Friday we released a new signal in Seer!

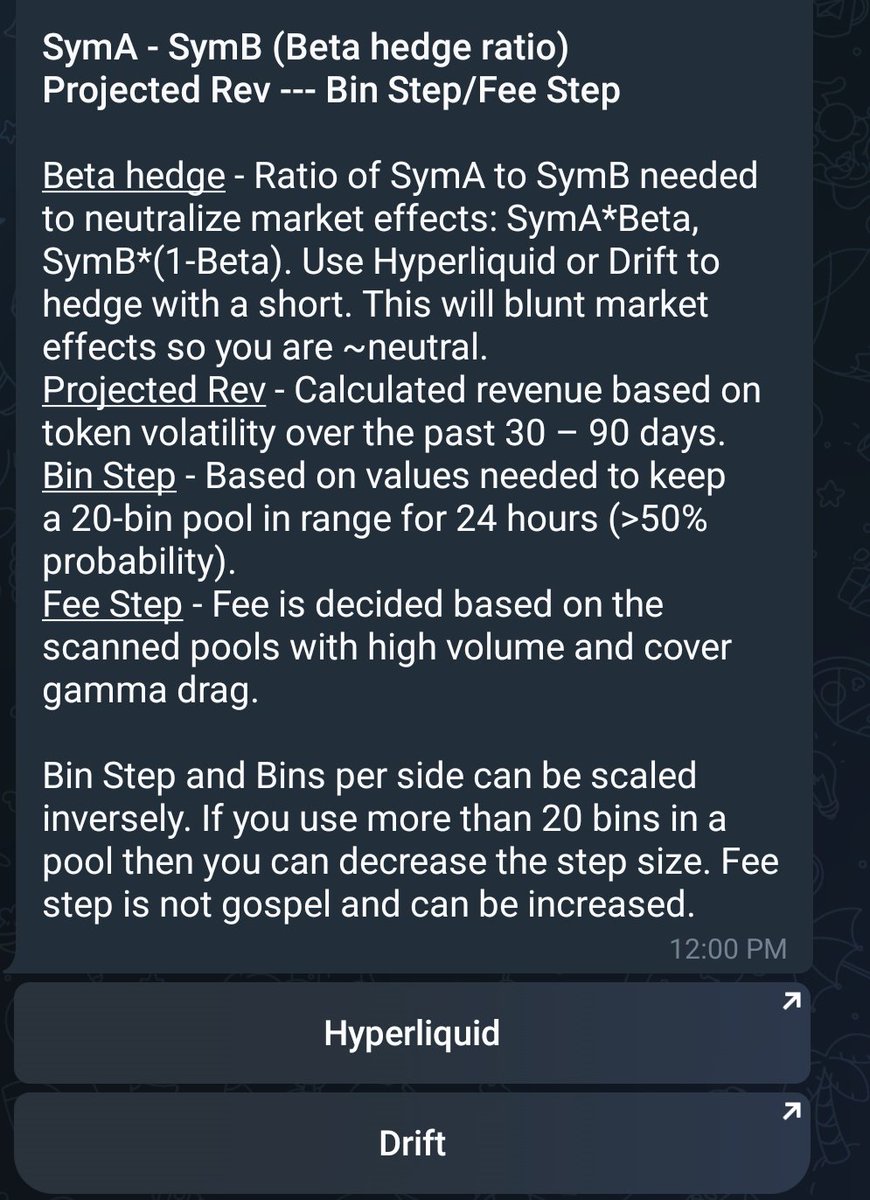

Meet Dither DLMM and how to engage with @MeteoraAG DLMM pools while limiting token exposure with @HyperliquidX or @DriftProtocol

Our alert outlines everything you need but we will break it down here in 2 topics:

