1/ NEW: Last night, DEF, @paradigm, @btcpolicyorg, @BlockchainAssn, @crypto_council, @DigitalChamber, @SolanaInstitute, & @UniswapFND, filed an amicus brief in @LewellenMichael’s case against the DOJ in support of Lewellen’s opposition to the DOJ’s motion to dismiss.

Let’s dive in 🧵

2/ First, a refresher on what this case is all about.

In Jan. 2025, Michael Lewellen filed a preemptive lawsuit against the DOJ for unfairly prosecuting noncustodial software developers as operators of money transmitting businesses under 18 U.S.C. §1960, the federal criminal statute which proscribes failing to register a “money transmitting business.”

The key issue contemplated in this case is whether Lewellen, in his plan to publish a DeFi protocol, engages in an unlawful activity under 18 U.S.C. §1960.

3/ Lewellen asserts a Declaratory Judgment Act (DJA) claim, asking the court to declare that he is not operating a "money transmitting" business and that he is not a "money transmitter," a First Amendment claim "that the money-transmitting laws are unconstitutional insofar as they apply to Lewellen’s writing and publishing of non-custodial and immutable software,” and a Fifth Amendment claim that the DOJ's interpretation of the money transmitting laws violates his Due Process rights.

4/ As DEF has said through its past advocacy, prosecuting developers of noncustodial p2p software under 18 U.S.C. § 1960 for operating “unlicensed money transmitting businesses,” is legally incorrect and unfair.

The DOJ pushing a radical new theory of criminal liability via criminal indictment, and in direct contravention of 2019 FinCEN Guidance, violates Due Process and fair notice principles, and makes the U.S. less competitive.

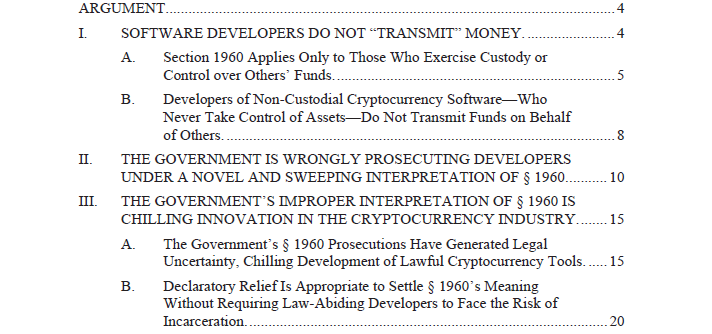

5/ Our amicus brief makes the following arguments:

6/ As we argue, “…to be subject to prosecution under § 1960 for “unlicensed money transmitting”—under any of the statute’s definitions of “money transmitting”—a person must have taken custody or control of another person’s funds. Yet, despite §1960’s “clear limits” the Government is actively prosecuting developers of noncustodial p2p software for “unlicensed money transmitting.”

Look no further than the cases against the developers of Tornado Cash and Samourai Wallet.

7/ But the Government’s theory is wrong on the law.

8/ Ultimately, the Government's theory of liability generates legal uncertainty, chills the development of LAWFUL digital asset tools, and potentially leads developers to move offshore or cease creating their tools entirely.

9/

10/ By submitting this amicus brief, DEF and our partners believe that declaratory relief is appropriate. Participants in the digital asset industry "are entitled to receive clarification from this court before stifling their [lawful] practices or otherwise exposing themselves to punishment."

end/ We are thankful to our partners, and appreciate the extremely talented team at @JonesDay for their help with this amicus brief.

You can read the full amicus brief at the link below 👇

62K

77

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.