Lido Founder Borrows 85M USDT from Aave to Buy Ethereum (ETH)

Key Insights:

- Lido founder Konstantin Lomashuk borrows 85M USDT from Aave to purchase Ethereum.

- World Liberty Financial adds 77,226 ETH worth $296M with $41.7M unrealized profit.

- ETH Strategy raises 12,342 ETH, totaling $46.5M for treasury protocol launch.

Lido founder Konstantin Lomashuk borrowed 85 million USDT from Aave to buy Ethereum. The move shows high conviction in ETH as the price posts strong gains.

World Liberty Financial continues accumulating with 77,226 ETH holdings total.

ETH Strategy completes a $46.5 million funding round, showing institutional confidence in Ethereum’s future prospects.

Lomashuk Leverages DeFi Protocols For Ethereum Accumulation

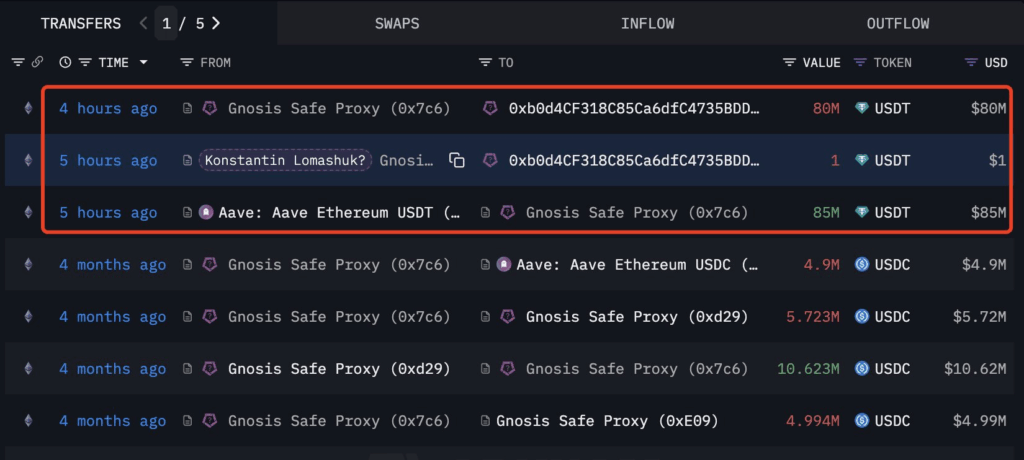

Lido founder Konstantin Lomashuk took 85 million USDT out of Aave to buy more Ethereum.

Lookonchain discovered that he transferred 80 million USDT to AmberGroup after he borrowed funds. AmberGroup invested in exchanges and borrowed 15,814 ETH worth $59.75 million.

The Lido founder used the available funds as collateral rather than selling existing assets. This approach facilitates portfolio maintenance through increased exposure to Ethereum through borrowing.

Blockchain analysis companies call the action a bullish sign for ETH. Market analysts consider the huge buy a vote of confidence in the Ethereum fundamentals.

ETH price action has solid gains with 5.4% gains in 7 days. Two-week gains were 29.7% and monthly gains came to 57.3% substantially.

The use of Aave’s lending protocol provides variable rates of borrowing for strategic deployment. The trade indicates growing institutional take-up of DeFi lending protocols.

World Liberty Financial Accumulates Ethereum

World Liberty Financial spent 1 million USDC to buy 256.75 ETH at $3,895 price. The purchase occurred roughly a day ago, continuing the systematic ETH accumulation strategy.

World Liberty accumulated a total of 77,226 ETH worth $296 million at an average price of $3,294.

Meanwhile, its current holdings show an unrealized profit of approximately $41.7 million based on pricing.

In other Ethereum news, smart trader 0xCB92 shorted ETH on June 11 while others showed FOMO.

ETH dropped to $2,120 after breaking through $2,880 resistance level. The trader shorted ETH again yesterday while the market showed enthusiasm.

Ethereum declined after breaking through $3,940 following the short position. Market observers question whether a similar pattern will repeat this time.

Mixed positioning shows institutional accumulation alongside tactical short-selling strategies. World Liberty’s continuous buying contrasts with smart money shorting approaches.

Institutional buyers focus on long-term Ethereum adoption while traders exploit volatility.

Both strategies make use of ETH’s price movement potential from different perspectives.

ETH Strategy Completes $46.5M Funding Round for Treasury Protocol Launch

ETH Strategy raised a total of 12,342 Ethereum worth approximately $46.5 million across fundraising.

The round included a private sale raising 6,900 ETH from institutional investors. Public sale contributed 1,242 ETH, while puttable warrants added 4,200 ETH.

Private presale offered 1 ETH per 10,000 STRAT tokens with vesting terms. Public sale maintained the same ratio with a 4-month cliff plus a 2-month linear unlock. Puttable warrants provided 1 ETH per 8,333 STRAT equivalent with similar vesting.

Meanwhile, the company allocated 11,817 ETH for deployment into ETH staking operations. Protocol liquidity receives funding to be phased in as growth occurs.

Notably, the partnership details for staking operations will be announced shortly by the team. The protocol growth and development team receives 525 Ethereum allocation for operational expenses.

Funds pay for retroactive expenses, audits, contributor rewards, and community development. STRAT token goes live on Uniswap v4 at 9:00 AM ET Tuesday.

The round of funding marks the end of the prelaunch stage, indicative of the protocol launch start. Three capital formation events targeted different types of investors effectively.

All sources of capital offer a strategic advantage for protocol development phases. Treasury protocol implementation tracks institutional Ethereum buying patterns in markets.

The post Lido Founder Borrows 85M USDT from Aave to Buy Ethereum (ETH) appeared first on The Coin Republic.