Visa's understanding of the next phase of stablecoins

Written by: Web3 Law

Recently, the U.S. Senate passed the National Innovation Act to Guide and Build U.S. Stablecoins (also known as the GENIUS Act), marking another important milestone in the U.S. regulatory clarity. Jack Forestell, Visa's Chief Strategy & Product Officer, published an article on June 23, titled The Potential genius of GENIUS, laying out Visa's vision for the future stablecoin world. This is in line with Visa CEO Ryan McInerney in an interview with CNBC.

Visa's point is very important, as one of the direct rulers of the value transfer of traditional fiat currency in the world, the so-called Spring River Plumbing Duck Prophet, they must have seen everything and prepared accordingly. So, we've taken Visa's point of view, along with some of my own reflections, to explore the next phase of stablecoins.

1. "Potential" moments in the history of payments

Jack Forestell, Visa:

For Visa, the GENIUS Act should be seen as a "potential" moment in the history of payments.

I say "potential" because while stablecoins represent an opportunity to usher in the next age of digital programmable money, there's still a lot of work to be done to truly scale.

Visa CEO Ryan McInerney also said, "Our world hasn't changed much because of the passage of the stablecoin bill, and Visa has been preparing for stablecoins for several years and welcoming the arrival of the stablecoin world."

Scaling new payment technologies is not an easy task, and it requires building broad trust with buyers, sellers, payers, and payees. Building this trust takes time to build and is rooted in a complex and intertwined set of functions. These capabilities work together to enable security, reliability, security, fraud protection, dispute resolution, ease of use, and continuous innovation.

For stablecoins to be part of the world's next-generation digital payment infrastructure, they need to be implemented at three levels:

1. The Technology Layer

It is essential to have a strong, scalable, flexible, and open technology backbone that can securely and reliably execute large-scale transactions at high speeds, with zero tolerance for failures, leaks, or violations.

Advances in blockchain technology have provided promising solutions to this problem.

2. The Reserve Layer

-

Trust must be built in the value and stability of the medium of exchange.

-

Regulated, reserve-backed stablecoins offer a solution to this problem.

3. The Interface Layer

There must be a ubiquitous interface layer where participants actively want to participate:

-

This layer must provide trust, rules, standards, security, and value to participants on both sides of each transaction

-

It must scale up to reach billions of end participants

-

It must provide users with a simple and convenient mechanism to convert value tokens into fiat currency of their choice (i.e., users must be able to use the value tokens they receive where they can and want to use them)

The Stablecoin Infrastructure alone cannot solve the last layer of problems, and without a solution, stablecoins will not be able to achieve mass adoption and the vision of becoming a mainstream means of value exchange.

If they are not widely available, they will certainly be used to solve narrow payment problems, provide closed-loop solutions, and serve as behind-the-scenes infrastructure for wholesale money flow markets and capital markets, but will not scale up in mainstream payments.

Web3 Xiaolu Thoughts on this:

We can use the blockchain that has been proven for more than a decade as the settlement layer, and the compliant stablecoin as the reserve layer, thus forming a stablecoin infrastructure. Similarly, the On/Off Ramp network around the world, and the financial institutions of the fiat channel are equally important.

On this basis, we can realize the convenient exchange of fiat currency and stablecoins to support the real-life scenarios of many stablecoin payments, so as to solve the "last mile" problem and make stablecoins ubiquitous.

The few strategic layouts seen here can be summarized simply:

Visa strategically invests in stablecoin infrastructure BVNK; BVNK will continue to connect with partners such as online/offline acquiring giant Worldpay and cross-border SME acquiring solution LianLian Pay, while combining its own capabilities such as Visa Direct and Account/Card products to achieve the last mile. Reference article: Web3 Payment 10,000 Words Research Report: Web3 Transformation of Consumer Cross-border Payment.

Circle issued its own stablecoin USDC, started with Coinbase, and then built the Circle Payment Network with various financial institutions around the world – an important network of stablecoin infrastructure to enable the last mile. Reference: Circle Publishes "Stablecoin Payment Network" White Paper.

Stripe's acquisition of Bridge and Privy to enable stablecoin infrastructure capabilities; Through Stripe's B2B2C strategy, it empowers B-ends such as Shopify to achieve the last mile. References: Stripe acquires Bridge, Stripe acquires Privy.

Ripple goes from the XRP blockchain, to the RippleNet network of financial institutions, to the RLUSD stablecoin. Reference articles: Ripple, XRP, RippleNet.

PayPal links superapp apps such as PayPal and Venmo through its own stablecoin PYUSD to integrate its customer base and serve its 40 million users, so that everyone can pay according to their wishes.

