Bitcoin Cash price

in USDCheck your spelling or try another.

About Bitcoin Cash

Bitcoin Cash’s price performance

Bitcoin Cash in the news

BCH jumped more than 5% Sunday to surpass $580, with analysts citing breakout patterns and calling for a possible push toward the $620–$680 range.

Polygon (POL) joined Bitcoin Cash (BCH) as an underperformer, declining 2.8% from Monday.

Bitcoin and Bitcoin Cash both come from the same blockchain. But in 2017, a major...

Tether has announced it will phase out USDT support for five underused blockchains — Omni,...

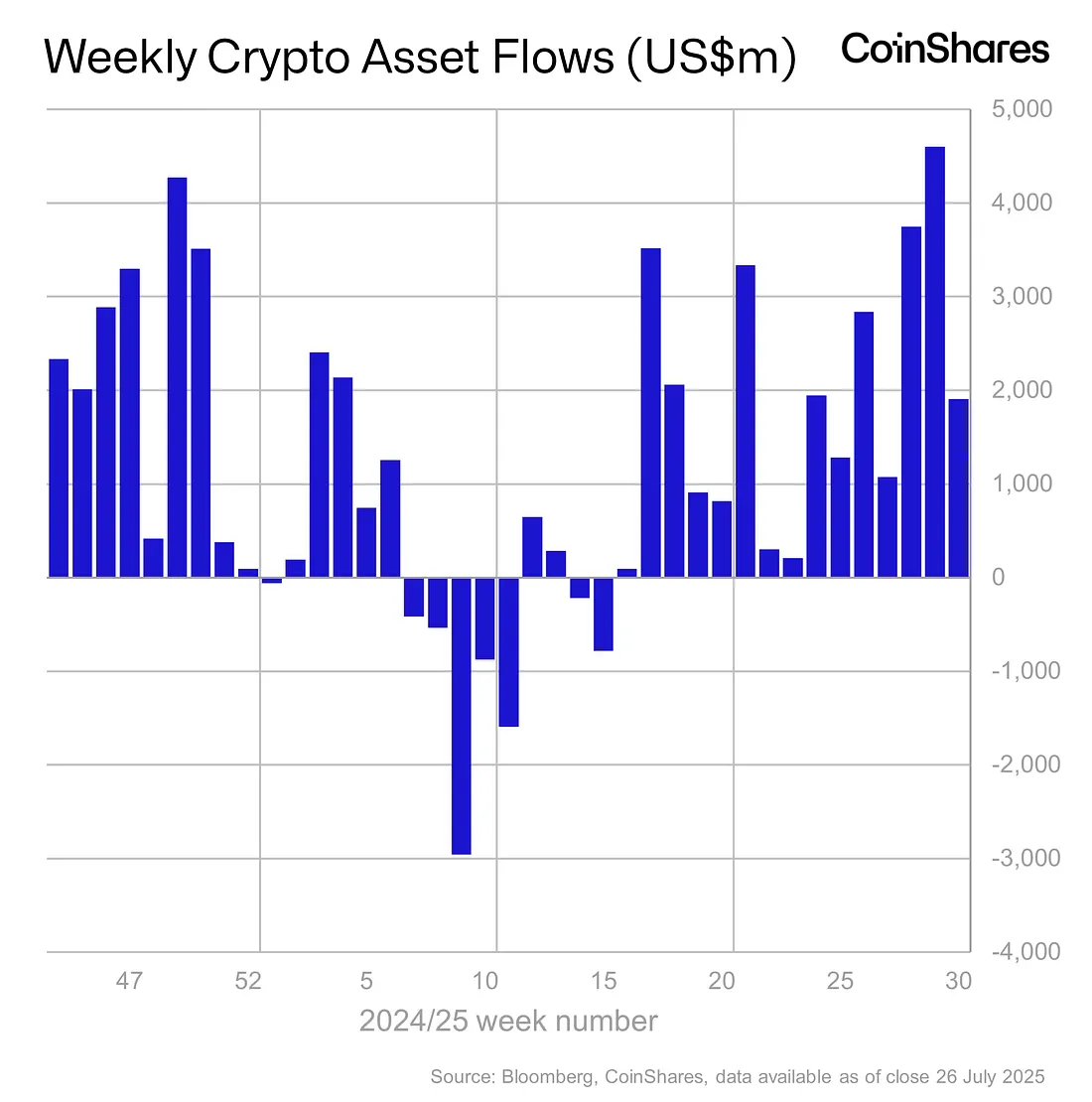

BCH rose sharply to $514.24 in early trading before consolidating between $505 and $510, showing signs of institutional interest.

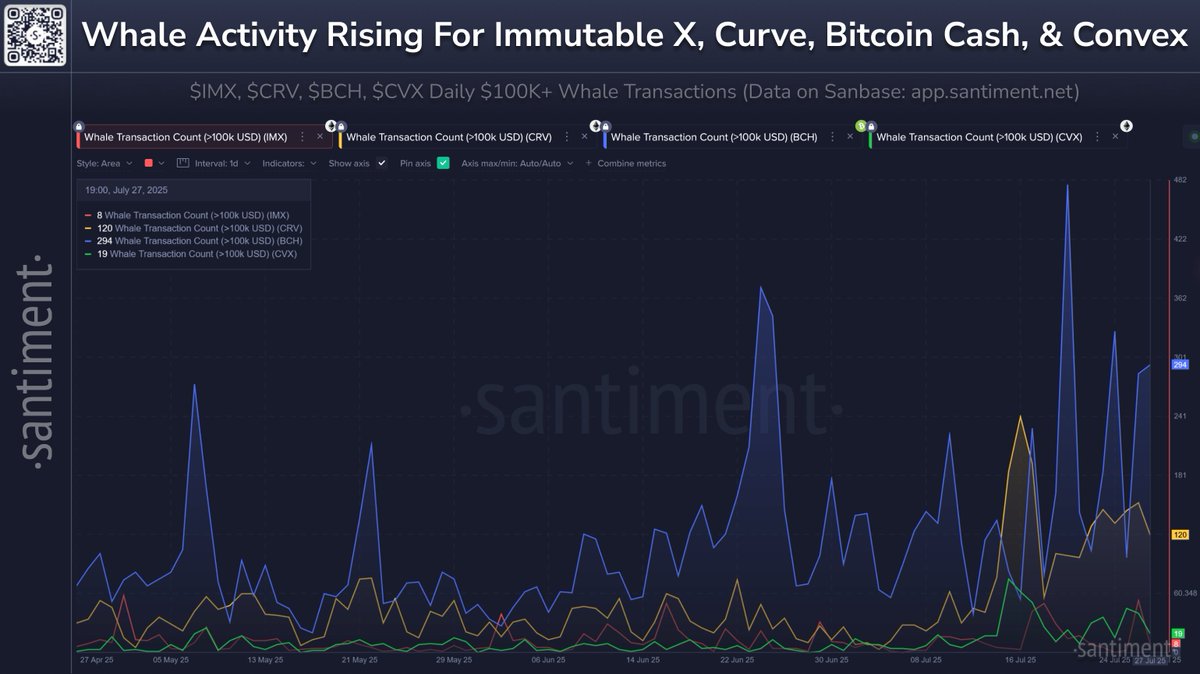

BCH sees heightened whale activity and rising open interest as traders weigh speculation against weak on-chain usage and recent suspicious transactions.

Bitcoin Cash on socials

Guides

Bitcoin Cash FAQ

Dive deeper into Bitcoin Cash

Bitcoin Cash (BCH) is a cryptocurrency payment network created to implement Bitcoin's core idea of facilitating peer-to-peer payments for everyday transactions rather than becoming a preferred store of value like Bitcoin (BTC).

Despite being the gold standard of the crypto world, Bitcoin has some inherent problems that are widely debated in the public domain. Its limited 1 MB block size is the most well-known of these, making it unscalable. This shortcoming has caused a notable rise in Bitcoin's transaction fees.

A section of the Bitcoin network's participants had been pushing for larger blocks as early as 2010. However, seeing no result from their efforts, this group hard-forked Bitcoin Cash from the Bitcoin blockchain on August 1, 2017. Bitcoin Cash was launched with an 8 MB block size limit, later expanding to 32 MB in 2018.

The main aim of Bitcoin Cash is to fulfill the original purpose of Bitcoin. Its team constantly strives to make BCH a cheaper, faster, scalable, and easy-to-use peer-to-peer electronic cash system. It also doesn't hold back regarding increasing block sizes or making other updates to keep the project well-aligned with its core objective. Bitcoin Cash works like Bitcoin, as it can be easily transferred from one individual to another without financial intermediaries or censorship.

BCH token holders can send and receive BCH through their digital wallets using the unique public keys associated with the latter. As a result, BCH transactions are settled almost instantly and involve a lower average transfer fee. Some well-known businesses that accept Bitcoin Cash for their goods and services are Twitch, Newegg, CyberGhost VPN, SlingTV, Namecheap, airBaltic, ALFAtop, Menufy, SatoshiDice, CoinRemitter, and eGifter.

How does BCH work?

Bitcoin Cash's workings are quite similar to that of Bitcoin. The primary difference is the bigger block size, allowing higher transaction speeds and lower fees. That said, larger block sizes make audit and storage expensive and lead to difficulties downloading a copy of the blockchain.

Like Bitcoin, Bitcoin Cash also uses a Proof of Work (PoW) consensus model for securing its network. Entities called miners compete against each other to process transactions and add new blocks to the Bitcoin Cash blockchain. They employ complex computing devices for this purpose. The hashing algorithm of Bitcoin Cash is SHA-256, the same as that of Bitcoin.

One of the biggest differentiators between Bitcoin and Bitcoin Cash is the "difficulty adjustment" for mining new blocks. While the Bitcoin software adjusts this difficulty factor every 2,016 blocks, it's done every 10 minutes in Bitcoin Cash.

The frequent updates aim to provide a clearer understanding of the required computing power for BCH mining. Miners of Bitcoin Cash receive rewards in the form of new BCH coins and transaction fees for their efforts in adding blocks. Bitcoin Cash also supports smart contracts, enabling the creation of decentralized applications (DApps) on its blockchain. Notable DApps built on Bitcoin Cash include CashFusion, CashScript, eatBCH, Flipstarter, AnyHedge, Libauth, Spedn, and Fountainhead.

Bitcoin Cash has a decentralized, low-cost, high-throughput, easy-to-use network for BCH transactions. Any changes required on its mainnet involve many nodes and a high level of consensus. This restricts trial-and-error processes, which are a must for innovation.

Launched in July 2021, Smart Bitcoin Cash or SmartBCH is a side chain of Bitcoin Cash created to explore new ideas and unlock new possibilities. It's compatible with Web3 API and Ethereum's EVM, offering high throughput for DApps, in a secure, decentralized, and fast environment. The side chain doesn't have any new tokens. Its native token is BCH, and all gas fees on the network are paid in BCH.

BCH price and tokenomics

Like Bitcoin, the maximum supply of Bitcoin Cash has a hard cap of 21 million coins. Of these, 19.17 million were in circulation at the time of writing. There are 17.12 million BCH holding addresses at press time, with the top 10 addresses holding nearly 2.3 million BCH. When Bitcoin Cash hard forked from Bitcoin, almost 16.5 million BCH coins were distributed amongst existing BTC holders at 1:1.

Every time a BCH miner successfully adds a new block to the Bitcoin Cash blockchain, s/he is awarded BCH coins as a reward. This process brings new BCH coins into the circulating supply. Bitcoin Cash has a deflationary mechanism called "halving," like Bitcoin. As per this mechanism, the block mining rewards are halved every 210,000 blocks or approximately four years. It shares Bitcoin's transaction history in this regard up to August 1, 2017, the day of its launch.

The last Bitcoin Cash halving happened in April 2020, which reduced the mining rewards from 12.5 BCH per block to 6.25 BCH. The next halving event is expected to occur in 2024, reducing the BCH mining reward to 3.125 BCH per block.

BCH developments

The most significant event in Bitcoin Cash's history was the 2018 hard fork, resulting in the creation of Bitcoin SV (BSV) on November 15, 2018. This split led to a significant drop in BCH's price from $444 to an all-time low of $76 on December 16, 2018. The hard fork emerged as a "civil war" between two competing camps within the Bitcoin Cash ecosystem. One camp, led by Roger Ver and Bitmain's Jihan Wu, supported the Bitcoin ABC software, maintaining a 32 MB block size. In contrast, the other camp, led by Craig Steven Wright and Calvin Ayre, favored Bitcoin SV with a 128 MB block size.

Another significant development for Bitcoin Cash occurred in March 2020 when Tether (USDT) stablecoin was launched on its blockchain through the SLP (simple ledger protocol) token standard. This implementation allowed users to transact USDT on the Bitcoin Cash blockchain alongside networks like EOS, Ethereum, Tron, Algorand, Liquid Network, and Omni.

About the founders

Network participants and miners collectively founded Bitcoin Cash in the Bitcoin ecosystem. These included prominent names like Roger Ver, Amaury Sechet, Bitmain, ViaBTC, and Craig Wright.

All these participants were against the proposed Segwit2x upgrade on Bitcoin, which meant increasing its capacity. They preferred increasing Bitcoin's block size to 8 MB instead. However, unable to fulfill their demand, this group launched a hard fork of Bitcoin on August 1, 2017, and named it Bitcoin Cash.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.