This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

SCA

Scallop price

0x7016...:SCA

$0.089991

-$0.00708

(-7.29%)

Price change for the last 24 hours

How are you feeling about SCA today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

SCA market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$13.24M

Network

SUI

Circulating supply

36,118,821 SCA

Token holders

82599

Liquidity

$2.38M

1h volume

$20,784.70

4h volume

$120,553.56

24h volume

$1.32M

Scallop Feed

The following content is sourced from .

Pix🔎

Was not expecting this

The highest yield in crypto right now...

isn't on Ethereum.

Isn't on Solana.

Isn't even on a DEX.

It's on a borrowing market built on SUI.

Hear me out:

> $130.45M TVL

> 52% on USDC (more on that below)

> First DeFi app backed by Sui Foundation

> $1M+ given back to users through loyalty programs

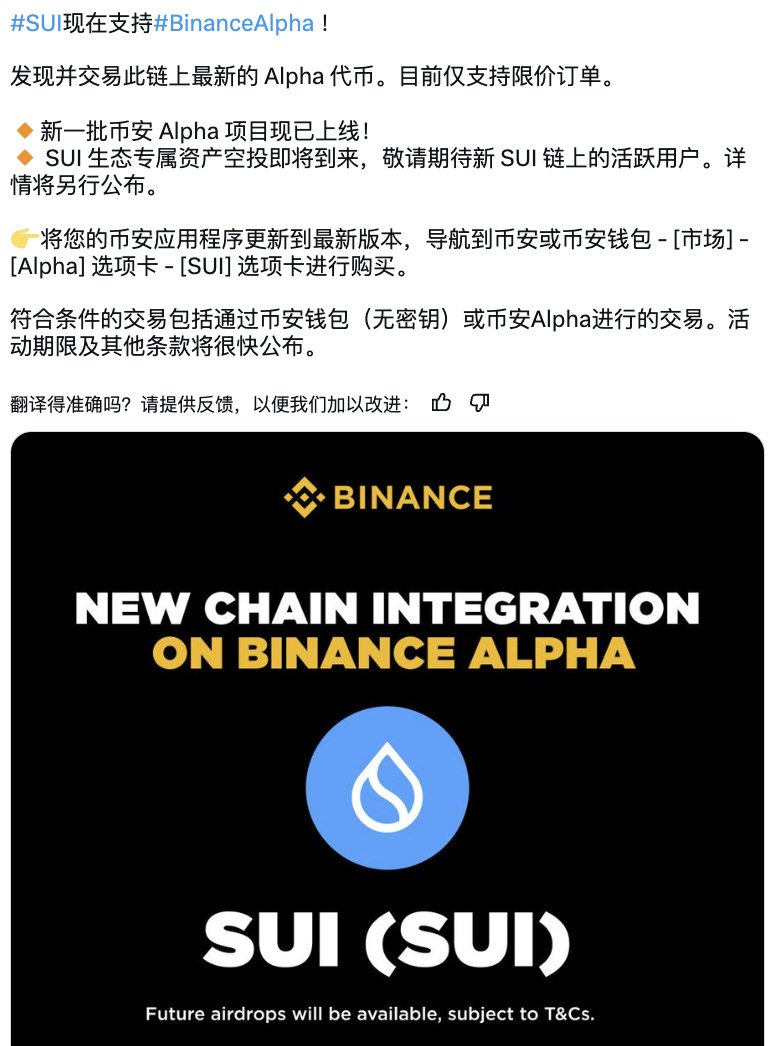

> Just hit Binance Alpha

But here's the twist:

You don't farm by lending.

You farm by borrowing.

Stake $SCA → borrow USDC → earn up to 52% APR

Good stuff

Show original

55.33K

252

Yuyue

The group asked, what should I do if such a good market is full of USDC? No fomo's journey and financial management

From my personal experience, no matter whether it is a bull or a bear, the most feared thing is FOMO. After Trump $TRUMP made some money, I experienced a liquidation, and there were a lot of drawdowns, until I blew up on a series of launched memes on Boop, and only now that this good market has returned a little bit of blood

Floating profit is just a dream after all

What I did when the market was bad:

First, develop the habit of keeping a diary and taking notes. One or two sentences a day, you don't need to be right, review your gains and losses,

Second, increase your pipeline revenue, such as a new skill tree, learn how to live stream on @Sidekick_Labs, and research skills related to live streaming and video

Third, increase the proportion of their stablecoin holdings, gradually change from the previous $SOL-margined diamond hands to U-guards, and gradually denominate the U-standard in @Solana_zh

Fourth, I really want to get fit, but I really don't work out, I'm too lazy (XD

Some group friends also found out that I was always asking where the interest rate is high and where there is a place to save money a while ago, mainly because I lost a lot 😭 of money. And one of Sui's top lending projects, which has just launched Binance alpha@Scallop_io is a good place to manage money

By the way, Sui has been really awesome lately. Binance has supported a series of Sui's token listings in the alpha sector, the first of which is scallops

Leverage multiple lending platforms on Sui to manage revolving loans, the basic principle of revolving loans is to provide higher capital utilisation and interest through the difference between borrowing interest rates on debit and credit rates

Here I'm looking at the veSCA subsidy mechanism on scallops. The more veSCA, the higher the reward APR of the token subsidy, so large investors can also consider using some funds to hedge mining, and if you calculate the short rate, APR 20%+ should be no problem, but considering the flexibility of funds, it is recommended to choose your spare money that will never be touched for pledge hedging

Show original

156.51K

103

Chok楚克

JUP's FDV is 25 times 😂 that of Cetus, isn't the space coming?

加密韋馱|Crypto V🇹🇭

Do you know why Binance Alpha makes trading on Sui cheaper, with low slippage and no clips?

One, of course, because Sui is awesome

The second reason is that Binance Alpha is connected to Cetus

You may only know that Cetus is the DEX of Sui Ryuichi, but in fact, Cetus is also the largest aggregator in Sui, which accounts for nearly 6% of Sui, which is almost Raydium+Jupiter on Sol

The main pools of $SCA and $NAVX are on Cetus

Fun fact:

Recently, there has been a lot of noise, but in fact TVL is mainly from the Sui-based Perp project with its own DEX and Lending function@bluefinapp and its largest transaction volume comes from Cetus

Another dex @KriyaDEX on Sui, his main pool is actually in Cetus...

49.17K

4

加密韋馱|Crypto V🇹🇭

Do you know why Binance Alpha makes trading on Sui cheaper, with low slippage and no clips?

One, of course, because Sui is awesome

The second reason is that Binance Alpha is connected to Cetus

You may only know that Cetus is the DEX of Sui Ryuichi, but in fact, Cetus is also the largest aggregator in Sui, which accounts for nearly 6% of Sui, which is almost Raydium+Jupiter on Sol