At the beginning of the issuance of PYUSD, PayPal introduced its evolutionary ideas:

At the beginning of its establishment, PayPal's responsibility was not only to promote payment, but also to introduce and spread a new technology - digital payment, which is now integrated into our lives and is ubiquitous.

Although PayPal's stablecoin PYUSD is not so eye-catching, PayPal's previous successful experience can provide experience guidance and novel insights for the launch of PYUSD stablecoin payments. Specifically, PayPal divides the evolution of Mass Adoption into three phases:

-

Awareness, the GENIUS Act is the best awakening;

-

Utility, obviously we're at this stage at the moment;

-

Ubiquity, more scenarios need to support stablecoin payments, rather than piling up there to apply for stablecoin licenses.

Similarly, the Visa CEO also talked about the ability to truly realize the needs of payments, which complements PayPal's evolutionary thinking:

Scaling new payment technologies is not an easy task, and we need to:

-

Trust (backed by Visa's tens of thousands of financial institutions)

-

Ease of use (front-end payment products, e.g. Visa Card, etc.)

-

Scale (Visa's network of tens of millions of consumers and merchants)

The final stage in the adoption of any new payment technology is Ubiquity, which is characterized by the seamless integration of technology into everyday life. At this stage, people are able to use new payment technologies effortlessly and without feeling – people are just paying as they want, just as we can connect to the internet as we please, regardless of the format of the telecom operators behind them.

For users, there may be no blockchain here, and it may not be stablecoins.

Second, Visa will help solve this problem

Jack Forestell, Visa:

Visa has built the world's largest, most secure, most trusted and most recognized Tier 3 payment system. Visa has invested billions of dollars in continuous improvement to make it increasingly compatible with the underlying medium of exchange and to make it easy and flexible for all parties to integrate into the Visa ecosystem.

By integrating Visa's infrastructure, services and connectivity, Visa delivers a seamless, secure digital payment experience with unmatched scale, reliability and security to billions of buyers and sellers around the world. Visa refers to this powerful combination as the "Visa as a Service" stack.

From the smallest sellers to the largest banks and businesses, they turn to the Visa stack when the world needs to scale their payment solutions. Crypto-native partners are no exception. Over the years, Visa has partnered with leading cryptocurrency and stablecoin players and platforms to provide access to the Visa stack and enable the massive scaling of payments that comes with it.

Since 2020, Visa has facilitated nearly $95 billion in crypto purchases and more than $25 billion in crypto spending—totaling more than $100 billion in flows.

Consumers and businesses around the world see 4.8 billion Visa credentials and nearly 14 billion Visa digital tokens as the best way to pay and to receive money for everyone, everywhere. Visa's technology stack delivers exceptional payment experiences and is constantly investing in making it the most advanced, secure and convenient way to pay.

-

With Visa's capabilities, users no longer need to ask themselves the following questions before making a purchase:

-

Will the merchant accept my payment?

-

Do I need a dedicated wallet to make payments?

-

Do I have the right type of currency in my wallet? Am I on the right blockchain?

-

What is the Gas Fee to pay this amount?

-

Can I keep my privacy? Once I buy something from a merchant, will anyone else be able to see all of my transactions and address without my permission?

-

Can I get rewarded?

-

How do I use my line of credit?

-

Who do I talk to if I have a problem?

-

Is it safe?

The vast majority of consumers and businesses will continue to pay in fiat currencies and enjoy the convenience of Visa credentials. The same is true for stablecoin-powered solutions that connect to the Visa stack.

Web3 Xiaolu Thoughts on this:

The core point of Visa here is that even if you have the ability to build a stablecoin infrastructure, it is not enough to have the ability, and we can also help you achieve scale through the Visa ecosystem network and Visa's capabilities. This is the core.

( Visa CEO on GENIUS ACT: We『ve been embracing stablecoins)

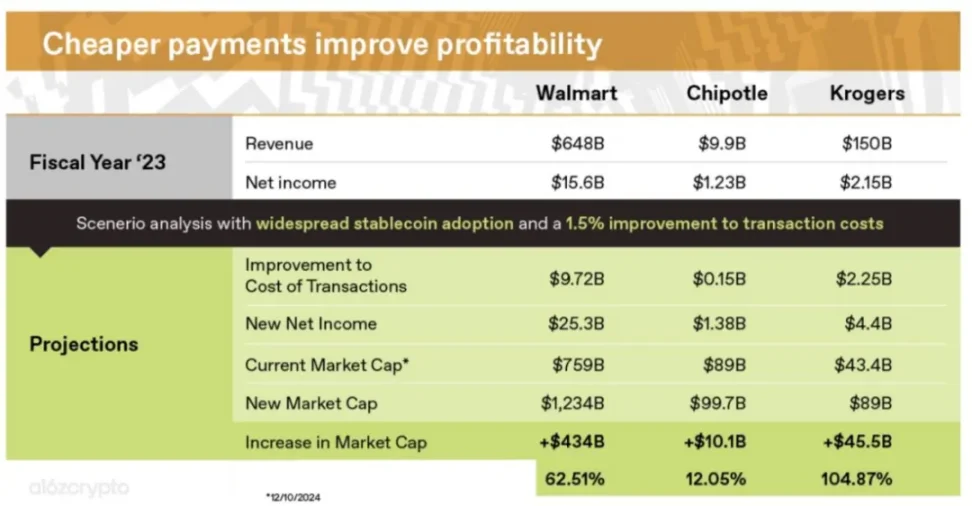

But just like Walmart, Amazon reports that they are also considering issuing their own stablecoins, which would be a huge boost to their profitability if these companies were able to circumvent the Visa/Mastercard settlement network and eliminate huge payment intermediary fees.

It's a question Visa can't avoid.

As written in the previous article "Web3 Payment 10,000 Words Research Report: How Stablecoins Will Perform in 2025":

The transaction fees of the current payment system directly erode the profits of most enterprises, and the reduction of these fees will bring huge profit margins to enterprises. The first boot has landed: Stripe has announced that they will charge a 1.5% fee on stablecoin payments, which is 30% lower than the credit card payment fees they charge.

For convenience, this assessment assumes that the business pays a 1.6% mixed payment fee/cost and that the cost of currency acceptance is extremely low.

Walmart has an annual revenue of $648 billion and may pay $10 billion in credit card fees and make a profit of $15.5 billion. Do the math: Eliminate payment fees and Walmart's profitability, so its valuation (regardless of other factors) can increase by more than 60% with cheaper payment solutions alone.

Chipotle is a fast-growing fast-food restaurant with annual revenues of $9.8 billion. It has an annual profit of $1.2 billion, of which $148 million is paid in credit card fees. By reducing payment fees alone, Chipotle was able to increase profitability by 12% – a staggering figure not available elsewhere on its balance sheet.

Krogers, a national grocery store, has the lowest profit margins and therefore the most profitable. Surprisingly, Krogers' net income and cost of disbursements can be almost equal. Like many grocery stores, its profit margins are less than 2%, which is lower than how much businesses pay to process credit card payments. With stablecoin payments, Krogers may double their profits.

(How stablecoins will eat payments, and what happens next, a16z)

3. What problems can stablecoins solve?

Jack Forestell is often asked, "What exactly do stablecoins solve?"

In this regard, he said: First, stablecoins have found a perfect Product Market Fit in the cryptocurrency trading market, and for some use cases, including emerging markets, stablecoins still represent a significant opportunity. Especially:

-

Users in small currencies, high inflation, and countries with foreign exchange difficulties, who want to hold US dollars but do not have easy access to them.

-

For certain cross-border money flow use cases, such as C2C person-to-person remittances or B2B business-to-business payments.

Tether CEO: Less than 40% of Tether's market cap is related to the cryptocurrency market. In other words, more than 60% of the market cap growth actually comes from the grassroots use of USDT in emerging markets. The next driver of USDT's market cap growth is likely to come from trading in commodities.

Visa sees these use cases as new processes that have not yet been fully addressed, providing a path for Visa's business to grow. In response, Visa plans to work with stablecoin-native partners, platforms, and our financial institution partners to harness the power of the Visa stack.

At present, it is unclear whether consumers and businesses will be willing to pay with stablecoins in developed markets such as the United States, as there are many competing options to pay with "digital dollars" directly from their bank accounts.

The GENIUS Act brings practical regulatory clarity to stablecoins, opening up a potential path for further adoption. Visa has been active in a variety of solutions in the stablecoin space, including:

-

Deploy Visa credentials and Visa digital tokens to connect stablecoin and cryptocurrency platforms and their users with fiat currencies and our global network

-

Provide local stablecoin settlement

-

Cross-border fund flow solutions through stablecoin infrastructure

-

Programmable currency solutions for customers

-

There are many more in development

Of course, it will take time for stablecoins to truly become geniuses – and we're just getting started.

Web3 Xiaolu Thoughts on this:

The CEO of Visa made it clear that there is a misconception about stablecoins now: because they are all US dollar stablecoins, it is natural that the United States is the main landing region for stablecoin applications. However, the real use case of stablecoins, Product Market Fit, is actually outside the United States, which is what we call Asia, Africa and Latin America - Global South. There are about 30-50 countries here, and the access to stablecoins can greatly improve financial efficiency.

The CEO of Tether also confirmed this in a previous interview with Bankless:

The U.S. is one of the most efficient markets for capital flows in the world, with financial channels up to 90% efficient. The introduction of stablecoins could increase efficiency from 90% to 95%, and the premium room is very limited. In contrast, in other parts of the world, the introduction of stablecoins can provide 30%-40% of financial efficiency. Therefore, for these countries, stablecoins are even more significant.

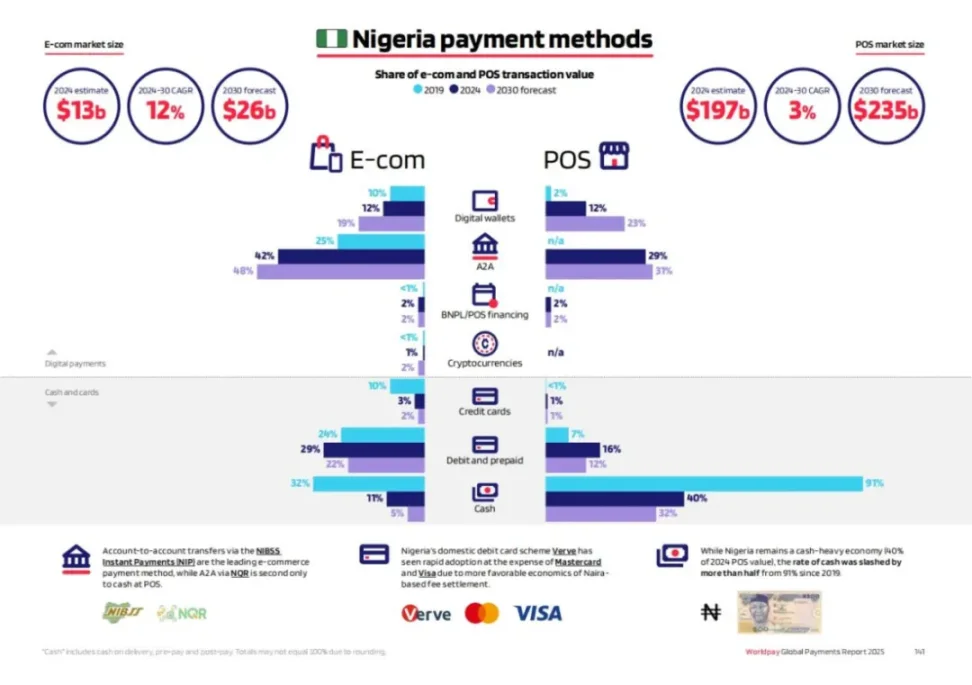

As a result, in these markets, even for Visa, it is difficult to reach. In our previous article (Web3 Payment 10,000 Words Research Report: Web3 Transformation of Consumer Cross-border Payment), we can see that in different countries, the choice of payment methods will be different. If you are interested, you can take a closer look.

GERMANY: CONSUMERS ARE THE MOST RELUCTANT TO USE A CREDIT OR DEBIT CARD (ONLY 32%), PREFERRING DIGITAL APP PAYMENT SERVICES (49%) AND BANK TRANSFERS OR WIRE TRANSFERS (35%). This may be because consumers value the security and ease of use of payments more, as highlighted in the Western Europe Online Payment Methods 2022 report.

PHILIPPINES: CONSUMERS PREFER DIGITAL APP PAYMENT METHODS (49%), WHICH MAY BE RELATED TO THE FACT THAT 48.2% OF CONSUMERS IN THE COUNTRY DO NOT HAVE ACCESS TO TRADITIONAL BANKING SYSTEMS.

Similarly, we were able to see in Worldpay's 2025 report that the penetration of Visa/Mastercard in Nigeria, a major economy in Africa, is very low. Offline is still king with cash.

(GPR 2025: the past, present and future of payments, WorldPay)

That's where Tether comes in. While the Global North is engaged in an arms race, Tether has reached deep into the Global South.

For example, there are still 3 billion people in the world who do not have bank accounts, and Tether currently reaches 450 million users, the opportunity here is huge, and it is important to distinguish between different products and use cases of stablecoins.

Reaching deep into Asia, Africa and Latin America, investing in infrastructure, this innovative distribution channel and deep penetration into emerging markets is key for Tether to stay ahead of the curve in the stablecoin space. Tether is not only technologically advanced, but has also built an unprecedented dollar distribution network across the globe, which is one of Tether's least well-known strengths.

If Circle turns around after its listing, it is full of competitors from traditional financial and industrial giants.

Tether's competitor is the Belt and Road Initiative from Tokyo:)