One of the largest untapped markets in crypto is undercollateralized lending.

@3janexyz takes this further, unlocking unsecured lending for users with no collateral needed.

🧵

The full report covers 3Jane's infrastructure, credit framework, and more.

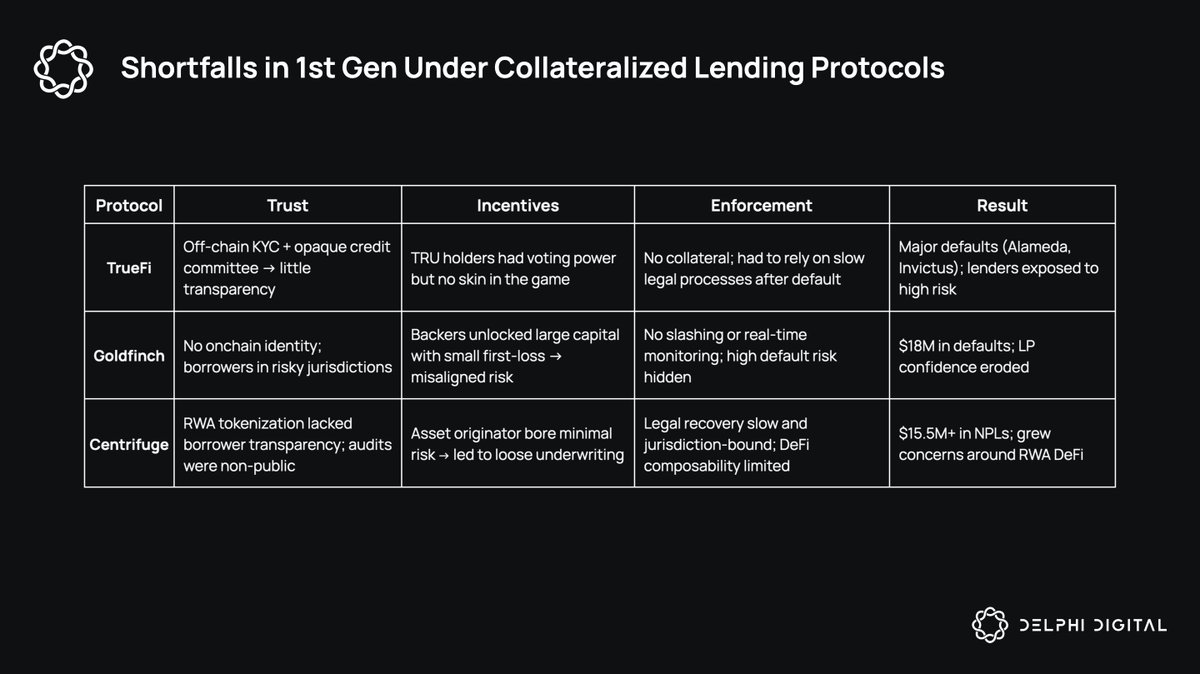

1/ Why hasn't undercollateralized lending worked?

During the crypto credit boom, CeFi lenders extended billions in unsecured loans based on relationships and "institutional sophistication." When Luna collapsed and 3AC defaulted, $49B in crypto credit vanished.

DeFi protocols like TrueFi and Goldfinch failed. CeFi captured all the big ticket demand, while protocols couldn't compete with no enforcement and poor trust mechanisms.

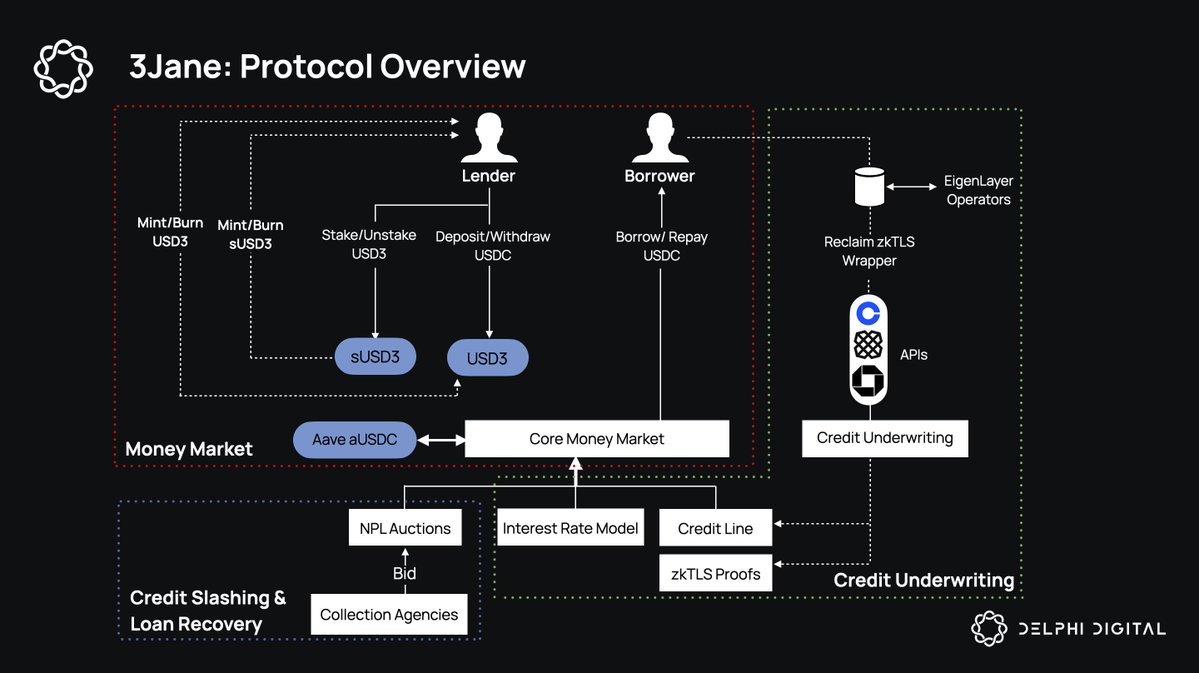

2/ 3Jane takes lessons from its predecessors to create a credit-based money market for USDC loans that doesn't require any collateral.

This is made possible through zero-knowledge proofs (ZKPs) which verify creditworthiness without exposing your data.

With ZKPs, users can prove their credit, income history, etc. without revealing the information to 3Jane.

3/ This is possible through 3Jane's Credit Algorithm (3CA) which determines loan terms:

Your credit line takes into account risk-adjusted assets and cash flows.

Your interest rate builds from a base rate plus your personal risk premium, with late penalties. Monthly payments are the minimum of the protocol repayment rate or lifetime portfolio appreciation.

Both your on-chain & off-chain data is factored into these calculations.

5/ 3Jane builds on Morpho's architecture with key modifications:

• Risk tranche: Lenders choose USD3 (senior, safer) or sUSD3 (junior, higher yield but takes losses first)

• Dynamic rates: Base rates adapt to utilization while idle funds earn Aave yields automatically

• Personalized pricing: Each borrower pays their own risk-adjusted rate, not just pool rates

This creates a more sophisticated market compared to traditional p2p lending.

6/ Where does 3Jane fall short:

• Privacy risk: Node operators could theoretically collude to expose user data.

• US-only: The enforcement mechanism limits the protocol to US borrowers at launch.

• Slow collections: Debt recovery can take months which could leave lenders stuck in limbo.

• Small lines: Initial credit limits will be conservative which reduces appeal.

• Cascade risk: Mass defaults could still trigger bank runs despite protections.

15.85K

75

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.