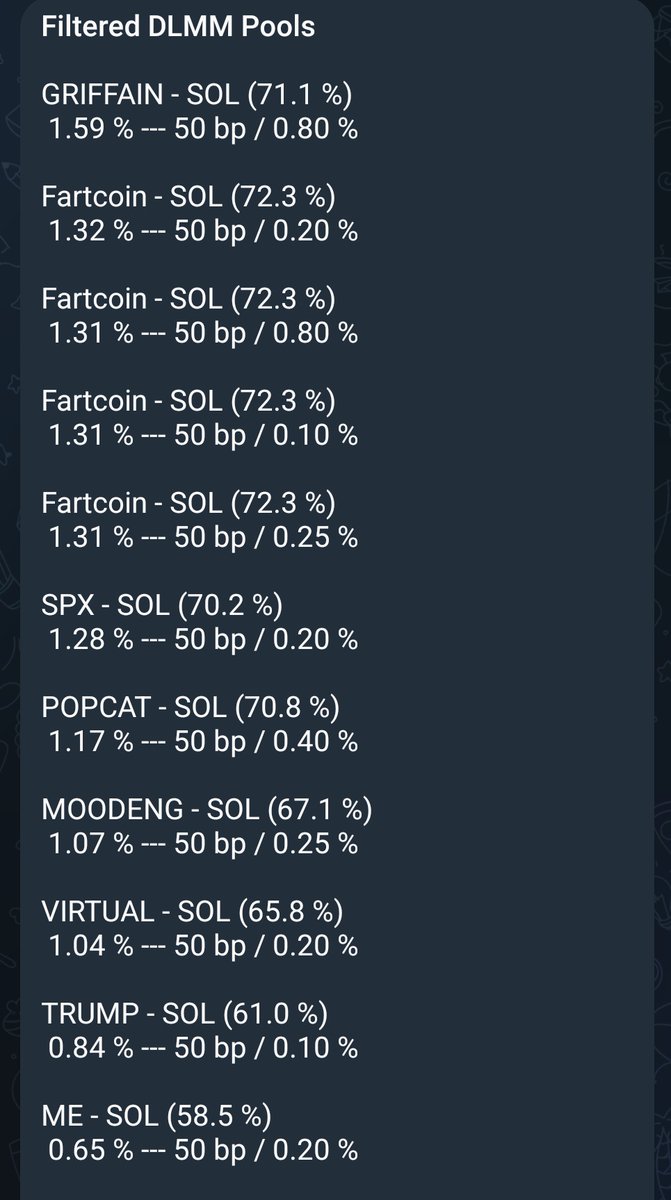

1. Picking Pools

2. Beta Hedge

1. Picking Pools

Our alert gives you two tokens, a beta Hedge ratio, estimated return per day, a step size and a few rate.

The fee rates are the most voluminous pools but the step size is based on the minimum required to cover a 24hr period of volatility.

So our 80-80 pool passes the minimum step and the fee is one in the alert.

Now we need to decide - do we believe in SOL and fartcoin over the short term or do we want to hedge downside?

2. Beta Hedge

If we want to hedge downside, we can use a beta hedge to eliminate our exposure to our DLMM tokens even in the DLMM.

That is, we will short the tokens in the pool after we deploy the DLMM. We will use our beta hedge. You can use Hyperliquid or Drift to open a short.

For Fartcoin - SOL we will short an equal USD value in our pool in the ratio 72.3 : 27.7

Our short will be ~72% fartcoin and 28% SOL. This is because fartcoin is more volatile.

The goal of this hedge is to remain ~neutral to the market despite operating a DLMM pool.

If the value of Fartcoin and SOL increases, then our hedge will compensate. If the value decreases, then our hedge will preserve value.

Using this method we remain with ~stable USD portfolio value while harvesting DLMM fees.

The goal of this new signalling tool is to allow anyone to act like an MM while limiting downside risk.

If you're a holder of Dither and qualify for premium - please use /settools in Seer to enable this new feature.

You will get signals which filter pools on perp availability and return criteria.

Although this mitigates risk for DLMMs, there are no "risk-free" strategies in Crypto.

Please understand what you are doing before you open DLMM and short positions on perp platforms.

1.66K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.