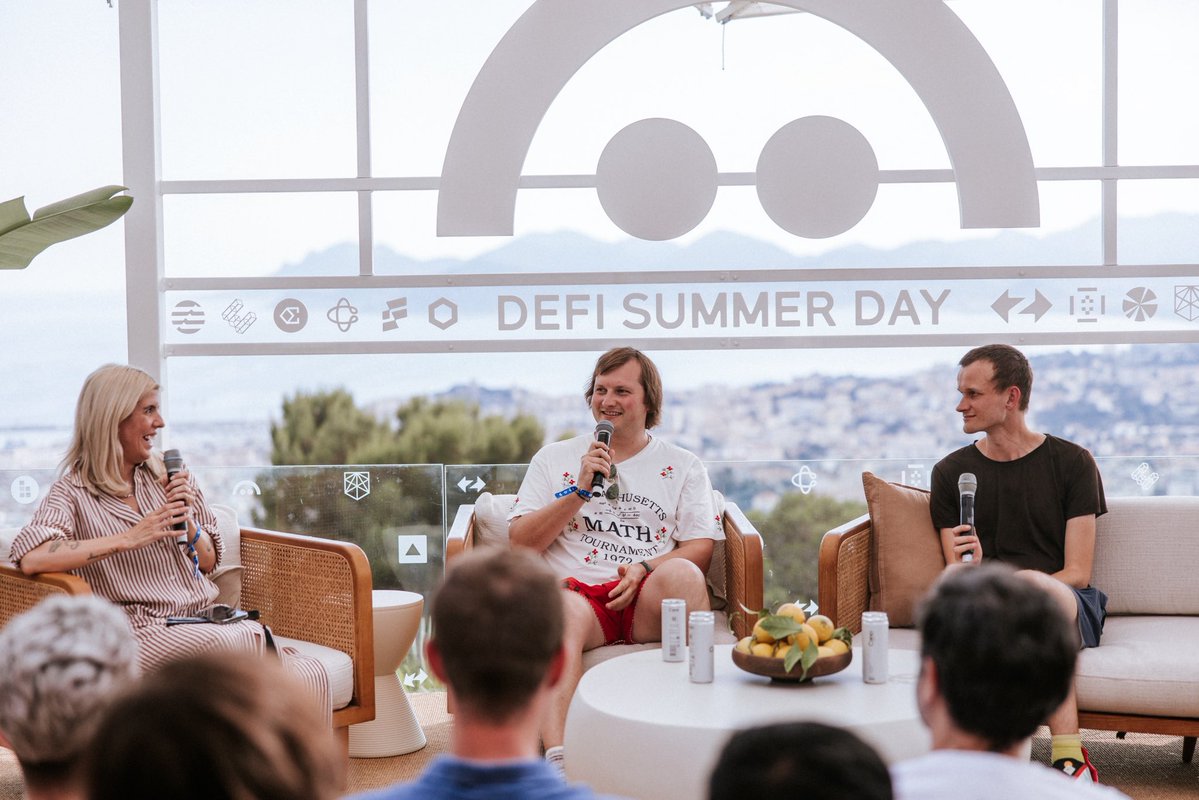

The heat wave in Europe did not stop us from having a blast at @EthCC Cannes!

The crypto space is getting exciting with several developments. Let's find out more from our EthCC 2025 summary 👇

3/ TradFi Liquidity Going Onchain

@RobinhoodApp stole the show with the announcement of Robinhood L2 chain, to be launched with Arbitrum Orbit Stack. Besides, they planned to launch tokenized US stocks on L2, perpetual futures in EU, and staking in the US.

It's highly likely that other TradFi institutions will follow Robinhood's lead and develop their own L1/L2. This marked an important milestone of institutions becoming more crypto-native.

Introducing The Robinhood Chain.

The first Ethereum Layer 2 optimized for real-world assets via @arbitrum—from public to private to global.

You shouldn’t have to rely on a broker to trade assets. Instead, you should be able to seamlessly trade real-world assets in seconds.

We’re working with regulators to make this a reality. More is coming soon.

4/ Crypto-Native Exploring Equity

While TradFi is exploring more on-chain opportunities, more crypto-native people are seeking exposure to equity.

