With stablecoin season heating up, @FalconStable YBS emerges as one to watch imo.

Both its yield mechanics & farming incentives offer unique opportunities for users seeking sustainable returns.

What is Falcon?

Falcon is a synthetic stablecoin protocol built for cyclical resilience.

$USDf & $sUSDf (staked ver.) are designed to accrue competitive yields from both positive & negative funding conditions.

Falcon leverages a multi-asset collateral model w/ optimised yield strategies. This approach has already pushed its TVL past $559M, supported by its ongoing Falcon Miles program that hints a potential airdrop.

Falcon employs a dual-mechanism to mint $USDf:

1⃣Stablecoins (USDT, USDC, DAI): Minted 1:1

2⃣Volatile Assets (BTC, ETH, etc.): Overcollateralised to ensure protocol integrity

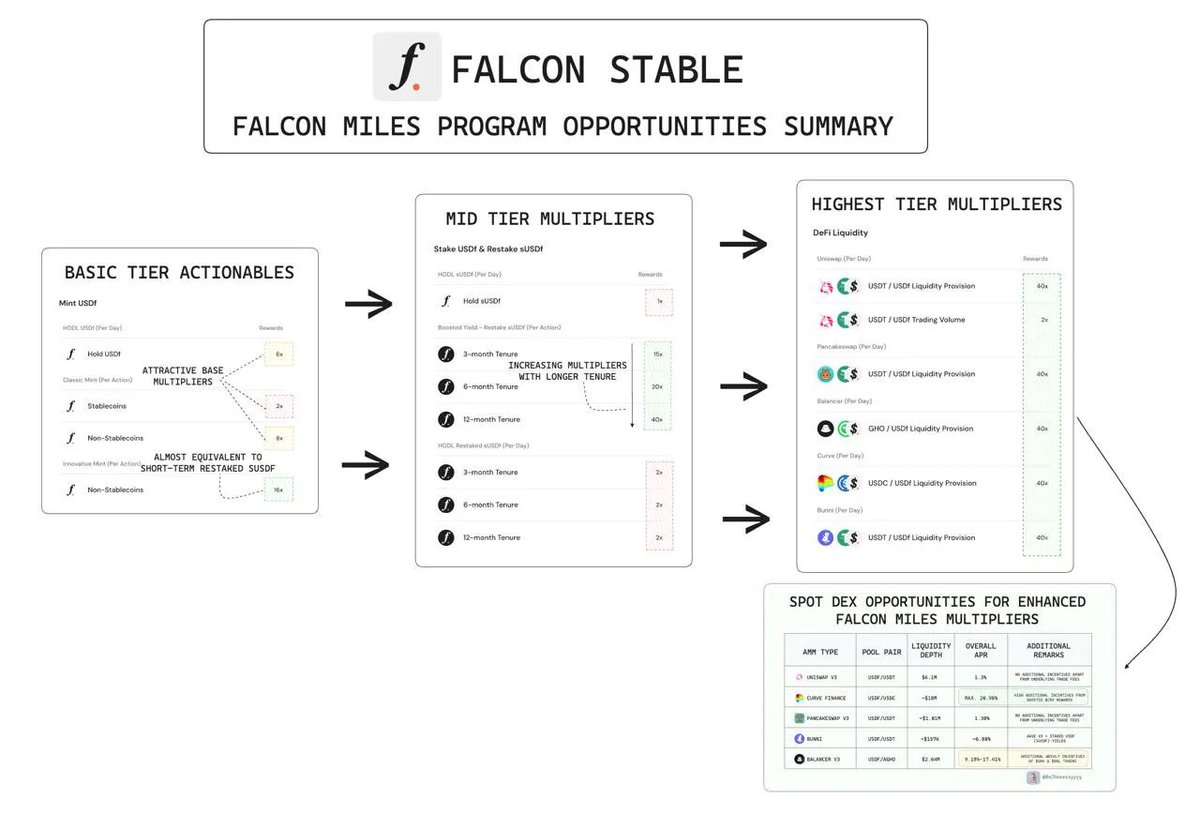

where diff. mint types come with its resp. multipliers:

🔹Classic Mint: 2x for stables, 8x for volatiles

🔹Innovative Mint: 16x (only possible via non-stablecoin deposits)

*HODL-ing $USDf itself holds a base 6x multiplier on a daily basis

Likewise, staking ($sUSDf) has much amplified multipliers (15x-40x) depending on staked tenure.

Max Yield & Miles Farming via LP Opportunities:

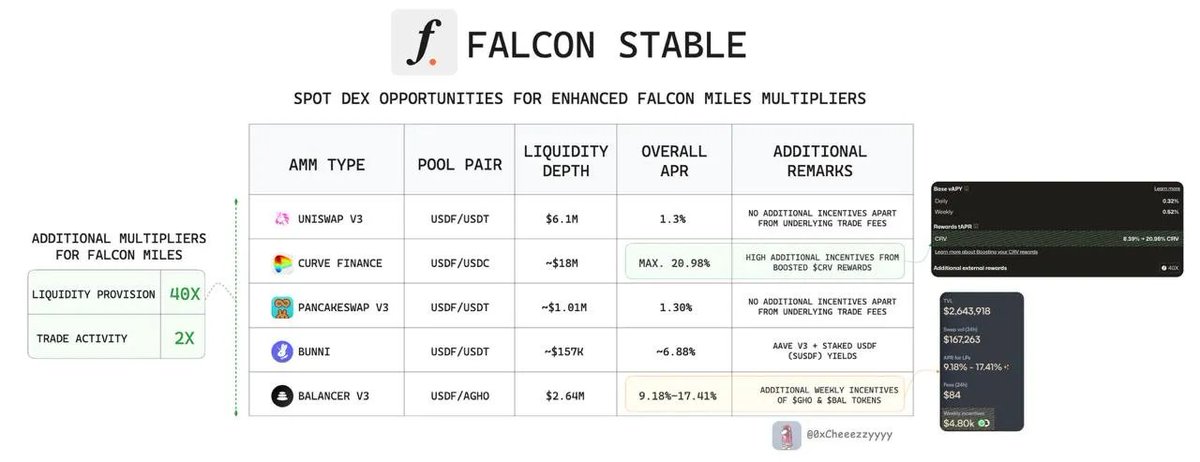

The highest tier multipliers are associated in liq. provision (up to 40x per dollar LP-ed, per day) where it includes:

