$SOL is the next target for Abraxas.

4 hours ago, Abraxas continued to pile on short volume for $SOL at a price of $145.25.

Notably, yesterday this wallet also continuously added short orders for $SOL, bringing the total volume of this order to ~$43.8M.

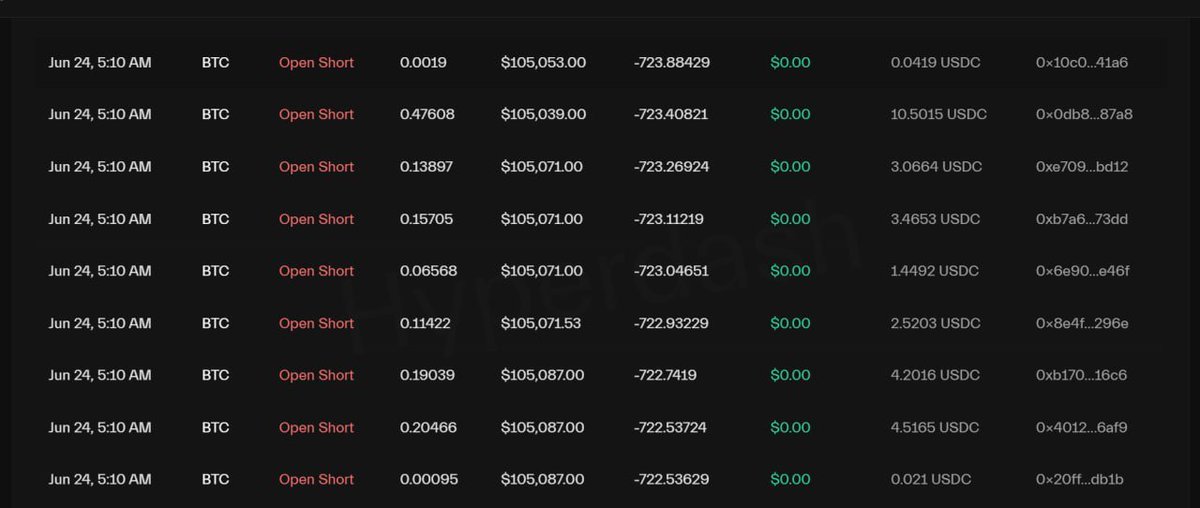

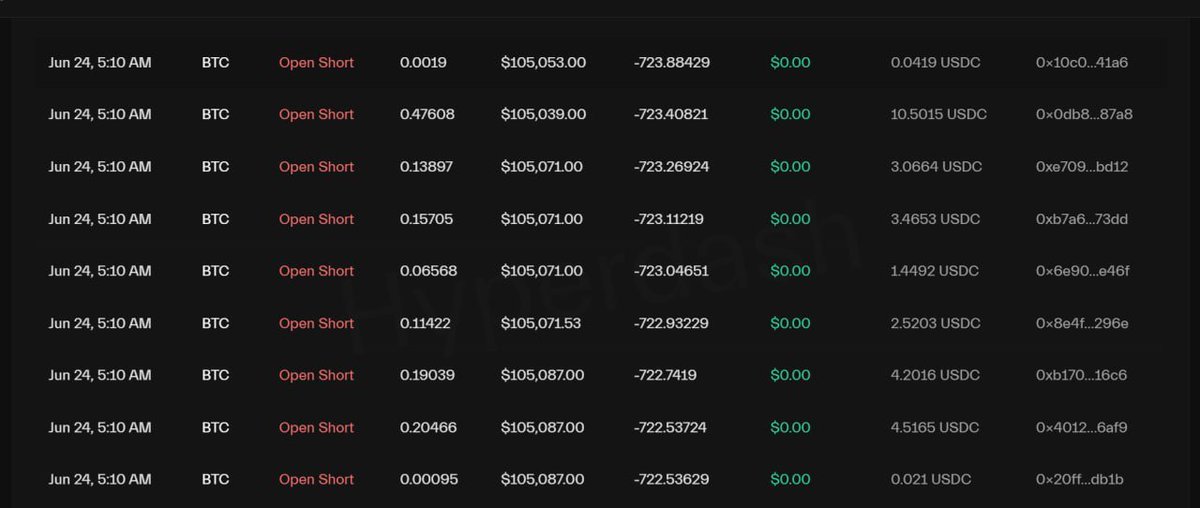

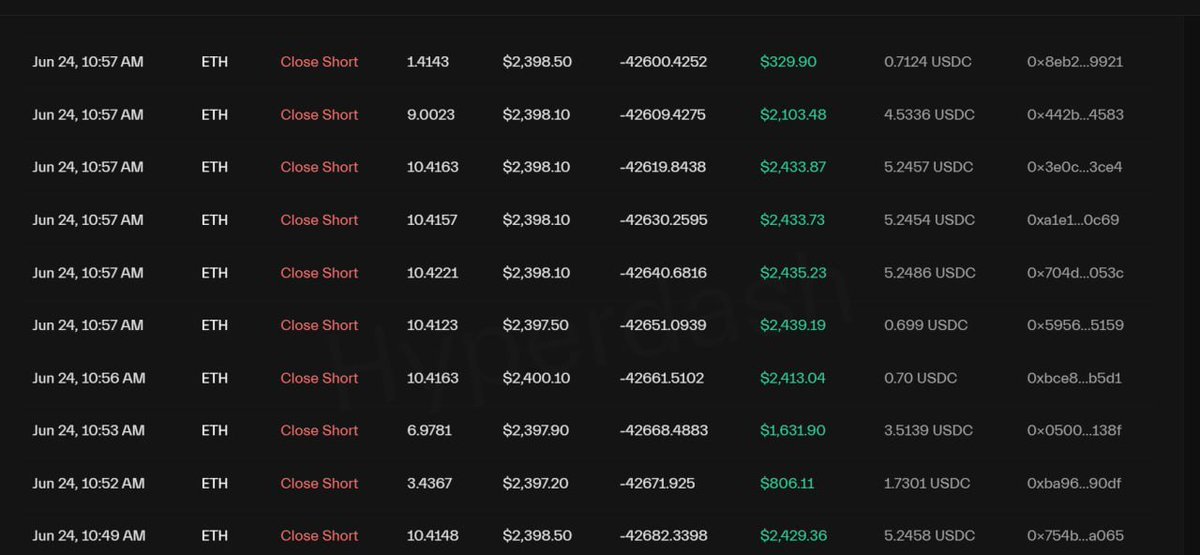

Alongside this, late last night and this morning, Abraxas partially closed some short orders for $ETH in the price range of 2K4 - 2K450 and $BTC in the price range of 105.2K-105.3K. However, the amount of $BTC taken for profit is quite small compared to the current volume.

Currently, the total volume of the two wallets is ~ $660M and PnL ~ $59M. The short order for $ETH is still yielding the most profit at ~ $19.5M. Meanwhile, one wallet shows signs of being in the red for the short order of $BTC at an entry price of $106.757K.

In light of the market fluctuations, it seems Abraxas is optimizing profits with its big short position. At the same time, this fund appears to be heavily betting on the downward movements of $BTC and $SOL.

Will this time, Abraxas's short position yield profits in the hundreds of millions like before?

Join the 52Hz Database to discuss:

Abraxas successfully "caught the bottom" and continues to pile on shorts.

In the past 24 hours, Abraxas has taken profits on part of its short position in $BTC at price levels of 99K - 101K and $ETH at price levels of 2K2 - 2K250, bringing in profits of approximately $30M.

Six hours ago, this wallet continued to increase the volume of its short position in $BTC at price levels of 104K - 105K, raising the total volume of the two wallets to about ~$650M.

The PnL of the two wallets is currently around ~$70M. This wallet is continuing to close part of its short position in $ETH at the current price level.

Carefully observing the time frames and price levels for taking profits last night, this fund took profits right at the bottom price levels of both $BTC and $ETH, just before important macro news last night. At the same time, it also continued to pile on shorts when $BTC surged.

This indicates that Abraxas is still not very confident in the market's rebound. They continue to pile on shorts when they see good entry points and optimize their short positions according to market fluctuations.

Join 52Hz to discuss further about the behavior of this VC:

10.77K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.