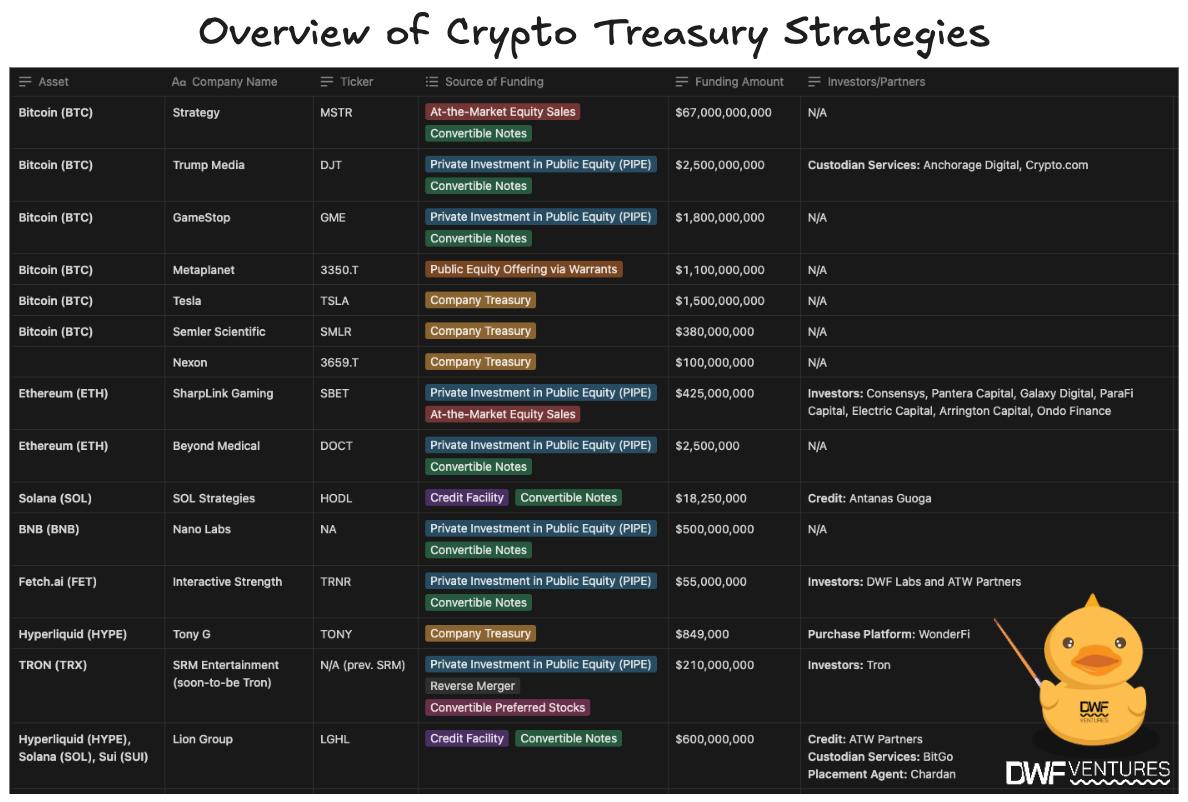

More crypto funds are investing in either listed or pre-listed equity deals, or through crypto treasury strategies similar to those of @MicroStrategy and Metaplanet.

For instance, @DWFLabs has invested in the $FET treasury of Interactive Strength (TRNR) using a combination of PIPE and convertible notes, a common structure in the market.

Public companies are increasingly embracing crypto treasury strategies, injecting over $40 billion into digital assets in the past year alone. This trend highlights a significant shift in how corporations are managing their capital.

We've identified 14 companies that have publicly adopted these strategies, with their combined crypto holdings now surpassing $76 billion.

5/ Ethereum DeFi

Ethereum DeFi is coming back, as seen from the increase in DEX and lending volumes over the past quarter. Despite the fast growth of Solana DeFi, Ethereum remains the No.1 chain that attracts most liquidity.

A decent amount of DeFi events were also hosted during EthCC, such as @aave and @dYdX.

6/ Stablecoins Everywhere

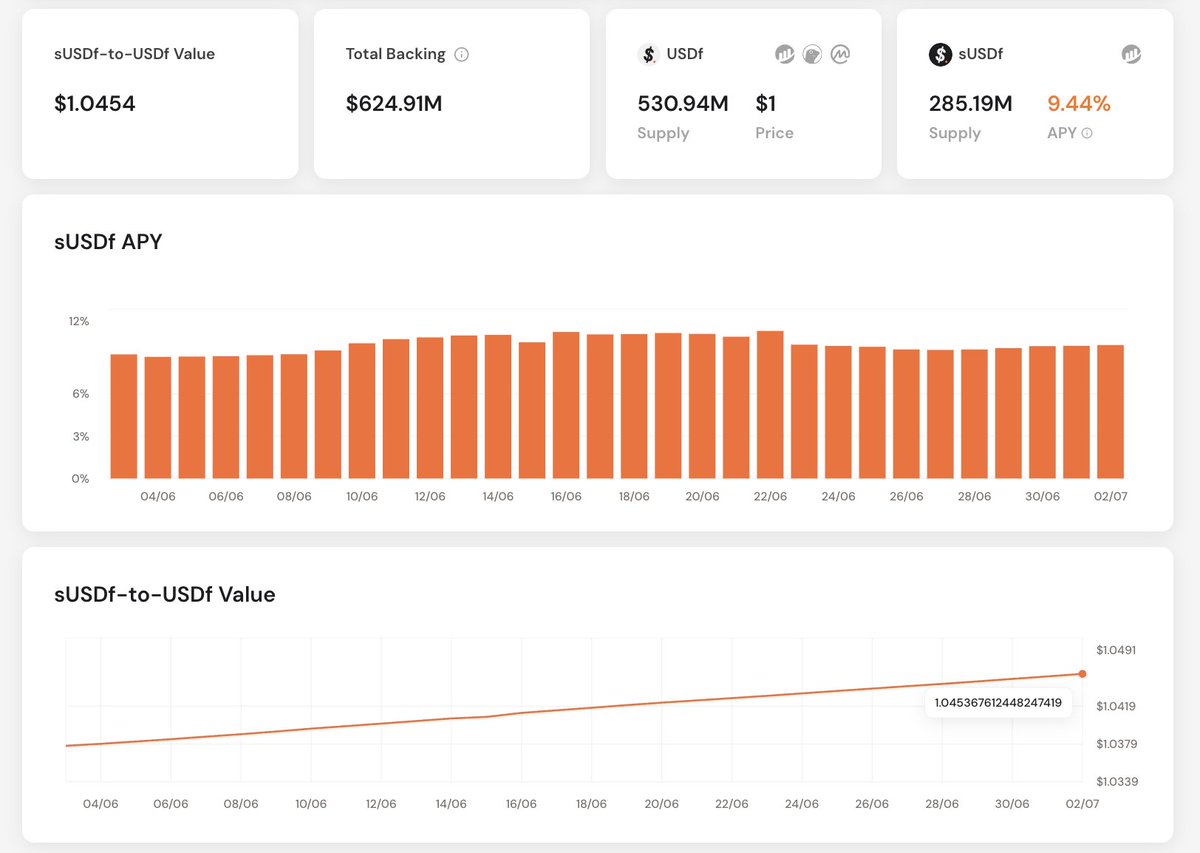

Stablecoins remained viral during the conference, largely contributed by the listing of @circle and the rise of fast-growing synthetic dollars like @FalconStable.

Many ecosystems such as @base @KaiaChain @StellarOrg are aware of the stablecoin trends, and therefore working towards building stablecoin TVLs and projects on their chains.

7/ Thoughts on Cannes

Cannes is a small city in France, so most builders are not based there.

Due to the heat wave in Europe, EthCC Cannes was particularly hot this year, especially since many side events took place outdoors (near the beach).

There were rumors that EthCC 2026 will be hosted in Cannes again. We can stay tuned for the upcoming news from the @ethereum foundation!

9/ NFA + DYOR

@ag_dwf

@fionaclairema

@DWFLabs

14.18K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.