🔸 @Uniswap V3 (USDf/USDT): ~1.4% APR

🔸 @CurveFinance (USDf/USDC): max. 20.98% APR (w/ boosted $CRV rewards)

🔸 @PancakeSwap V3 (USDf/USDT): ~1.3% APR

🔸@bunni_xyz (USDf/USDT): ~6.88% APR (@aave V3 + staked $USDf yields)

🔸 @Balancer V3 (USDf/aGHO): 9.18-17.41% APR (weekly $GHO & $BAL incentives)

with coverage across major AMMs, capital can be deployed where you hold the most strategic edge.

*Bonus: If you're LP-ing on Uniswap/PancakeSwap, you're cur. eligible for extra ~30% APY in USDf incentives on @Merkle_Trade (only for a limited period)

---

On Transparency & Protocol Credibility

While the stablecoin landscape saw many new entrants w/ innovative yield mechanisms, security & trust here is non-negotiable imo.

Notably, Falcon stands out with its strong emphasis on institutional-grade custody & operational transparency:

a. Off-chain Reserves: Industrial-grade custodial solutions @CeffuGlobal @FireblocksHQ @ChainUpOfficial

b. Operational management: via tier-1 CEX @binance

This foundation is also reinforced with consistent audits & accountability efforts handled by top-tier security firm/independent auditors @zellic_io @pashovkrum @htdgtl.

This is a green flag I look out for when choosing which protocol to entrust my $$$.

----

On Expanding DeFi Integrations

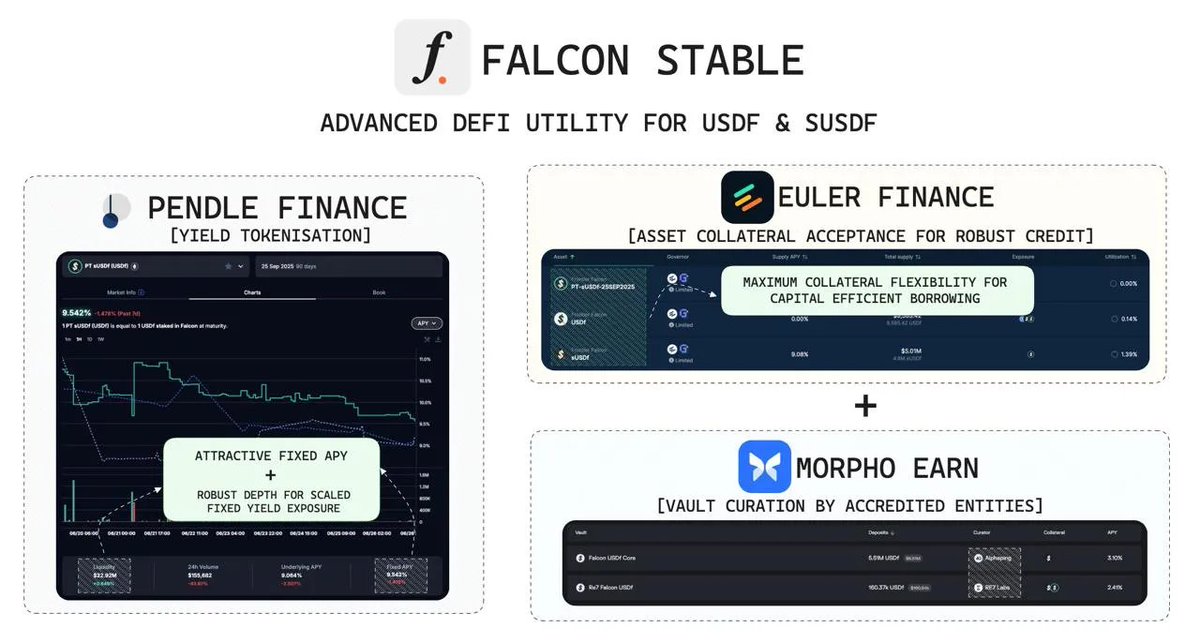

The premise of YBS is to enhance itself in DeFi integrations where:

More DeFi Opportunity breath = More utilisation & multi-layered combinations for enhanced productivity.

where emerging advanced DeFi utility for $USDf are already made available:

🔸Yield Tokenisation via @pendle_fi: 9.06% fixed APY on $sUSDf w/ robust $22.1M depth

🔸Lending on @eulerfinance: $USDf $sUSDf & PT-USDf supported as collateral

🔸 Earn on @MorphoLabs: $USDf vaults curated by @0xAlphaping @Re7LabsCurated $USDf vaults via @0xAlphaping & @Re7Labs

these will only expand significantly in time to come as it leverages on its foundational liquidity base.

IMO, its only a matter of time before new, more complex multi-level strategies emerge.

This will further unlocks deeper asset composability + further cementing Falcon's relevance in the evolving YBS landscape.

Attaching the relevant links for reference below👇

To get started on @FalconStable, feel free to use my referral code:

(Uniswap/PancakeSwap existing LPs) To be eligible for an extra 30% APY on Merkle Trade, do visit:

8.2K

73

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.