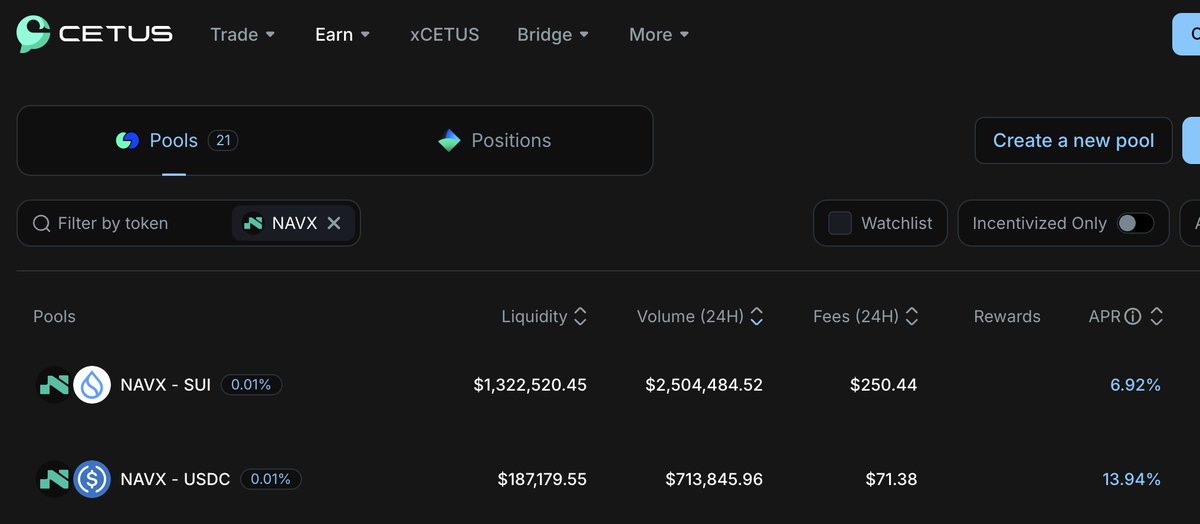

The main pools of $SCA and $NAVX are on Cetus

Fun fact:

Recently, there has been a lot of noise, but in fact TVL is mainly from the Sui-based Perp project with its own DEX and Lending function@bluefinapp and its largest transaction volume comes from Cetus

Another dex @KriyaDEX on Sui, his main pool is actually in Cetus...

链研社

The new single volume king is coming, swiping NAVX in the Binance wallet, why swiping it? Sui chains have the lowest gas fees, will not be clamped by clips, and have the lowest wear and tear.

The 1000U trading volume loss is about 0.1U~0.3U, and the Binance wallet does not support direct purchase with the exchange balance, so you need to withdraw 1Sui+USDC from the exchange.

Why does NAVX cost less than other coins?

NAVX-SUI, a $1.3 million dollar pot, and NAVX-USDC The handling fee of the two pools is just in case, just in case for the purpose of letting you brush volume, and the gas fee is also the lowest among all chains.

BinanceAlpha is now too many people in the roll, not necessarily to get much gain, than who costs less. If you don't want to roll, you can also go and provide NAVX liquidity

The highest trading volume of B2, ZKJ, the highest trading volume on the BNB chain, has a daily trading volume of 200 million US dollars, and according to the handling fee, there is a handling fee of 20,000 US dollars, and the annualised income of providing LP is 500%+.

Assuming that the trading volume of the NAVX pool is 100 million US dollars, then the annualised return of LP can probably be more than 250%, and you can buy some coins to form LPs, and at the same time, you are bullish on the future of the Sui ecosystem.

From the standpoint of Binance, in the end, the coins that have maintained the largest trading volume on the chain, and the coins with good project fundamentals, have the opportunity to list Binance contracts and spots, which is an interesting game, and I think it is also NAVI @navi_protocol The reason why it is so volatile is that the spot on the Sui ecosystem is currently Cetus, since the ecological development is good, there must be more than one, who do you think will be next to bet in advance!

140.8K

75

Nick P 🐈🏆

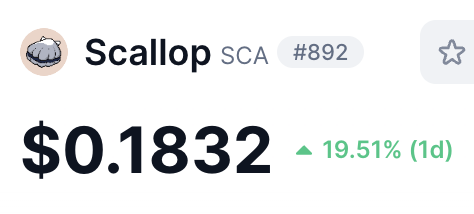

Shell $SCA on Binance Alpha Hug !

Rely on ~ It's too fierce

Congratulations to the big guy Orange @gaudy168

The article I wrote today also brings good luck 🥳

Nick P 🐈🏆

『 Shell : Will it be the next Pendle ? 』

Shell @Scallop_io is one of my favourite protocols in the SUI ecosystem

If you want to talk about SUI revenue strategy, you have to talk about shells first

Although it is not the same as the Pendle mechanic, the shell made me feel like a very early Pendle ~ trust my instincts (most of my Pendle is $0.5 entry)

1️⃣ Shell vs Pendle comparison

🔹 Shell's Market Cap is 1/40 of Pendle's ; The TVL is 1/20

🔹 The "lock-up rate" of Beike tokens is similar to that of Pendle, but the point is that the average lock-up period of Beike tokens is 3.7 years, and Penlde only has 1 year

