ARB

Arbitrum price

$0.27220

-$0.00100

(-0.37%)

Price change for the last 24 hours

Arbitrum market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$1.35B

Circulating supply

4,963,238,296 ARB

49.63% of

10,000,000,000 ARB

Market cap ranking

--

Audits

Last audit: 9 Nov 2021, (UTC+8)

24h high

$0.27470

24h low

$0.25270

All-time high

$2.4053

-88.69% (-$2.1331)

Last updated: 12 Jan 2024, (UTC+8)

All-time low

$0.24200

+12.47% (+$0.030200)

Last updated: 7 Apr 2025, (UTC+8)

How are you feeling about ARB today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Arbitrum Feed

The following content is sourced from .

Lisa Florentina

The war situation is tense, so the entire market is dumping heavily, and with the BTC DOM combo rising, every altcoin is suffering.

I am still focused on InfoFI and believe that this trend can still provide some income at least until 2025, so this is an opportunity to buy $VIRTUAL and $KAITO at a low price.

Just a small step here, when it drops below $1, I will DCA again.

I plan to stake 50%, and hold 50% to sell if the price increases.

If there’s a good strategy, just a few Genesis Launches from @virtuals_io or airdrops from @KaitoAI will break even.

Additionally, @yapyo_arb has just launched a leaderboard, a project backed by Arbitrum, Kaito, and @cookiedotfun, which should also be promising. Let’s take advantage and grind, guys.

This season, investing in the wrong airdrop projects can also lead to losses; only yap to earn, selling saliva, or typing to make money is safe, though it’s a bit tough.

Show original

2.71K

0

ESSE

You can't lose courage in life, and it's no different in crypto.

We're all too anxious right now, especially in the information cocoon of Twitter per capita A8, A9. Make money and feel that you make less, and lose money and feel that the sky is falling!

Yesterday, the market washed a lot of people together, including the spot copycat lying flat party, and the basic heart is dead, such as the $OP $ARB L2 faith party, $FIL these days Wang Pan Party..

I have to say, I admire @cz_binance very much, in 13 years, all in $BTC, selling a house to break the comfort zone of life, and embracing encryption with the unity of knowledge and action!

That's right, you can't make money you don't understand! Many of us now, buying and selling coins are too casual, and they buy without studying the fundamentals.

There are indeed many opportunities for crypto, but this will always be a zero-sum game market, and if you don't improve your awareness, you can only be a leek for a lifetime!

3.35K

1

alvin617.eth 🐻⛓️

BTC dropped to a low of 98,200, currently rebounding to around 101,250.

The DeFi weekly report released last Friday... is it completely irrelevant now?

However, I still included the Base ecosystem in my buy-the-dip list.

At that time, Base topped the weekly inflow with 40 million USD.

Notable news includes JPMorgan entering Base to issue JPMD, the ACP narrative led by Virtual, and Creator Bid joining the AI agent launchpad competition, but ultimately, it cannot compete with the historical unfolding of the Iraq War.

🔸 @cobie posted late on the 22nd asking which tokens besides $BTC $ETH $SOL $HYPE would be good to buy the dip on after this market crash? It’s a good time to organize the interesting answers in the comments a bit. 👇

🔸 @Auri_0x mentioned $STRK, an ETH layer 2 competing with Solana TPS, which has a far lower FDV than arb and op, with related narratives including BTC L2 and more.

🔸 @0xMert_ the Solana general mentioned JTO, zcash, and hSOL.

🔸 @blknoiz06 mentioned $WLD, Ansem believes we need infrastructure to prove who is human and who is AI, and Worldcoin could very well become such a database infrastructure.

🔸 @jessepollak mentioned $COIN, a strong and diversified product ecosystem, one of the most capable and visionary on-chain teams in the field. 👀

🔸 @Awawat_Trades expressed considerations regarding the time frame.

- PAXG/XAUT, the reason is obvious.

- BNB/LEO, limited upside, but also limited downside.

- AAVE/MKR: a good choice.

Personally, I still think it’s not worth being overly optimistic, but I did buy some coins that I believe have dropped significantly.

Crypto Wesearch 每日幣研

Base continues to see positive developments, with Trump pressuring the Federal Reserve to raise interest rate expectations - 0620 Coin Research Weekly Report

🔥【Top 1 Cross-Chain Net Inflow】 @base +42 million

🔥 JPMorgan enters @base, introducing JPMD: JPMorgan Chase has trial-launched the deposit token JPMD on the Base network. The Base ecosystem tokens are worth watching, including @AerodromeFi, @virtuals_io, @KaitoAI, @GAME_Virtuals, @clankeronbase, and others.

🔥 GENIUS stablecoin bill passes swiftly: The U.S. Senate overwhelmingly passed the GENIUS bill with a vote of 68-30. The total market cap of stablecoins has surpassed $250 billion, with @Tether_to and @circle together holding an 86% market share.

💡 Featured Content - Stablecoins: Stablecoins and AI Financial Innovation By @Defi0xJeff

【Recommended Reading Link】

Credit to @jd950108 @0xfomor

Check out the latest issue of Coin Research Weekly, scroll down 👇

21.47K

14

🎱

Wen yield tokens?

3 months back you said we wanted to launch

Now after close to 3+ months nothing to show for ?? Are you even targeting 2025 launch??

DeFi Devin

The yield tokens are live on testnet @GammaSwapLabs and we are v close to initial deployment on mainnet

We originally wanted to go live a few months ago but yields tokens are a v complex strategy. We realised we needed to do more testing to make sure the strategies are gud for initial deployment (safety first!)

Here is the gameplan to get to 1B in TVL

📌 Launch yield tokens on Base initially for ETH

📌 Support other assets and integrate more deeply with eco (Aerodrome, Pendle, etc)

📌 Expand yield token strategies to other chains (Sonic, Arbitrum, Ethereum + ???)

📌 Collect more data and improve capital efficiency over time to increase APYs (tigher ranges, V2 for cheaper hedging, etc). This will help yield tokens scale to unbelievable heights.

GammaSwap is undeniable. Team is goated and @0x_danr is smartest giga chad I know personally. Product is leading the nascent category. We will not be satisfied until we make liquidity great again.

1.5K

1

Retarded Trader 📈📊

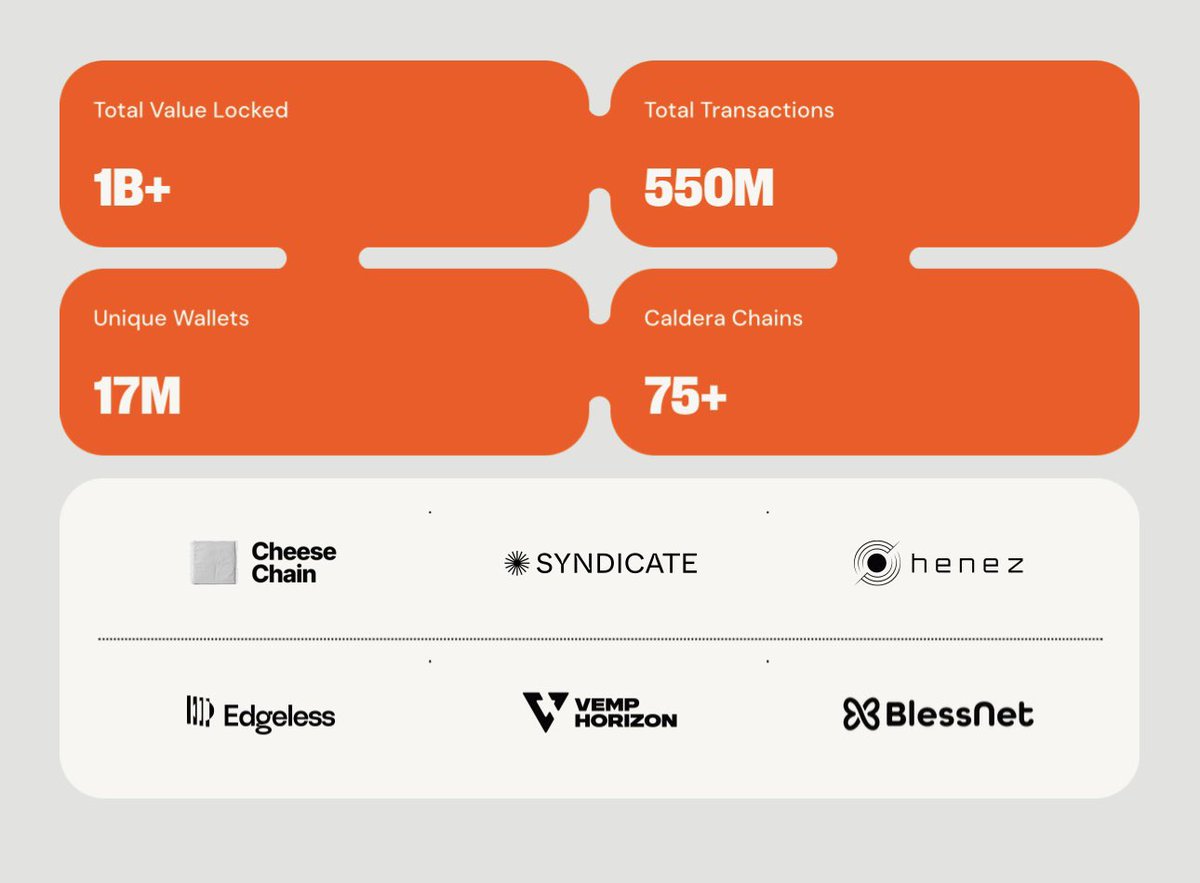

Everyone’s busy debating L3 vs L2 vs “modular meta,” but @Calderaxyz just quietly became the internet backbone of Ethereum’s rollup future.

TL;DR? They’ve:

→ Launched 75+ custom rollups

→ Hit $1B+ TVL

→ Processed 550M txns

→ Onboarded 17M unique wallets

→ Shipped intent-based bridging (Metalayer magic)

→ AND now power infra for AI agents via GenLayer’s testnet

The Metalayer is wild as it’s a unifying mesh for the rollup multiverse. It makes Optimism, Arbitrum, Polygon, and every EVM chain feel like neighborhoods on the same cosmic block.

With <2s finality and “dApp teleports” across chains, it’s less bridging, more Stargate.

@evans1vn nailed it the other day saying, intent-based bridging flips UX from “manual mode” to “autopilot.” You don’t pick chains. You just do things. And @jimmyboolish dropping stats like $517M in TVL and 45 rollups live? Let’s just say the receipts are loud.

Also, let’s not forget that GenLayer testnet has now commenced.

It’s a fully agentic AI trust infra, built on Caldera.

AI agents making real-world calls, decisions, and transactions but rollup-native. Not vaporware. Not waitlist hype.

Also their one-click rollup deployment saves devs from gray hairs. As @hodl_strong put it, “this is where the gold is.” No more setting up chains like it’s 2019. You deploy and go. Imagine if AWS let you spin up a chain instead of a server.

10x–100x cheaper txs. Instant bridging. Full EVM compatibility. 2s blocks. Rollups on rails. And VCs like Sequoia and Dragonfly backing the entire stack.

Gmera Frens

Show original

5.1K

22

Arbitrum price performance in USD

The current price of Arbitrum is $0.27220. Over the last 24 hours, Arbitrum has decreased by -0.37%. It currently has a circulating supply of 4,963,238,296 ARB and a maximum supply of 10,000,000,000 ARB, giving it a fully diluted market cap of $1.35B. At present, Arbitrum holds the 0 position in market cap rankings. The Arbitrum/USD price is updated in real-time.

Today

-$0.00100

-0.37%

7 days

-$0.05990

-18.04%

30 days

-$0.12450

-31.39%

3 months

-$0.12130

-30.83%

Popular Arbitrum conversions

Last updated: 23/06/2025, 12:19

| 1 ARB to USD | $0.27200 |

| 1 ARB to PHP | ₱15.6707 |

| 1 ARB to EUR | €0.23665 |

| 1 ARB to IDR | Rp 4,485.49 |

| 1 ARB to GBP | £0.20272 |

| 1 ARB to CAD | $0.37442 |

| 1 ARB to AED | AED 0.99892 |

| 1 ARB to VND | ₫7,118.56 |

About Arbitrum (ARB)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Arbitrum FAQ

How much is 1 Arbitrum worth today?

Currently, one Arbitrum is worth $0.27220. For answers and insight into Arbitrum's price action, you're in the right place. Explore the latest Arbitrum charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Arbitrum, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Arbitrum have been created as well.

Will the price of Arbitrum go up today?

Check out our Arbitrum price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials