not publicly responded to the rumours that the personnel changes involve layoffs and voluntary resignations.

In fast-growing companies, personnel changes are not uncommon. However, for a company seeking an IPO, the stability of the governance structure and the continuity of the senior management team are often seen by investors as important indicators of the company's maturity and risk management capabilities.

This also reminds the market that the test of an IPO is not only revenue growth and customer expansion, but also whether the company can demonstrate stable and sustainable "full-stack capabilities" in multiple dimensions such as capital, organization, personnel and compliance.

Summary: Wall Street is open, and the second half of the crypto prime broker is off to a good start

Whether FalconX can successfully ring the NASDAQ bell remains to be released. But what is certain is that a series of strategic moves have clearly outlined the contours of the future:

After Circle opened the window of confidence in crypto IPOs, FalconX is trying to enter the public eye as "the next drop in the wave of crypto institutionalization". Its role is not only the valuation story of a certain company, but also a symbolic turning point for the entire crypto industry from the fringe to the mainstream.

Can it replicate Circle's capital miracle? Will it be able to avoid the valuation highs and price declines that Coinbase experienced in 2021? The answers to these questions may gradually emerge in its upcoming prospectus.

But one thing is certain: in this new cycle of capital, trust and institutional synergy, FalconX is no longer a bystander.

Show original4.43K

0

SRM price performance in USD

The current price of srm-entertainment is $0.000081964. Over the last 24 hours, srm-entertainment has decreased by -79.73%. It currently has a circulating supply of 1,000,000,000 SRM and a maximum supply of 1,000,000,000 SRM, giving it a fully diluted market cap of $81,964.01. The srm-entertainment/USD price is updated in real-time.

5m

+0.15%

1h

-93.21%

4h

-97.90%

24h

-79.73%

About SRM Entertainment (SRM)

SRM FAQ

What’s the current price of SRM Entertainment?

The current price of 1 SRM is $0.000081964, experiencing a -79.73% change in the past 24 hours.

Can I buy SRM on OKX?

No, currently SRM is unavailable on OKX. To stay updated on when SRM becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of SRM fluctuate?

The price of SRM fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 SRM Entertainment worth today?

Currently, one SRM Entertainment is worth $0.000081964. For answers and insight into SRM Entertainment's price action, you're in the right place. Explore the latest SRM Entertainment charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as SRM Entertainment, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as SRM Entertainment have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.