What is the magic of Beike that allows users to willingly lock up for an average of 3.7 years ? (More on that later)

🔹 Over the last 30 days, Pendle is 900k and Shell is 1.45m slightly higher than Pendle

2️⃣ Shell mechanism fascinating place

The core gameplay of Shell is that you need to buy $SCA, lock it into veSCA, and then go to greatly boost the income (I think it's worth buying)

Locked-in veSCA Benefits:

1. Loyalty Program :

According to the amount and time of locking veSCA, it will be airdropped from time to time, and this part of the income is not very much at present

2. Referral Program:

If someone else uses your link, they can get a discount on their borrowing fees; You can also get a portion of the borrowing fee

Welcome to use my link :

3. Revenue Enhancement ⭐️⭐️⭐️

This is the point, the core gameplay 🔥

That's why everyone is willing to lock up for 3.7 years

Example:

You deposit a sum of money into Scallop and borrow USDC out

You can get a reward for lending money, and the reward will be higher than the interest

Let's say you lock 100,000 veSCA today for 4 years

Loan $20,000 and APR up to 4x (maximum) = APR 40%

Lending $50,000 , APR Reward 3x = APR 30 %

Loan $100,000 , APR Reward 2x = APR 20 %

PS: The APR floats

(The above are the APR after deducting interest, the more you stake, the greater the amount of veSCA can be increased)

✅ Emphasis ~ Emphasis ~ Focus

"Different lending pools have different conditions for growth"

You can try to do a loan allocation to maximise your returns

For example:

USDC The reward APR of the amount you lend has reached the maximum 4 times, but there is still a limit to borrow, and the reward multiplier will decrease if you borrow more, however, you can borrow different stablecoin pools USDY / FDUSD / USDT to keep the reward APR 4 times

In addition, there are SUI/ETH/WAL lending pools that can be played in this way

✅ Key ~ Key ~ Key ~ Key ~ Key Points

The money you borrowed

You can also set another layer, staking in other protocols to earn an annualised 7% ~ 20%

PS: The picture below is the top 3 major households

He can achieve an APR of almost 60% 🔥 just in the shell

3️⃣ Precautions for using shells

🔹 The shells have only been out for about a year, and they have not been tested for a long time

🔹 $SCA Only 40% of the tokens are unlocked, and 60% are still in circulation

🔹 The price of $SCA currency has risen by 100% in the past 1 month

🔹 The incentive subsidy of the SUI ecosystem is only until the end of this year, and it is unknown whether there will be an incentive subsidy next year to make APR so fragrant~

4️⃣ My impressions

I am bullish on the SUI ecosystem because of several protocols that I have experienced, and the experience has been pleasant

SUI has made frequent moves in both internal ecological development and external strategy

The shell mechanic appealed to me, and I highly recommend it from the big guys I know

He has a real expense benefit in his own right, and there will be no SUI subsidy in the future

I also have the ability to make blood and share profits with users

In the future, it may be able to produce a flywheel effect, replicating the legend of Pendle's coin price turning a hundred times from the bottom

In this article, we will first introduce shells

In the next article, I will write: Shell with other protocols' revenue strategy

35.36K

20

SCA price performance in USD

The current price of scallop is $0.089991. Over the last 24 hours, scallop has decreased by -7.29%. It currently has a circulating supply of 36,118,821 SCA and a maximum supply of 250,000,000 SCA, giving it a fully diluted market cap of $13.24M. The scallop/USD price is updated in real-time.

5m

-0.02%

1h

-0.30%

4h

+0.33%

24h

-7.29%

About Scallop (SCA)

SCA FAQ

What’s the current price of Scallop?

The current price of 1 SCA is $0.089991, experiencing a -7.29% change in the past 24 hours.

Can I buy SCA on OKX?

No, currently SCA is unavailable on OKX. To stay updated on when SCA becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of SCA fluctuate?

The price of SCA fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Scallop worth today?

Currently, one Scallop is worth $0.089991. For answers and insight into Scallop's price action, you're in the right place. Explore the latest Scallop charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Scallop, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Scallop have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials