재보험 투자 프로토콜 Re, Pendle Pool 등장

Re 는 재보험을 통해 수익을 발생시켜 홀더들에게 환원하는 프로젝트입니다.

$21M 투자 및 Ethena 와의 협업을 했었고, 자세한 사항은 예전 포스팅 ()을 참고해 주시기 바랍니다.

이런 Re 가 Pendle 에 reUSDe 풀을 출시 했네요

$142M 의 TVL 과

Ethena USDe / sUSDe 자산 예치

그리고 Pendle 까지 행보가 좋은것 같아서,

놀고있던 sUSDe 를 예치하여 reUSDe 로 만든 후에, Pendle 의 LP 로 예치 하였습니다.

얘네는 아직 포인트 시스템은 없는데,

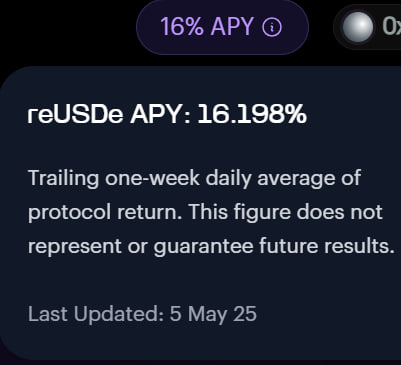

지난 주 이자율이 16% 나 되네요

아마도 큰 보험관련 사고만 없다면,

크립토 장 상황과 상관없이, 꾸준한 이자를 만들어 낼 수 있지 않을까 싶습니다.

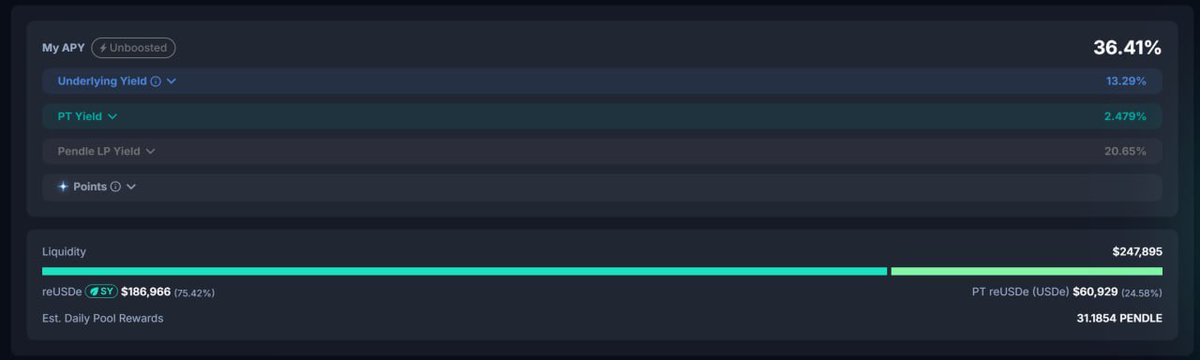

현재 Pendle Pool 약 $248K 밖에 안되는데,

그래서인지 초반 LP 이자율이 Boosting 포함 80% 이고, 저는 Unboosted 라 36% 정도네요

관심있으신 분들은 @re 를 살펴보시기 바랍니다.

단, 얘네 KYC 해야 됩니다.

예치 하면 KYC 를 해야 준다고 나와서 깜놀 했는데, 다행히 한 5분이면 끝나고 그뒤에 바로 주네요

Ethena x Re

$USDe / $sUSDe of @ethena_labs can now be deposited to @re

What is Re?

- 'Reinsurance' RWA Protocol

- $21M investment from Electric Capital, Framework, and others

- TVL $135M (but not tracked on @DefiLlama yet)

- Website claims to offer additional interest of up to 23%.

- KYC required for deposits

- 40 days lockup on deposits

According to the docs, the deposited assets are invested in risk pools that invest in various reinsurance contracts and earn interest based on fees and premiums.

First of all, the current contract is with Ethena, which seems to insure Ethena's assets.

Other reinsurances in the real world, such as vehicle insurance, liability insurance, and property insurance, seem to be the original targets.

The surplus assets that are not used for insurance earn interest at $sUSDe for $USDe / $sUSDe, and the rest of the general stable is invested in assets that generate the highest interest at their own discretion.

In addition, they select reinsurance contracts to earn stabilized interest by excluding catastrophic risk contracts such as fires and typhoons.

It seems like a pretty interesting project.

I don't know much about the yield or stability of the reinsurance field, but I remember when I interviewed for my first job at the Korean reinsurance company "Korean Re" (wow the name Re is becoming interesting now), it was a very profitable and stabilized sector.

Of course, if there is a disaster-level accident due to a wrong contract, you may lose money.

Let's dig down more as it goes!

400

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.